Cardano (ADA) Price Prediction For March 29

With a value decline of 6% over the previous 24 hours, ADA, the native token of the Cardano blockchain, reached a key stage and is on the verge of a large value drop. Over the previous week, ADA has been consolidating in a slender vary between $0.69 and $0.75.

Cardano (ADA) Technical Evaluation and Upcoming Ranges

Nonetheless, as a result of a bearish market sentiment and a notable value decline, ADA has reached the decrease boundary of the zone and is on the verge of breaking out of this consolidation.

In accordance with professional technical evaluation, ADA has turned bearish and weak because it falls under the 200 Exponential Transferring Common (EMA) on the each day timeframe. Regardless of the weak and bearish development, if the asset value falls under the $0.69 stage, there’s a sturdy chance it might drop by 9% to succeed in $0.64 within the coming days.

Nonetheless, traditionally, each time ADA’s value reached the decrease boundary of consolidation, it skilled an upside transfer together with shopping for stress. Nonetheless, this time, the sentiment is totally bearish, and main property like Bitcoin (BTC) and Ethereum (ETH) are influencing the general market, growing the chance of ADA dropping to the $0.64 stage within the coming days.

Present Worth Momentum

At press time, ADA is buying and selling close to $0.695, registering a 6% value decline over the previous 24 hours. Nonetheless, throughout the identical interval, the asset’s buying and selling quantity jumped by 30%, indicating heightened participation from merchants and traders in comparison with the day gone by.

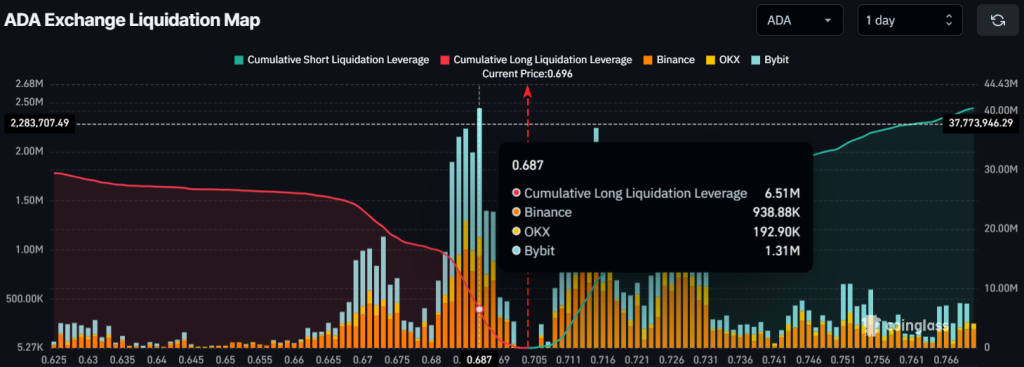

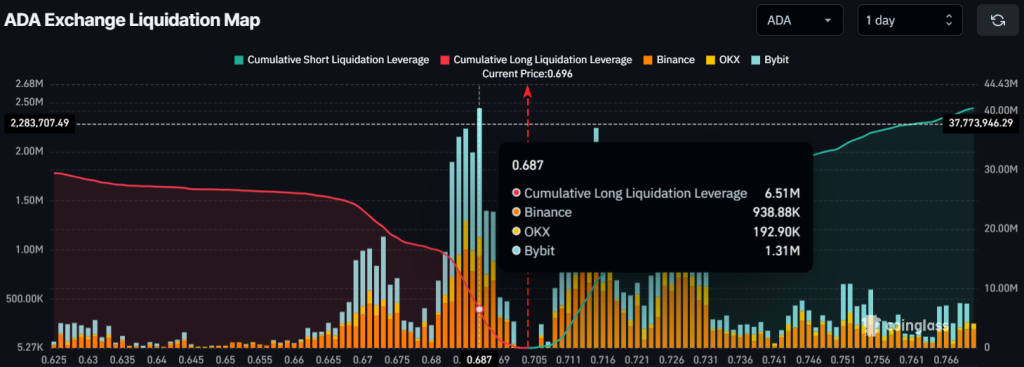

Key Liquidation Ranges

In the meantime, with the bearish market sentiment and ADA trading at an important stage, merchants’ outlook seems to have shifted as they’re strongly betting on the quick facet.

Information from the on-chain analytics agency Coinglass reveals that merchants are closely over-leveraged at $0.715, with $11.15 million price of quick positions. Nonetheless, bulls are over-leveraged at $0.687, having constructed $6.51 million price of lengthy positions, clearly indicating that bears are at present dominating the asset.