BTC whales take a backseat but investors can stay calm because…

- Bitcoin whale transactions expertise a major decline, impacting BTC circulation and trade balances.

- Common transactions surge to an all-time excessive, regardless of BTC remaining beneath the impartial line on RSI.

Amidst the rollercoaster journey of Bitcoin [BTC] value fluctuations, actions of main gamers within the cryptocurrency market, often called whales, have noticeably waned in current months. This decline in whale transactions has impacted the general circulation of BTC.

Nonetheless, regardless of this, common transactions have proven indicators of resilience and continued gaining momentum.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Bitcoin whales decelerate transactions

Glassnode’s knowledge revealed a major slowdown in Bitcoin whale transactions over the previous few months. Notably, the influx of BTC to exchanges from whales has been remarkably quiet this yr, with a present switch quantity of $187 million. In comparison with the height influx worth of $1.82 billion, there was a putting decline of 85.4%, highlighting the severity of the discount in whale transactions.

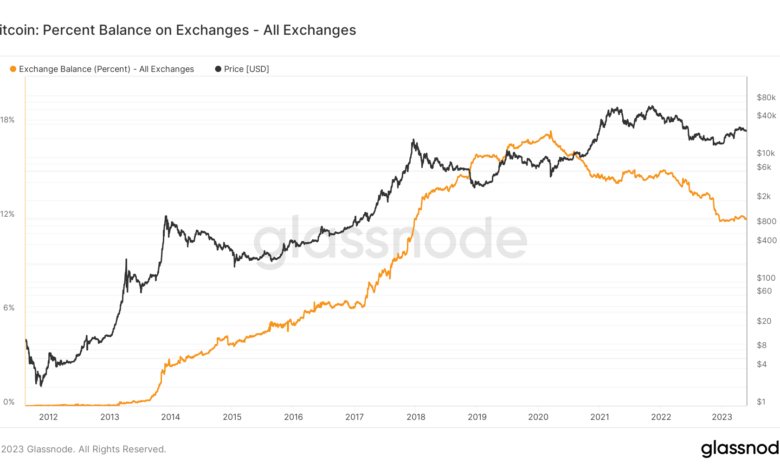

Moreover, this decline has consequently resulted in a lower within the total BTC steadiness on exchanges. Based on the BTC trade steadiness metric, the present steadiness was at its lowest level. It had roughly 2.3 million BTCs held throughout all exchanges. Moreover, this translated to the bottom proportion steadiness on exchanges primarily based on the present trade steadiness metric, which stood at round 11.8%.

Supply: Glassnode

Analyzing Bitcoin flows throughout exchanges

Regardless of the lower in whale transactions and the decline in BTC steadiness on exchanges, Bitcoin has maintained a wholesome stream of exercise throughout completely different exchanges. The stream metric, which displays BTC’s every day deposits and withdrawals on exchanges, confirmed notable inflows and outflows.

Supply: Glassnode

Nonetheless, as of this writing, there had been extra withdrawals than deposits noticed on numerous exchanges. The full influx as of this writing exceeded 22,000 BTC, whereas the outflow surpassed 31,000 BTC. Total, there was a comparatively balanced quantity between inflows and outflows every day, leading to a smaller combination netflow quantity.

Transaction hits historic excessive

Regardless of the obvious reluctance of Bitcoin whales to actively interact within the present market, transactions have been flourishing. As of this writing, Bitcoin transactions reached an all-time excessive. The transaction rely had surpassed 512,000, marking a outstanding 120% improve.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

This unprecedented degree demonstrated that retail transactions had been gaining momentum and driving up the general transaction rely, even with out substantial contributions from whales.

Supply: Glassnode

As of this writing, Bitcoin traded at roughly $26,480, experiencing a minor every day lack of lower than 1%. Moreover, it remained positioned beneath the impartial line on the Relative Energy Index, signaling a bearish pattern available in the market.