Cardano (ADA/USD) Price Analysis – 6 July 2023

Introduction

This report offers a technical evaluation of Cardano (ADA) for six July 2023. The evaluation consists of an summary of the value and quantity and an in depth examination of the every day and month-to-month technical indicators and transferring averages.

This report goals to supply merchants and traders with insights into ADA’s short-term and long-term market traits. This will help them resolve whether or not to purchase, promote, or maintain this cryptocurrency.

Please notice that technical evaluation doesn’t assure future efficiency and ought to be used along with different analysis and funding methods.

Worth/Quantity Overview

As of 5:31 p.m. UTC on 6 July 2023, on Binance, the value of Cardano (ADA) is $0.2821, a lower of $0.0024 (-0.84%) from the earlier shut. The quantity of ADA traded within the final 24 hours is 127,452,840 ADA. The day’s vary is $0.2761 – $0.2937.

Timeframes

In technical evaluation, the selection of timeframe performs a major position. The timeframe refers back to the interval that the evaluation considers. On this report, we use two timeframes: every day and month-to-month.

- Every day: The every day timeframe makes use of the value knowledge of every day. Every level on a chart represents the value knowledge of a single day. This timeframe is shorter and thus extra fitted to merchants who goal to revenue from short-term value fluctuations available in the market.

- Month-to-month: The month-to-month timeframe makes use of the value knowledge of every month. Every level on a chart represents the value knowledge of a single month. This timeframe is longer and thus extra fitted to traders who goal to revenue from long-term value traits available in the market.

Technical Indicators

Technical indicators are mathematical calculations based mostly on a cryptocurrency’s value and quantity. They assist to foretell future value ranges and market course, and might generate purchase and promote indicators. The every day technical indicators present insights into the short-term market traits, whereas the month-to-month technical indicators give a broader view of the long-term market traits.

Listed here are the definitions of the technical indicators used on this report:

- RSI (14): The Relative Energy Index measures the pace and alter of value actions on a scale of 0 to 100. Historically, the market is taken into account overbought when above 70 and oversold when under 30.

- STOCH (9,6): The Stochastic Oscillator compares a cryptocurrency’s closing value to its value vary over a sure time frame. The market is taken into account overbought when above 80 and oversold when under 20.

- STOCHRSI (14): The Stochastic RSI is a mix of the Stochastic Oscillator and the Relative Energy Index. It’s thought of overbought when above 80 and oversold when under 20.

- MACD (12,26): The Shifting Common Convergence Divergence is a trend-following momentum indicator that reveals the connection between two transferring averages of a cryptocurrency’s value.

- ADX (14): The Common Directional Index measures the energy of a development. A worth above 25 signifies a robust development.

- Williams %R: This momentum indicator measures overbought and oversold ranges. Just like the Stochastic Oscillator, the market is taken into account overbought when above -20 and oversold when under -80.

- CCI (14): The Commodity Channel Index is a momentum oscillator used to determine cyclical traits in a cryptocurrency. A worth above +100 suggests an overbought situation, whereas a price under -100 suggests an oversold situation.

- ATR (14): The Common True Vary measures market volatility.

- Highs/Lows (14): This indicator measures the very best and lowest costs over a specified interval.

- Final Oscillator: This oscillator combines short-term, intermediate-term, and long-term value motion into one oscillator and makes use of a weighted common to supply a extra correct image.

- ROC: The Fee of Change is a momentum oscillator that measures the share change in value between the present value and the value a sure variety of intervals in the past.

- Bull/Bear Energy (13): These indicators measure the ability of consumers (bulls) and sellers (bears) over a sure interval.

