Cardano (ADA) Rally Cooling Off, Market Sentiment or What?

ADA, the native token of the Cardano blockchain, is gaining vital consideration from crypto fanatics following an asset supervisor’s transfer to file for a Cardano Alternate-Traded Fund (ETF) in the USA. This improvement has sparked notable curiosity amongst merchants and traders, leading to spectacular upside momentum.

Cardano (ADA) Dropping its Achieve

Because the market surge pushes ADA close to an important resistance stage, the asset has begun experiencing huge sell-offs, inflicting its value to fall—one other disappointment for merchants and traders at the moment.

Regardless of the latest fall within the ADA token value, the asset has reclaimed its uptrend because it strikes above the 200 Exponential Transferring Common (EMA) on the day by day time-frame. Moreover, at the moment’s notable promoting stress has not had any vital affect on investor sentiment, as long-term holders look like accumulating the token.

Present Value Momentum

ADA is at the moment buying and selling close to $0.77 and has skilled a value surge of over 11% prior to now 24 hours. Nonetheless, the asset reached an intraday excessive of $0.815 with a 16% acquire, however the market misplaced a good portion of these good points, probably as a consequence of ongoing revenue reserving and the present market sentiment.

Nonetheless, participation from merchants and traders has surged to the subsequent stage, growing by greater than 120% throughout the identical interval.

ADA Value Motion

In response to professional technical evaluation, ADA is at an important resistance stage of $0.85, the place it confronted resistance at the moment.

Primarily based on the latest value motion, if ADA continues to rally and breaches the $0.85 stage, closing a day by day candle above it, there’s a sturdy risk it may soar by 32% to achieve the $1.13 stage sooner or later.

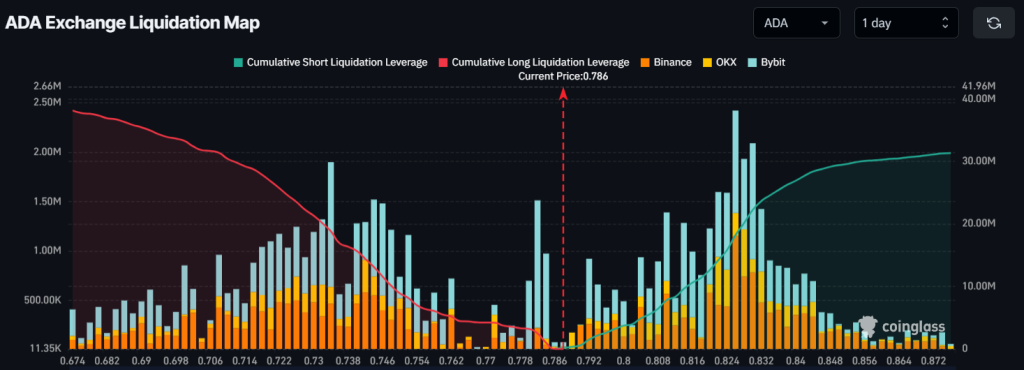

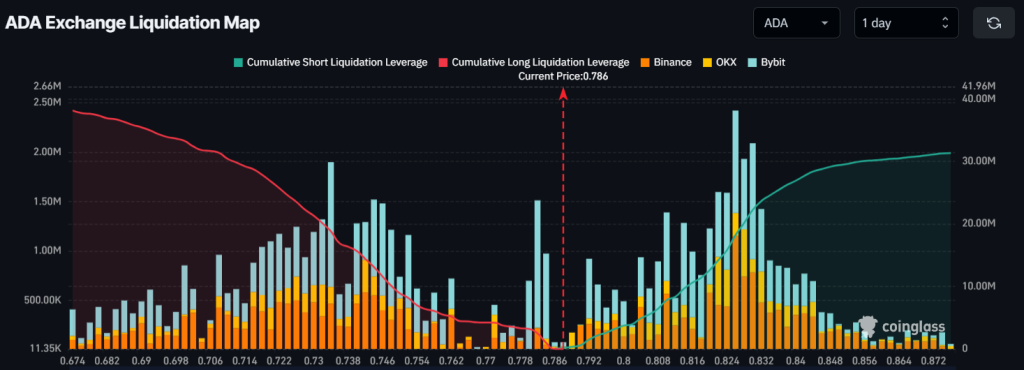

ADA’s Main Liquidation Areas

Presently, merchants are taking a combined method. At current, the foremost liquidation areas are close to $0.734, the place merchants holding lengthy positions are over-leveraged, with $18.80 million price of lengthy positions. Conversely, $0.826 is one other liquidation stage, the place merchants holding quick positions are over-leveraged, with $18.20 million price of quick positions.

When combining these on-chain metrics with technical evaluation, it seems that long-term holders are accumulating tokens, whereas intraday merchants are taking benefit of the present market sentiment.