Can Bitcoin benefit from the meme craze? Data suggests…

- Bitcoin community observes development as curiosity in memecoins will increase.

- Miner revenues start to say no.

The crypto market has been flooded with memecoins resembling PEPE not too long ago. Customers have been flocking to memecoins and the curiosity in them peaked once more. An unlikely recipient of the hype was Bitcoin.

Learn Bitcoin’s Value Prediction 2023-2024

Bitcoin joins the occasion

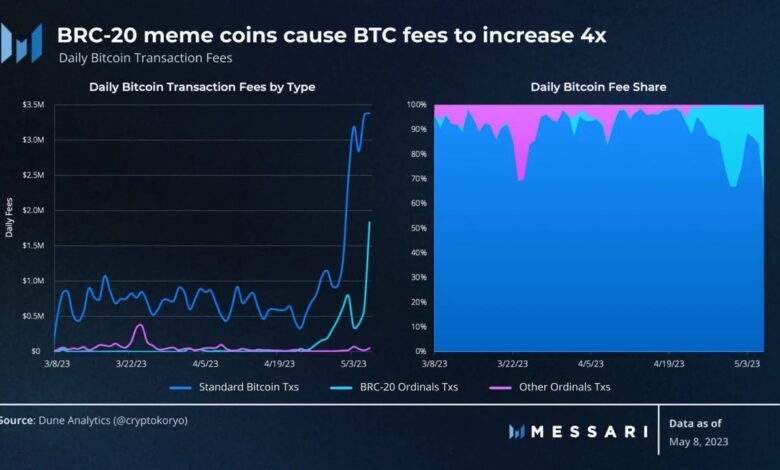

In accordance with information supplied by Messari, memecoins weren’t gaining traction on Ethereum scaling options, however have been making their mark on the Bitcoin community.

These memecoins have been in a position to unfold to the community as a result of novel BRC-20 customary constructed on the Ordinals protocol.

The rising curiosity in memecoins impacted the day by day transaction charges that have been being generated on the community. The information indicated that BRC-20 Ordinal transactions generated greater than $1.5 million in day by day charges.

Although basic transactions nonetheless make up a majority of the charges generated on the community, a big share of it was now generated by BRC-20 transactions.

Supply: Messari

Nevertheless, the quantity of normal Bitcoin transactions has began to say no.

In Could, there was a big lower in Bitcoin’s exercise, coinciding with a market-wide worth correction.

This decline in exercise was noteworthy because it marked the primary time since July 2021 that the variety of day by day distinctive Bitcoin addresses fell under 800,000.

Supply: Santiment

Affect on miners

The falling transactions on the Bitcoin community might affect the state of Bitcoin miners and their incomes capability. At press time, the day by day income being generated by miners dropped from $41.72 million to $29.44 million in the previous few days.

Supply: Blockhain.com

Moreover, there was a current upward pattern in hash price, which reached a historic excessive of 350 tera-hashes per second, based mostly on a 30-day shifting common.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

A excessive hash price enhances the general safety and stability of the community by making it extra proof against potential assaults.

Nevertheless, a excessive hash price will increase competitors amongst miners. Thus, making it tougher for particular person miners to earn rewards as a result of increased computational energy required.

Supply: glassnodein