BonkDAO’s 1.69 trillion token burn: Will it affect BONK’s price?

- BonkDAO’s token burn diminished provide by 1.8%, but BONK confronted resistance at $0.00003517.

- Market sentiment remained bearish, with excessive quick curiosity and weak technical indicators for BONK.

BonkDAO’s determination to burn 1.69 trillion Bonk [BONK] tokens as a part of the “BURNmas” occasion has grabbed consideration within the crypto neighborhood.

With $54.52 million value of tokens being faraway from circulation, the overall provide of BONK is diminished by 1.8%.

This might have vital implications for the market. At press time, BONK is buying and selling at $0.00003144, reflecting a 6.50% decline previously 24 hours.

Given this deflationary motion, the query arises: Will it affect BONK’s worth and market sentiment transferring ahead?

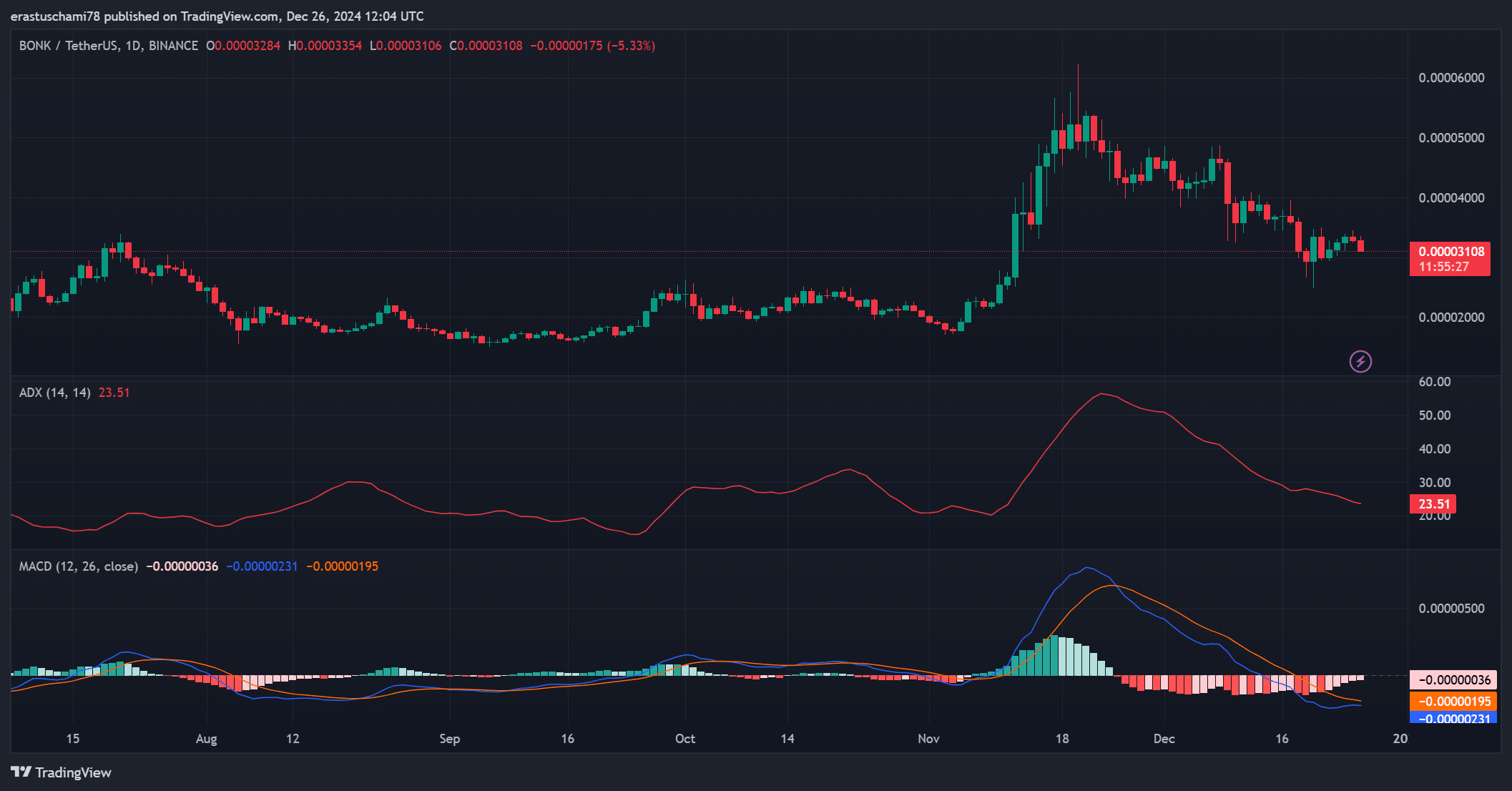

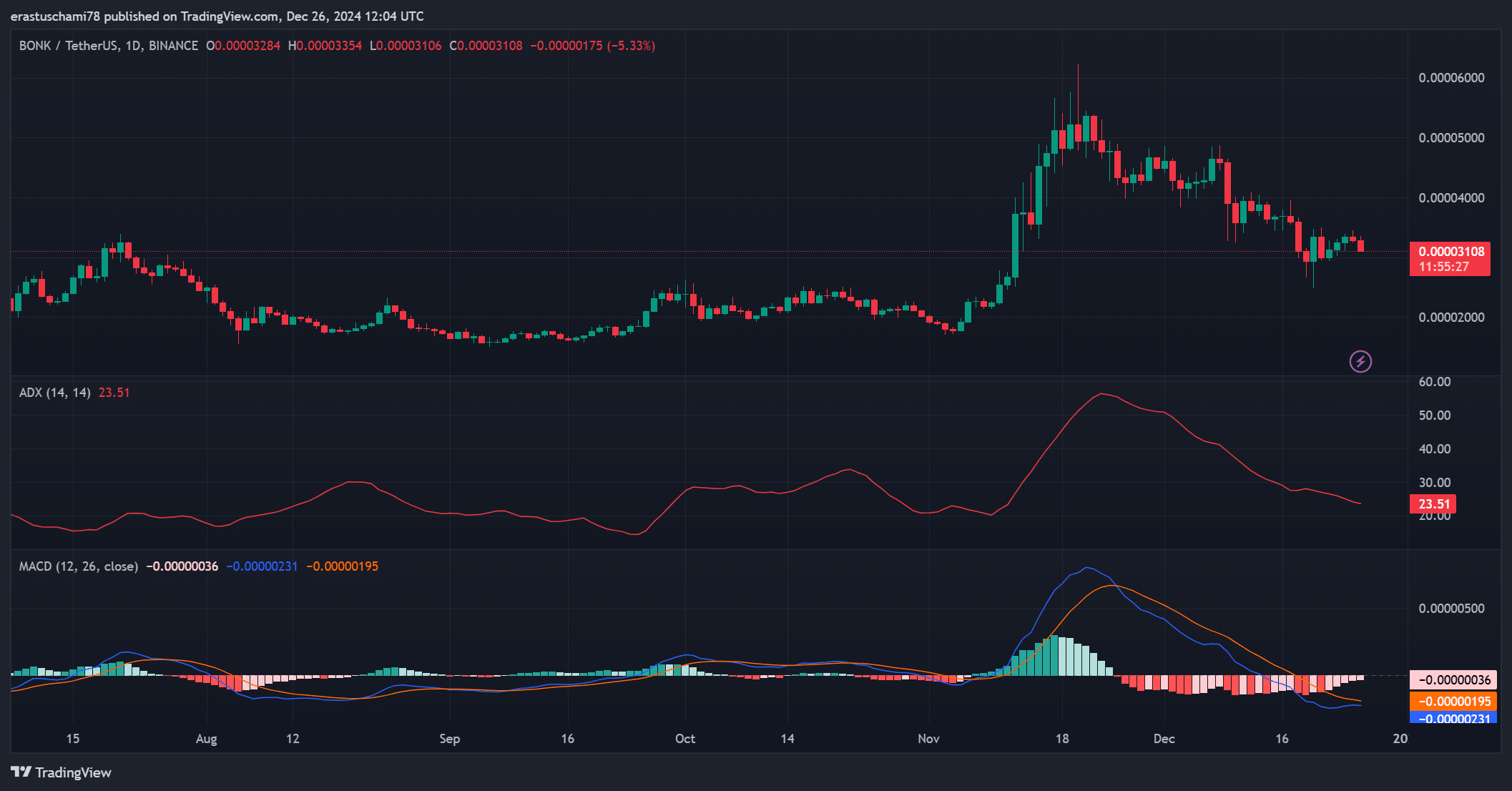

What’s the outlook for BONK’s worth motion?

