Can Ethereum bulls take bears out of the market?

- The optimistic studying of the bulls and bears indicator means that the value may enhance.

- Ethereum’s community was overvalued and will hinder the potential upswing.

The value of Ethereum [ETH] may need decreased by 7.30% within the final 24 hours, however an evaluation of a key indicator prompt that the decline may quickly finish.

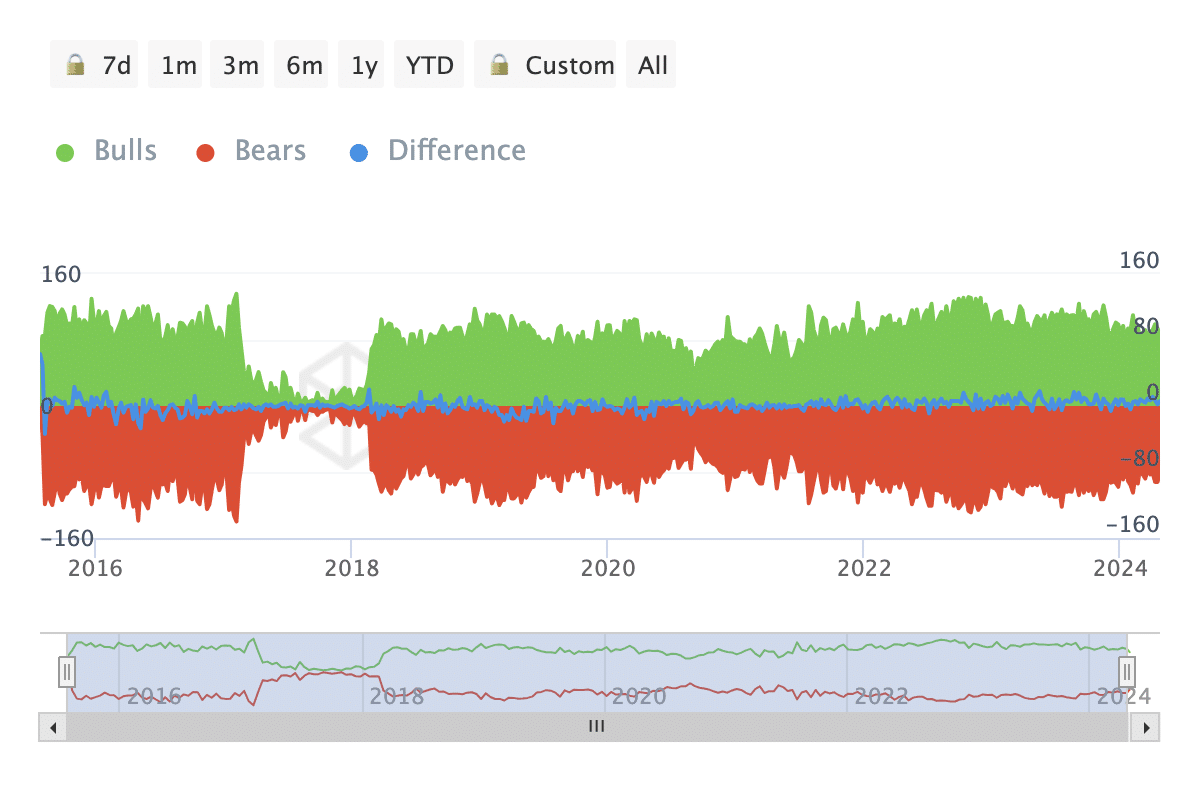

The indicator talked about right here is the Bulls And Bears metric offered by IntoTheBlock. This indicator may be measured in addresses or quantity.

Nevertheless, the main target is often on massive consumers or sellers, as they’ve an enormous affect on value actions.

The 1% wish to preserve the religion

A web unfavorable of the Bulls and Bears indicator suggests extra massive promote orders than buys. On this occasion, the value of the asset concerned may lower.

However for Ethereum, knowledge showed that the studying was optimistic, indicating bullish confidence within the value development. Ought to this metric keep its place over the approaching days, then ETH may be capable of rise towards $3,100.

