BTC Bulls Are Back? On-chain Indicators Point to Short-Term Rally

- BTC recorded its highest every day lively handle depend on 2 August.

- The current enhance in community exercise, surge in loss-making transactions, and rising adverse sentiment are all indicators of a short-term worth rally for Bitcoin.

The variety of every day lively addresses that commerce Bitcoin [BTC] has surged in August, reaching a three-month excessive of 1.07 million on 2 August, knowledge from Santiment confirmed. Nonetheless rising, the variety of addresses which have accomplished BTC transactions right now was 1.03 million.

📈 #Bitcoin‘s handle exercise has surged to its highest stage in 3.5 months in August. This utility enhance, mixed with main loss transactions & adverse sentiment, is a powerful signal {that a} short-term (at minimal) $BTC worth bounce is extra possible. https://t.co/5PzjYROX5T pic.twitter.com/G2tevAWdSM

— Santiment (@santimentfeed) August 3, 2023

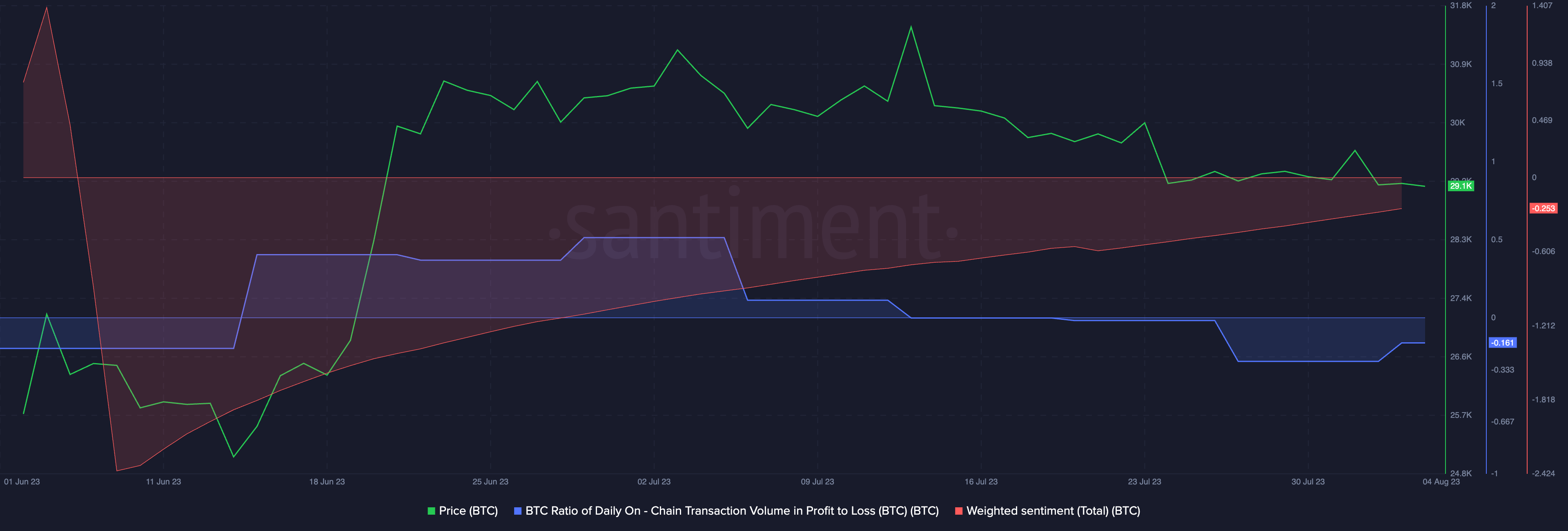

Because the variety of every day lively BTC addresses will increase, the variety of transactions involving the cryptocurrency that has resulted in losses has additionally grown. An examination of the coin’s ratio of every day on-chain transaction quantity in revenue to loss revealed this.

This indicator measures the worth of an asset’s transactions that return income to the worth of its transactions leading to a loss inside a single day. When the indicator logs an uptick and is above the zero line, market contributors are making extra income than losses. Conversely, market contributors are recording extra losses when this metric returns a worth under zero.

