Cardano (ADA/USD) Price Analysis – 13 June 2023 | Binance Data

Introduction

This report offers a complete evaluation of Cardano’s (ADA) value dynamics on Binance, protecting technical indicators, shifting averages, and pivot factors.

Value and Quantity Overview

As of 9:21 a.m. UTC on 13 June 2023, on Binance, the worth of ADA is $0.2817, which is a lower of $0.0012 (-0.42%) from the earlier shut. The amount of ADA traded within the final 24 hours is 151,816,450. The very best value of ADA within the final 24 hours was $0.2865, and the bottom value was $0.2726. The bid value is $0.2816, and the ask value is $0.2817.

Technical Indicators

Technical indicators are mathematical calculations that use historic value, quantity, and (within the case of futures contracts) open curiosity data to foretell future value actions.

Right here’s an in depth breakdown of the technical indicators for ADA:

- RSI(14): The Relative Energy Index (RSI) compares the magnitude of current beneficial properties to current losses in an try to find out overbought and oversold situations of an asset. An RSI of 59.484 signifies a purchase place.

- STOCH(9,6): The Stochastic Oscillator compares a safety’s closing value to its value vary over a selected time frame. A worth of 62.476 signifies a purchase place.

- STOCHRSI(14): The Stochastic RSI combines two widespread indicators, the Stochastic Oscillator and the Relative Energy Index. A worth of 84.646 means that the asset is in an overbought situation, which generally ends in a promote sign. Nonetheless, it’s necessary to notice that property can stay in overbought or oversold situations for an prolonged time frame.

- MACD(12,26): The Transferring Common Convergence Divergence (MACD) is a trend-following momentum indicator that exhibits the connection between two shifting averages of a safety’s value. A worth of 0.002 signifies a purchase place.

- ADX(14): The Common Directional Index (ADX) is used to measure the power or weak point of a development, not the precise route. A worth of 30.026 signifies a purchase place.

- Williams %R: The Williams %R is a momentum indicator that measures overbought and oversold ranges. A worth of -20.408 means that the asset is in an overbought situation, which generally ends in a promote sign. Nonetheless, it’s necessary to notice that property can stay in overbought or oversold situations for an prolonged time frame.

- CCI(14): The Commodity Channel Index (CCI) is a momentum-based oscillator used to assist decide when an funding car is reaching a situation of being overbought or oversold. A worth of 164.7832 signifies a purchase place.

- ATR(14): The Common True Vary (ATR) is a market volatility indicator. A worth of 0.0030 suggests much less volatility.

- Highs/Lows(14): This worth represents the best and lowest costs during the last 14 days. A worth of 0.0021 signifies a purchase place.

- Final Oscillator: The Final Oscillator is a technical indicator that’s used to determine potential value reversals. A worth of 53.539 signifies a purchase place.

- ROC: The Fee of Change (ROC) is a momentum oscillator, which measures the share change between the present value and the n interval previous value. A worth of two.403 signifies a purchase place.

- Bull/Bear Energy(13): The Elder-Ray Index, developed by Dr. Alexander Elder, is an oscillator that measures the facility of bulls and bears available in the market. A worth of 0.0060 signifies a purchase place.

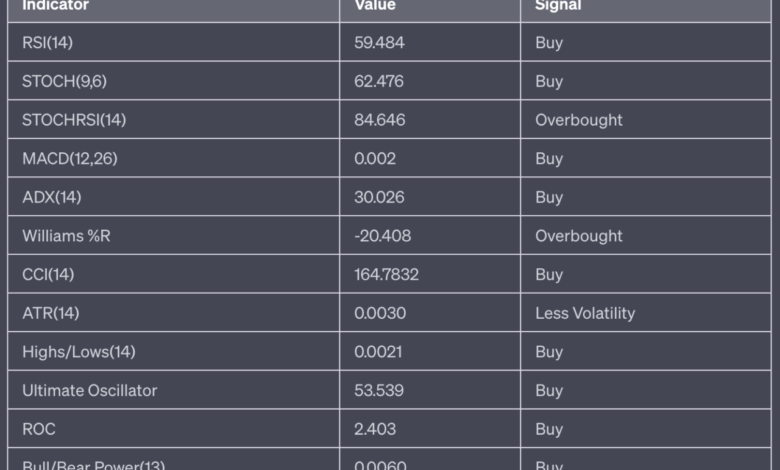

Here’s a abstract of the technical indicators in desk kind:

In abstract, the technical indicators counsel a robust bullish sentiment for ADA since there are ten purchase alerts, zero promote alerts, and nil impartial alerts. The general abstract is a STRONG BUY.

Transferring Averages

Transferring averages are a kind of information smoothing method that analysts use in technical evaluation to determine tendencies in a set of information, akin to inventory costs. They assist to scale back the noise and fluctuation in value information to current a smoother line, making it simpler to see the general route or development.

There are a number of sorts of shifting averages, however two of the commonest ones are the Easy Transferring Common (SMA) and the Exponential Transferring Common (EMA).

- Easy Transferring Common (SMA): The SMA is calculated by including collectively the costs for a sure variety of intervals after which dividing by that variety of intervals. For instance, a 5-day SMA would add collectively the closing costs for the final 5 days after which divide by 5. The SMA offers equal weight to all the info factors in its calculation.

- Exponential Transferring Common (EMA): The EMA is just like the SMA, nevertheless it offers extra weight to current information. This implies it responds extra rapidly to current value adjustments than the SMA. The calculation of the EMA is a little more advanced than the SMA, involving an exponential smoothing issue to provide extra weight to current costs.

