BNB trades in historic buy zone: It could rally 42% only IF…

- BNB data main development in distinctive tackle depend available in the market, trending greater.

- On the each day chart, merchants with shut stop-orders might be compelled out of their positions, triggering a possible rally.

Up to now 24 hours, the market motion hasn’t been in full favor of bullish merchants, because it declined by 3.57%.

AMBCrypto discovered that this decline might have been forcibly triggered by traders with notable holdings, and a buyback might resume, doubtlessly placing Binance Coin [BNB] among the many prime market gainers.

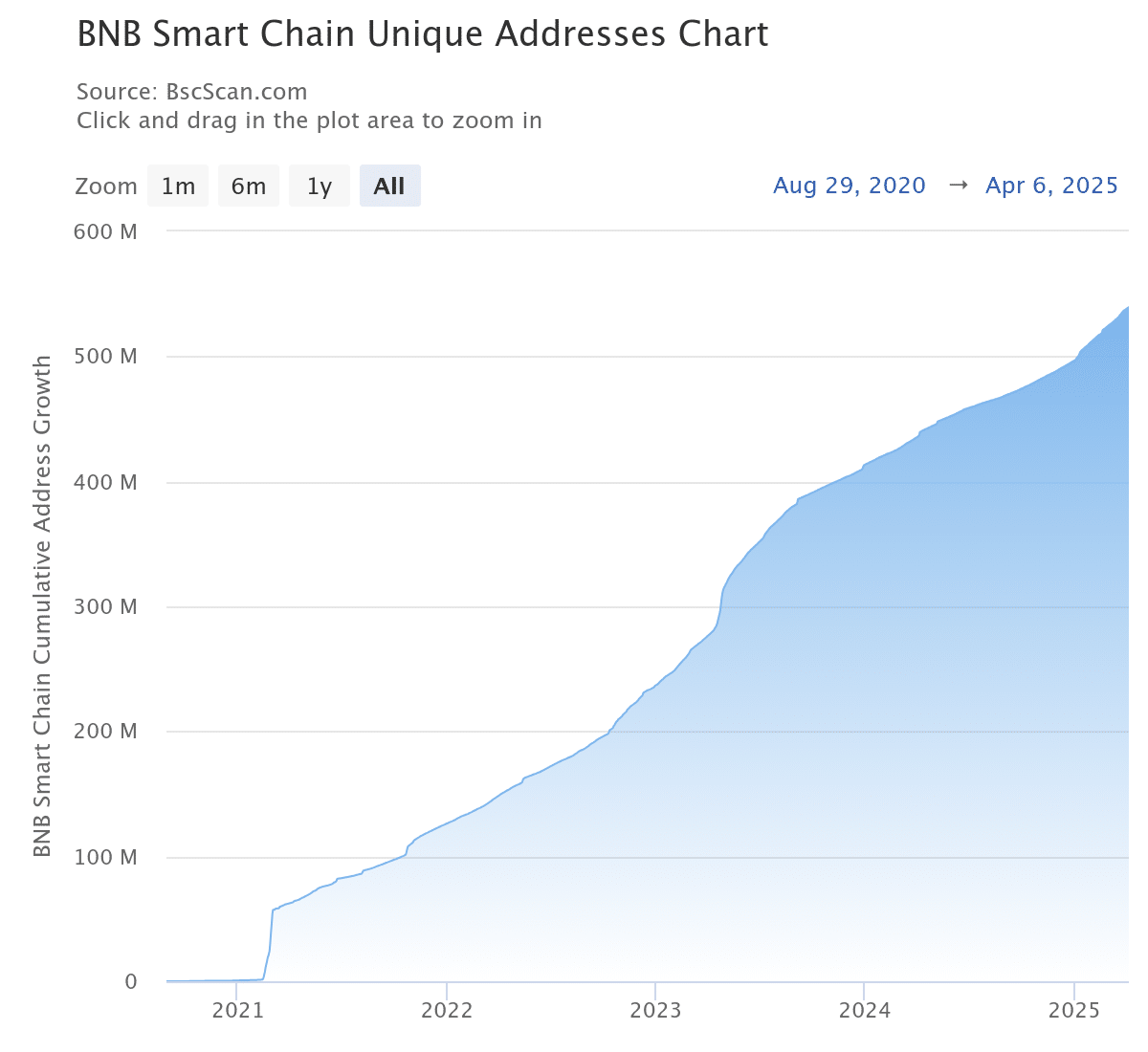

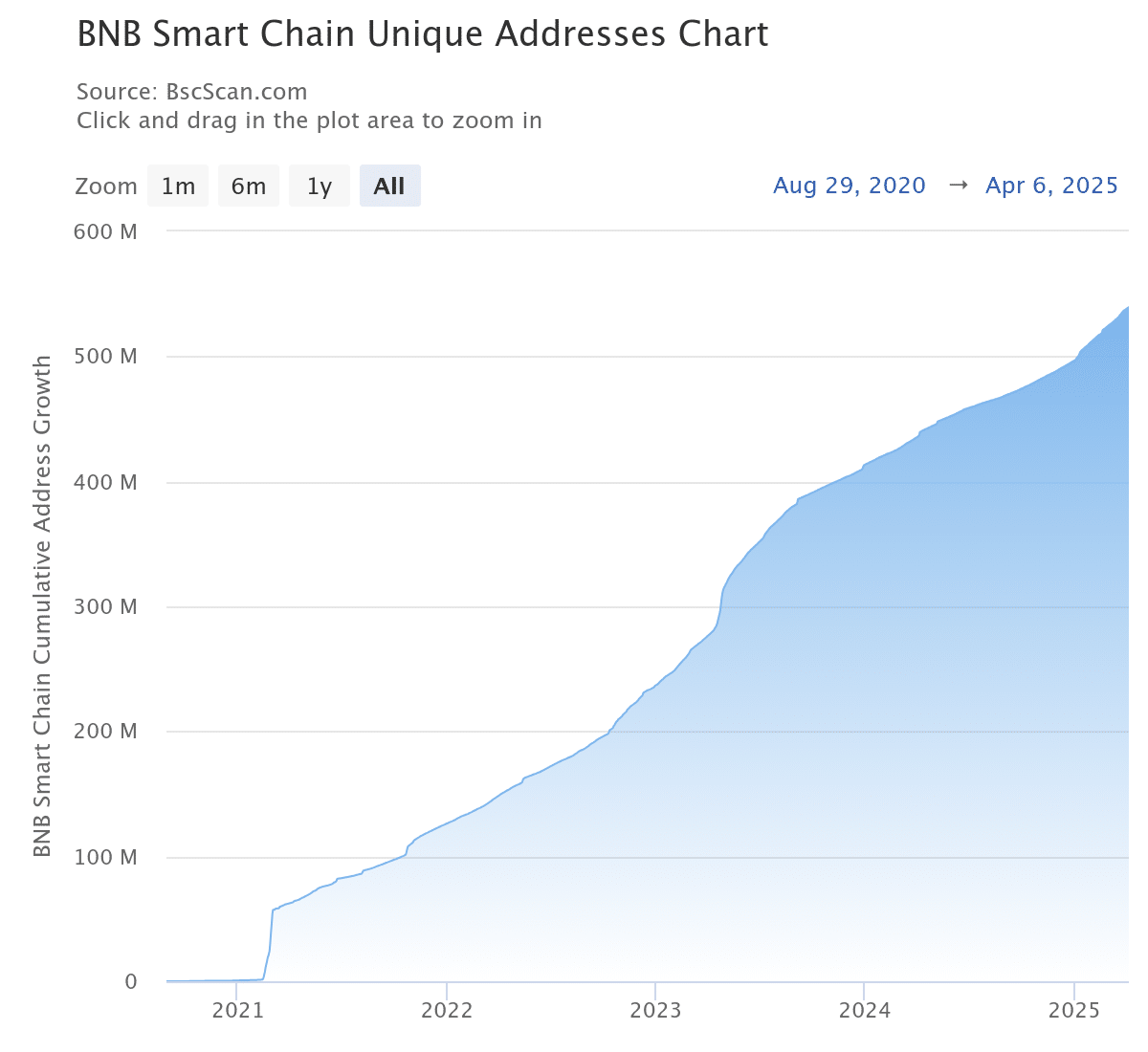

BNB adoption steadily grows

Over the previous 24 hours, BNB adoption available in the market has grown considerably. Distinctive addresses reached a file 539 million. This displays a rise of 268,000 from the day prior to this’s degree.

