BTC’s annual volatility pattern offers insights into this upcoming event

- Bitcoin struggles with low volatility because the bulls and bears are locked in a stalemate.

- A take a look at either side of the coin with the prospects of a bullish breakout matched by a possible main crash.

We will all agree that Bitcoin’s worth motion has been considerably uneventful recently. However, what if its historic efficiency contrasted with the present degree of volatility might supply some insights into what to anticipate within the subsequent 2 months?

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Bitcoin’s efficiency within the final seven days underscored low volatility coupled with a liquidity crunch. Latest knowledge steered that whales had been feeling the warmth since they feed on liquidity supplied by smaller accounts.

Liquidity on either side of #Bitcoin worth is so skinny that whales need to both break up their market orders into smaller order sizes to reduce slippage or watch for pockets of liquidity earlier than smashing buttons.

Cranked the Quantity Percentile filter manner all the way down to see how and… pic.twitter.com/dpXddCKgiX

— Materials Indicators (@MI_Algos) May 16, 2023

The above knowledge mirrored the present market situations had been underpinned by low volatility. This brings us to the subsequent necessary statement. In line with a current IntoTheBlock evaluation, Bitcoin’s volatility ranges as of 18 Could stood inside a traditionally important vary.

The evaluation additionally revealed that the volatility metric was under 40%. This time marks the eighth time that it has been that low within the final 5 years.

$BTC volatility reaches traditionally important lows.

📉60-day annualized volatility has fallen under 40% for the eighth time prior to now 5 years

💰On common $BTC vol stays under this degree for five weeks and leads to a 46% worth acquire

⚠️Nonetheless, 3 crashes of fifty% have adopted… pic.twitter.com/TW8NozgIqE— IntoTheBlock (@intotheblock) May 18, 2023

Will summer season ship bullish bliss or summon the large unhealthy bear?

An evaluation of Bitcoin’s worth motion between Could to July 2020, 2021, and 2022 revealed one thing value noting. There was a drop in volatility inside these three months in every of these years, adopted by a noteworthy rally. To date issues have turned out considerably related this 12 months contemplating the at present low volatility.

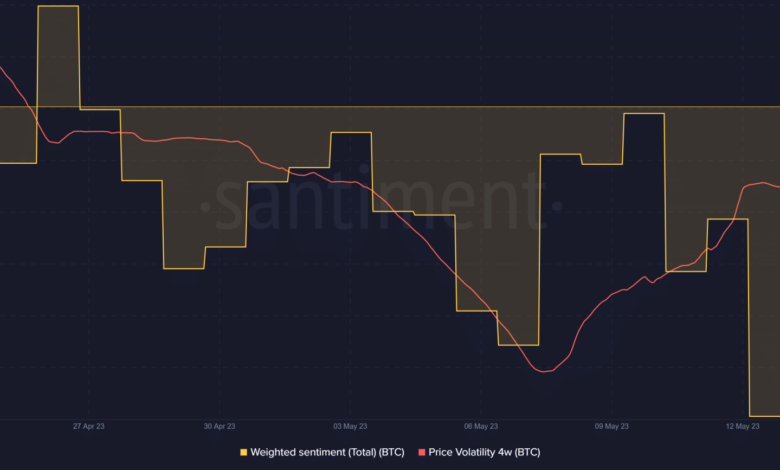

Supply: Santiment

Investor sentiment has additionally been on an general downward trajectory over the last 4 weeks. However does this imply that Bitcoin is about to get pleasure from a bullish explosion inside the subsequent 8 weeks? The identical IntoTheBlock evaluation revealed that the low volatility under 40% lasts for roughly 5 weeks on common and that there was a 50% draw back after that on three related events.

Learn Bitcoin’s [BTC] worth prediction 2023-24

If BTC is certainly due for a 50% crash from the present degree, it might go it as little as the $13,500 worth vary. Bear in mind the chance could also be low however by no means zero.

There’s a lot that determines Bitcoin’s worth final result. For instance, BTC was nonetheless experiencing bullish volumes which suggests there was nonetheless some degree of confidence available in the market. Its on-chain quantity went up barely within the final 4 days.

Supply: Santiment

We all know it was predominantly bullish quantity initially as a result of Bitcoin’s marketcap went up by as a lot as $21 billion between 12 and 18 Could. A powerful wave of promote strain worn out a considerable quantity of that gained marketcap, suggesting that short-term profit-taking continues to be lively.

One can solely wait and see whether or not these situations will dampen sentiments additional and trigger one other main crash, or set off the subsequent wave of accumulation.