Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Expectations related to Spot Ethereum ETFs are excessive on the again of their launch

- Ethereum’s utility, adoption, transactions, and charges may turn out to be useful for the altcoin

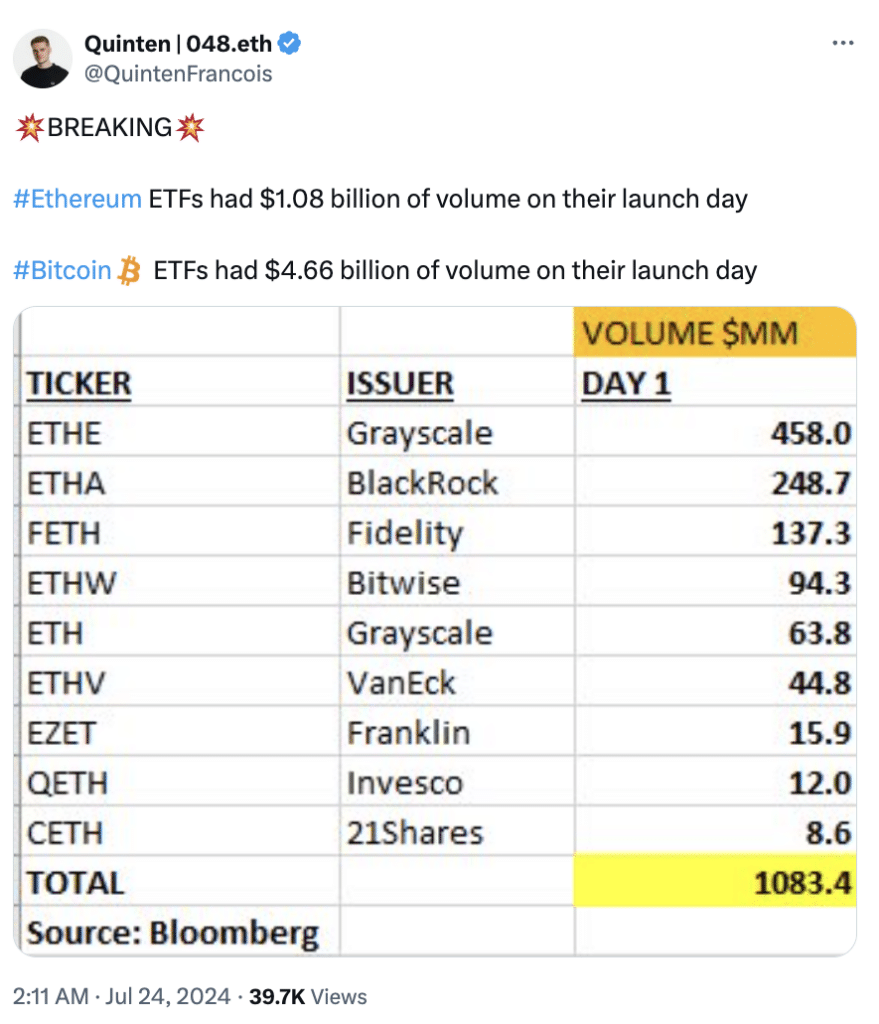

It has been greater than 24 hours since Ethereum ETFs went dwell, with preliminary reviews being pretty promising. The truth is, the primary day of buying and selling reportedly yielded over $1 billion in buying and selling quantity.

Ethereum ETFs’ buying and selling volumes on the primary day of buying and selling means that it’s off to a very good begin. Nevertheless, can it construct up and surpass Bitcoin ETFs when it comes to demand and quantity? Perhaps, nevertheless it’s price noting right here that Ether’s spot ETF volumes have been only a quarter of what spot Bitcoin ETFs registered within the first day of buying and selling.

Supply: X

Bitcoin could have the primary mover benefit, however Ethereum additionally has some strengths that will bolster its volumes and spot demand going ahead. Listed below are among the key components that will enable Ethereum to offer Bitcoin a run for its cash within the spot ETF section.

Ethereum shines in utility

The newly launched ETF will expose Ethereum to conventional buyers. Their standards for funding is totally different from what the crypto market is used to. For instance, they have an inclination to deal with natural progress components and that is the place Ethereum takes the cake.

The community helps good contracts. Because of this, its ecosystem has grown immensely through the years, with over 4,000 Dapps at press time. These Dapps help sturdy demand for ETH within the type of gasoline charges.

