XRP retraces to $2 – Should you buy the dip or stay on the sidelines?

- XRP has confronted intensified promoting stress, growing the danger of breaking a vital assist zone.

- Is Ripple dropping its high-reward attraction?

Over the previous 48 hours, Ripple [XRP] has skilled important promoting stress, with 1.12 billion tokens offloaded, driving the worth towards the essential $1.95 — $2 assist zone.

Traditionally, this stage has supplied sturdy assist, performing as a key accumulation space for patrons. Nonetheless, with promoting stress nonetheless excessive and market situations unsure, can historical past repeat itself?

Is XRP’s ground about to crack?

To date, XRP has examined the $1.95 — $2 assist 3 times since its December rally to $2.80, every time bouncing again as patrons stepped in.

However this time, the market-wide momentum, particularly from Bitcoin [BTC] at $80k, isn’t as sturdy as earlier than.

Why does this matter? Whale sell-offs are occurring simply as Bitcoin data 4 straight days of decrease lows, pushed by uncertainty over Trump’s ‘reciprocal’ tariff stance on the 2nd of April.

In earlier recoveries, Ripple has carefully adopted Bitcoin’s bounce from $77k. For now, so long as BTC holds above $80k, XRP’s $2 assist may keep sturdy. Nonetheless, if BTC falters, XRP may face extra draw back stress.