BTC’s ratio of every day on-chain transaction quantity in revenue to loss was -0.161 at press time, suggesting that extra BTC trades returned losses on the time of writing.

Additional, weighted sentiment stays adverse because the coin continues to linger in a slim worth vary. Per Santiment, BTC’s weighted sentiment was -0.25 at press time.

In line with Santiment:

“This utility enhance, mixed with main loss transactions & adverse sentiment, is a powerful signal {that a} short-term (at minimal) $BTC worth bounce is extra possible.”

However is the king coin prepared for such a leap?

Lastly, a purpose to smile?

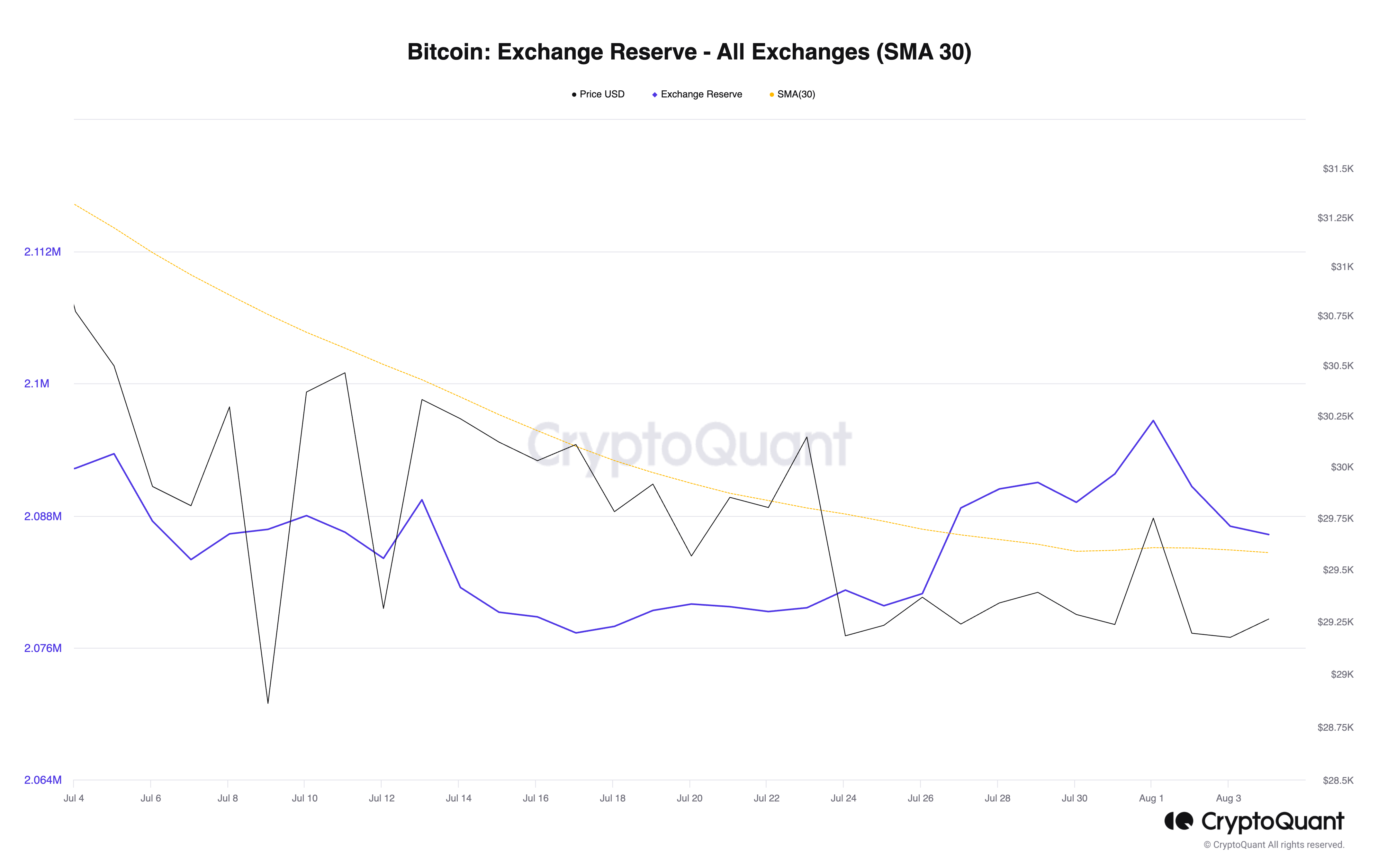

Regardless of going through robust resistance at $30,000 and buying and selling in a good vary for the previous two months, BTC holders have been reluctant to promote their cash, in keeping with an evaluation of trade exercise.

