Is HODLing XRP the right move for the altcoin’s investors now?

- XRP has a observe file of bouncing again when BTC hits its peaks

- If the suitable elements align, a $4 goal may quickly be inside attain

XRP’s surge previous $3, pushed by whale accumulation, has rewarded affected person traders, however holding regular has been no simple feat. With a 53% year-to-date progress, traders are clearly torn – Lock in good points now or keep the course for even larger rewards?

The age-old dilemma in a bullish market

Amongst high-caps, XRP’s 40% month-to-month good points stand out, with over half of that coming within the New 12 months alone. Whereas this alerts a robust rally, it additionally alludes to speedy appreciation – Maybe an excessive amount of, too quickly. The RSI appeared to again this up, leaping from impartial to overbought in simply three days.

In markets like this, profit-taking is nearly inevitable.

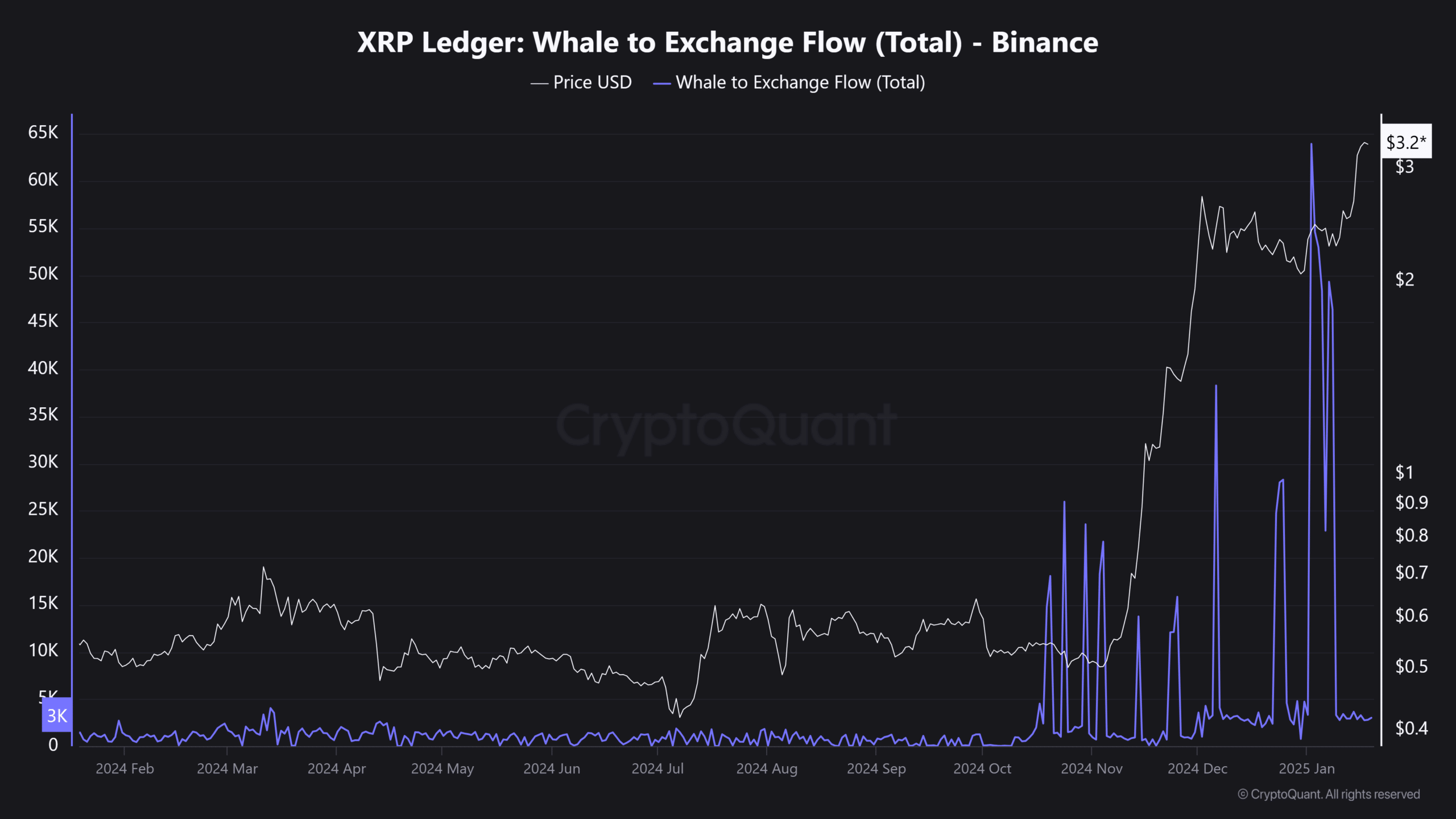

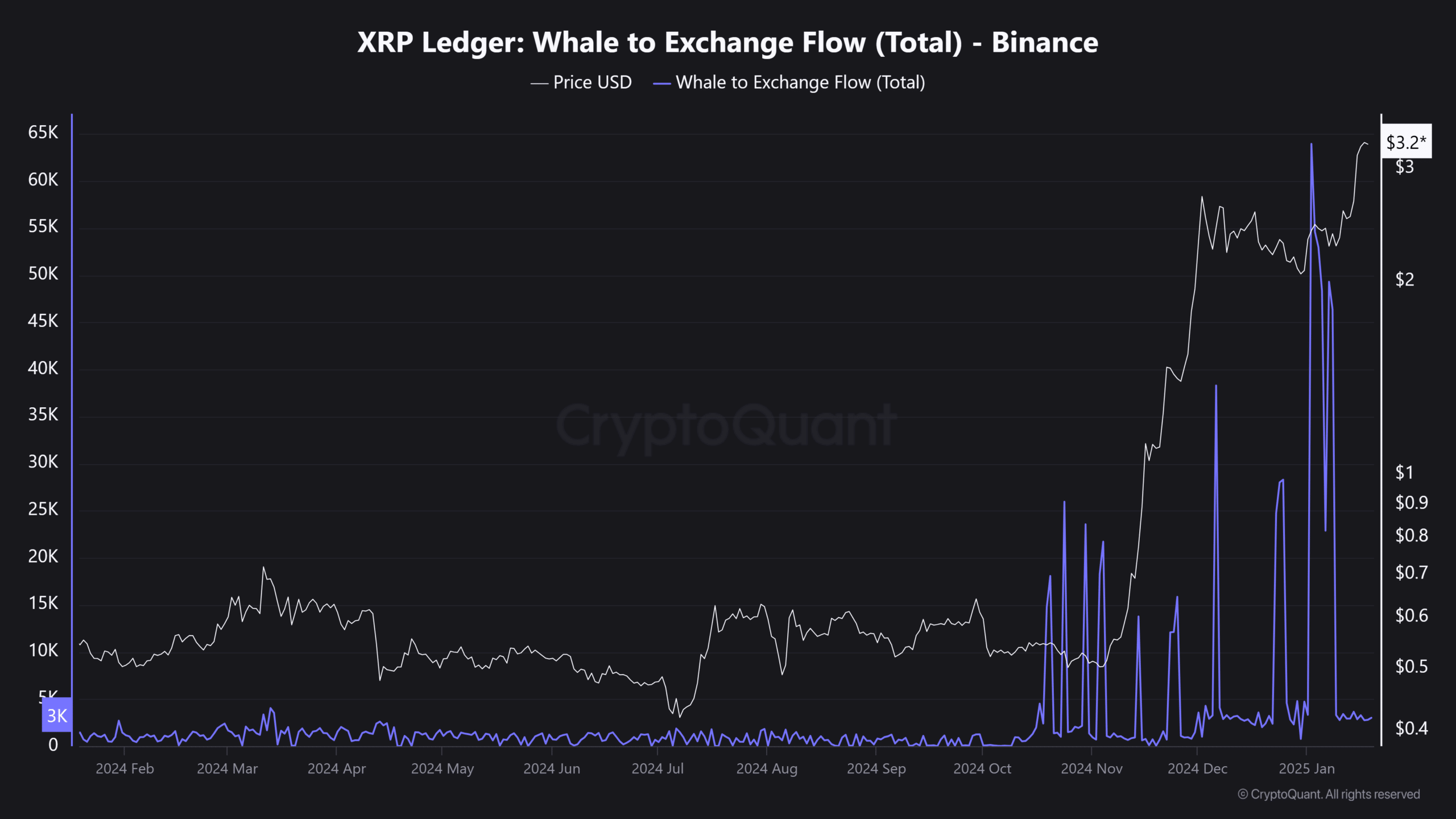

After a 53% surge in XRP in lower than three weeks, it’s no shock that merchants are cashing out. In truth, within the final two day alines, XRP flowing into Binance has surged to almost 350 million – A staggering 1567% hike.

Supply: CryptoQuant

Nonetheless, right here’s the place it will get fascinating – Regardless of the profit-taking, whales are nonetheless holding agency. With round $4 billion accrued for the reason that final Trump pump, the anticipated ‘huge’ sell-off merely hasn’t materialized. Clearly, these whales aren’t in it for a fast win – They’re taking part in the lengthy recreation.

