Users keep faith in Ethereum despite market ebbs and flows

- On a YTD foundation, ETH’s non-zero handle depend pumped 13%.

- Staking may very well be one of many predominant catalysts behind elevated retail adoption.

Ethereum [ETH], the second-largest crypto asset on the planet and the largest community for non-fungible tokens (NFT) and decentralized finance (DeFi) purposes, stays a drive to be reckoned with within the ever-changing crypto panorama.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

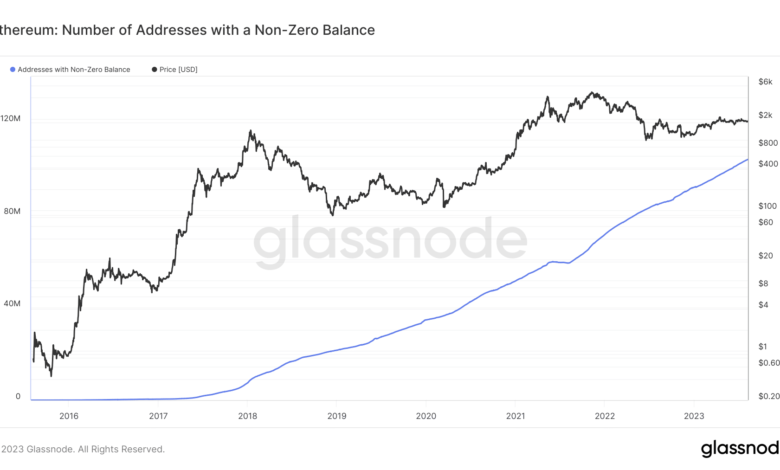

As per information from on-chain evaluation agency Glassnode, the variety of addresses holding a optimistic variety of ETH tokens surged previous 104 million, marking a sturdy progress trajectory since its launch almost eight years in the past.

Supply: Glassnode

Whereas the market weathered ebbs and flows through the years, the urge for food for the most important altcoin remained unscathed. The crypto winter of 2002 did make traders cautious concerning the dangers related to digital belongings. Nevertheless, the strong restoration of 2o23 helped dispel the damaging sentiment to an ideal diploma.

On a year-to-date (YTD) foundation, ETH’s non-zero handle depend has pumped 13%.

Particular person traders see progress potential

Curiously, retail traders exhibited vital curiosity in ETH’s long-term prospects. Information from Santiment highlighted that the availability amassed by wallets who held between 0-10 ETH grew significantly over the past 4 years.

Usually, particular person crypto consumer tendencies are drowned out by the cacophony of whales and massive traders. Nevertheless, if crypto belongings intend to turn into a most popular type of financial savings and a transaction medium, it’s crucial that they get accepted by most people.

Supply: Santiment

Staking performs its half

Staking, which permits customers to lock their ETH holdings within the hopes of incomes yields, may very well be one of many predominant catalysts behind elevated retail adoption. For the reason that execution of two main occasions – the Merge and the Shapella improve – staking has turn into profitable with staked worth in ETH constantly hitting new all-time highs (ATH).

📈 #Ethereum $ETH Whole Worth within the ETH 2.0 Deposit Contract simply reached an ATH of 27,181,897 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/Bd0fFXW81V

— glassnode alerts (@glassnodealerts) August 10, 2023

DeFi exercise bounces again

Retaining the promising progress in non-zero addresses apart, Ethereum’s decentralized finance (DeFi) panorama additionally confirmed indicators of restoration. In line with IntoTheBlock, the overall worth locked (TVL) in Ethereum bounced again from final week’s lows to $41.5 billion as of 9 August.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Worth Prediction 2023-24

The growing curiosity demonstrated by DeFi traders, nevertheless, was not mirrored by ETH’s value exercise. The altcoin’s bulls have struggled to elevate the worth past $1870 for the reason that begin of August.

On the time of writing, ETH exchanged palms at $1,856.66, information from CoinMarketCap revealed.