Cardano (ADA) rally imminent? Traders eye $0.76 breakout

- Bollinger Bands seem like squeezing on ADA’s 12-hour chart, signaling a possible upside rally.

- The on-chain metric revealed that exchanges have witnessed an outflow of $13.80 million price of ADA tokens.

Cardano [ADA] has been caught in a decent consolidation for over per week, struggling to realize upward momentum.

On the time of writing, the crypto market sentiment gave the impression to be bettering, giving hope that ADA would possibly break via and resume its upward rally.

Cardano’s technical evaluation and worth motion

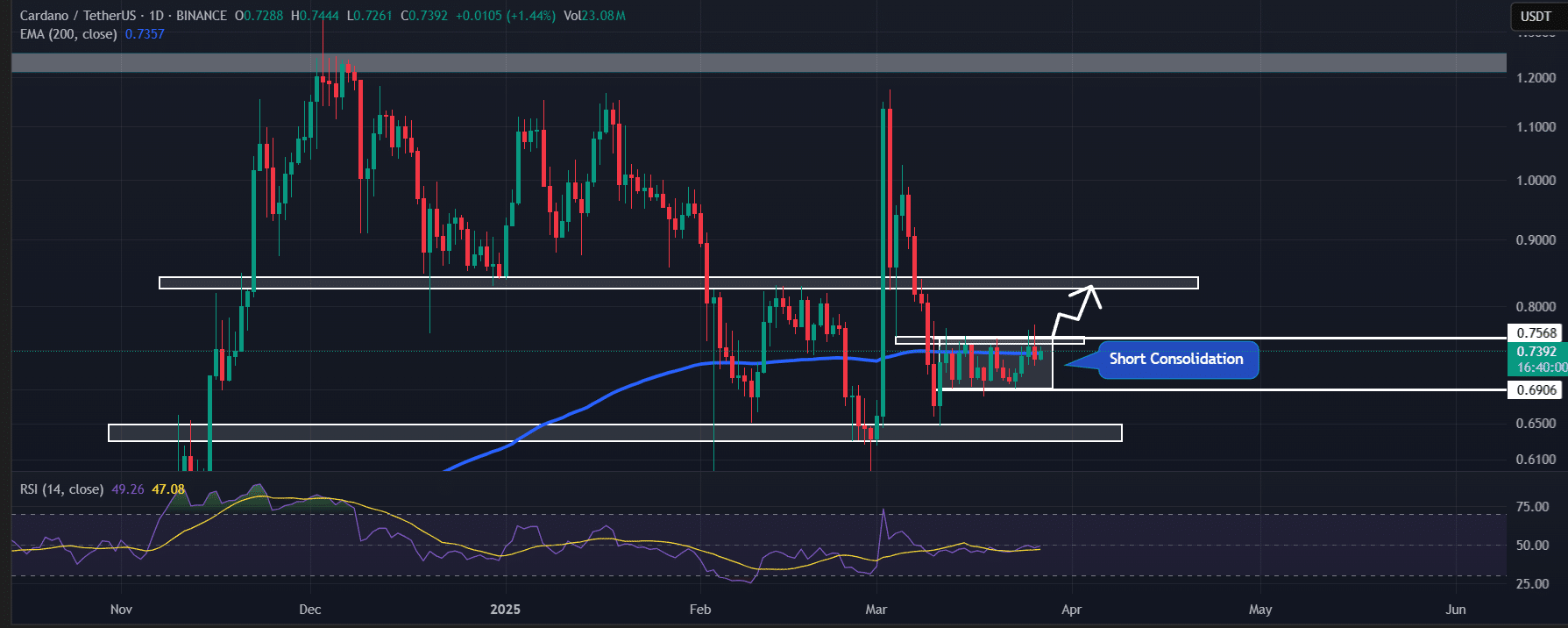

In line with AMBCrypto’s technical evaluation, ADA has been consolidating inside a decent vary between $0.69 and $0.75.

Because the market recovers, the asset has hit the consolidation’s higher boundary, a stage the place reversals occurred beforehand.

Supply: TradingView

In the meantime, the 200-day Exponential Shifting Common (EMA) can be appearing as a resistance stage, limiting ADA’s upward motion.

Moreover, a outstanding crypto analyst shared a publish on X (previously Twitter) and expressed their view on ADA utilizing a technical indicator referred to as the Bollinger Bands.

Within the publish, the analyst famous that the Bollinger Bands are narrowing on ADA’s 12-hour chart, signaling a possible spike within the coming days.

