Cardano (ADA/USD) Price Analysis for 12 June 2023

This report offers a complete evaluation of Cardano (ADA)’s worth dynamics on Binance, masking technical indicators, transferring averages, and pivot factors.

On the time of the report, Cardano (ADA) was priced at $0.2824, experiencing a rise of $0.0205 (+7.83%) in comparison with the earlier interval. The snapshot was taken at 05:44:11 UTC, with a buying and selling quantity of 289,460,007 models on Binance.

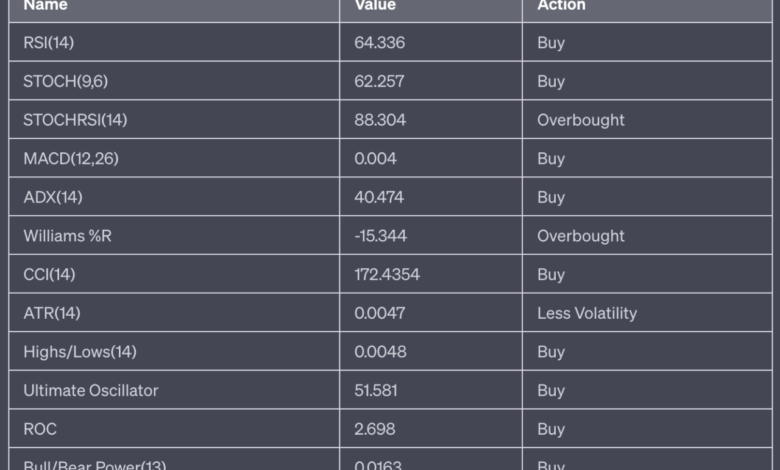

Technical indicators are mathematical calculations based mostly on an asset’s worth and quantity. They’re used to foretell future worth actions and establish buying and selling alternatives.

- RSI(14): The Relative Energy Index (RSI) measures the pace and alter of worth actions. An RSI worth of 64.336 is taken into account a purchase sign, suggesting bullish momentum.

- STOCH(9,6): The Stochastic Oscillator compares a specific closing worth of an asset to a spread of its costs over a sure time frame. The worth of 62.257 is taken into account a purchase sign, suggesting bullish momentum.

- STOCHRSI(14): The Stochastic RSI is an oscillator that measures the extent of the RSI relative to its high-low vary over a set time interval. A price of 88.304 signifies overbought situations, suggesting a possible worth reversal or slowdown within the close to future.

- MACD(12,26): The Shifting Common Convergence Divergence (MACD) is a trend-following momentum indicator. A optimistic MACD worth (0.004) signifies a purchase sign, suggesting a bullish development.

- ADX(14): The Common Directional Index (ADX) measures development power with out regard to development path. A price of 40.474 is taken into account a purchase sign, suggesting a robust development is current.

- Williams %R: The Williams %R is a momentum indicator that measures overbought and oversold ranges. A price of -15.344 signifies overbought situations, suggesting a possible worth reversal or slowdown within the close to future.

- CCI(14): The Commodity Channel Index (CCI) is a momentum-based oscillator used to assist decide when an funding automobile is reaching a situation of being overbought or oversold. A price of 172.4354 is taken into account a purchase sign, suggesting bullish momentum.

- ATR(14): The Common True Vary (ATR) is a technical evaluation indicator that measures market volatility. A price of 0.0047 suggests much less volatility.

- Highs/Lows(14): This worth of 0.0048 is a purchase sign, suggesting bullish momentum.

- Final Oscillator: The Final Oscillator is a technical indicator that’s used to generate purchase and promote alerts, incorporating the value motion of an asset for 3 completely different time durations. A price of 51.581 signifies a purchase sign, suggesting bullish momentum.

- ROC: The Price of Change (ROC) is a momentum oscillator, which measures the share change between the present worth and the n interval previous worth. A price of two.698 is a purchase sign, suggesting bullish momentum.

- Bull/Bear Energy(13): The Bull Energy/Bear Energy indicator measures the shopping for or sellingpressure available in the market. A price of 0.0163 is a purchase sign, suggesting bullish momentum.

