Dissecting Bitcoin’s Wall Street-driven rally: From ETF inflows to macro risks

- Bitcoin’s largest breakout weapon may also double as its sharpest macro set off.

- A clear view of U.S. crypto sentiment is extra necessary than ever.

As Bitcoin [BTC] grinds into contemporary highs, the dialog shifts from momentum to magnitude. How excessive can this leg go, and the place does the following liquidity ceiling sit?

However past worth motion, there’s a deeper structural narrative enjoying out: Bitcoin is changing into geopolitically tethered. With U.S. spot ETF inflows ramping up and the Coinbase Premium Index (CPI) flashing inexperienced, Wall Avenue is clearly within the combine.

Brief-term bullish? Completely. However now the chart’s acquired a macro beat, that makes each pump far more layered – and risky.

Contained in the U.S. Bitcoin vault

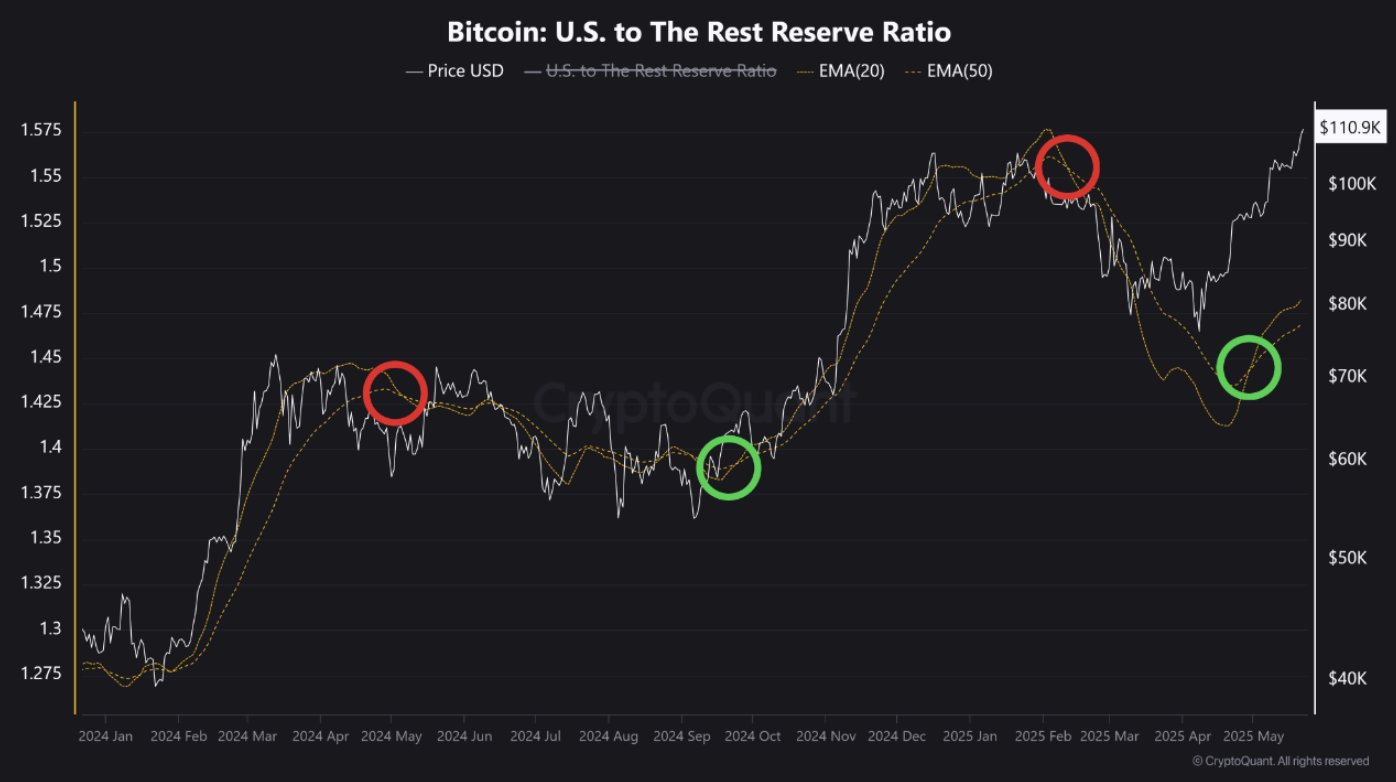

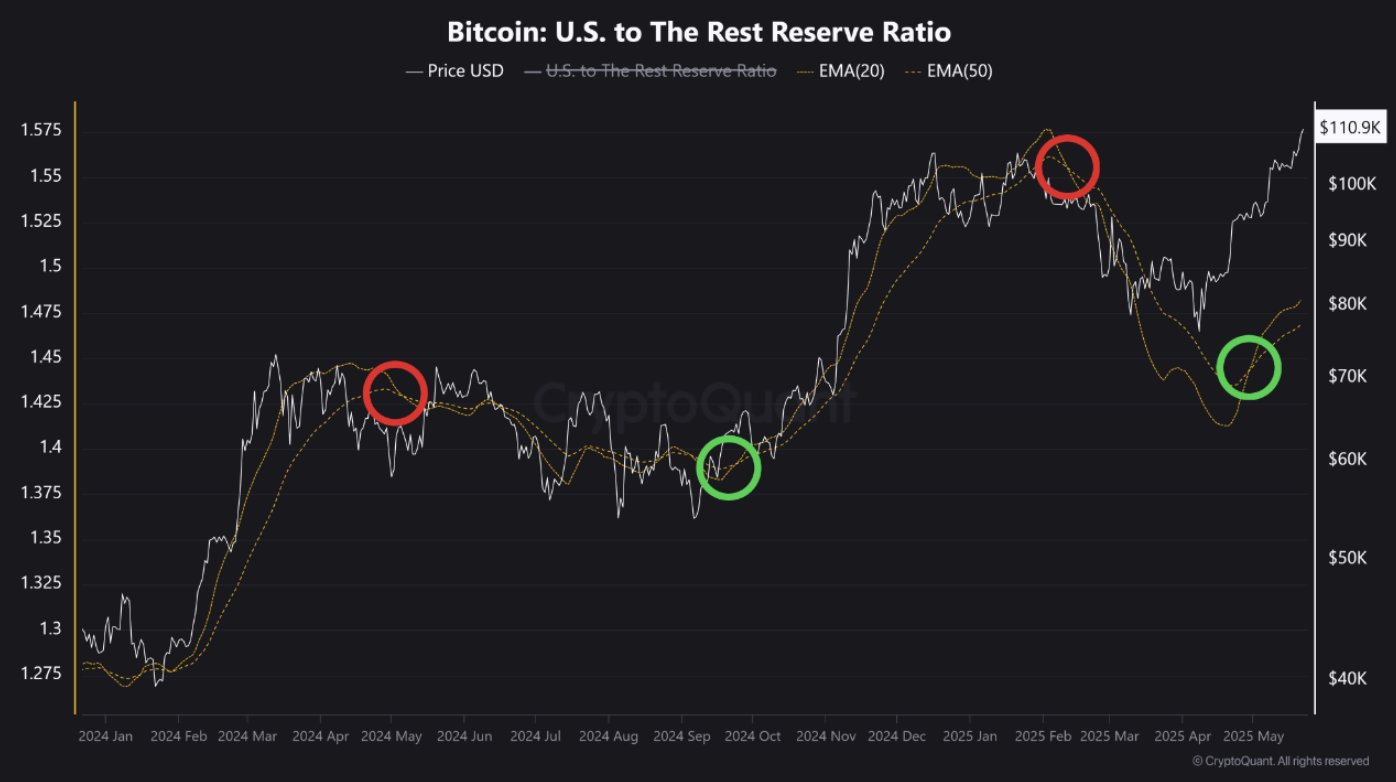

CryptoQuant data is flashing a key sign: When the BTC U.S. to Relaxation Reserve Ratio spikes, it usually marks heavy accumulation by U.S. gamers that units up golden crosses – prime setups for bull runs.

Proper now, that acquainted sample is lighting up once more. The current inexperienced circle pinpoint vital “dip zone” similar to This fall 2024, which kicked off a monster 75% rally.

Supply: CryptoQuant

Fueling this golden cross, U.S. Bitcoin spot ETFs are on a tear, logging seven straight days of web inflows.

