Bullish surge or volatile retest ahead?

- Bitcoin’s $100K breakthrough triggers document volumes and volatility in crypto buying and selling markets.

- Large liquidations and leveraged positions drive Bitcoin’s unsure retest of $100K resistance.

Bitcoin [BTC] has achieved a historic milestone, marking its first-ever every day shut above $100,000, in response to crypto analyst Rekt Capital.

In the meantime, the value breakthrough displays rising bullish momentum within the crypto market and has sparked discussions about Bitcoin’s subsequent potential strikes because it retests this key stage.

Risky retest at $100K resistance

Rekt Capital’s analysis points to ongoing volatility as Bitcoin undergoes its third consecutive retest of the $100,000 stage.

Whereas the symmetrical triangle breakout earlier in December signaled bullish continuation, the present worth motion stays unsure.

Supply: X

The crucial zone of $99,757.85, recognized as a key resistance-turned-support space, is being carefully monitored.

If BTC fails to carry above this stage, analysts counsel it could retrace to deeper assist areas similar to $91,070.40 and even $87,325.43, ranges seen throughout prior consolidation phases.

Nonetheless, if the $100K retest holds, Bitcoin might set up this stage as new assist, paving the way in which for additional upward motion.

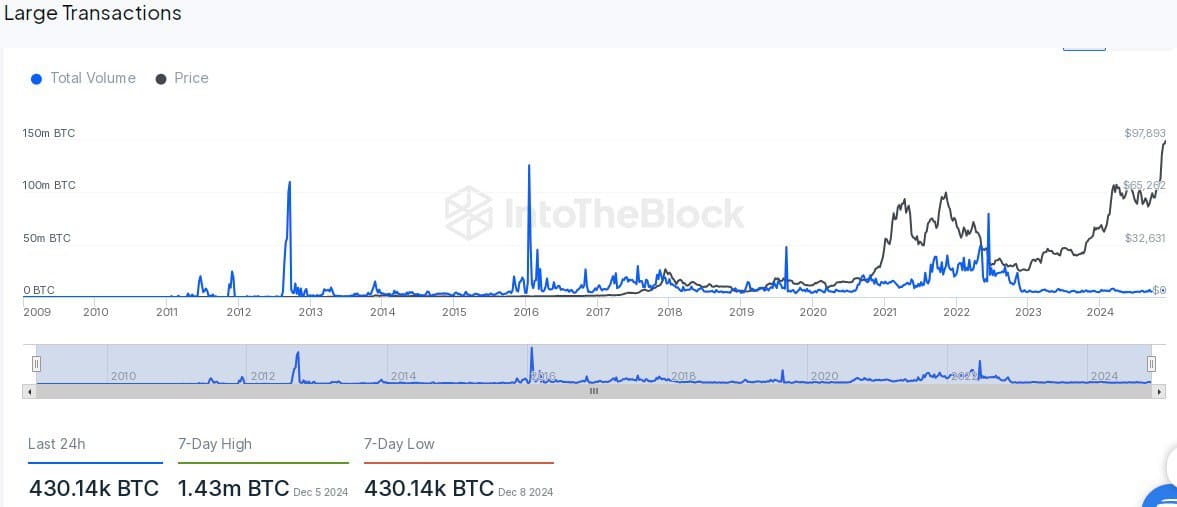

Massive transactions and market exercise tendencies

Knowledge from IntoTheBlock reveals tendencies in Bitcoin’s massive transaction volumes, which frequently spike throughout bullish cycles.

Historic knowledge exhibits that transaction peaks have aligned with main bull markets in 2013, 2017, 2021, and early 2024.

Over the previous seven days, Bitcoin noticed a notable 1.43 million BTC in transaction quantity on fifth December, 2024, which has since dropped to a 7-day low of 430,140 BTC on eighth December.

Supply: IntoTheBlock

This discount suggests cooling exercise following the historic worth milestone, as institutional gamers and whales could also be ready for worth stabilization earlier than growing exercise once more.