ADA’s worth momentum

At press time, ADA traded close to $0.74, reflecting a 1.5% worth drop within the final 24 hours.

Throughout the identical interval, its buying and selling quantity fell by 10%, exhibiting lowered dealer and investor participation amid worth consolidation.

ADA’s Relative Power Index (RSI) stood at 47, signaling neither overbought nor oversold circumstances. Market sentiment may now affect the worth course.

If ADA breaks previous the 200-day EMA and its consolidation vary, closing a day by day candle above $0.76, it may rise by 13% to succeed in $0.85.

Such a breakout may additionally create alternatives for additional upward momentum.

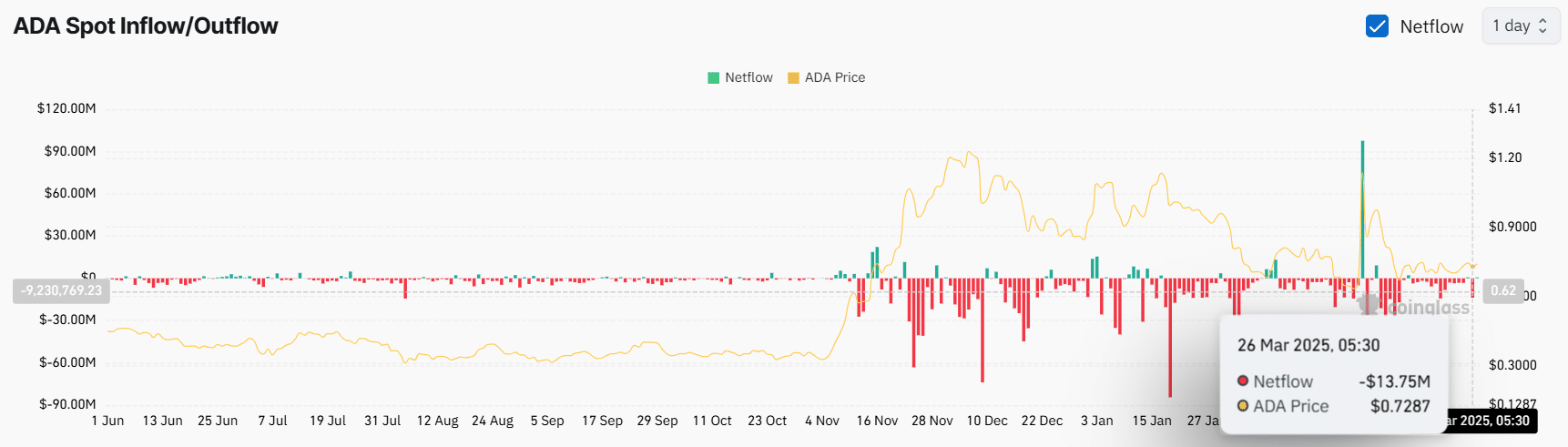

Bullish on-chain metrics

Regardless of the worth drop and ongoing struggles, whales and long-term holders have been accumulating the token, as reported by the on-chain analytics agency Coinglass.

Information from Spot Influx/Outflow revealed that exchanges have witnessed an outflow of a major $13.75 million price of ADA tokens over the previous 24 hours, indicating potential accumulation by holders.

Supply: Coinglass

In the meantime, intraday merchants are additionally following an identical pattern.

