Can Ethereum recover? – A 60% cut to its 2025 price target raises doubts

- StanChart’s Geoffrey Kendrick projected that Base has clawed $50B from ETH’s market cap.

- Amberdata believed ETH may supply extra shorting beneficial properties within the close to time period.

Normal Chartered (StanChart) has massively downgraded its Ethereum [ETH] worth goal for 2025 from $10K to $4K, a 60% slash.

In response to a report by The Block, StanChart’s Head of Digital Property Analysis, Geoffrey Kendrick, singled out Coinbase’s Base as one short-term threat issue.

Kendrick famous,

“Layer 2s, and Base particularly, now extract super-profits from the Ethereum ecosystem…We estimate that Base (the dominant Layer 2) has eliminated $50 billion of market cap from Ethereum alone.”

The analyst added that L2s now dominate transaction charges and bypass the mainnet. To resolve this, he advisable Ethereum slapping a ‘tremendous tax’ on L2s, or else the ETH/BTC ratio would dip decrease.

Market reactions: What’s subsequent for ETH?

Kendrick additionally highlighted that the previous Ethereum modifications, together with ‘The Merge’ and ‘Dencun’ upgrades, had been crucial for long-term scalability however have been ‘worth damaging.’

Reacting to the report, Solana’s Co-Founder Anatoly Yakavenko termed it ‘spicy.’

When requested whether or not an identical ‘Base state of affairs’ on Solana would drag SOL to single digit worth, Yakavenko downplayed it, citing Ethereum’s weak ‘alignment.’

For his half, Ceteris, pseudonymous Head of Analysis at Delphi Analysis, jibed that StanChart’s $4K goal was comparatively greater.

“Normal Chartered is infamous for having ridiculously unrealistic worth targets, they’re at all times approach too excessive.”

