‘Cheap’ Solana can flip Ethereum ‘this week’ – Analyst

- Solana is rapidly catching as much as Ethereum on the charges entrance.

- Nevertheless, the Ethereum ecosystem nonetheless instructions buyers’ belief.

The Solana [SOL] vs. Ethereum [ETH] debate resurfaced once more on Crypto Twitter following studies that the previous may quickly flip the latter on the charges entrance.

In accordance with on-chain analyst Dan Smith, Solana was rapidly closing in on Ethereum on transaction charges. Smith claimed that,

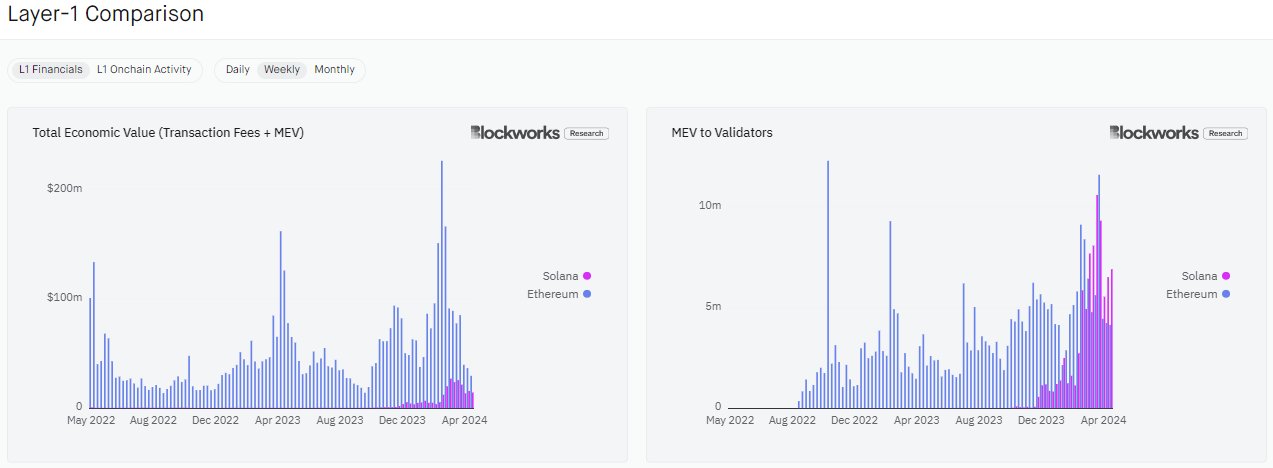

“Solana will flip Ethereum in transaction charges + captured MEV this month, possibly even this week”

Transaction charges check with costs linked to community exercise, whereas MEV means validators’ highest worth derived by maximizing block manufacturing or ‘affirmation.’

Solana vs Ethereum: charges and different fronts

Smith backed his argument with information, noting that there was a few $300K distinction between Solana and Ethereum’s charges.

Supply: X/Dan Smith

The chart confirmed Solana recorded a big surge in 2024, closing many of the hole with Ethereum.

