What Is Nominated Proof-of-Stake (NPoS) and Why Do We Need It?

Mining proved that consensus can work, however not that it should waste vitality. NPoS, or nominated proof-of-stake, takes the identical objective—agreeing on legitimate transactions—and makes it collaborative. It’s a contemporary mannequin that mixes equity, transparency, and effectivity—one which’s already powering ecosystems like Polkadot and Kusama.

What Is Nominated Proof-of-Stake (NPoS)

Nominated proof-of-stake (NPoS) is a sort of proof-of-stake (PoS) consensus mechanism the place token holders take an energetic position in securing the community. As a substitute of operating a node themselves, these community members—referred to as nominators—select reliable validators who create and confirm new blocks.

Each side share rewards and penalties, which retains everybody aligned. The extra tokens you bond, the extra weight your vote carries. This setup makes NPoS work as a democratic and clear course of the place fame, belief, and efficiency matter. It’s how Polkadot, Kusama, and different Substrate-based networks maintain their ecosystems safe and truthful.

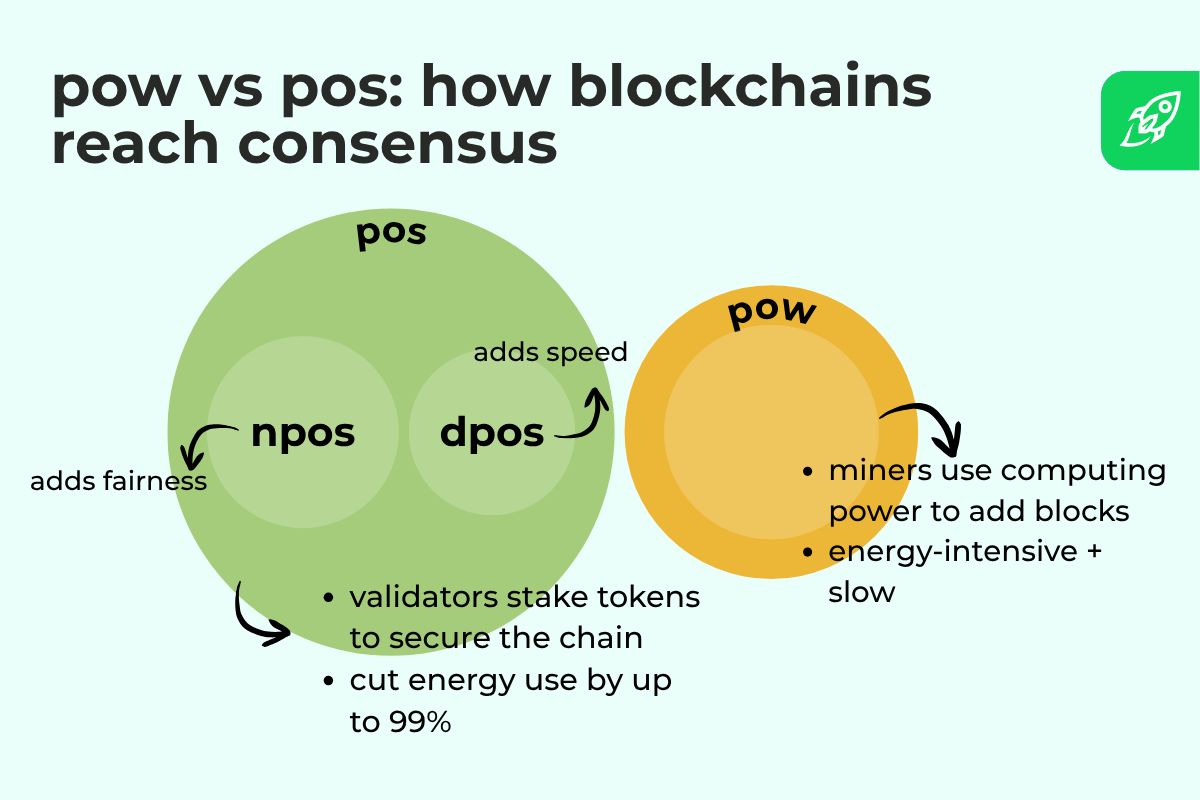

What Makes NPoS Completely different from Different Proof-of-Stake Methods

Whereas NPoS is constructed on the identical basis as proof-of-stake (PoS), it takes a special method to equity and validator choice. In conventional PoS, anybody can run validator nodes by staking tokens—the upper the stake, the upper the possibility to validate.