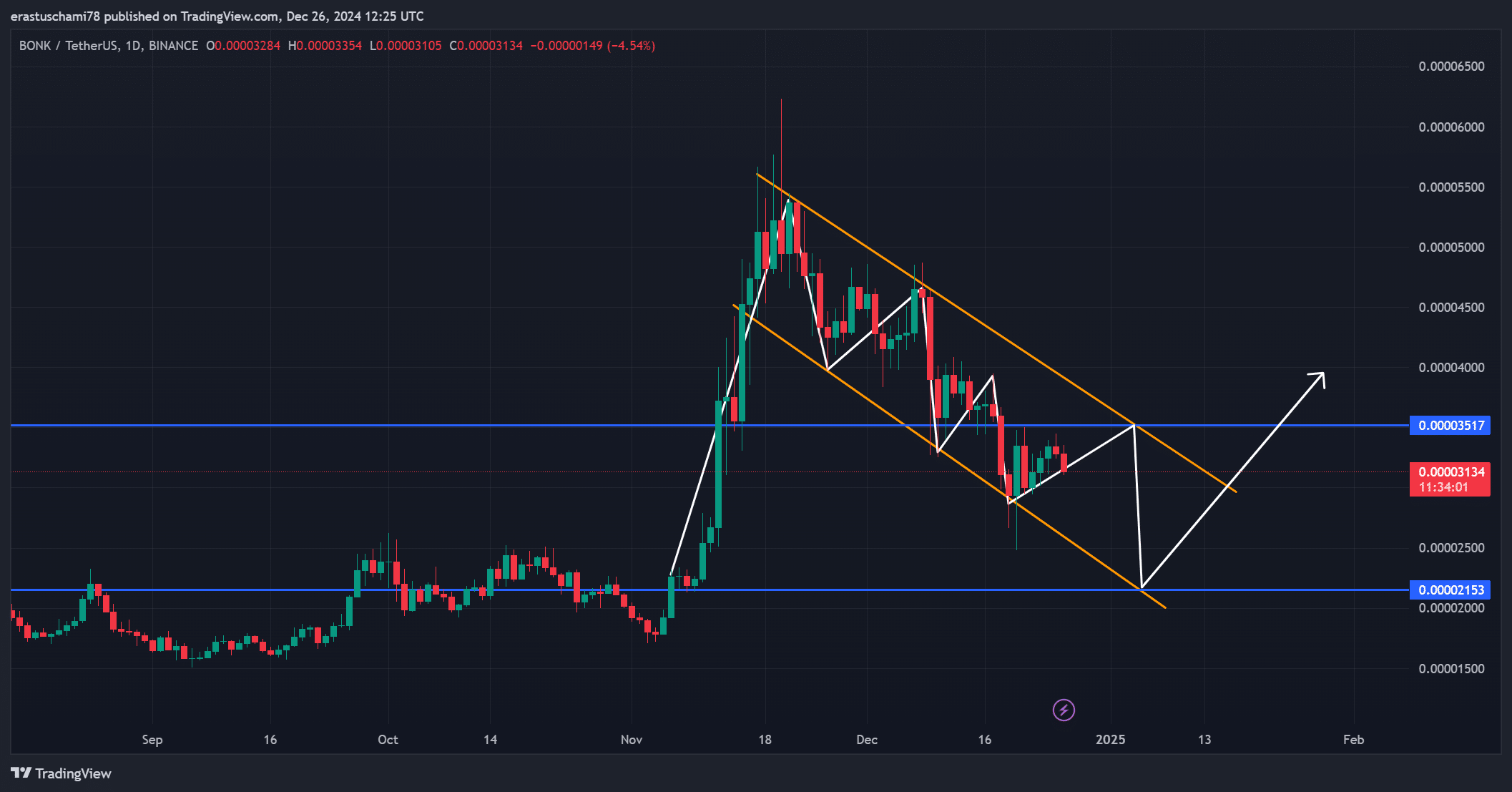

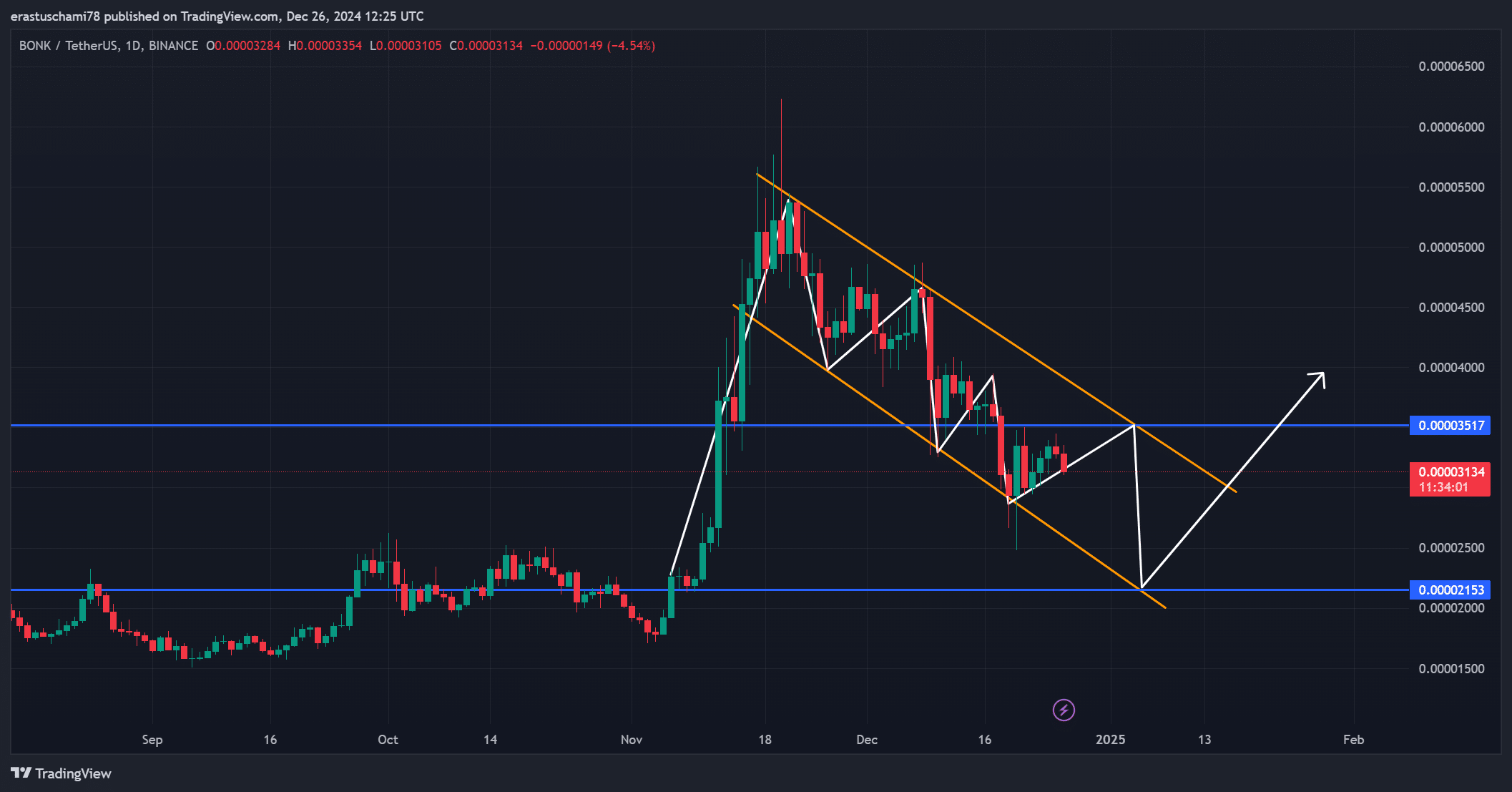

BONK’s worth motion reveals a sample of resistance, significantly on the $0.00003517 stage. This resistance level may act as a barrier to additional upward motion except substantial shopping for quantity comes into play.

Nevertheless, with BONK buying and selling at $0.00003144 at press time, it faces challenges in breaking via this resistance with out elevated market help.

The 6.50% drop within the final 24 hours indicated that the continuing pattern was nonetheless in a consolidation section.

