BTC, ETH pave the way as short positions surge

- Lengthy positions have seen over $36 million in liquidations in comparison with round $6 million for brief positions.

- The crypto market has maintained its $1 trillion market cap regardless of the decline in crypto market caps.

Through the earlier week, a lot of the main cryptocurrencies within the crypto market skilled declines. Because of this, some merchants have initiated brief positions available in the market, speculating on persevering with the downward worth development.

The crypto market sees extra brief positions

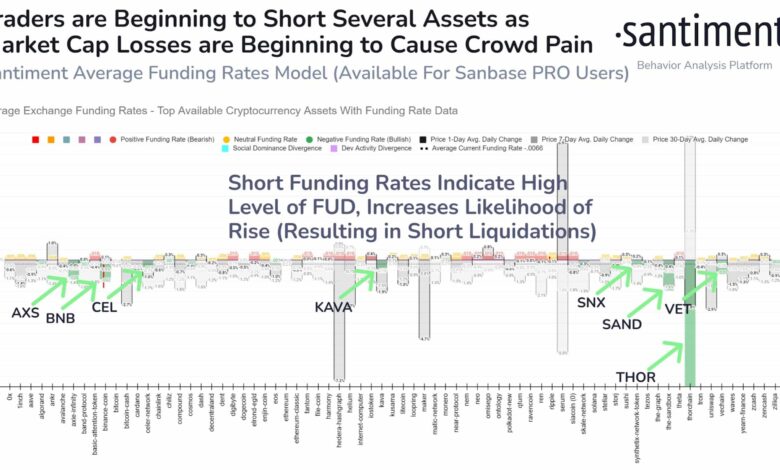

A latest submit by Santiment confirmed that the prevailing place within the crypto market was brief. Many merchants have been seemingly embracing brief positions throughout most belongings, a response to the declining costs.

The escalating brief positions, evident via the unfavorable funding fee, might set off Worry, Uncertainty, and Doubt (FUD) and result in extra liquidations.

Supply: Santiment

Though these brief positions would possibly mirror a pessimistic market sentiment, they may additionally function a precursor to a bullish development. It is because bullish merchants would possibly seize the chance introduced by the value dip to provoke shopping for exercise.

Crypto market brief vs. lengthy positions

In accordance with information from Coinglass, the continuing lower in crypto market costs has resulted in fewer liquidations for brief positions than for lengthy ones. An examination of the liquidation chart revealed substantial liquidation exercise for lengthy positions on 15 and 16 August.

The development has endured as much as the time of this writing.

On 15 August, lengthy positions skilled liquidations exceeding $122 million, in distinction to roughly $9.5 million for brief positions. Transferring to 16 August, lengthy place liquidations reached $111 million, whereas brief positions confronted round $15 million in liquidations.

As of this writing, lengthy positions have encountered roughly $37 million in liquidations, whereas brief positions have seen roughly $6 million.

Supply: Coinglass

Moreover, scrutinizing the lengthy/brief ratio for prime belongings by market capitalization on Coinglass emphasised the prevalence of brief positions. Bitcoin’s [BTC] brief place surpassed $15 billion at press time, juxtaposed with lengthy positions totaling over $13 billion. For Ethereum [ETH], brief positions have been round $5.9 billion, whereas lengthy positions have been round $5.4 billion.

Equally, Ripple [XRP] and Binance Coin [BNB] exhibited important figures. At press time, lengthy positions and brief positions for XRP sat at over $1 billion and $960 241 million, respectively. In the meantime, BNB’s lengthy and brief positions have been at $241 million and $232 million respectively throughout the identical interval.

The crypto market maintains the $1 trillion capitalization

Regardless of the noticed lower, CoinMarketCap information indicated that the crypto market had upheld its capitalization above $1 trillion. Nevertheless, the info from CoinMarketCap revealed that the collective market capitalization had declined by roughly 1.7% as of this writing.

Moreover, inside the final 24 hours, main cryptocurrencies comparable to BTC, ETH, BNB, and XRP have skilled declines in worth of round 2%, 1.7%, 1.4%, and a couple of.3%, respectively.

Over the previous week, these declines have been extra pronounced, with BTC and ETH encountering drops of over 3%, BNB experiencing a lower of over 4%, and XRP seeing a decline of over 6%.