NPoS modifications this by letting token holders nominate validators, and solely validators with broad neighborhood backing be part of the validator set. In contrast to delegated proof-of-stake (DPoS), the place a small, fastened group controls validation, NPoS retains a whole bunch of validators energetic. This design creates a extra decentralized system that avoids centralization dangers frequent in conventional proof-of-stake and DPoS fashions.

Learn additionally: What Is Delegated Proof-of-Stake (DPoS)?

Widespread PoS Challenges That NPoS Solves

Traditional proof-of-stake programs face points like uneven energy distribution and weak incentives for equity.

Nominated proof-of-stake addresses these utilizing sport principle and discrete optimization to create stability amongst validators.

The community’s algorithm spreads nominations evenly to enhance community safety and stop dominance by just a few massive gamers. It additionally minimizes vitality consumption by changing competitors with cooperation. Most significantly, it ensures truthful illustration, giving smaller members a task by nomination swimming pools and clear elections.

This mix of math and social belief retains the community steady, safe, and inclusive for all.

How NPoS Works (Step by Step)

The nominated proof-of-stake (NPoS) mannequin makes use of a structured election course of the place nominators and validators work collectively to safe the community. Let’s break it down step-by-step.

Bonding: How one can Lock Tokens for Staking

Token holders bond their stake—locking tokens to take part in staking. On Polkadot, you’ll be able to stake straight or be part of a Nomination Pool with as little as 1 DOT. Your bonded stake stays locked till you unbond it, making certain dedication to community safety.

Staking Election: Validator Choice Course of

The staking election course of determines the energetic validator set each period (that are 24 hours on Polkadot and 6 hours on Kusama). Elected nodes safe the community—they course of and validate transactions, then bundle them into new blocks.

Every election cycle makes use of the Phragmén Methodology to pick validators pretty from a whole bunch of candidates.

Phragmén Methodology: How Equity Is Maintained

The Phragmén Methodology is a mathematical algorithm making certain the system stays truthful and environment friendly. It distributes nominators’ votes to maintain validators’ backing balanced, stopping whales from dominating. Every course of is clear and verifiable on-chain.

Period and Session: Timeframes for Rewards and Elections

An period lasts 24 hours on Polkadot and 6 on Kusama, divided into smaller periods (4h and 1h). Validators create new blocks, incomes Period Factors for uptime and reliability.

Reward Distribution: How Staking Rewards Are Shared

Validators earn staking rewards for good habits—performing truthfully and staying on-line. These rewards are shared with customers (nominators) based mostly on stake proportion. The common Polkadot yield is ~14% nominal and ~5–6% actual after inflation.

Slashing: Penalties for Misbehavior

When validators show misbehavior or dangerous habits, like double-signing or downtime, they’re slashed. This protects the community from assaults and retains it securing blocks safely.

Unbonding Interval: How Withdrawals Work

Unstaking triggers an unbonding interval—28 days on Polkadot, 7 on Kusama. Throughout unbonding, your funds stay on the chain, however you’ll be able to’t switch them till full validation and verifying transactions are full. This delay discourages sudden exits and strengthens the community.

Advantages of NPoS

The nominated proof-of-stake (NPoS) mannequin combines decentralization, effectivity, and consumer participation. Right here’s what makes it stand out:

Safety By Distributed Stake

Stake is unfold throughout many validators: Greater than 297 validators on Polkadot and round 1,000 on Kusama maintain the community safe. As a result of nominators share each rewards and penalties, validators keep accountable and motivated to behave truthfully.

Power Effectivity and Sustainability

NPoS is very energy-efficient, since there’s no mining or {hardware} race. Validators take turns creating blocks, holding prices and energy use low.

Decentralization and Inclusivity

With a whole bunch of validators and Nomination Swimming pools, anybody can assist the community. Even customers with small balances can be part of staking with 1 DOT or much less.