Distinctive addresses are these interacting with the BNB Good Chain for the primary time. This consists of receiving or sending BNB. They’re typically handled as an estimate of customers on the chain.

Supply: Bscscan

The expansion in distinctive addresses could also be linked to buying and selling BNB previously 24 hours. Customers both bought or obtained the asset throughout this time.

Moreover, the variety of transactions on the chain elevated considerably. It reached 4 million throughout the similar interval, indicating greater participation. This contributed to the asset’s general development.

Supply: Bscscan

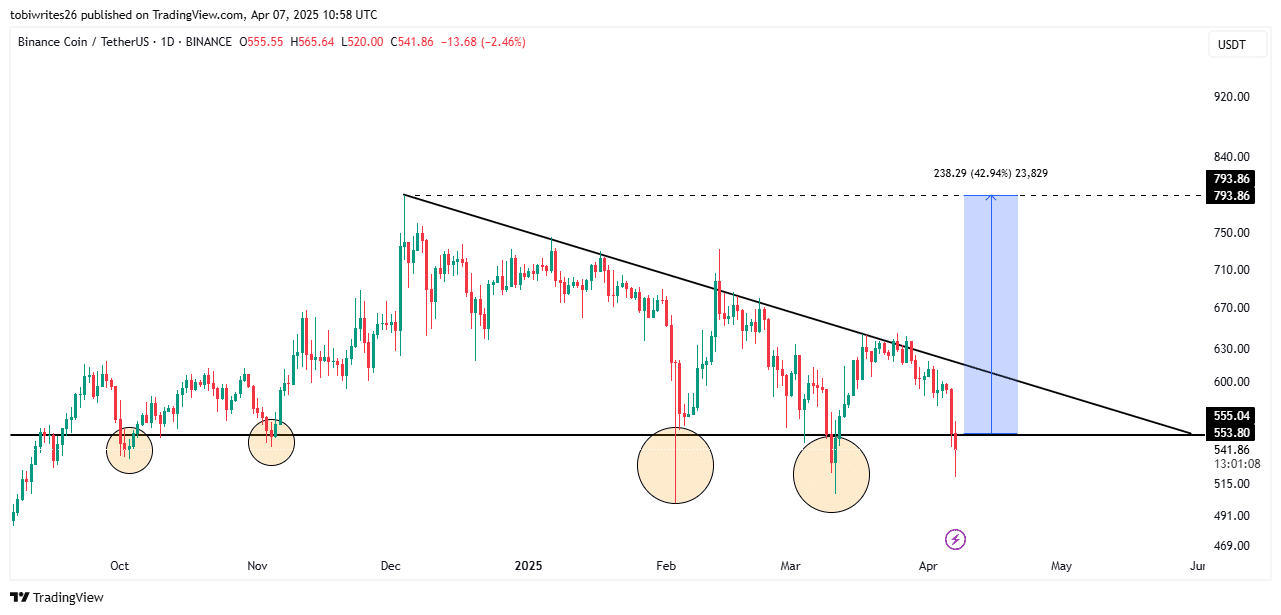

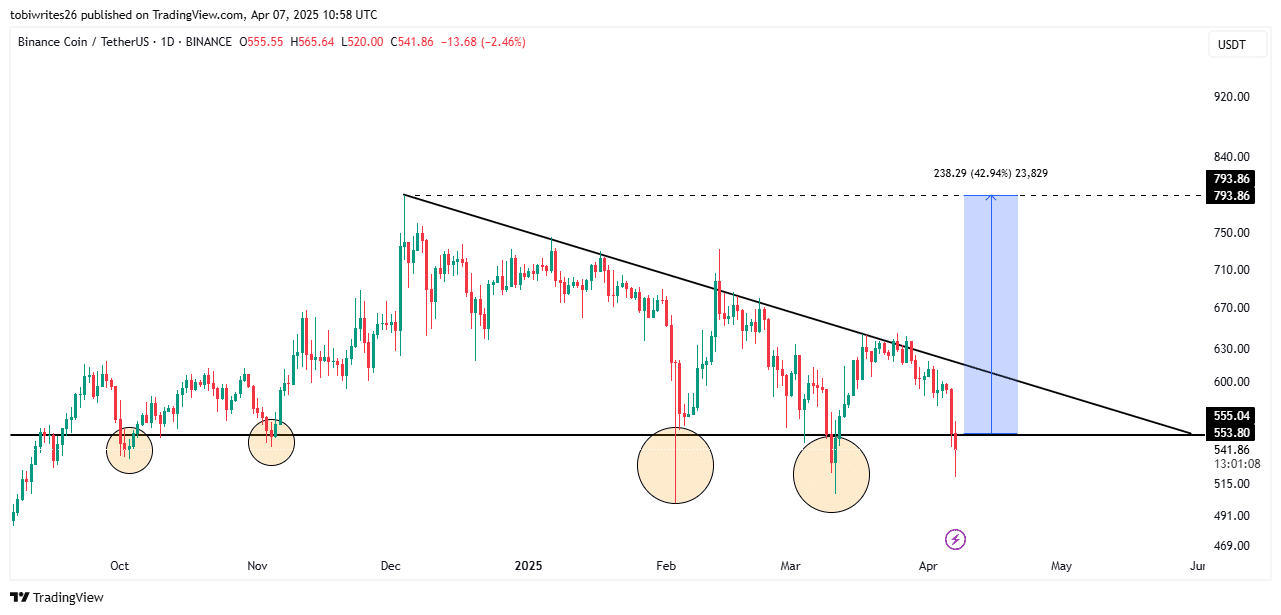

On the chart, AMBCrypto discovered that BNB is shaping up for a significant push to the upside available in the market because it trades in a historic purchase zone.

Historic zone—Will ‘paper arms’ be compelled out?

On the each day chart, BNB has traded right into a key help degree, forming a bullish triangle sample, hinting at a significant rise on the horizon.

This degree is of curiosity as a result of the primary two instances the asset traded into this zone, it led to a significant value push to the upside.

Nevertheless, within the final two situations, it has triggered liquidity sweeps—or cease hunts. In these instances, the worth fashioned an extended, downward wick earlier than shortly reversing.

Supply: TradingView

This state of affairs forces ‘paper hand’ merchants out of the market. These merchants typically have stop-losses close to help ranges or low conviction.