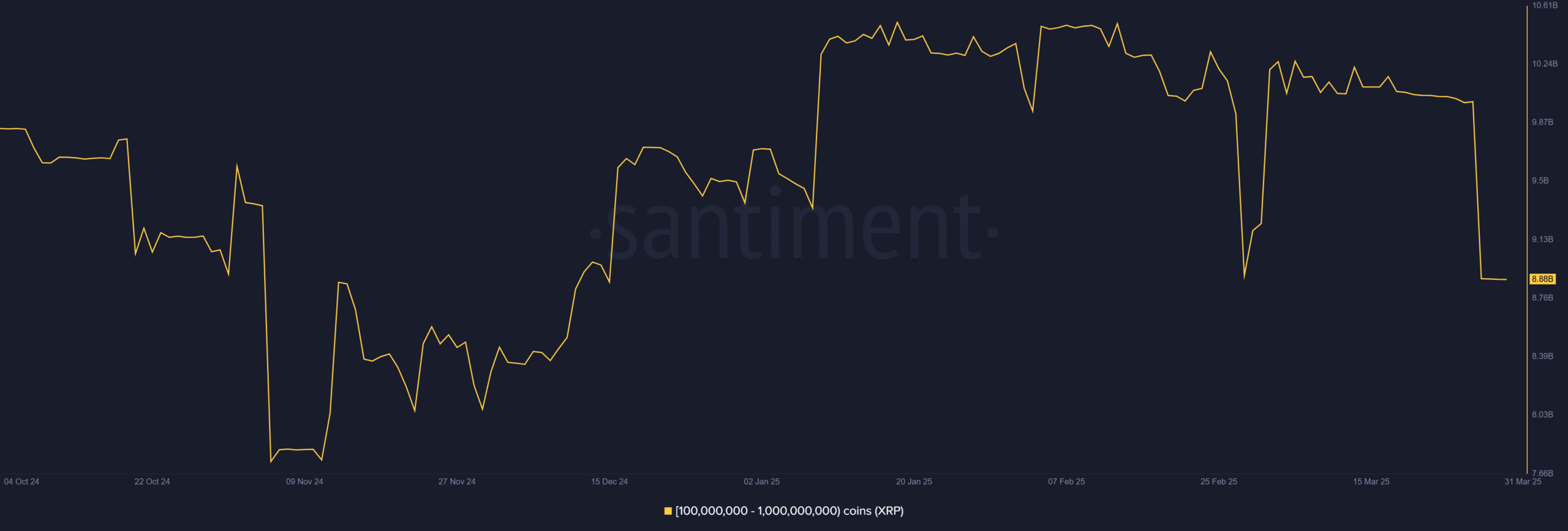

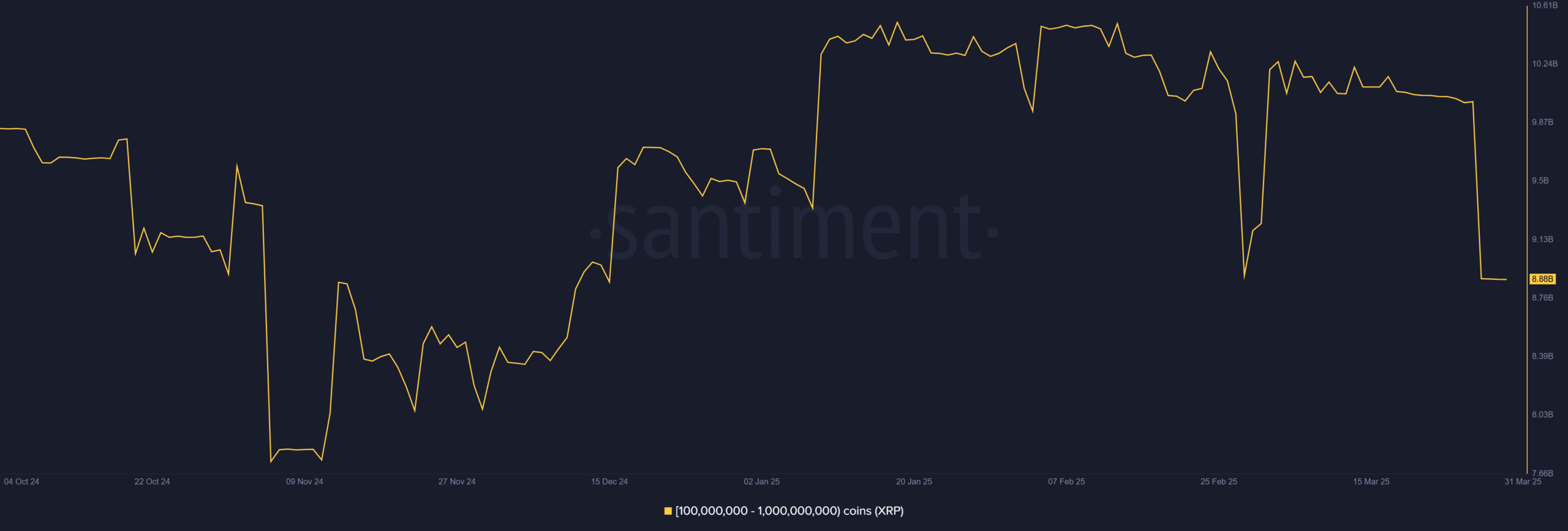

A key whale cohort, holding 100M–1B XRP, performed a significant function in previous rebounds. Throughout the late-February dip, they injected $4 billion into XRP, serving to it get better to $2.50.

Now, in simply two days, these whales have dumped over 2 billion XRP.

Supply: Santiment

If whales don’t step in once more quickly, XRP’s $2 assist may very well be in hassle – particularly with rising stress from each market traits and inside elements.

Quick sellers are capitalizing on the uncertainty

With market volatility rising, de-risking is in full swing.