Effectivity and Transparency

Computerized stake balancing retains the system environment friendly, whereas all validator actions and rewards are seen on-chain. The algorithm ensures truthful stake backing throughout members.

Dangers and Limitations of NPoS

Like all consensus system, nominated proof-of-stake (NPoS) has trade-offs it’s best to perceive earlier than staking.

Monetary Danger from Shared Slashing

Each validators and nominators face monetary dangers. If a validator shows dangerous habits—like going offline or signing two blocks—everybody backing them loses a share of their stake.

On Polkadot, penalties vary from 0.1% to 100%, relying on severity. This rule retains validators accountable however exposes nominators to shared losses.

Technical Danger and Node Reliability

Every validator runs a number of nodes to remain linked. {Hardware} failure, sluggish updates, or poor uptime scale back rewards for all members. For this reason selecting dependable validators issues.

Minimal Stake and Accessibility

A minimal stake is required to earn rewards straight. On Polkadot, it modifications dynamically however can attain a number of dozen DOT. Smaller customers can nonetheless be part of by Nomination Swimming pools, however direct entry stays restricted for some.

Illiquidity In the course of the Unbonding Interval

If you unstake, funds enter a 28-day unbonding course of on Polkadot (7 on Kusama). Throughout this time, you’ll be able to’t transfer your tokens, which provides a short-term liquidity threat to the system.

Actual-World Examples of NPoS

The nominated proof-of-stake (NPoS) mannequin is used most notably in Polkadot and Kusama, two linked networks constructed on Substrate. They share the identical design however serve totally different functions—Polkadot for stability, Kusama for experimentation.

Polkadot

Polkadot at the moment runs with 600 energetic validators, chosen from over 1,200 candidates every period. Precisely 22,500 nominators stake their tokens to safe the community. Roughly 50% of all DOT is staked, producing a mean 14% nominal reward, or about 5–6% actual yield after inflation. Validators produce new blocks each 6 seconds, sustaining quick and dependable block instances.

Kusama

Kusama, Polkadot’s canary community, makes use of the identical NPoS course of however operates sooner. It has round 1,000 energetic validators, 6-hour eras, and a 7-day unbonding interval. As a result of it’s extra experimental, yields fluctuate between 12–18%, relying on whole stake. Kusama’s open governance and fast upgrades make it a stay testbed for future Polkadot improvements.

NPoS vs. Different Consensus Mechanisms

Each blockchain wants a consensus mechanism to agree on legitimate transactions. Nominated proof-of-stake (NPoS) belongs to the proof-of-stake (PoS) household however provides its personal equity and accountability layer. Right here’s the way it compares to different main fashions.

NPoS vs. Delegated Proof-of-Stake (DPoS)

In delegated proof-of-stake (DPoS), customers vote for a small, fastened group of delegates—typically 21–30 validators—who deal with all block manufacturing. This could result in centralization and vote buying and selling.

NPoS, against this, runs with a whole bunch of validators and makes use of algorithmic elections as an alternative of direct recognition votes. Nominators share each rewards and penalties, encouraging good habits and fairer validation.

DPoS programs prioritize velocity above all, whereas NPoS focuses on safety and stability.

NPoS vs. Conventional Proof-of-Stake (PoS)

In commonplace proof-of-stake, validators are chosen randomly and weighted by stake—no neighborhood enter is required. NPoS replaces randomness with mathematical elections (by way of the Phragmén Method) that distribute stake evenly. Each fashions are energy-efficient, however NPoS achieves stronger decentralization and extra predictable validator turnover.

NPoS vs. Proof-of-Work (PoW)

Proof-of-work secures the community by bodily value—miners use huge computing energy so as to add blocks. NPoS replaces that value with financial proof: staked tokens. It requires minimal vitality and produces blocks each few seconds.

Whereas PoW ensures security by expense, NPoS achieves it by stake-based belief and neighborhood accountability—a much more environment friendly and sustainable consensus course of for contemporary blockchain networks.

Last Ideas

NPoS makes blockchain expertise truthful, steady, and environment friendly. As a substitute of machines competing, customers work collectively to guard the community.

It’s a easy thought with lasting worth, and one which rewards honesty, punishes threat, and retains choices clear. This stability is what makes the system robust.

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native rules earlier than committing to an funding.