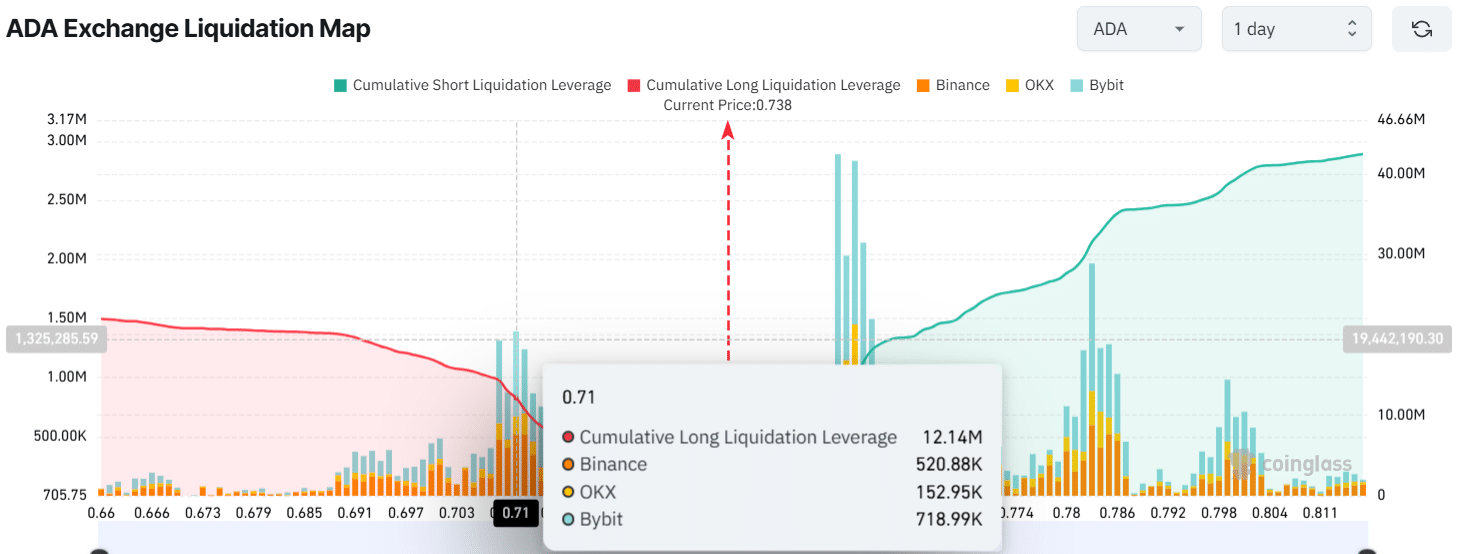

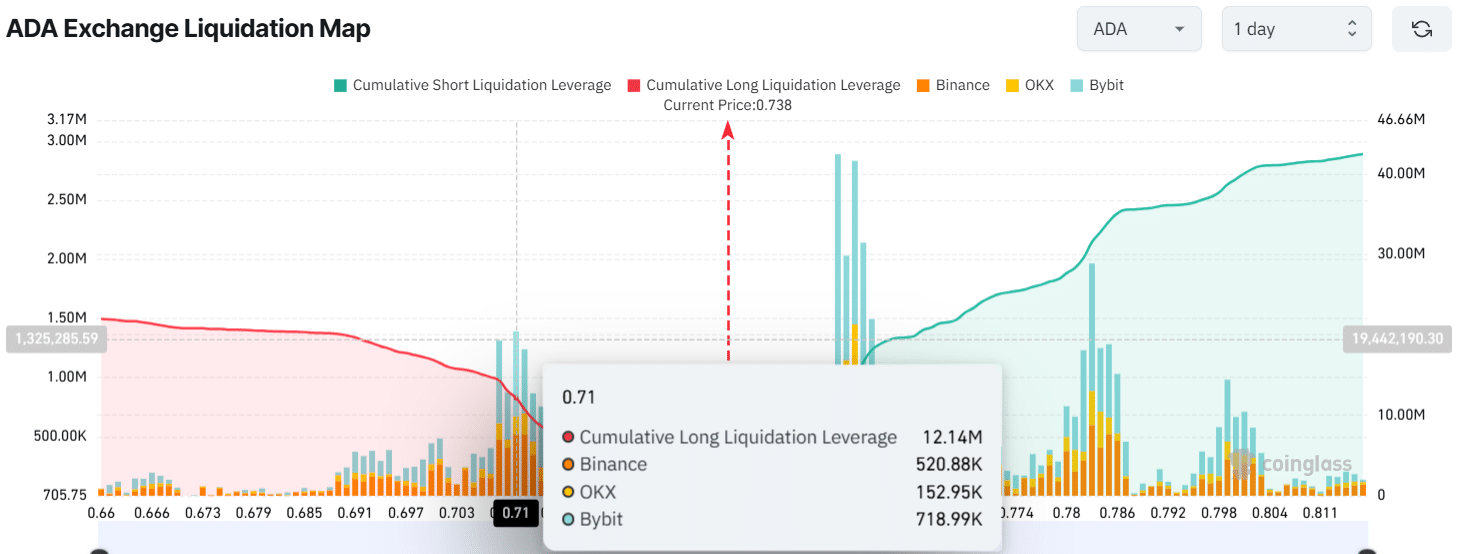

Coinglass knowledge reveals that merchants are at present over-leveraged at $0.71 on the decrease aspect, with $12.15 million price of lengthy positions.

Then again, the $0.753 stage is one other over-leveraged zone, the place merchants have held $9 million price of brief positions.

Supply: Coinglasss

The over-leveraged ranges recommend bulls are dominating the asset and are seemingly driving it towards ending its extended consolidation.