Crypto – gold on edge: Will Trump’s tariffs trigger a Bitcoin sell-off?

- Bitcoin’s market worth has crossed $2 trillion, elevating the stakes of Trump’s tariff plan even increased.

- With gold and the greenback surging, is the crypto market about to face its greatest sell-off but?

Trump’s sweeping tariff plan has traders on edge. What started as a ten% import tax on Canada, Mexico, and China is now simply the beginning of a a lot greater strategy.

With Q1 unfolding, is the crypto market well-positioned to soak up the strain, or is a serious sell-off looming?

What’s at stake?

With the entire crypto market valued at over $3 trillion and Bitcoin [BTC] holding 60% of the market share, the stakes are sky-high.

Even a small shake in BTC’s worth may go away even essentially the most established cash within the crimson. In such a local weather, a long-term technique could be the most secure wager.

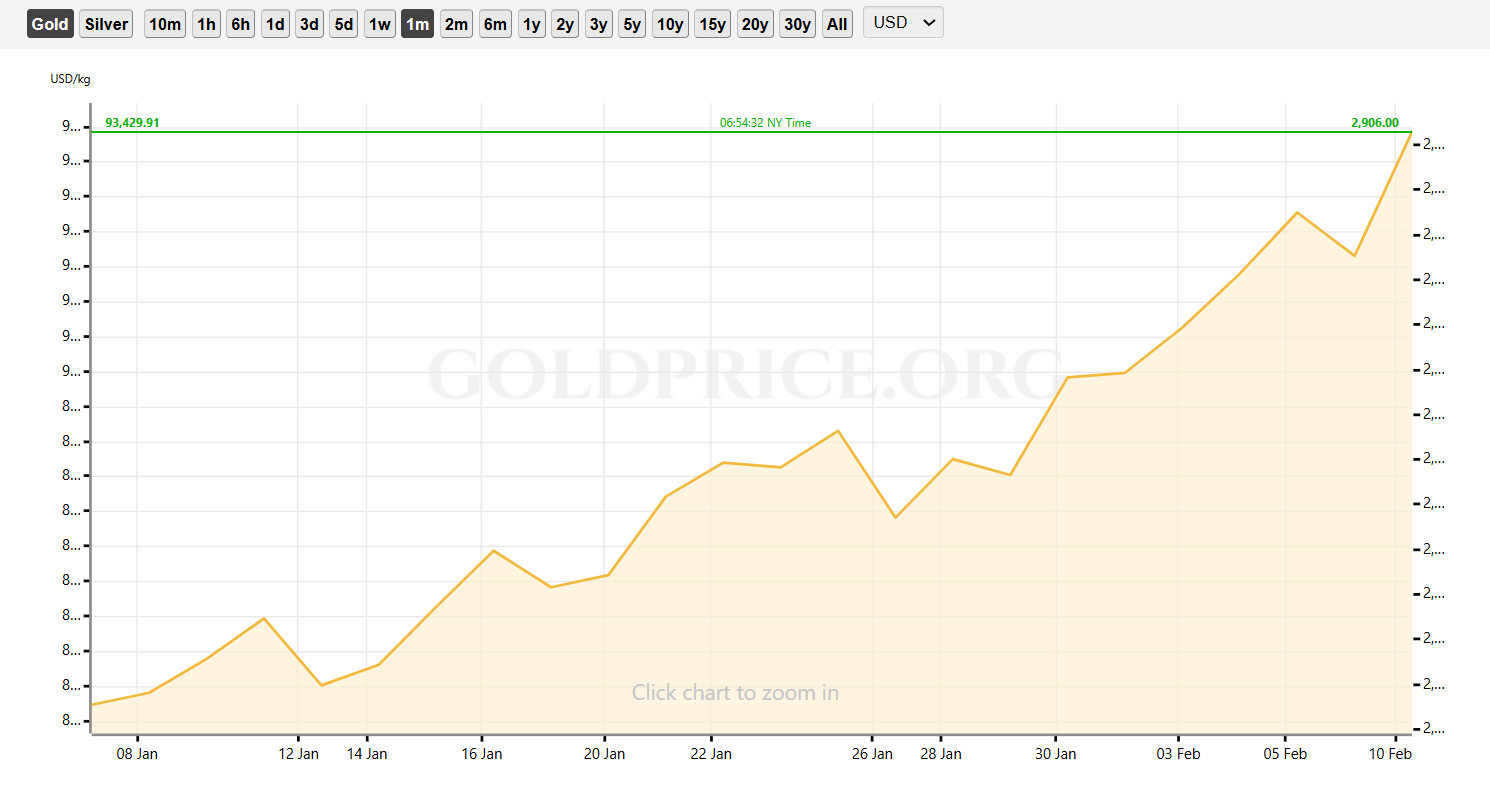

However proper now, many traders are chasing fast good points, and gold appears to be the go-to protected haven. Its 30-day valuation has surged by a large 247.18%, with 4% of that soar coming simply in February.