In the meantime, giant traders make the most of the state of affairs by accumulating BNB at discounted costs because the market developments decrease.

If robust momentum follows this shopping for exercise, BNB might breach the descending resistance line sample. It would rally 42% to $793, a degree final seen in December 2024.

AMBCrypto analyzed the market response to those discounted costs. They discovered that purchasing sentiment dominated each spot and spinoff markets, supporting the buildup narrative.

Merchants see accumulation alternative available in the market

Within the spot market, shopping for exercise has been robust. Up to now 24 hours, $9.83 million value of BNB has been accrued as costs slid decrease, bringing the overall accumulation over the previous three days to $21.04 million.

This accumulation transfer highlights that merchants are shopping for in giant volumes to make the most of BNB’s low value within the spot market.

The identical sentiment exists within the derivatives market, because the Open Interes (OI)-Weighted Funding Fee remained constructive.

Supply: Coinglass

On the time of writing, the OI-Weighted Funding Fee—a key indicator used to find out market sentiment in BNB’s futures market—confirmed a bullish outlook. The studying determines market sentiment, displaying bullish conduct when above 0% and bearish conduct when under 0%.

At press time, the studying stood at 0.0020%, indicating bullish market exercise. Lengthy merchants dominate unsettled futures contracts, actively betting on a rally.

If bullish sentiment continues to develop amongst each spot and spinoff merchants, it implies that BNB might obtain the projected value leap to its December excessive.