Supply: TradingView

Of Social Quantity

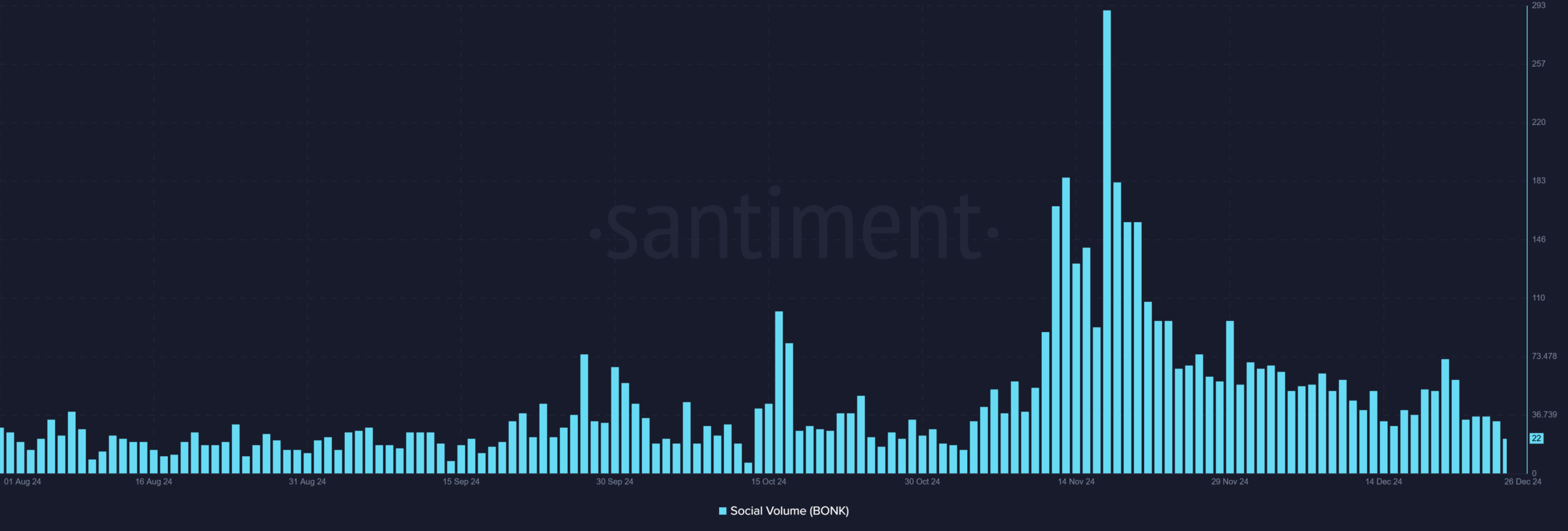

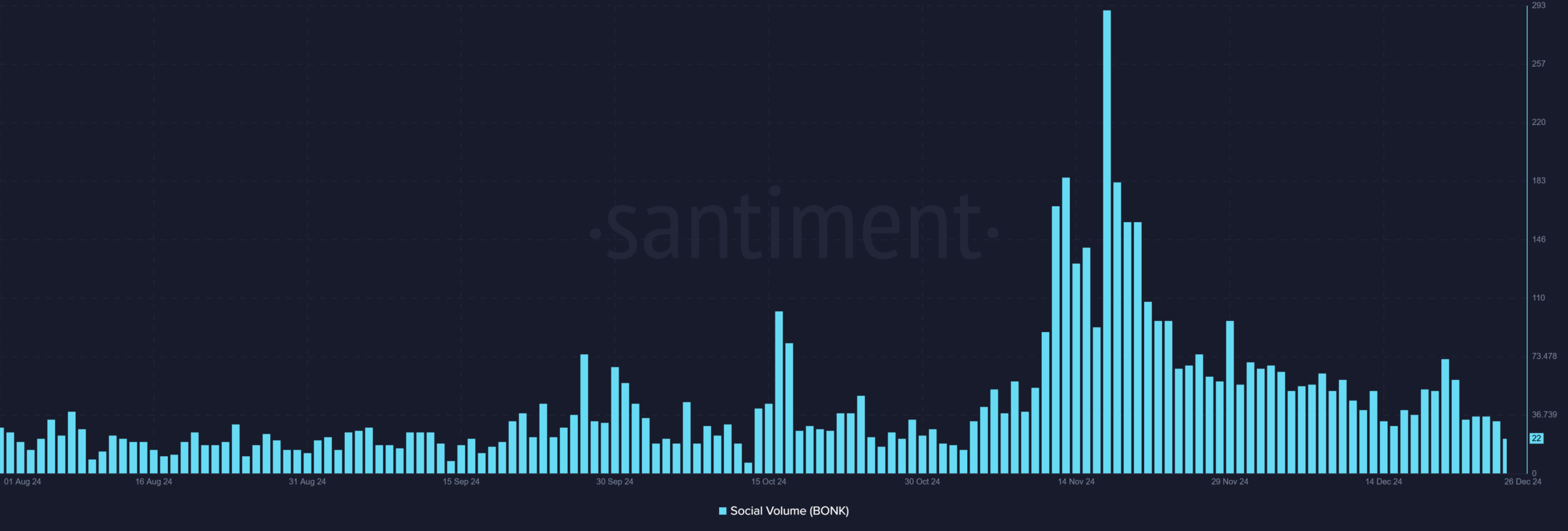

Social Quantity knowledge painted an image of reducing curiosity in BONK. In mid-November, social mentions peaked at over 290, however by the twenty sixth of December, that they had dropped to only 22.

This vital discount in social engagement advised that the joy surrounding the token burn was fading.

Whereas excessive Social Quantity typically indicators robust worth motion, this drop might be an indicator that the market is transferring away from BONK, awaiting a recent spark to reignite its momentum.

