BTCFi dominance, Ethereum’s fall, and May forecast

- Runes on Bitcoin’s blockchain can save merchants from huge losses within the coming months.

- Staking on the Ethereum blockchain is on the rise, elevating issues about its future as “cash.”

Forward of the FOMC assembly (Federal Open Market Committee) of Could 2024, the crypto-market noticed a major decline. Bitcoin dropped to $56,494 – A stage final seen on 28 February 2024. Market sentiment skewed in the direction of the facet of concern as traders rebalanced their portfolios in expectation of no fee cuts.

Bitcoin’s MVRV Ratio (7-D) fell to -8.099%, at press time. On common, Bitcoin holders have been underwater. It urged that the market worth was considerably decrease than the worth at which most acquired BTC.

It may be taken as an indication of undervaluation. In response to AMBCrypto’s market report for the month of April, Bitcoin will proceed its downward journey for almost all of buying and selling classes in Could.

Supply: Santiment

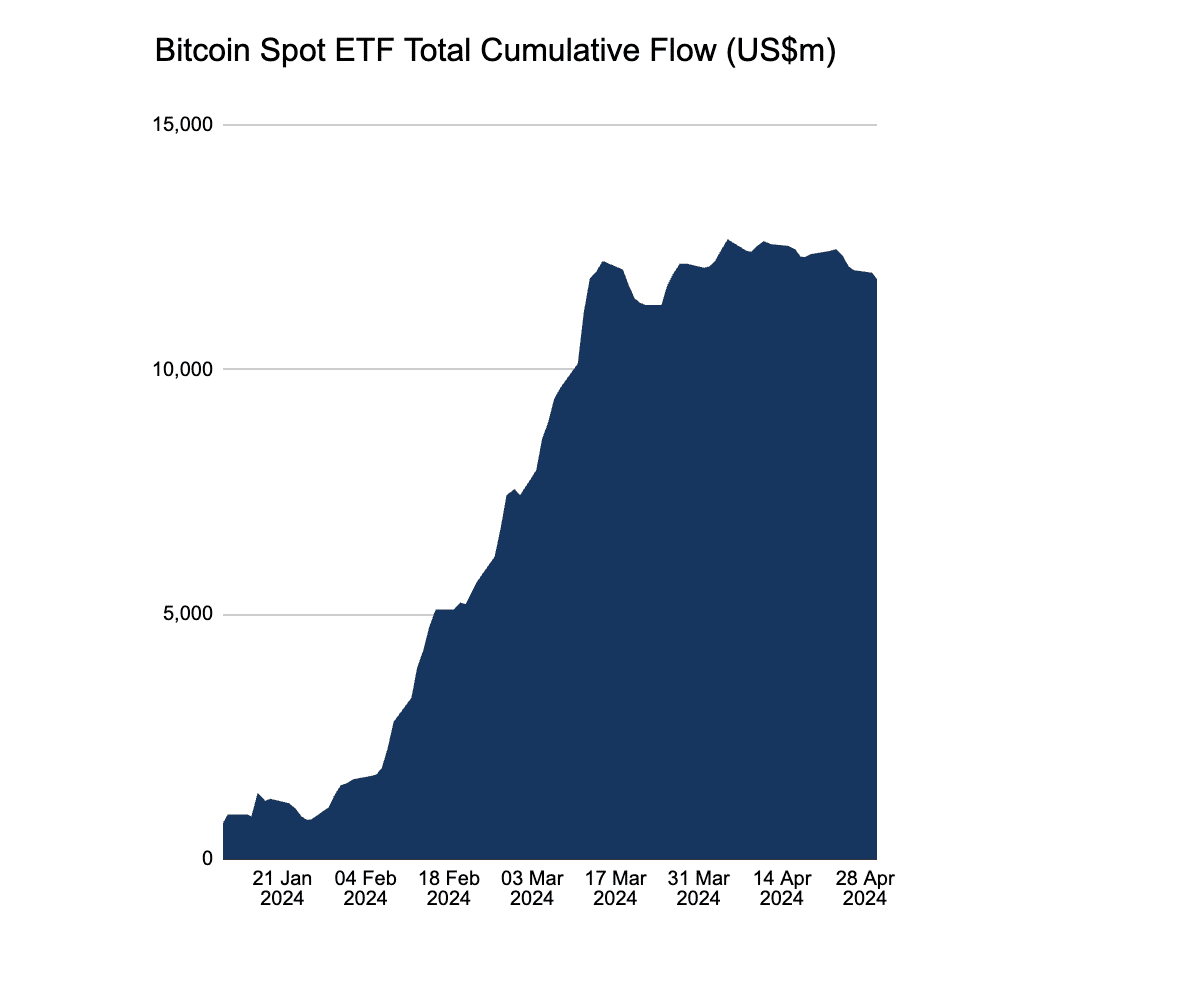

Nevertheless, the report discusses three components (Associated to BTCFi, Choices ETF, and Solana) that might reverse the king coin’s trajectory. Investments by means of BTC ETFs could have a much bigger affect on value, in comparison with the fed fee lower anticipation or geopolitical strains.

Since 24 April, BTC ETF outflows have been outweighing the inflows. On 30 April, a $161 million outflow was registered – The very best within the final three days.

AMBCrypto’s report throws mild on a contemporary perspective although – It reveals quite a few establishments are looking for approval for Bitcoin ETFs. If these ETFs are green-lit in Could, it may result in a major hike in demand, doubtlessly driving the worth north.

Bitcoin’s savior – Runes

The rise of DeFi on the Bitcoin blockchain may save merchants from registering huge losses within the coming months (AMBCrypto’s report dives into its full particulars).

Apparently, the 7-day transferring common of Bitcoin’s market cap to transaction price ratio fell under that of Ethereum. It highlighted an enormous surge in exercise on the Bitcoin community because the launch of the Runes protocol. Principally, this ratio signifies how a lot cash is flowing right into a cryptocurrency relative to the transaction charges being paid.

Altcoins’ efficiency in April

Following Bitcoin’s footsteps, the worth of different cryptocurrencies additionally fluctuated by a major diploma. April was a unstable month for many altcoins. The broader market witnessed a downturn because of geopolitical tensions and inflation fears. Nevertheless, some sectors thrived, like gaming tokens.

As per AMBCrypto’s report, Ethereum’s dominance has been challenged by Solana, whose DeFi market share has been surging steadily. In the meantime, an Ethereum ETF remains to be pending SEC approval, and staking on the Ethereum blockchain is on the rise, elevating issues about its future as “cash.”

Check out AMBCrypto’s Market Evaluation – April 2024 Version

Dive into April’s market tendencies, invaluable information, and unique insights to assist your self navigate by means of Could’s market actions.

The report delves deep into key subjects like –

- Rising recognition of DeFi on Bitcoin

- America’s love for memecoins

- Fall in USDT’s dominance

- Solana’s TVL masterstroke

- NFT market’s restoration

- Market forecast for Could

You can too obtain the complete report right here.