The most recent on the twenty second of Might pulled in a staggering $935 million, with BlackRock’s IBIT ETF alone hauling $877 million, completely syncing with BTC’s 1.81% day by day shut at $111,917.

Overlay that with a inexperienced Coinbase Premium Index (CPI) and also you’ve acquired a setup that echoes earlier accumulation-to-expansion cycles. If this rhythm holds, BTC’s subsequent worth discovery zone might stretch all the best way as much as the $192.5k deal with.

Will Wall Avenue’s urge for food flip momentum into mania?

No person can neglect the post-“Trump pump” crash. Bitcoin smashed by way of two consecutive all-time highs in beneath 30 days, solely to get caught in a volatility vortex that despatched it spiraling.

The twentieth of January marked the inflection level. As Trump re-entered the Oval Workplace, danger markets recoiled. Headlines have been stacked with tariff revival chatter, sticky inflation prints, and a Fed signaling tighter for longer.

Wall Avenue rotated defensive — and so did crypto.

That’s when the BTC: U.S. to Relaxation Reserve Ratio flipped pink, exhibiting U.S. buyers have been pulling again quick. Large outflows from U.S. exchanges lined up completely with Bitcoin’s fall to $76k, all in lower than 100 days.

Supply: TradingView (BTC/USDT)

Trying ahead, if tariffs chill and inflation cools, risk-on flows might proceed surging, pumping contemporary U.S. capital into Bitcoin’s veins.

However beware — macro FUD is a lurking beast. When it rears, Wall Avenue’s defensive mode kicks again in.

That golden cross? It’s bullish, however chasing a November-style 75%+ blast off rally? Too optimistic for now.