Supply: Santiment

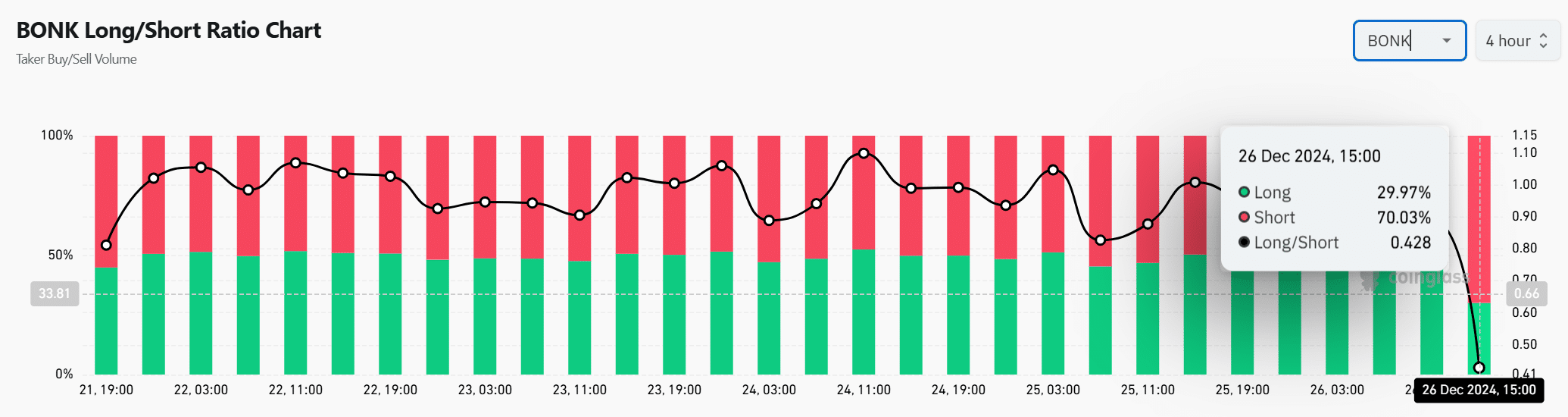

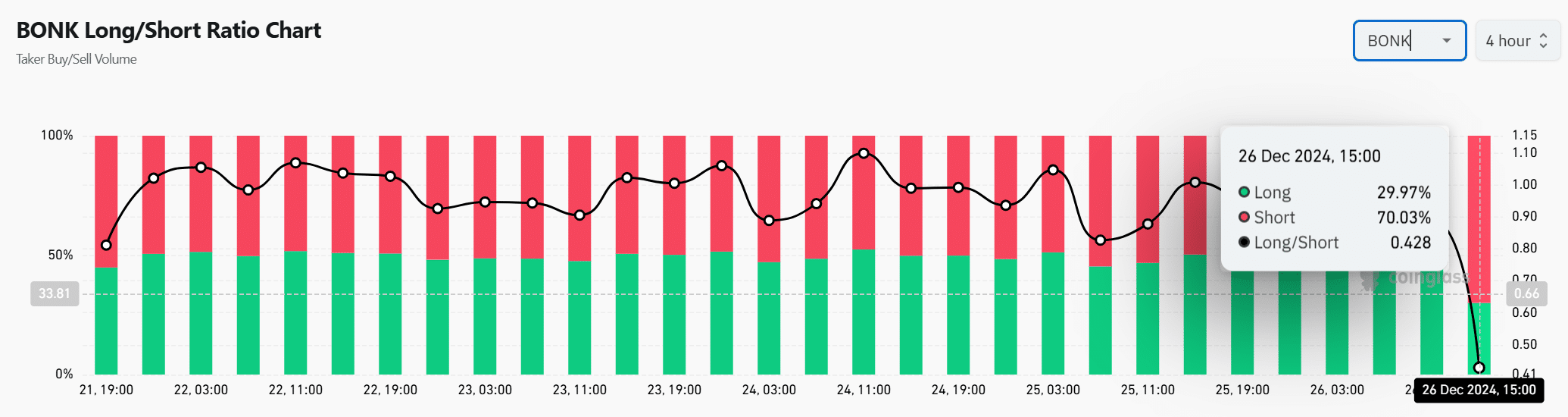

Are merchants betting on an extra decline?

Market sentiment leans closely in direction of quick positions. As of the twenty sixth of December, solely 29.97% of positions are lengthy, whereas 70.03% are quick.

This exhibits that merchants expect an extra decline in BONK’s worth.

The massive quick curiosity suggests a bearish outlook, although this might result in a brief squeeze if the market strikes in an surprising course.

Supply: Coinglass

What do technical indicators counsel for the value pattern?

The technical indicators present blended indicators. The Common Directional Index (ADX) is at 23.51, indicating a weak pattern, whereas the Transferring Common Convergence Divergence (MACD) exhibits a adverse studying of -0.00000036.

These indicators counsel that though a small rally is feasible, the market lacks robust momentum to maintain a major worth rise within the close to time period.