Supply: Goldprice.org

As capital flows into conventional property, Bitcoin has felt the strain, posting a 4% decline in the identical timeframe. Whereas its restoration has been swift, its standing as a “danger asset” is clearly again within the highlight.

What does this imply for crypto? With Trump’s tariffs on key suppliers signaling a deeper shift, traders would possibly pivot to short-term good points, placing long-term HODLing in danger.

Assessing Bitcoin’s long-term outlook

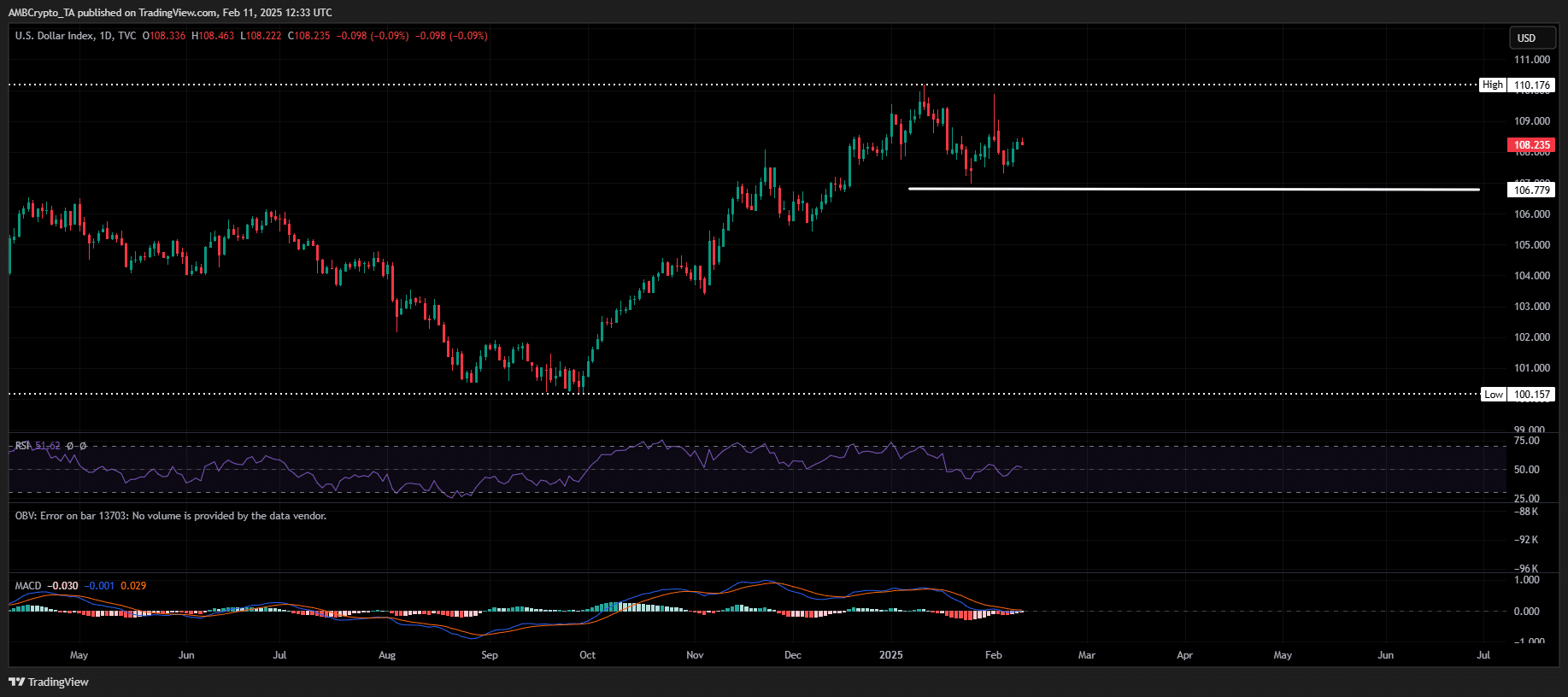

With crypto more and more tied to macro developments, maintaining a tally of key metrics is essential. The U.S. greenback index (DXY) simply reclaimed 108 after Trump’s 25% tariff on key metals – placing Bitcoin in a susceptible spot.

Supply: TradingView (DXY)

Traditionally, DXY and BTC transfer inversely. With DXY nonetheless climbing and simply 1% off its yearly peak, Bitcoin may face renewed strain.

Learn Bitcoin’s [BTC] Worth Prediction 2025–2026

Flashback to mid-December – when DXY final hit 108, BTC plunged 15% in two weeks to $89K.

As Bitcoin fights to reclaim $100K, is the market shifting from long-term conviction to short-term revenue chasing? The indicators are laborious to disregard.