Can Ethereum flip Bitcoin by 2030?

- Ethereum’s transition to PoS places it on track to offer Bitcoin a battle.

- A prediction stated that Ethereum’s income might hit $51 billion by 2030 whereas ETH might hit $11,848.

Future can’t be denied. It could solely be delayed. This assertion explains the sentiment of those that imagine that Ethereum [ETH] will flip Bitcoin [BTC] by 2030. Nonetheless, this dialogue has been happening for a very long time.

However on the time of writing, Ethereum had not but flipped Bitcoin by way of market cap.

Regardless of the state of issues, some Ethereum supporters argue that the flipping would occur. AMBCrypto checked if there was any time that the good contract blockchain got here near overtaking Bitcoin.

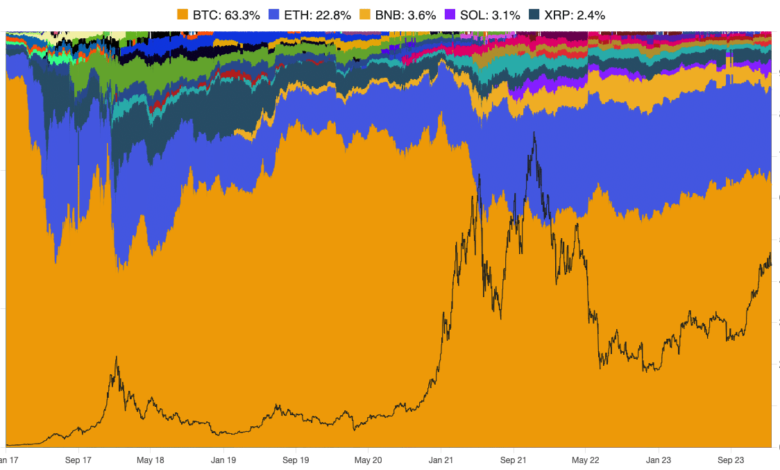

In keeping with data from Blockchain Middle, Ethereum’s market dominance rose to 36.9% in June 2017.

At that, Bitcoin’s dominance was round 44.4%. Finally, the flipping didn’t occur. However between that interval and now, a number of issues have modified.

Supply: Blockchain Middle

Ethereum’s new mannequin adjustments Bitcoin’s operation

One of many main adjustments was Ethereum’s transfer away from Proof-of-Work (PoW). Up till September 2022, each Bitcoin and Ethereum utilized the PoW consensus mechanism.

The PoW mechanism permits the verification of transactions by means of miners. On this case, miners get rewards for including computation energy to the community. However Ethereum stopped utilizing that methodology and transitioned to Proof-of-Stake (PoS) throughout a serious improve referred to as “The Merge.”

With PoS, Ethereum now not wants miners however validators. Right here, customers don’t need to be miners, they usually additionally get rewarded for validating new blocks of transactions.

This “ease” has aided Ethereum’s recognition. Additionally it is one of many causes some predictions are assured that Bitcoin will play second-fiddle by 2030.

Nonetheless, Bitcoin has not been resting on its oars. Latest developments have confirmed that the Satoshi Nakamoto-developed undertaking could possibly be able to battle Ethereum pound for pound.

Competitors escalates between the kings

This assertion could possibly be linked to the creation of NFTs on the Bitcoin community. In the course of the 2021 bull market, NFTs bought well-liked, and most of them had been constructed on the Ethereum blockchain. Because of this, demand for ETH elevated.

Nonetheless, the introduction of Bitcoin Ordinals in 2023 Q1 has ensured that Ethereum has intense competitors in that regard. AMBCrypto checked out CryptoSlam’s data and located that Bitcoin was giving its reverse quantity a run for its cash.

At press time, NFT seven-day gross sales on the Ethereum blockchain had been $92.39 million. Bitcoin was an in depth second with $90.18 million throughout the similar interval.

Supply: CryptoSlam

So, if demand for ETH rises on account of these property, there’s a excessive probability that BTC additionally observe. Ought to this stay the identical case, Ethereum flipping Bitcoin by 2030 could be troublesome.