Supply: IntoTheBlock

Nevertheless, failure to maintain the established order or enhance on it might ship the value of the altcoin under $2,800. When AMBCrypto checked out Ethereum’s STH-NUPL, we noticed that market contributors weren’t precisely assured within the cryptocurrency.

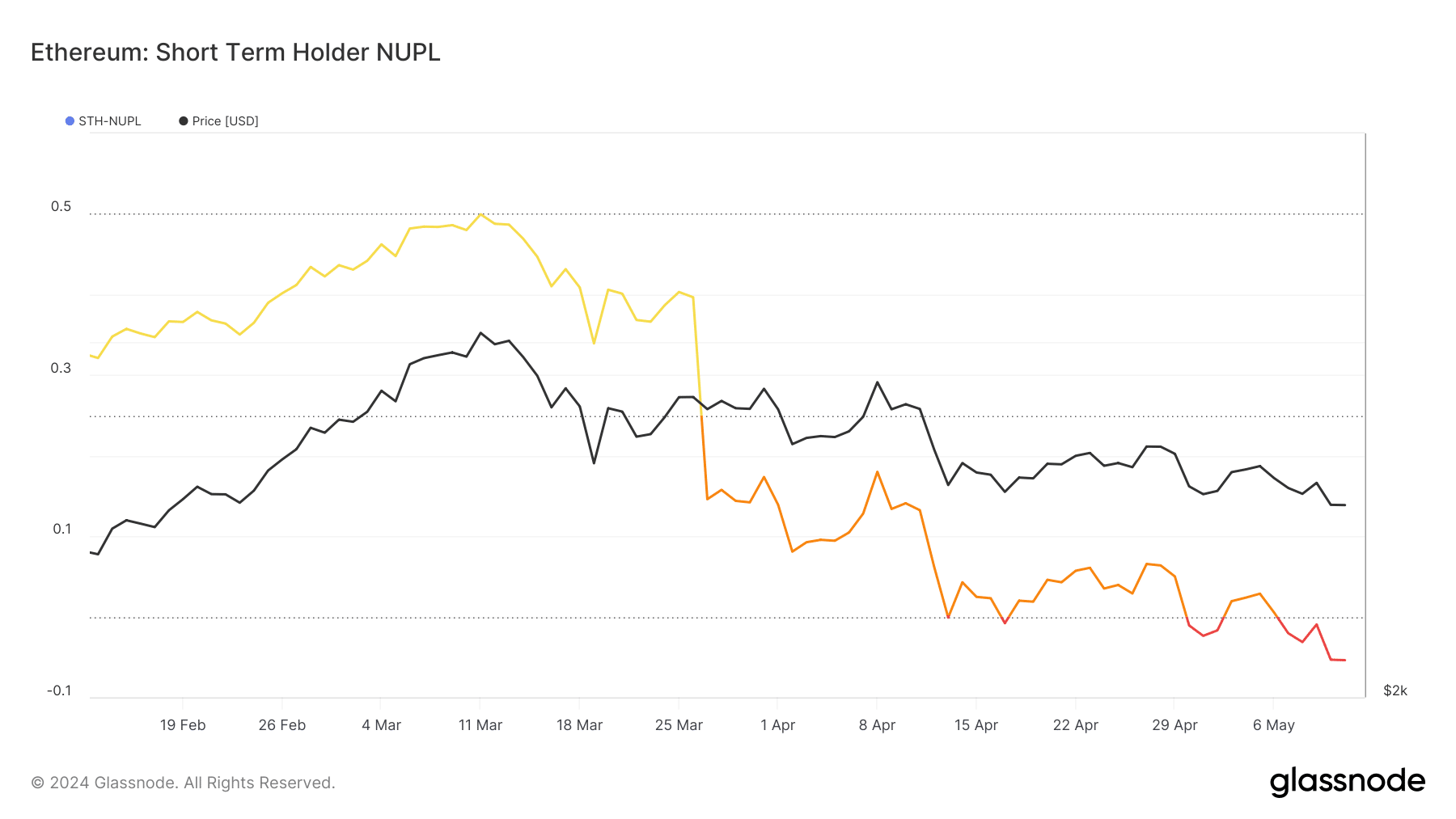

STH-NUPL stands for Brief Time period Holder — Web Unrealized Revenue/Loss. With this metric, one can have an concept of the conduct of short-term buyers.

