Blur founder defends platform amid NFT market slump

The founding father of Blur, a rival to OpenSea focusing on savvy merchants, got here to the protection of {the marketplace} immediately amid a chronic droop in NFT costs.

Pacman, whose actual identify is Tieshun Roquerre, responded to Twitter chatter about whether or not Blur is guilty for killing the market.

“We launched in October 22. Since then, some flooring costs have gone up, some flooring costs have gone down,” Pacman tweeted late on July 5. “One of many few instances flooring costs went up in live performance was after we injected liquidity into nfts through our airdrop. One of many few instances flooring costs went down in live performance was when $40m of liquidity was eliminated through the Azuki mint (not throwing stones, the market simply strikes based mostly on liquidity greater than anything).”

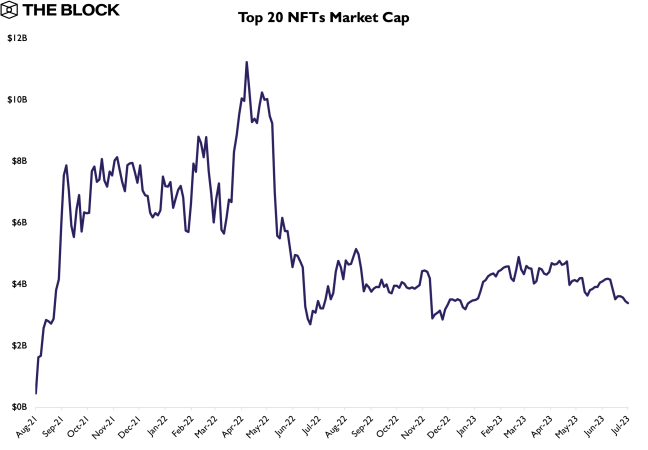

The NFT market has been in a supressed state for over a 12 months, at the least relative to the dizzying heights of 2021. Recently, even the premier collections have suffered.

The ground value — the most affordable level of entry for an NFT assortment — of Yuga Labs’ Bored Ape Yacht Membership presently sits at 28 ETH (round $53,000), as little as it’s been in over 18 months and fewer than half its worth at first of the 12 months, in keeping with NFT Value Ground knowledge. The ground value of Azuki, one other fashionable assortment, crashed after its creator Chiru Labs botched the launch of a brand new set of NFTs final week.

In each circumstances, fingers have been pointed at Blur, the Paradigm-backed market for professional merchants.

Lior Messika, whose enterprise agency Eden Block is an investor in Yuga Labs, mentioned that NFT whales who had beforehand recognized as “collectors” now model themselves merchants and even “Blur farmers,” including that the area had turn into distorted by the “concern and greed of some merchants.” Brad Kay, a analysis analyst at The Block Analysis, mentioned a big a part of the Azuki sell-off could possibly be attributed to Blur’s lending platform.

Dominating buying and selling volumes

Blur is actually dominating buying and selling volumes. It presently accounts for 70% of NFT market quantity on Ethereum, in keeping with The Block Analysis’s knowledge. The Block reported earlier this 12 months that the corporate is elevating cash at a billion-dollar valuation.

In his tweet immediately, Pacman advised criticism of Blur’s success is misplaced.

“When asset costs are up, ppl don’t actually speak in regards to the root trigger (ie blur injecting liquidity), however when they’re down, the pitchforks come out,” he mentioned. “Unhealthy takes unfold like wildfire and at this level I simply think about it the price of doing enterprise.”

Regardless of the selloffs in main collections, knowledge from The Block Analysis suggests the broader market is holding up roughly because it has for the previous 12 months. The chart under displays the mixed market capitalization of the highest 20 NFT collections, multiplying flooring value by provide.

NFT market capitalization. Supply: The Block Analysis.