The importance of various interval shifting averages (like 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day) lies within the timeframe that merchants are all in favour of:

- 5-day, 10-day, and 20-day shifting averages are sometimes used for short-term tendencies. They reply rapidly to cost adjustments and are helpful for merchants trying to make the most of short-term value actions.

- 50-day and 100-day shifting averages are extra medium-term. They’re much less delicate to day by day value fluctuations and supply a clearer image of the medium-term development.

- 200-day shifting common is a long-term development indicator. It’s much less delicate to day by day value fluctuations and offers a clearer image of the long-term development. Many merchants think about a market to be in a long-term uptrend when the worth is above the 200-day shifting common and in a long-term downtrend when it’s under.

It’s necessary to notice that shifting averages are lagging indicators, which means they’re based mostly on previous costs. They will help determine a development however gained’t predict future value actions.

Right here’s an in depth breakdown of the shifting averages for ADA:

- MA5: The 5-day shifting common is $0.2801, indicating a purchase place. The 5-day exponential shifting common is $0.2803, indicating a purchase place.

- MA10: The ten-day shifting common is $0.2787, indicating a purchase place. The ten-day exponential shifting common is $0.2791, indicating a purchase place.

- MA20: The 20-day shifting common is $0.2774, indicating a purchase place. The 20-day exponential shifting common is $0.2780, indicating a purchase place.

- MA50: The 50-day shifting common is $0.2745, indicating a purchase place. The 50-day exponential shifting common is $0.2767, indicating a purchase place.

- MA100: The 100-day shifting common is $0.2764, indicating a purchase place. The 100-day exponential shifting common is $0.2840, indicating a promote place.

- MA200: The 200-day shifting common is $0.3092, indicating a promote place. The 200-day exponential shifting common is $0.3033, indicating a promote place.

Here’s a abstract of the shifting averages in desk kind:

In abstract, the shifting averages counsel a bullish sentiment for ADA since there are 9 purchase alerts and three promote alerts. The general abstract is a BUY.

Pivot Factors

Pivot factors are technical evaluation indicators used to find out the general development of the market over totally different time frames. They’re calculated utilizing the excessive, low, and shutting costs of a earlier buying and selling interval. If the buying and selling value for the subsequent interval is above the pivot level, it’s thought-about a bullish sentiment, and whether it is under the pivot level, it’s thought-about bearish.

There are a number of strategies to calculate pivot factors, every with its personal method of calculating help and resistance ranges. Listed below are the strategies used on this report:

- Traditional: That is the commonest technique of calculating pivot factors. The pivot level is calculated as the common of the excessive, low, and shutting costs from the earlier buying and selling interval. Help and resistance ranges are then calculated off of this pivot level.

- Fibonacci: This technique applies the mathematical idea of Fibonacci sequences to the worth information to calculate the pivot level and related help and resistance ranges.

- Camarilla: This technique makes use of a singular equation to calculate the pivot level and help and resistance ranges, which frequently ends in a lot nearer ranges than different strategies.

- Woodie’s: This technique offers extra weight to the closing and opening costs when calculating the pivot level.

- DeMark’s: This technique was developed by Tom DeMark and makes use of the connection between the opening, closing, and excessive and low costs of the earlier buying and selling interval to calculate the pivot level.

Right here’s an in depth breakdown of the pivot factors for ADA:

- Traditional: The S3, S2, S1, Pivot Level, R1, R2, and R3 values are $0.2766, $0.2782, $0.2801, $0.2817, $0.2836, $0.2852, and $0.2871 respectively.

- Fibonacci: The S2, S1, Pivot Level, R1, R2 values are $0.2782, $0.2795, $0.2817, $0.2830, and $0.2852 respectively. The S3 and R3 values will not be obtainable for this technique.

- Camarilla: The S1, Pivot Level, and R1 values are $0.2811, $0.2817, and $0.2824 respectively. The S2, S3, R2, and R3 values will not be obtainable for this technique.

- Woodie’s: The S2, S1, Pivot Level, R1, and R2 values are $0.2768, $0.2803, $0.2818, $0.2853, and $0.2853 respectively. The S3 and R3 values will not be obtainable for this technique.

- DeMark’s: The S1, Pivot Level, and R1 values are $0.2809, $0.2821, and $0.2845 respectively. The S2, S3, R2, and R3 values will not be obtainable for this technique.

In abstract, the pivot factors counsel that ADA has sturdy help and resistance ranges. The truth that the present value is above a lot of the help ranges and under the resistance ranges means that ADA is in a bullish development. Nonetheless, merchants ought to watch these ranges as a break above the resistance or under the help might point out a potential development reversal.

Conclusion

Primarily based on the technical indicators, shifting averages, and pivot factors evaluation, Cardano (ADA) is at present exhibiting a robust bullish sentiment. The technical indicators counsel a robust purchase, with ten purchase alerts and no promote alerts. The shifting averages additionally point out a bullish development, with 9 purchase alerts and three promote alerts. The pivot factors additional help this bullish sentiment, with the present value above a lot of the help ranges and under the resistance ranges.

Nonetheless, it’s necessary to notice that whereas the symptoms counsel a bullish development, market situations can change quickly, and previous efficiency is just not indicative of future outcomes. Due to this fact, merchants ought to proceed to watch these indicators and think about different market components and their threat tolerance earlier than making funding selections.

As all the time, it’s really useful to make use of these indicators as a part of a broader evaluation and to seek the advice of with a monetary advisor for a extra complete funding technique.

Featured Picture Credit score: Photo / illustration by “Dylan Calluy” through Unsplash