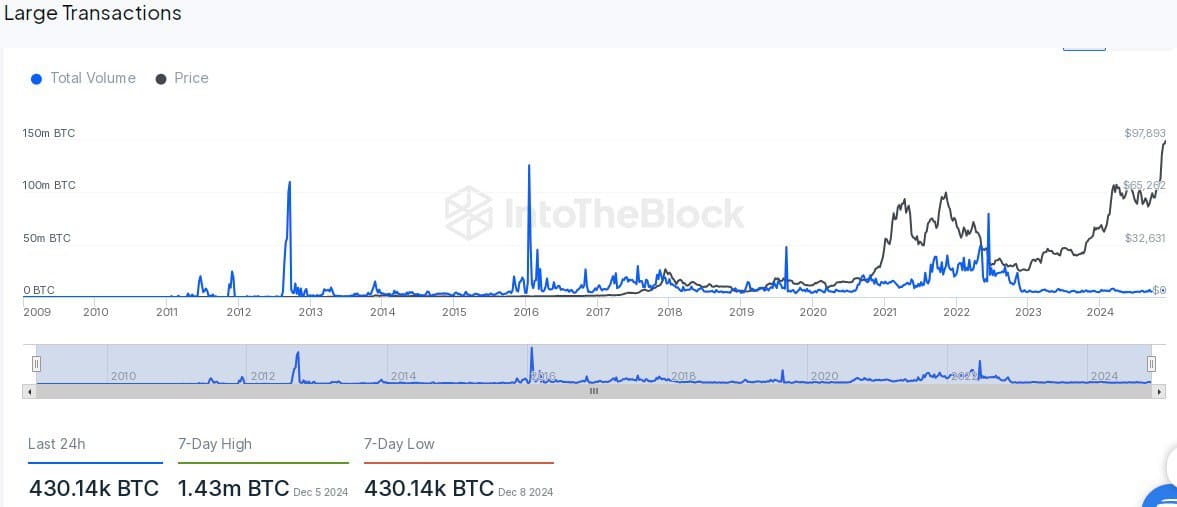

Liquidations and leverage knowledge counsel lively volatility

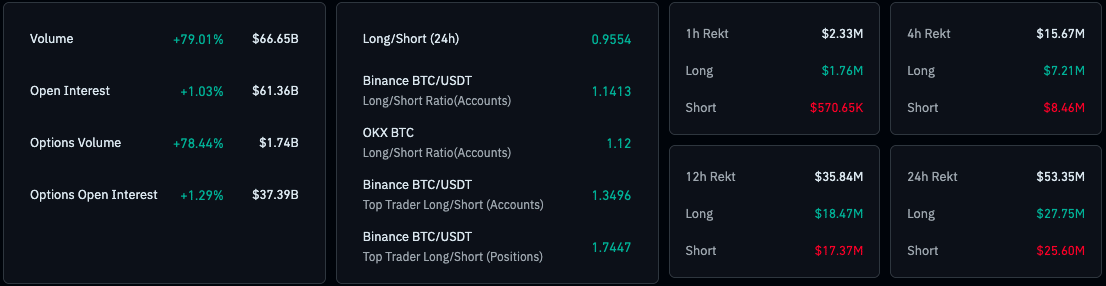

CoinGlass knowledge exhibits important exercise in leveraged positions as merchants navigate Bitcoin’s worth actions.

Supply: Coinglass

The 24-hour liquidation whole reached $53.35 million, break up between $27.75 million in longs and $25.60 million in shorts, indicating balanced stress on either side of the market.

The biggest liquidations occurred previously 12 hours, the place lengthy positions dominated with $18.47 million liquidated.

Quick positions, nevertheless, noticed heavy liquidations over shorter timeframes, together with $8.46 million in a 4-hour interval, reflecting elevated volatility across the $100K mark.

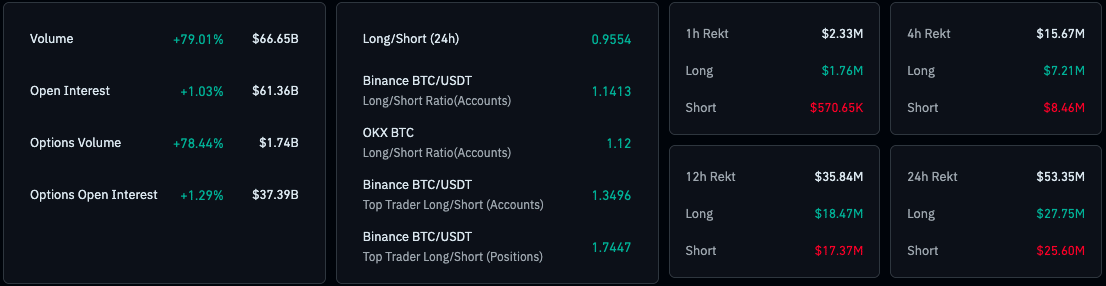

Derivatives and buying and selling metrics

Buying and selling metrics additionally suggest elevated market exercise. Bitcoin’s 24-hour buying and selling quantity rose by 79.01% to $66.65 billion, whereas open curiosity grew by 1.03% to $61.36 billion.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In choices markets, quantity elevated by 78.44% to $1.74 billion, with choices open curiosity rising by 1.29% to $37.39 billion.

Supply: Coinglass

These figures point out heightened curiosity from merchants and buyers, notably in derivatives markets, as Bitcoin’s worth actions entice speculative and hedging exercise.