Can Bitcoin’s price crash again?

- The Bitcoin value crash has been sudden, catching many traders off guard.

- Because the market braces for what’s subsequent, stablecoins might be poised to step in.

The current Bitcoin [BTC] crash has divided the market. Bulls argue it’s a “bear entice,” banking on a liquidity sweep to spark a restoration.

In the meantime, worry is creeping in, with greed hanging by a thread.

As Q1’s volatility ramps up, will the “Trump pump” swoop in to save lots of the day once more, or is a deeper Bitcoin value crash inevitable?

Worry of Bitcoin value crash mounts

Bitcoin has slipped 9% within the final three days, leaving many to query if that is the beginning of a bigger crash. And with the Division of Justice now cleared to promote $6.5 billion price of BTC, the considerations are solely intensifying.

Clearly, a surge in liquidity appears imminent, however with $568 million in outflows from BTC ETFs – the second main pull in underneath a month – a provide shock nonetheless feels far off.

Including to the strain, Binance’s stablecoin netflow has turned destructive, with $383 million pulled off the platform.

In truth, given the macro components at play, stablecoins may change into the go-to “secure haven” for 2025 – one thing you’ll need to keep watch over as issues unfold.

Supply: CryptoQuant

So, with retail and institutional traders in a holding sample, worry is beginning to mount. If this pattern continues, Bitcoin could dip even additional, probably falling under the $90K mark within the quick time period.

Nevertheless, the long-term outlook remains to be up within the air. Keep in mind the “Trump pump” from This autumn final 12 months that propelled BTC to an all-time excessive of $108K in simply 60 days?

With Trump’s inauguration simply ten days away, may a repeat of that rally spark contemporary FOMO and breathe life again into the market?

It is likely to be tougher than it sounds

Trying on the greater image, there’s nonetheless lots to unpack. The greenback index (DXY) exhibits no indicators of easing, and Treasury yields are nonetheless in excessive demand.

As Bitcoin’s value crash stirs up worry, these conventional belongings are poised to learn.