A take a look at its trade reserves on a 30-day shifting common revealed a 1.4% decline within the final month. This metric tracks the whole variety of BTCs held inside cryptocurrency exchanges.

When the worth of BTC’s trade reserves rises, it signifies larger promoting stress as extra cash are being forwarded to exchanges for onward gross sales. Alternatively, a decline suggests a discount in BTC distribution and is commonly a precursor to a worth uptick.

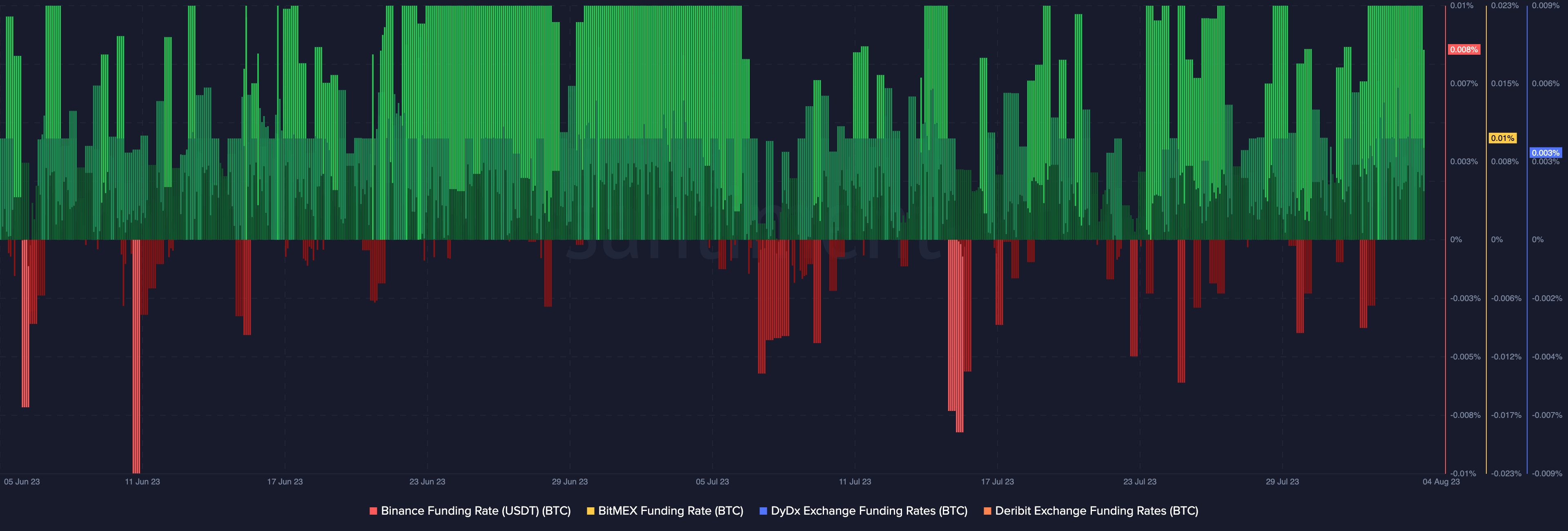

As well as the declining variety of BTC sell-offs, most merchants are betting on a worth enhance.. That is evident from the funding charges on the futures market throughout main exchanges, which present that longs outnumber shorts. This can be a constructive signal, because it means that many merchants consider that the value of Bitcoin will rise within the brief time period.

Whereas these on-chain indicators trace at a worth development within the short-term, it stays vital to concentrate to macro elements which may have an effect on BTC’s worth negatively.