Chainlink: Key zone tested as LINK holds above $12.57: What’s next?

- LINK holds above $12.57 as accumulation alerts sturdy investor conviction.

- On-chain metrics stay bearish, elevating doubts a few sustainable breakout.

Chainlink [LINK] has demonstrated sturdy investor confidence, with almost 90,000 addresses accumulating over 376 million tokens on the $6.26 degree.

This accumulation zone has now develop into a crucial demand wall, which regularly acts as a basis for future worth surges.

Such large shopping for curiosity usually displays long-term conviction and potential upside stress.

Nevertheless, on-chain and technical alerts present blended sentiments, elevating the query—can this help degree actually drive a bullish reversal?

Chainlink: Rebound or deeper correction?

On the time of writing, LINK traded at $12.88, down 1.14% prior to now 24 hours. Value motion confirmed LINK bouncing across the $12.57 help zone after breaking a multi-month downtrend.

This degree is pivotal; a powerful rebound right here might drive LINK to check $15.57 and ultimately $17.78. Nevertheless, if bears reclaim management, LINK can slide towards the subsequent help at $10.17.

Due to this fact, LINK’s near-term pattern hinges on whether or not patrons can defend this key worth flooring.

Supply: TradingView

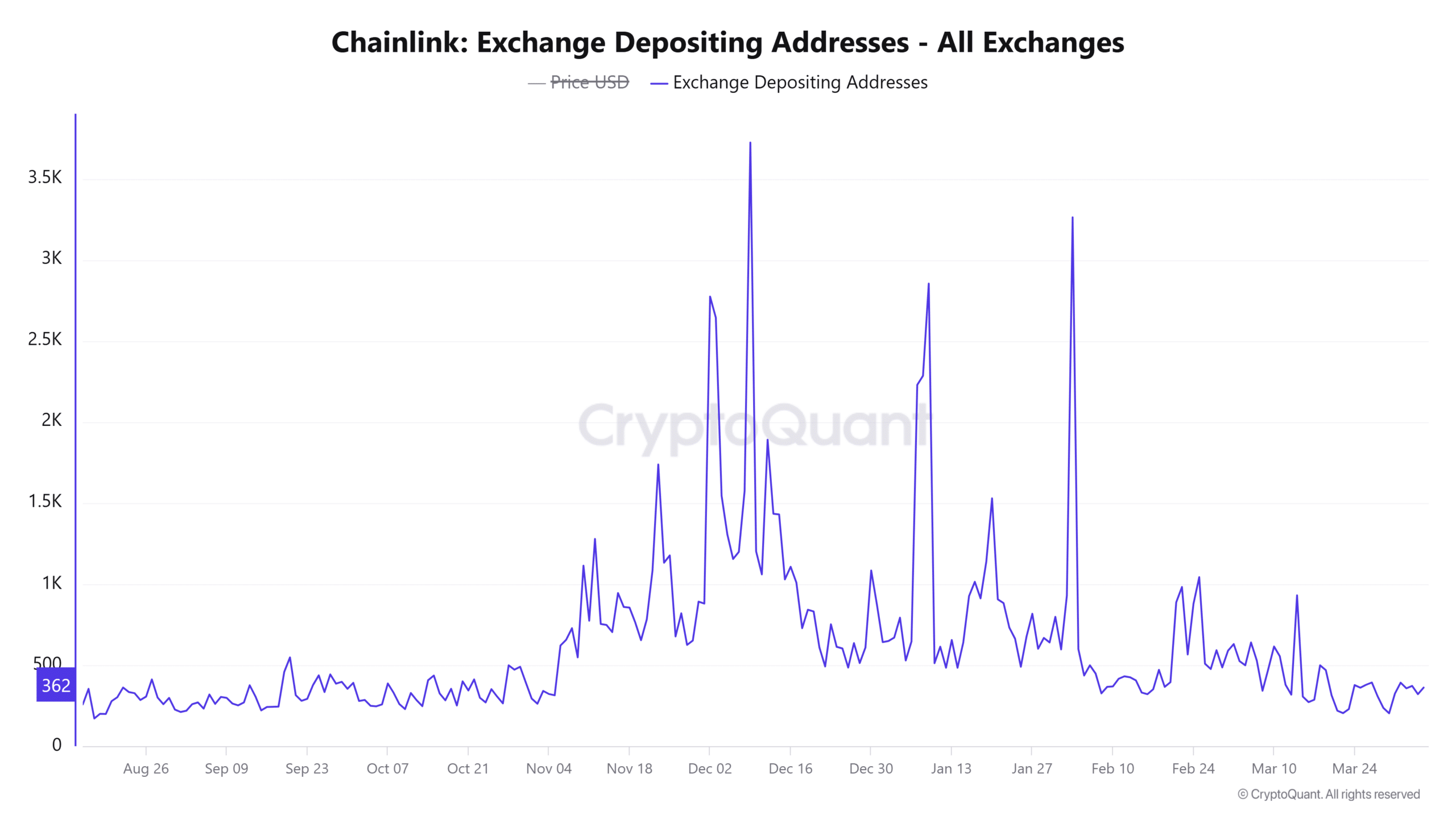

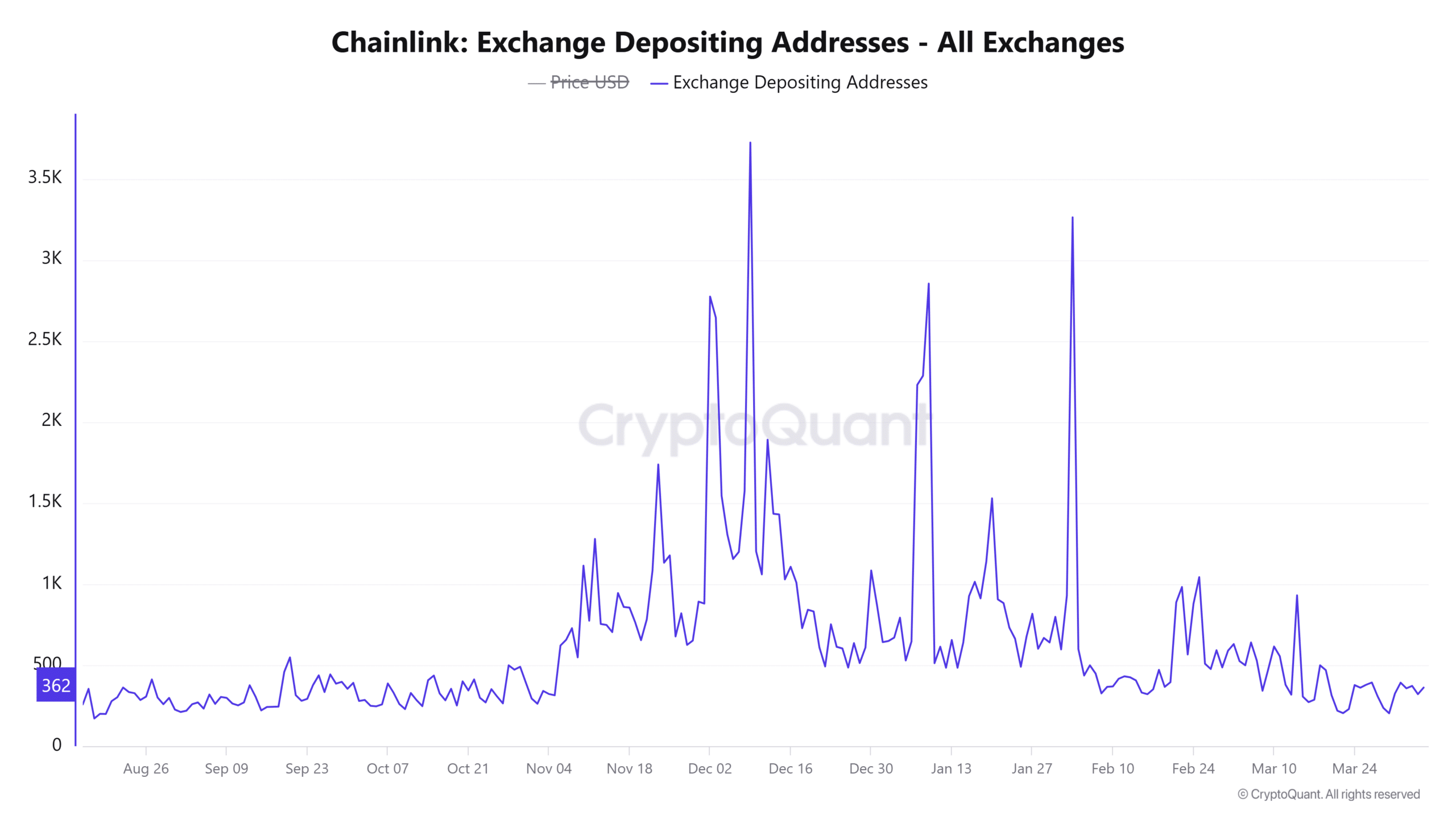

What does change exercise say?

Alternate depositing addresses elevated by 1.54%, whereas withdrawing addresses rose by solely 0.78%. This means extra LINK holders are sending tokens to exchanges, which might sign preparation for promoting.

