Can Polygon zkEVM replicate 2023’s success in 2024?

- The hike in Polygon’s community exercise triggered a spike in zkEVM’s each day fuel utilization.

- zkEVM’s community stats remained decrease than zkSync Period, regardless of latest upticks.

The final month of 2023 was absolute bliss for Polygon [MATIC] zkEVM, as its community exercise skyrocketed. The hike in community exercise indicated an enormous surge in adoption and utilization.

Since we’ve entered a brand new yr, let’s take a more in-depth take a look at zkEVM’s community stats to see whether or not the identical pattern will proceed in January 2024.

Of Polygon zkEVM’s efficiency in December

In a tweet dated the third of January, Right this moment In Polygon, a well-liked X (previously Twitter) deal with famous that zkEVM’s each day lively addresses surged by greater than 200% in December.

Additionally, its variety of each day transactions spiked by over 130% within the final 30 days.

NEW:

Over the past 30 days, Polygon zkEVM each day lively addresses have elevated 202% and each day transactions have elevated 134%. pic.twitter.com/qqEhuxWYGq

— Right this moment In Polygon (@TodayInPolygon) January 3, 2024

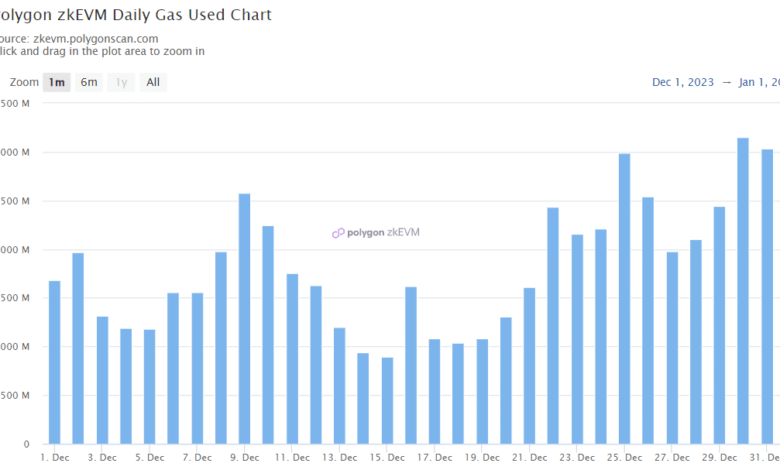

Because of that uptick, the rollup’s fuel utilization elevated. This was evident from AMBCrypto’s evaluation of Polygonscan’s knowledge, which confirmed an increase in zkEVM’s each day common fuel used chart.

Supply: Polygonscan

What about 2024?

Issues for 2024 additionally look fairly optimistic. Notably, AMBCrypto’s examined Artemis’ data, which revealed that zkEVM managed to keep up its development when it comes to its Every day Lively Addresses.

The same pattern was additionally famous on its Every day Transactions chart.

Nonetheless, the rollup’s TVL dropped sharply after registering a spike on the twenty eighth of December, which was regarding.

Dropping TVL often signifies a shift within the demand for particular DeFi providers or within the reputation of particular DeFi protocols.

Supply: Artemis

Polygon zkEVM vs. zkSync Period

Since we’re assessing zkEVM’s efficiency, it’s essential to try its high competitor, zkSync Period. AMBCrypto’s evaluation of Artemis’ data revealed that regardless of zkEVM registering development on a number of fronts, it was nonetheless behind zkSync.

Each zkEVM’s Every day Lively Addresses and Every day Transactions have been low in comparison with these of its competitor.

Nonetheless, the excellent news was that zkEVM’s income was near that of zkSync, and contemplating the expansion charge, it will likely be fascinating to see whether or not zkEVM manages to outshine zkSync.

Supply: Artemis

Is your portfolio inexperienced? Take a look at the MATIC Revenue Calculator

MATIC stays bearish

Whereas Polygon zkEVM managed to keep up a development charge on sure fronts, MATIC, however, felt the wrath of the bears. In keeping with CoinMarketCap, within the final 24 hours, MATIC was down by greater than 2%.

The token’s buying and selling quantity additionally witnessed a rise whereas its value dropped, which legitimized the downtrend. On the time of writing, MATIC was buying and selling at $0.9859, with a market capitalization of over $9.4 billion.