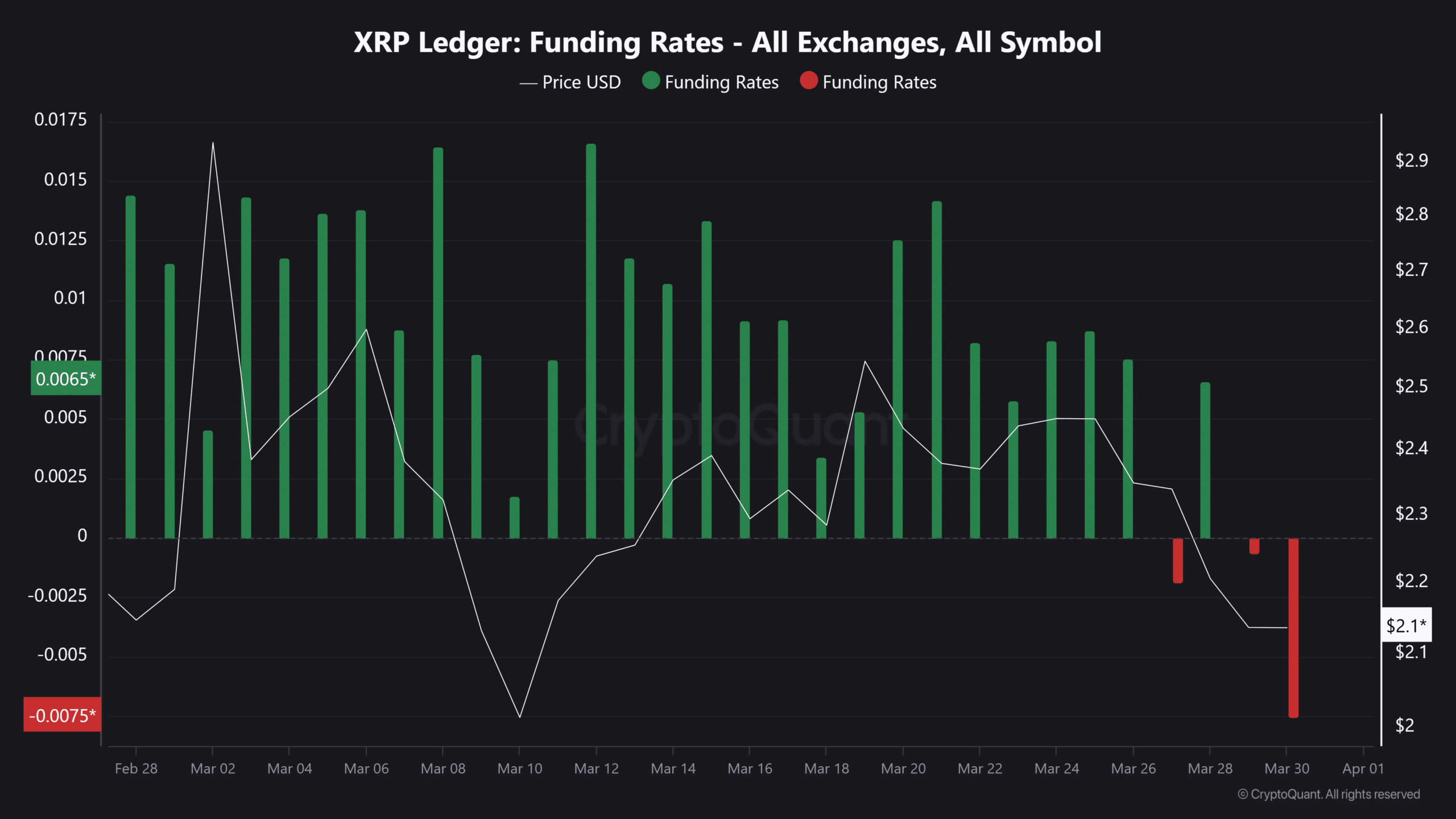

The Estimated Leverage Ratio (ELR) is nearing its March low, exhibiting fewer high-risk trades, whereas promote orders hold climbing, including to XRP’s provide within the futures market.

Might a provide shock occur? Possibly. XRP noticed 86 million movement out of Binance, surpassing the 77 million in promote orders on the spot market. However it’s not sufficient to offset stress from futures and massive gamers.