Nevertheless, the rise in outflows nonetheless reveals some confidence amongst long-term holders preferring self-custody.

Total, the change information mirrored a neutral-to-cautious sentiment, with traders reacting to each technical setups and macro uncertainty.

Supply: CryptoQuant

How bearish are on-chain indicators?

On-chain alerts at the moment painted a largely bearish image. Internet community development was barely constructive at 0.15%, exhibiting sluggish person adoption.

Moreover, the proportion of addresses “within the cash” dropped by 0.95%, which means extra holders are at the moment underwater.

Giant holder focus fell by 0.17%, whereas massive transactions dropped by 12.28%, suggesting whales are decreasing publicity. These alerts replicate lowered confidence throughout the board.

The MVRV lengthy/quick distinction was -6.37%, a transparent indication that short-term holders have been struggling larger unrealized losses than long-term ones. This usually displays panic promoting and weak palms exiting the market.

Nevertheless, such circumstances may type the idea for worth reversals if accumulation follows. Due to this fact, monitoring worth conduct close to help turns into essential within the days forward.

Supply: Santiment

Chainlink should maintain above $12.57 and reclaim larger resistance ranges to verify a bullish breakout. Nevertheless, press time on-chain alerts remained bearish, and promoting stress nonetheless lingered.

Due to this fact, LINK isn’t but primed for a bullish breakout—additional draw back stays seemingly until sturdy shopping for momentum emerges quickly.