Compound prices dip as investors take profits following a brief jump

- COMP’s worth elevated by over 80% inside every week after founder Robert Leshner left Compound.

- Nonetheless, as many start to take income, COMP’s worth has decreased within the final month.

The worth of Compound [COMP] rallied by 83% every week after the undertaking’s founder Robert Leshner exited the undertaking and introduced the launch of Superstate on 28 June. Now shedding most of its features, the alt’s worth has plummeted by double digits since August started.

Learn Compound’s [COMP] Value Prediction 2023-24

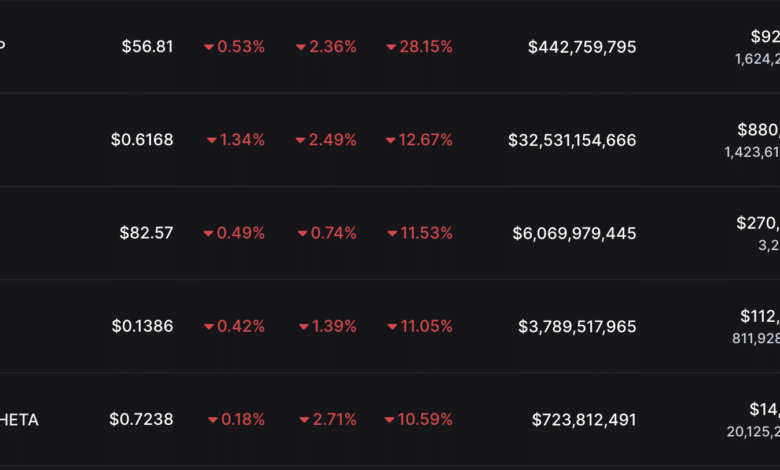

At press time, COMP traded at $56.81. With a 28% decline in worth within the final week, it ranked because the crypto asset with essentially the most losses.

Supply: CoinMarketCap

Pyrrhic victory after Leshner’s exit

On 28 June, Leshner introduced his departure from the lending protocol and made filings for the registration of his new firm Superstate. This firm will create a short-term authorities bond fund that makes use of the Ethereum blockchain as a secondary record-keeping system.

At the moment, I am excited to announce the founding of a brand new firm, @superstatefunds

Superstate’s mission is to create regulated monetary merchandise that bridge conventional markets & blockchain ecosystems.

— Robert Leshner (@rleshner) June 28, 2023

In a current report whereby it tracked the efficiency of DeFi-related crypto belongings, on-chain analytics agency Glassnode famous that COMP and MakerDAO’s MKR had been the “two tokens that stand out as main drivers of this development.”

The surge in COMP’s worth was sustained until mid-July, when it peaked at $82.3. Since then, it has launched into a downtrend attributable to elevated profit-taking exercise on-chain.

A take a look at COMP’s worth efficiency on a D1 chart confirmed the sell-offs. Following the worth peak on 16 July, COMP accumulation lowered, and most each day merchants started to dump their luggage.

Key momentum indicators have since trended downward and had been noticed in oversold areas at press time. For instance, the alt’s Cash Circulate Index (MFI) was 27.83. Additionally removed from its heart line, COMP’s Relative Energy Index (RSI) was 39.95.

Additional, signaling continued liquidity exit, the token’s Chaikin Cash Circulate was unfavorable at press time beneath the zero line. It’s trite information {that a} CMF worth beneath the zero line is an indication of weak spot out there.

Supply: COMP/USDT on TradingView

Most merchants have chosen to promote their COMP tokens attributable to how worthwhile the transactions have been within the final month. On-chain knowledge revealed that, on a 30-day transferring common, for each 1 COMP transaction that resulted in a loss, there have been 1.41 transactions that resulted in a revenue.

Supply: Santiment

Is your portfolio inexperienced? Verify the Compound Revenue Calculator

Might the chances favor one of the best punters

The drop in COMP’s worth has additionally been exacerbated by the lower in Open Curiosity within the final month. Per knowledge from Coinglass, Open Curiosity has seen a 47% decline since COMP’s worth peaked.

The futures market has additionally been considerably marked by unfavorable funding charges, signalling that many have continued to put bets in favor of a decline in COMP’s worth.

Supply: Coinglass