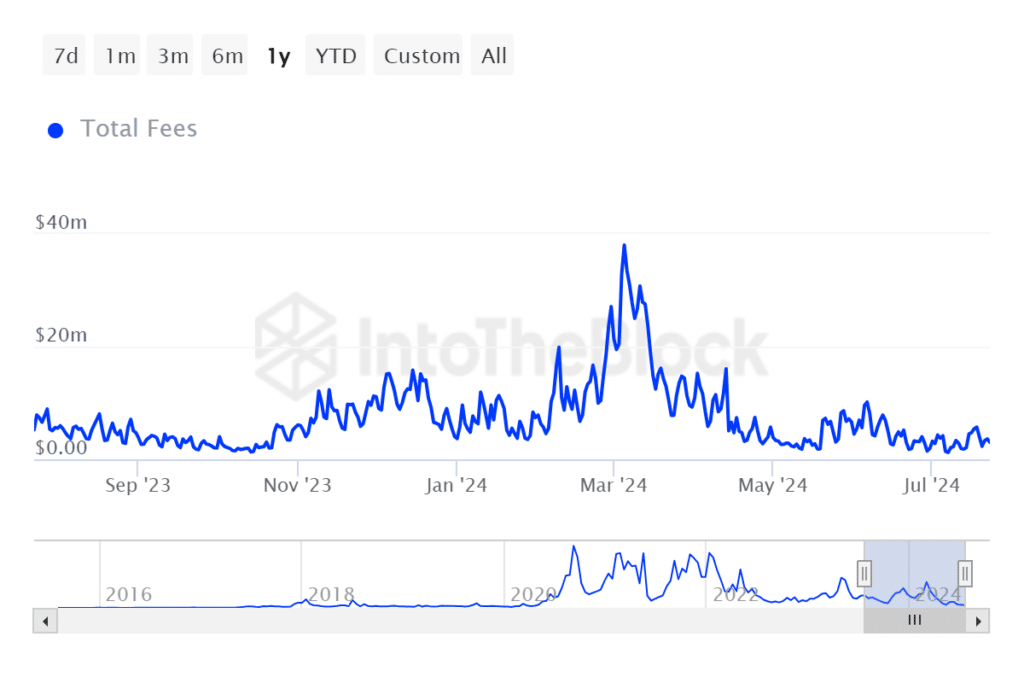

For context, Ethereum charges ranged from as little as $1.22 million to as excessive as $38 million within the final 12 months.

Supply: IntoTheBlock

Moreover, Ethereum’s staking mannequin which offers alternatives for passive earnings is akin to dividends in conventional finance. Conventional buyers could discover that interesting.

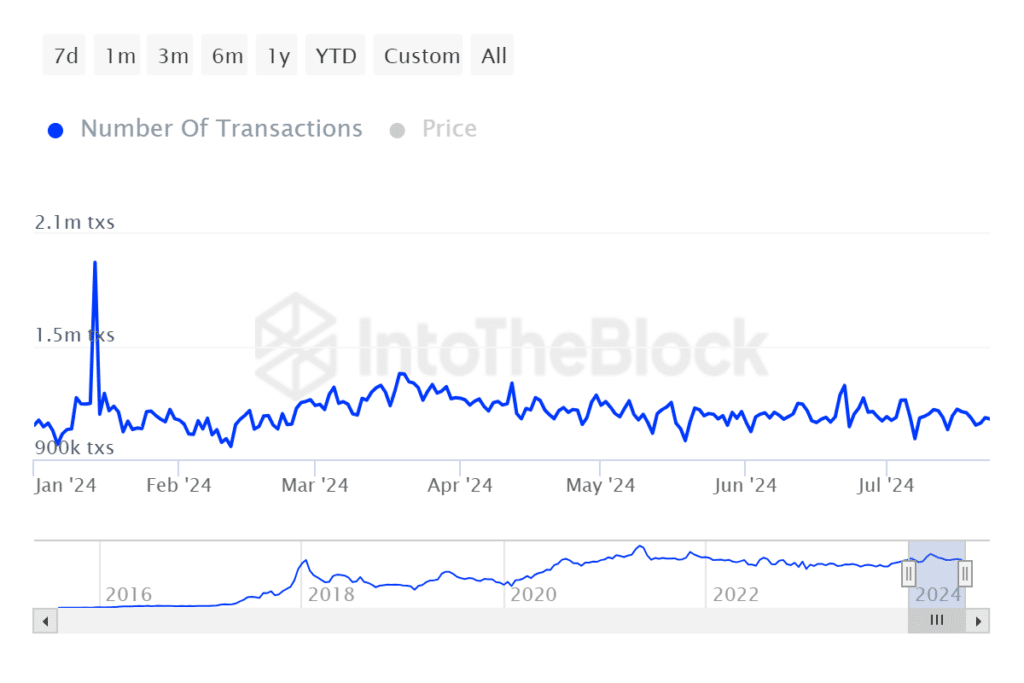

Ethereum transactions additionally current a more healthy picture than Bitcoin transactions. The latter has been struggling to hit greater than 500 day by day transactions on a YTD foundation. Quite the opposite, Ethereum’s YTD day by day transactions common over 1 million.

Supply: IntoTheBlock

The utility, charges, and transactions underscore key areas the place Ethereum outperforms Bitcoin.

A take a look at the cryptos on the value entrance is perhaps helpful too. ETH trades at a worth significantly decrease on the charts, in comparison with BTC ($3,450 versus $66,422 at press time). This will improve the notion that investing in Ethereum ETFs could present buyers with increased good points.

In spite of everything, revenue is the secret.

Simpler stated than carried out

Ethereum can maintain its personal in opposition to Bitcoin based mostly on what now we have seen above. Nevertheless, BTC already has a robust lead and its first mover benefit means many merchants could desire it to the second choice. As well as, Bitcoin’s community additionally has its successful factors such because the proof-of-work system which is maybe, the height of decentralization.

Bitcoin additionally continues to register an inflow of institutional demand, regardless of Ethereum ETFs’ rollout. The subsequent few weeks or months ought to supply a clearer image relating to which of the 2 cash will outperform the opposite on the ETFs’ demand entrance.