If this development continues, their technique may pave the way in which for a robust push in the direction of $4, making holding XRP the savvy transfer for these eyeing long-term rewards.

XRP in an financial imbalance

As XRP surged previous $3 with a 17% leap, hitting $3.50 – simply 11% shy of its all-time excessive from seven years in the past – it then pulled again by 8% at press time. This dip got here as market dynamics shifted, with provide overtaking demand, creating an financial imbalance.

Now, the promote sentiment is taking on within the perpetuals market, as highlighted by the taker purchase/promote ratio, giving shorts a transparent benefit. The outcome? $8.44 million in lengthy liquidations.

It’s clear the Futures market is rising riskier for XRP holders. And yet, the Open Curiosity (OI) has solely dropped by 0.70%. This implies extra lengthy positions may quickly be squeezed out within the days forward.

Why? Within the quick time period, volatility might enhance as traders give attention to Bitcoin with the Trump pump in full swing. As capital strikes from XRP to BTC, the XRP/BTC pair has turned purple too, signaling a shift in market focus.

Except whales re-enter the buildup part, we may even see extra profit-taking and compelled closures of XRP lengthy positions. So, warning is required within the derivatives market.

Supply: CryptoQuant

Life like or not, right here’s XRP market cap in BTC’s phrases

That being mentioned, within the spot market, the shortage of aggressive promoting by whales is an indication of robust conviction.

If Bitcoin peaks and profit-taking slows, XRP may see a push in the direction of $4, making HODLing a wise transfer in the long term.