Moreover, Ethereum dominating the Decentralized Finance (DeFi) house makes a robust case for the flipping. That is main due to its good contract functionalities.

On the peak of the bull market in 2021, Ethereum’s Whole Worth Locked (TVL) hit $97 billion.

The TVL determines the whole worth of digital property locked in a protocol. So, the rise at the moment implied that market members trusted the undertaking sufficient to repeatedly add liquidity to it.

Supply: DeFiLlama

5 figures for ETH by 2030?

This DeFi dominance is why some analysts imagine that the Vitalik Buterin-led undertaking can chunk into Bitcoin’s market share. For instance, in Might 2023, VanEck predicted that the blockchain’s income might rise as excessive as $51 billion by 2023.

The analysis additionally talked about that Ethereum’s dominance amongst good contracts protocols might rise to 70%. The mutual fund and ETF administration agency additionally talked concerning the value, noting,

“In our Base Case, we assume that Ethereum will obtain $51B in annual income within the 12 months ending 4/30/2030. We deduct a validator price from this whole, 1%, and a world tax fee of 15%, and we arrive at money flows of $42.90B to Ethereum. Assuming an FCF a number of of 33x, 120.7M token, we come to a Base Case 2030 Value Goal of $11,848 per token.”

On an all-time foundation, ETH’s value has elevated by 89,382.45%. BTC, however, had seen its worth rise by 68,863,742%. By evaluating each costs, one can assume that ETH was undervalued massively undervalued in comparison with Bitcoin.

Nonetheless, there have been predictions that the Bitcoin value might rise increased. One of many causes could possibly be linked to the recently-approved Bitcoin spot ETFs.

With the ETF approval, extra institutional capital is anticipated to stream into Bitcoin. This might additionally have an effect on the worth motion positively. Because of this, ARK Make investments CEO Cathie Wooden famous that BTC might cross the $1 million mark by 2030.

Ethereum flips Bitcoin right here

Within the meantime, analyst Michaël van de Poppe believes that the Bitcoin spot ETF approval was a sign for ETH to shine. In keeping with him, the event might drive liquidity rotation into the Ethereum ecosystem.

#Ethereum approaches the low of 2022 and is probably going going to take the liquidity there.

If an ETF approval for #Bitcoin occurs, I feel we’ll have a liquidation candle on ETH/BTC and after {that a} rotation into Ethereum, mixed with a bullish weekly divergence. pic.twitter.com/kGq91S7kq9

— Michaël van de Poppe (@CryptoMichNL) January 9, 2024

However will this result in Ethereum flipping Bitcoin? Nicely, that may be onerous to resolve, contemplating that an Ethereum spot ETF could possibly be accredited earlier than or by Might 2024.

Relating to the variety of holders, AMBCrypto evaluation of Santiment confirmed that BTC had 52.76 million. ETH, however, had greater than double that at 112.52 million.

Supply: Santiment

Can Ethereum flip Bitcoin by 2030? Our verdict

This information indicated that Ethereum had skilled extra adoption than Bitcoin. If the expansion continues on this method, then it might enhance its possibilities of flipping Bitcoin by 2030.

One other potential affect of the flipping is the provision. For Bitcoin, it has a hard and fast provide of 21 million cash. This is among the causes Ethereum may discover it onerous to flip it.

As a result of if demand for BTC will increase with its fastened provide, the worth and market cap will go increased.

The provision of ETH, nevertheless, is limitless. However the undertaking, due to its burning mechanism, ensures that demand matches the ETH provide.

Additionally, the shift to PoS had significantly impacted the tokenomics. That is additionally one of many causes market members have caught to ETH because it grew to become a yield-generating asset.

Given its totally different use instances, demand from retail and establishments alike is anticipated to extend.

Sensible or not, right here’s ETH’s market cap in BTC’s phrases

However to flip Bitcoin could be a tough nut to crack. Moreover, 2030 is a very long time to foretell what would occur with each tasks.

However contemplating the current developments, Ethereum may get very near flipping Bitcoin. Nonetheless, it isn’t assured that the previous would surpass the primary cryptocurrency by that point.