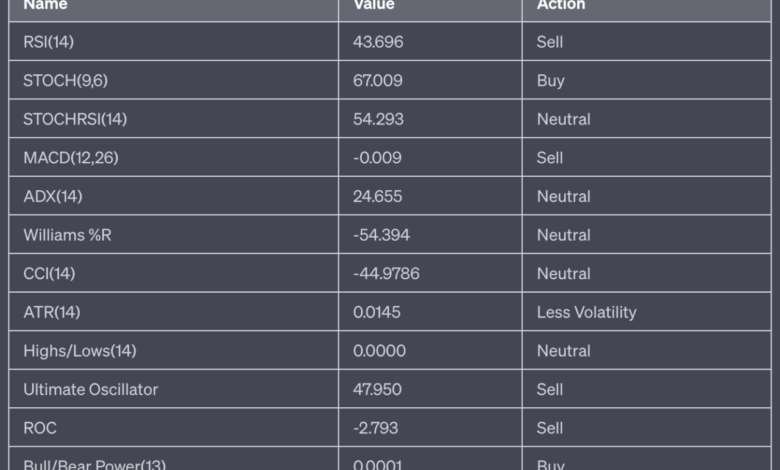

Every day

The every day technical indicators for ADA present a basic “SELL” sentiment, with 4 promote indicators, two purchase indicators, and 5 impartial indicators.

Month-to-month

The month-to-month technical indicators for ADA present a “STRONG SELL” sentiment, with 9 promote indicators, 0 purchase indicators, and one impartial sign.

In abstract, the every day technical indicators for Cardano (ADA) recommend a “Promote” sign, indicating that the value might lower within the short-term. Nonetheless, the month-to-month technical indicators recommend a “Robust Promote” sign, indicating a possible longer-term downward development. This implies that warning is suggested for each short-term and long-term merchants and traders.

Shifting Averages

Shifting averages easy out value knowledge to kind a trend-following indicator. They don’t predict value course however relatively outline the present course with a lag.

MA5, MA10, MA20, MA50, MA100, MA200: These are the 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day transferring averages respectively. They’re calculated by including up the closing costs over the required variety of days after which dividing by that variety of days.

Shifting averages are used to easy out value knowledge to assist merchants and traders determine and ensure traits over particular intervals. They’re calculated by averaging a cryptocurrency’s value over a sure variety of days.

Within the context of this report, we’re taking a look at each every day and month-to-month transferring averages.

- Every day Shifting Averages: These are calculated utilizing the closing costs of ADA over the previous 5, 10, 20, 50, 100, and 200 days. Every day transferring averages present insights into the short-term development of ADA and are extra attentive to latest value adjustments.

- Month-to-month Shifting Averages: These are calculated utilizing the closing costs of ADA over the previous 5, 10, 20, 50, 100, and 200 months. Month-to-month transferring averages present insights into the long-term development of ADA and are much less attentive to latest value adjustments however extra indicative of long-term traits.

Right here’s the every day and month-to-month transferring averages knowledge for Cardano (ADA) on 6 July 2023:

Every day Shifting Averages

The every day transferring averages for ADA present a “STRONG SELL” sentiment, with all 12 indicators indicating a promote.

Month-to-month Shifting Averages

The month-to-month transferring averages for ADA present a “STRONG SELL” sentiment, with 11 promote indicators and 1 purchase sign.

In abstract, each the every day and month-to-month transferring averages recommend a “Robust Promote” sign for Cardano (ADA). This means that the value is usually trending downwards within the brief and long run. Nonetheless, the 200-month transferring common signifies a “Purchase” sign, suggesting that the value is above the typical of the previous 200 months, which could possibly be a bullish sign within the very long-term context.

Conclusion

The technical evaluation of Cardano (ADA) for six July 2023 reveals a bearish development in each the short-term (every day) and long-term (month-to-month) timeframes. The vast majority of the technical indicators and transferring averages sign a “Promote” or “Robust Promote” situation. This implies that the market sentiment is predominantly damaging for ADA at the moment.

Nonetheless, it’s essential to notice that market situations can change quickly, and previous efficiency doesn’t point out future outcomes. Whereas the present evaluation suggests a bearish development, different components, equivalent to market information, world financial situations, and adjustments within the cryptocurrency sector, can affect the value of ADA.

Buyers and merchants ought to use this technical evaluation as one device amongst many of their decision-making course of. It’s additionally essential to contemplate your private danger tolerance and funding targets when making buying and selling selections.

Featured Picture Credit score: Photo / illustration by “Dylan Calluy” through Unsplash