Here’s a abstract of the technical indicators:

In abstract, the technical indicators counsel a robust bullish sentiment for ADA. There are 9 purchase alerts, 0 promote alerts, and 0 impartial alerts. The general abstract is a robust purchase.

Shifting averages are a sort of knowledge smoothing approach that analysts use in technical evaluation to establish developments in a set of knowledge, reminiscent of inventory costs. They assist to cut back the noise and fluctuation in worth information to current a smoother line, making it simpler to see the general path or development.

There are a number of sorts of transferring averages, however two of the most typical ones are the Easy Shifting Common (SMA) and the Exponential Shifting Common (EMA).

- Easy Shifting Common (SMA): The SMA is calculated by including collectively the costs for a sure variety of durations after which dividing by that variety of durations. For instance, a 5-day SMA would add collectively the closing costs for the final 5 days after which divide by 5. The SMA provides equal weight to all the info factors in its calculation.

- Exponential Shifting Common (EMA): The EMA is much like the SMA, but it surely provides extra weight to current information. This implies it responds extra shortly to current worth modifications than the SMA. The calculation of the EMA is a little more complicated than the SMA, involving an exponential smoothing issue to present extra weight to current costs.

The importance of various interval transferring averages (like 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day) lies within the timeframe that merchants are enthusiastic about:

- 5-day, 10-day, and 20-day transferring averages are sometimes used for short-term developments. They reply shortly to cost modifications and are helpful for merchants seeking to reap the benefits of short-term worth actions.

- 50-day and 100-day transferring averages are extra medium-term. They’re much less delicate to each day worth fluctuations and supply a clearer image of the medium-term development.

- 200-day transferring common is a long-term development indicator. It’s much less delicate to each day worth fluctuations and offers a clearer image of the long-term development. Many merchants contemplate a market to be in a long-term uptrend when the value is above the 200-day transferring common and in a long-term downtrend when it’s beneath.

It’s vital to notice that transferring averages are lagging indicators, that means they’re based mostly on previous costs. They might help establish a development however received’t predict future worth actions.

The 5-day, 10-day, 20-day, and 50-day easy and exponential transferring averages (SMA and EMA) point out a purchase, suggesting bullish momentum within the quick time period. Nonetheless, the 100-day and 200-day SMA and EMA point out a promote, suggesting a bearish development in the long term.

Here’s a abstract of the transferring averages in desk type:

In abstract, the transferring averages counsel a purchase development with a slight bearish momentum in the long run. There are 8 purchase alerts and 4 promote alerts. The general abstract is a purchase.

Pivot factors are utilized by merchants as a predictive indicator and to indicate ranges of technical significance. When used at the side of different technical indicators, pivot factors might help to identify important worth actions.

For the Basic pivot factors, the pivot level is at $0.2813, with assist ranges at $0.2792 (S1), $0.2756 (S2), and $0.2735 (S3), and resistance ranges at $0.2849 (R1), $0.2870 (R2), and $0.2906 (R3).

The Fibonacci pivot factors counsel a pivot level at $0.2813, with assist ranges at $0.2791 (S1), $0.2778 (S2), and resistance ranges at $0.2835 (R1), $0.2848 (R2), and $0.2870 (R3).

The Camarilla pivot factors point out a pivot level at $0.2813, with assist ranges at $0.2824 (S1), $0.2819 (S2), and $0.2813 (S3), and resistance ranges at $0.2834 (R1), $0.2839 (R2), and $0.2845 (R3).

The Woodie’s pivot factors counsel a pivot level at $0.2817, with assist ranges at $0.2800 (S1), $0.2760 (S2), $0.2743 (S3), and resistance ranges at $0.2857 (R1), $0.2874 (R2), and $0.2914 (R3).

The DeMark’s pivot factors point out a pivot level at $0.2818, with assist at $0.2803 (S1) and resistance at $0.2860 (R1).

Here’s a abstract of the pivot factors in desk type:

Featured Picture Credit score: Photo / illustration by “Dylan Calluy” by way of Unsplash