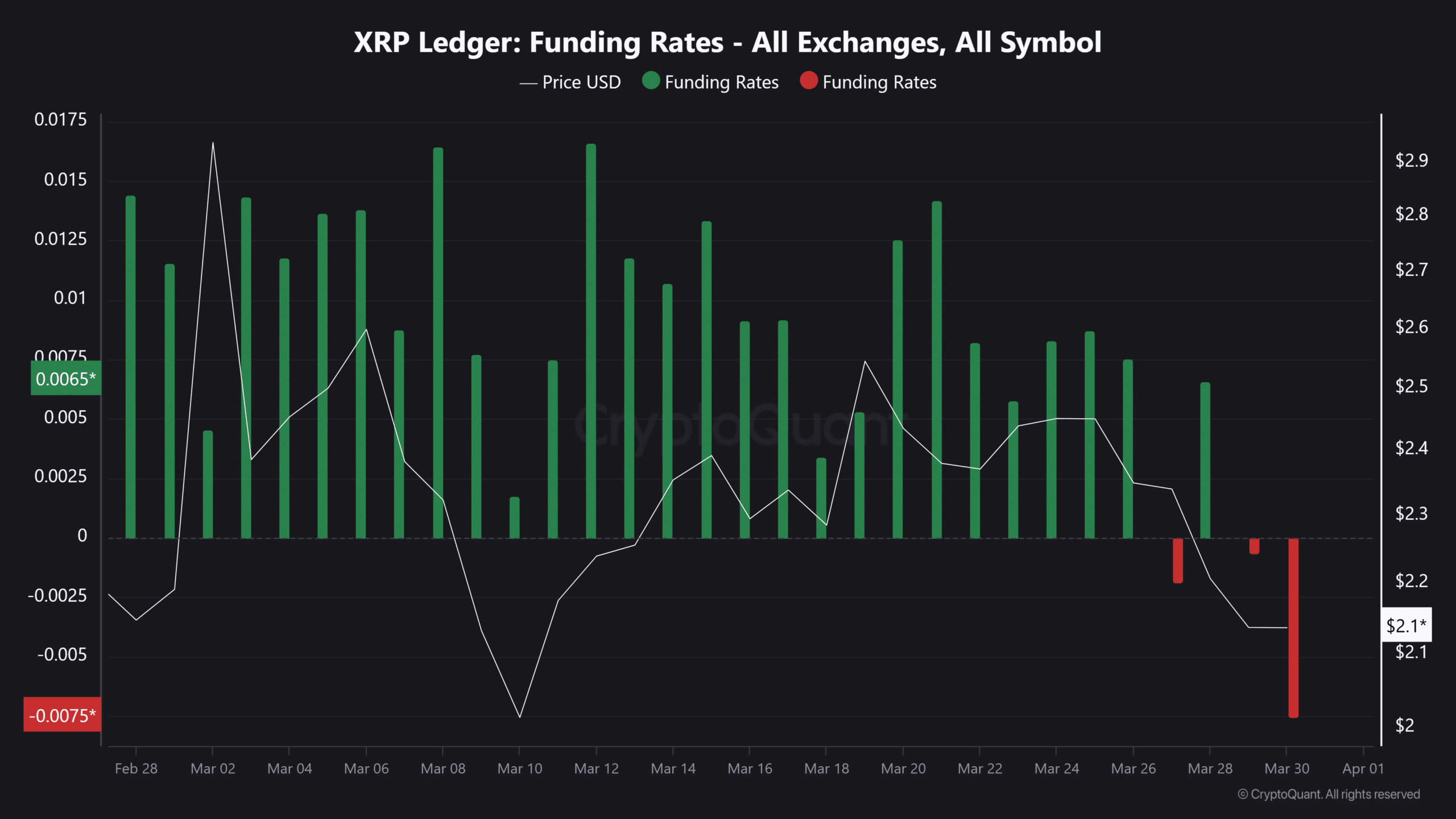

Including to the priority, quick sellers are capitalizing on weak market sentiment, with Funding Charges (FR) flipping adverse for the primary time this month – indicating an growing quick bias in perpetual contracts.

Supply: CryptoQuant

If this pattern continues, a protracted squeeze may push XRP under $1.95.

With longs dominating derivatives till now and no main accumulation in sight, Ripple’s key assist is in danger – particularly if Bitcoin loses floor after the tariff information.