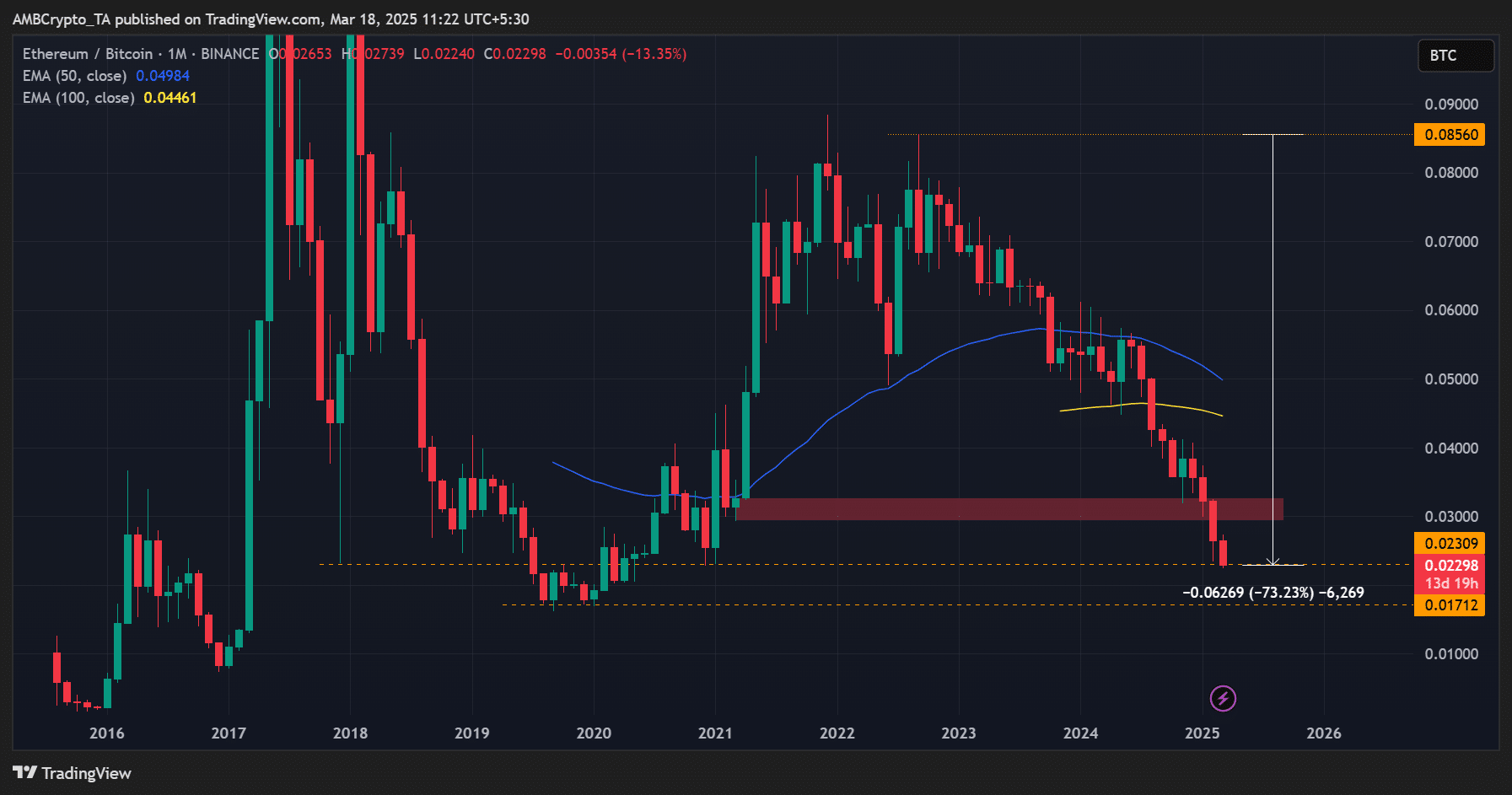

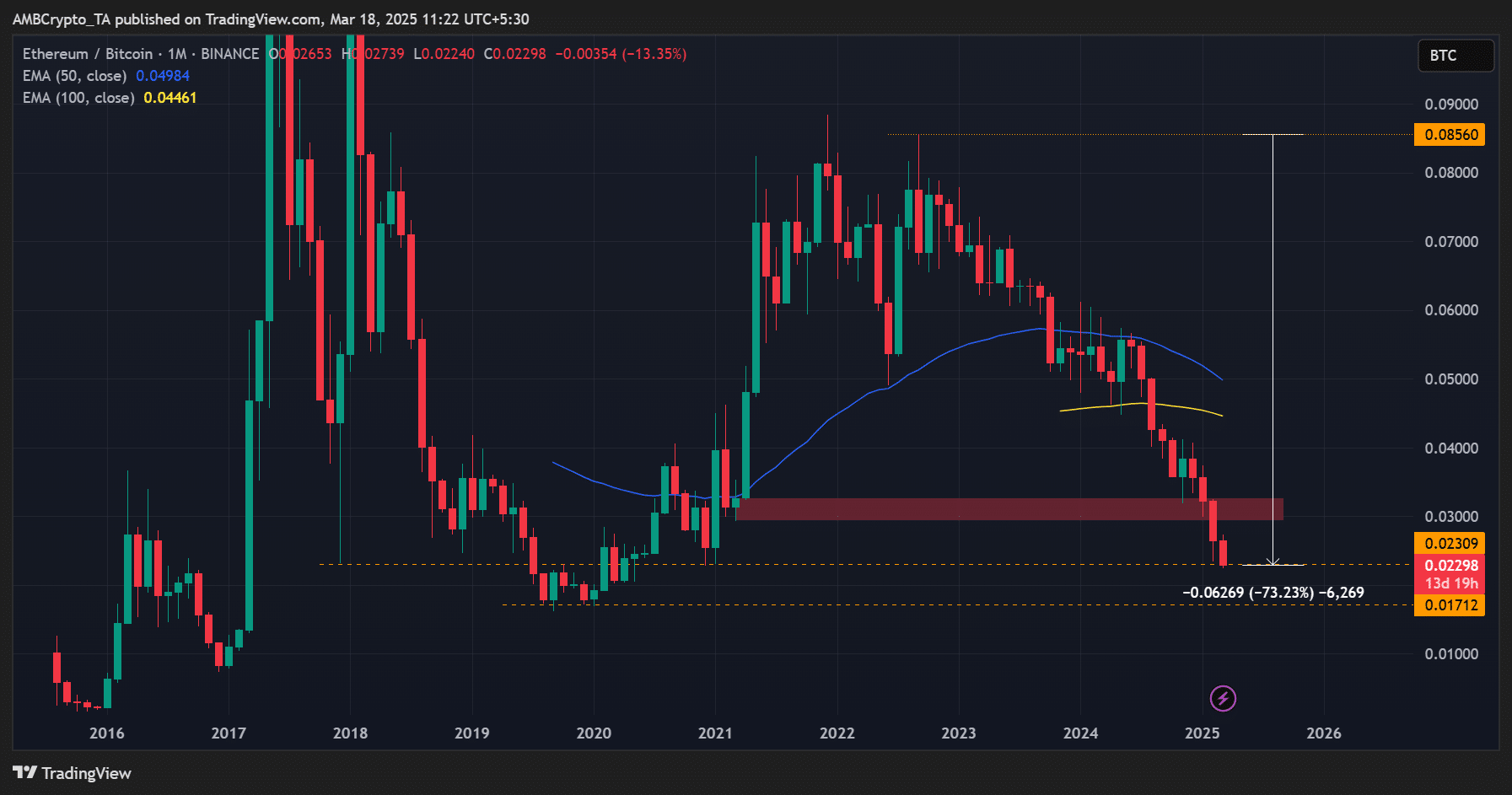

That mentioned, the ETH/BTC ratio, which tracks ETH worth efficiency relative to BTC, marked a brand new 5-year low of 0.22 and was down 73% from its 2022 highs. Merely put, ETH has underperformed BTC for five years.