Traders panic, however ETH could come to their help

From our evaluation, ETH’s underwhelming value motion has modified the sentiment buyers have towards the coin. In March, the metric was within the optimism (yellow) area.

At that time, holders had been assured in ETH’s value motion. However as of this writing, that reading has reached the capitulation (crimson) area, indicating that market contributors are in worry.

Supply: Glassnode

Nevertheless, worry can act as gas for a bounce. If the STH-NUPL continues to fall, ETH’s value may also lower.

Shifting, on, a turnaround may happen as intense worry might set off a more durable upswing if shopping for stress will increase.

On this occasion, Ethereum may goal an increase towards $3,500. In addition to this metric, AMBCrypto discovered one other indicator suggesting that ETH may quickly get better.

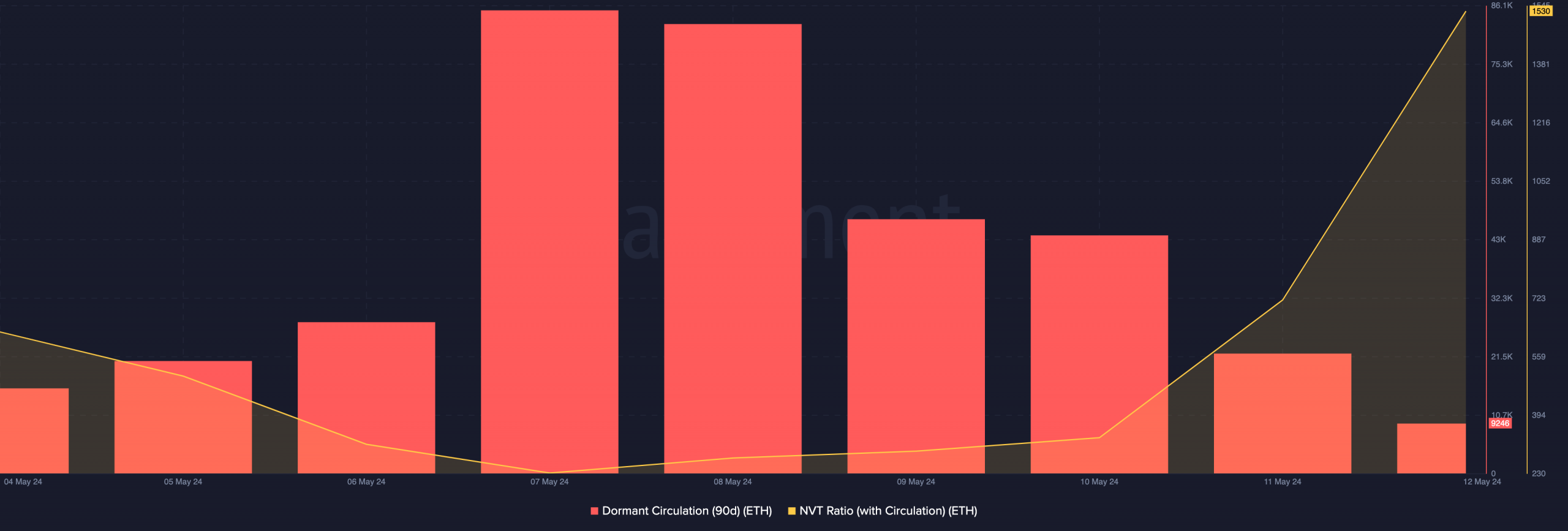

This time, we appeared to the dormant circulation. In keeping with on-chain data from Santiment, the 90-day dormant circulation had dropped to 9246.

If the metric will increase, it implies that cash that haven’t moved for an extended whereas are beginning to change wallets. Generally, this implies outdated fingers are promoting.

Supply: Santiment

Thus, the latest decline implied that long-term Ethereum buyers weren’t promoting as a lot as they did across the seventh and eighth of Might.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Nevertheless, the Community Worth to Transaction (NVT) ratio prompt that ETH may nonetheless be overvalued. Low values of the NVT counsel undervalued.

However for Ethereum, the metric spiked, indicating that the community is overvalued relative to transactions.