Chainlink defends $7: Can it recover recent losses?

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

- Chainlink’s decrease timeframe market construction bias was bullish at press time.

- The 2023 provide zone of $8 had vital promote restrict orders.

Throughout the latest October pullback, Chainlink [LINK] defended the $7 psychological degree. On the early Asian buying and selling session on 16 October, LINK zoomed previous $7.3 and flipped the 4-hour chart market construction to bullish bias.

Learn Chainlink [LINK] Value Prediction 2023-24

A earlier LINK worth evaluation by AMBCrypto evaluated the potential for sellers extending good points to the $7 psychological degree. The concept was vindicated as consumers re-grouped on the degree up to now few days.

Can LINK prolong the restoration?

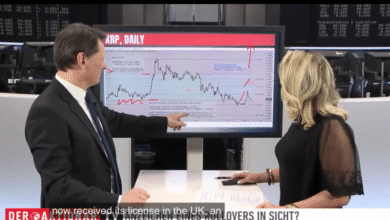

Supply: LINK/USDT on TradingView

LINK’s September large restoration faltered on the 2023 provide zone of $8.0 – $8.8 (purple). The pullback that adopted eased on the $7 psychological degree. Curiously, the extent was confluent with the 50% Fib degree and H12 bullish order (OB).

The Fib instrument was based mostly on the latest excessive of $8.2 on 30 September and the earlier low of $5.7 on 11 September. Primarily based on the instrument, the quick hurdles had been 78.6% Fib ($7.73) and the 2023 provide zone of $8.0 – $8.8 (purple).

At press time, worth motion moved past the latest decrease excessive of $7.43. The upswing flipped the H4 market construction to a bullish bias. So, sellers might wait to re-enter the market on the overhead resistance ranges – 78.6% Fib degree and the 2023 provide space.

The 50% Fib degree shall be a key shopping for curiosity for bulls and a shorting goal for sellers if the worth falters at overhead hurdles.

In the meantime, the RSI and OBV had been optimistic at press time. It indicated that purchasing strain spiked alongside improved demand from the Spot market. Nevertheless, the capital inflows remained muted, as proven by the unfavorable CMF within the first half of October.

Key purchase and promote restrict orders at $7 and $8

Supply: Mobchart

In keeping with Mobchart, key purchase and promote restrict orders had been positioned on the $7 and the provision zone. On the Binance Alternate, promote restrict orders of 74.43k LINK had been positioned at $8 on the time of writing.

Is your portfolio inexperienced? Try the LINK Revenue Calculator

Equally, there have been appreciable purchase restrict orders between $7.0 and $7.1, which coincided with the marked white space on the worth charts (H12 bullish zone).

Ergo, LINK’s restoration might intention on the 2023 provide zone, however a faltering within the space might power bulls to regroup on the $7 psychological degree.