Supply: ETH/BTC, TradingView

The truth is, in comparison with the S&P 500 Index, SPX, ETH has underperformed U.S. equities since 2018, noted Quinn Thompson, Founding father of Lekker Capital, a macro-focused crypto VC.

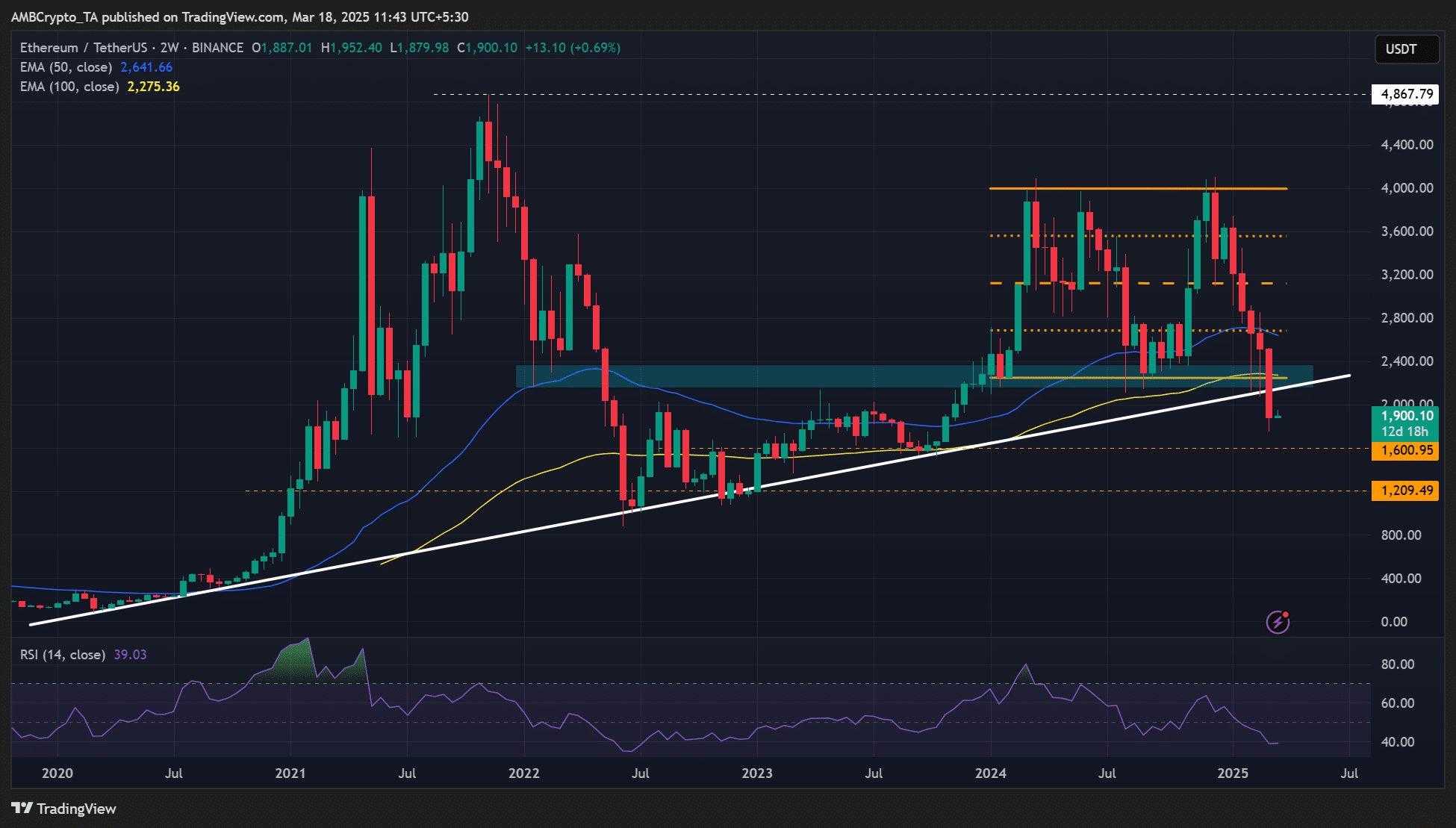

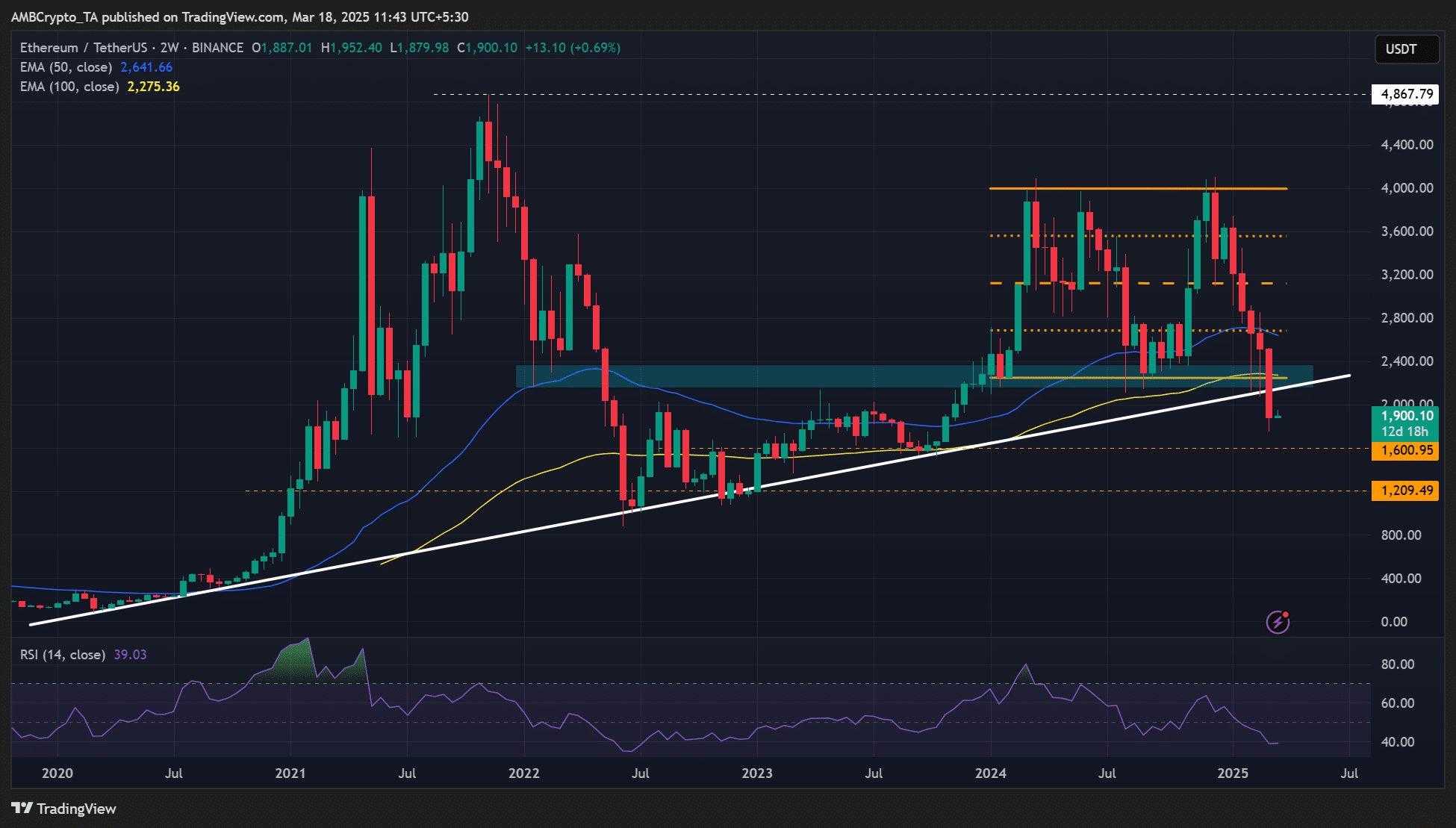

Initially of this cycle, ETH jumped 167%, rallying from $1600 to $4K between late 2023 and early 2024. Nonetheless, as of this writing, the altcoin was valued at $1.9K and was on the right track to erasing all this cycle beneficial properties if it dipped decrease.

In response to Amberdata’s Greg Magadini, ETH may nonetheless supply extra shorting alternatives, citing altcoins’ sell-off and ETH/BTC decline. He said,

“ETH stays probably the most fascinating short-trade. The robust ETH/BTC ratio and the general altcoin sell-off look like robust developments that may proceed to pull ETH a lot decrease.”

Supply: ETH/USDT, TradingView

From a worth motion perspective, ETH broke under its 5-year trendline assist, additional reinforcing the weak market construction acknowledged by Magadini.

Whether or not quick sellers will drag it to $1.6K or $1.2K stays to be seen.