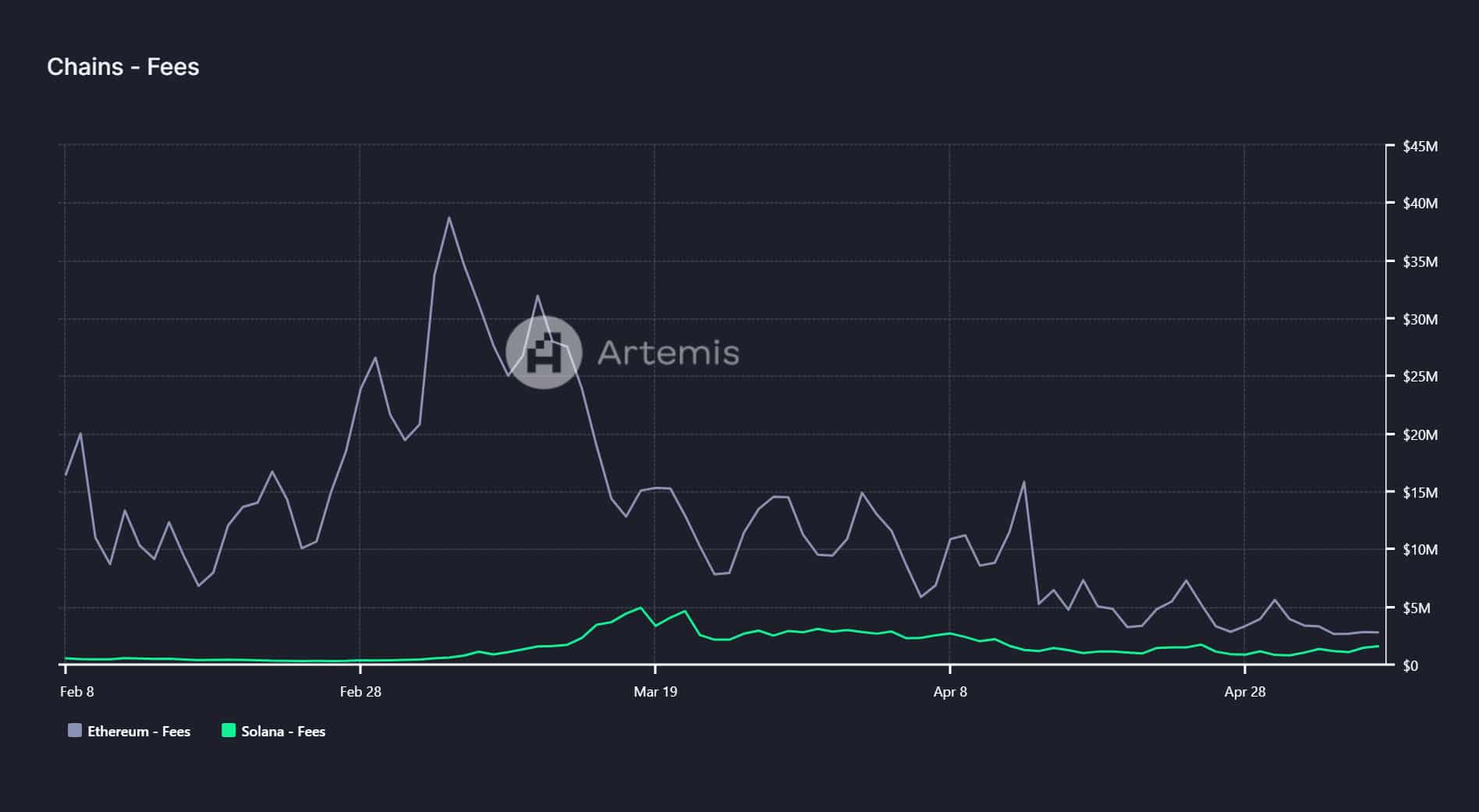

AMBCrypto’s analysis of Artemyz’s data confirmed the development on the charges entrance. The info confirmed that Ethereum community charges had dropped considerably because the finish of February.

On the seventh of Might, Ethereum charges hit $2.8 million, whereas Solana had $1.6 million.

Supply: Artemyz

Nevertheless, different market watchers argued that Ethereum transaction quantity ought to embrace all L2 to seize its “actual worth.” To which, Dan Smith responded,

“The query is whether or not or not pushing exercise to L2s the place ETH, the asset is used as a foreign money, drives sufficient worth again to the L1 to compensate for the lack of L1 exercise”

Regardless of its community challenges, Solana, on common, has cheaper transaction costs than Ethereum.

Reacting to Smith’s projection of SOL eclipsing ETH, crypto analyst Ansem wondered,

“And it’s nonetheless 100x cheaper to transact on for customers, actually take into consideration this & clarify to me intimately why ETH continues to be value 5x extra by market cap”

Issues are additionally hitting up on the DEX (Decentralized Change) entrance after Solana’s Jupiter change outperformed Ethereum’s Uniswap on the Distinctive Lively Wallets (UAW) entrance.

Like Ansem, most market watchers underscored SOL as grossly undervalued, particularly after final week’s pullback.

However, Ethereum had a commanding lead on TVL (Whole Worth Locked) and total token worth on value charts.

Solana had $4 billion in TVL, whereas Ethereum’s studying stood at $53.3 billion at press time, underscoring that Ethereum had extra buyers’ belief.