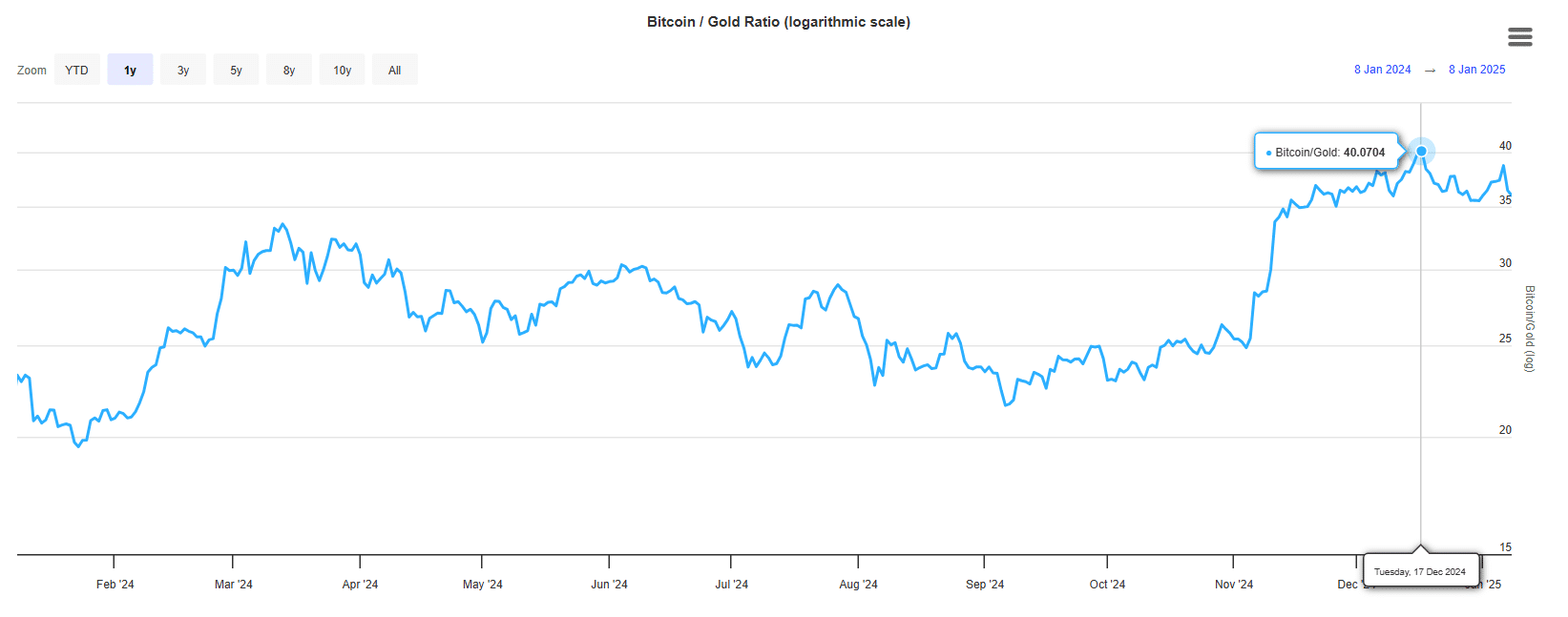

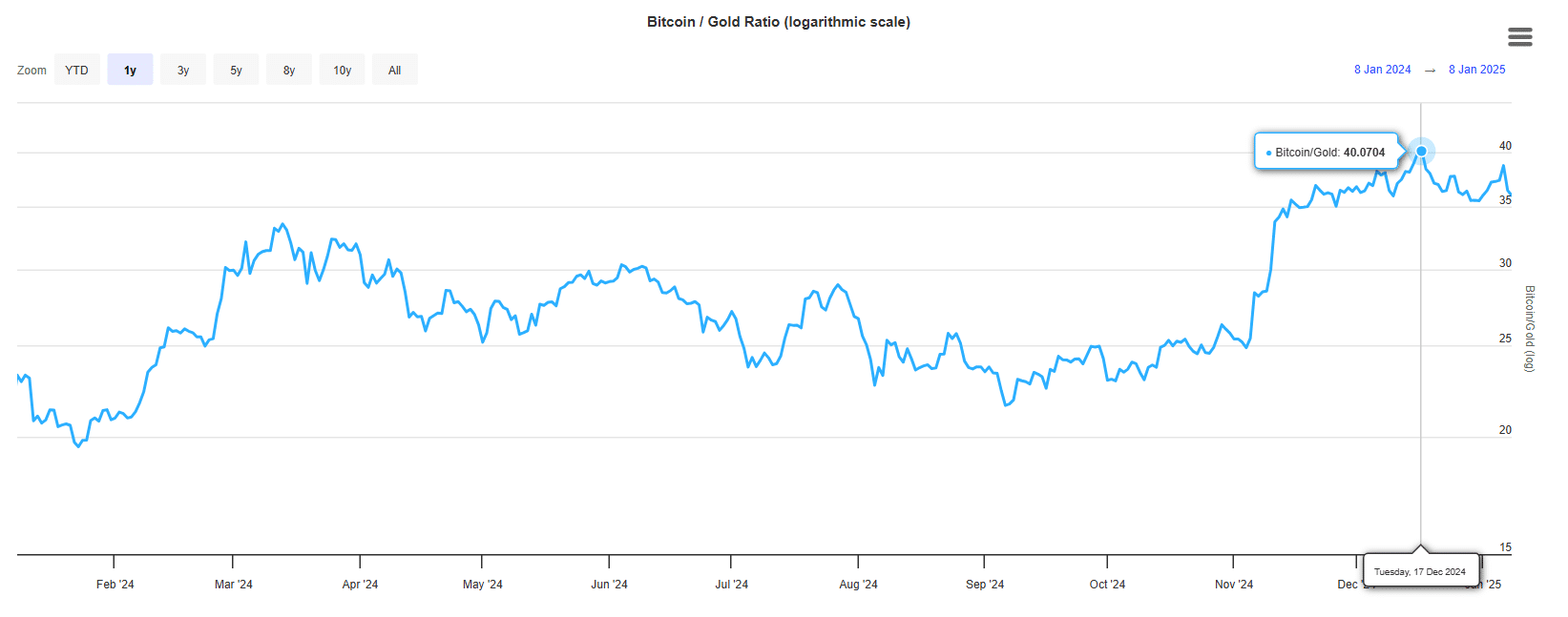

However this might simply be the tip of the iceberg. The Bitcoin-to-Gold ratio, which surged to a document 40 when BTC hit $108K, has now dipped under 35.

Supply: LongTermTrends

Whereas gold (XAU) has been comparatively flat not too long ago, a deeper Bitcoin value crash under $88K may change all the pieces.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

Right here’s why: With the U.S. coping with rising debt and world inflation pressures, gold’s standing as a safe-haven asset is extra powerful than ever.

As market dangers develop, traders are prone to flip to gold, probably sidelining Bitcoin’s enchantment as a retailer of worth.