Supply: TradingView

Market sentiment

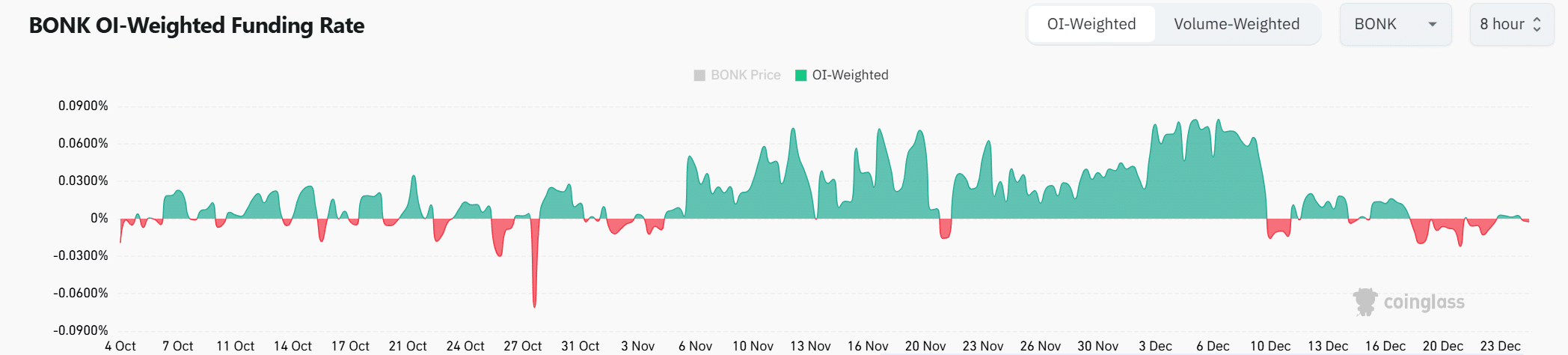

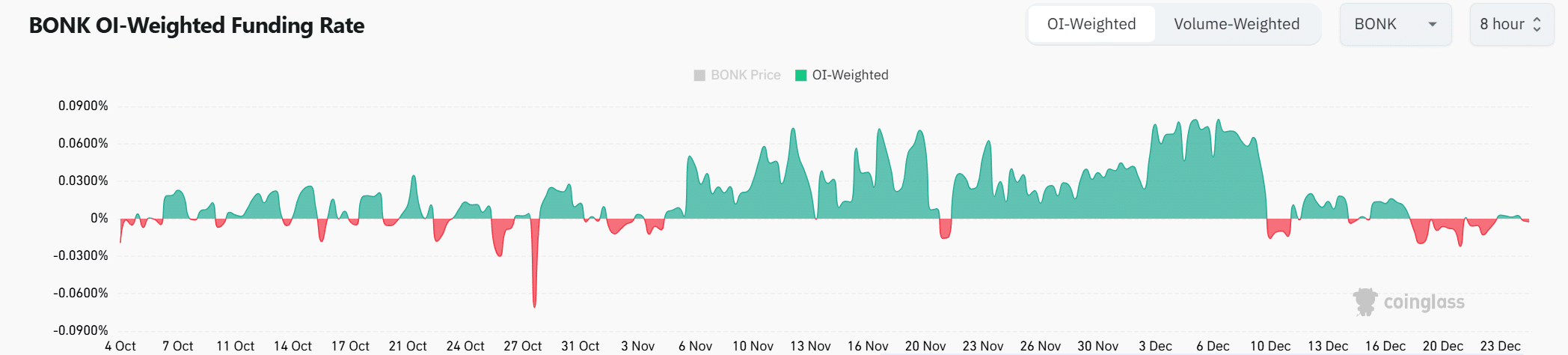

The OI-Weighted Funding Charge has fluctuated between -0.09% and 0.09% in latest months, and was 0% at press time.

This indicated that merchants had been uncertain in regards to the market’s course and had been hesitant to take giant positions, leading to a impartial market stance.

Supply: Coinglass

Learn Bonk’s [BONK] Value Prediction 2024–2025

Whereas the token burn occasion by BonkDAO reduces the provision of BONK, the present bearish sentiment, mirrored in Social Quantity, Lengthy/Quick Ratios, and weak technical indicators, advised that this deflationary motion wouldn’t set off a major worth rally within the quick time period.

Due to this fact, with out new catalysts, BONK is unlikely to expertise a considerable worth improve.