BTC’s Fear and Greed Index signals caution, but should you buy at $82K?

- The Bitcoin Rainbow Chart confirmed that the latest dip was a shopping for alternative, whilst concern prevailed.

- The liquidation heatmaps pointed to a worth bounce to $86.3k within the coming days.

Bitcoin [BTC] noticed a 6.89% worth bounce from the tenth of March’s 1-day buying and selling session worth, closing at $78.6k. It has already encountered notable resistance on the $84k area.

Evaluation of the value chart and the liquidation ranges confirmed that short-term consolidation was possible.

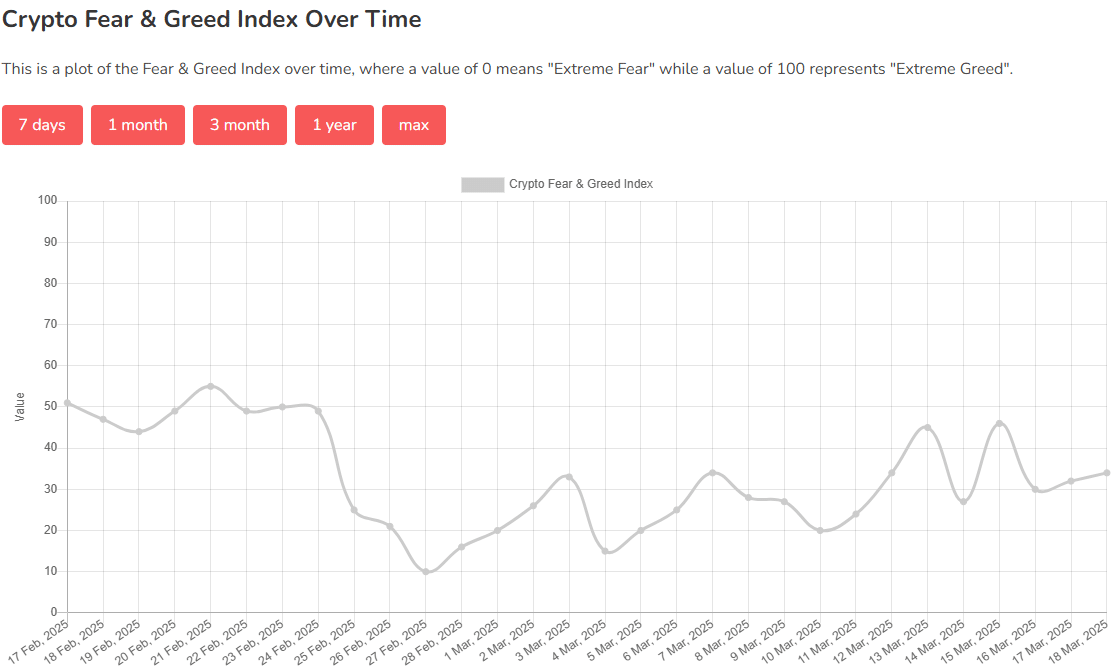

Supply: Various.me

The Bitcoin Concern and Greed Index was at 34, exhibiting concern. Over the previous week, it has hovered round 30-40, dipping to excessive concern and a worth of 24 on the eleventh of March.

Bitcoin spot ETFs noticed outflows of $900 million up to now 5 weeks, underlining the bearish market sentiment.

Purchase Bitcoin whereas concern grips the broader market

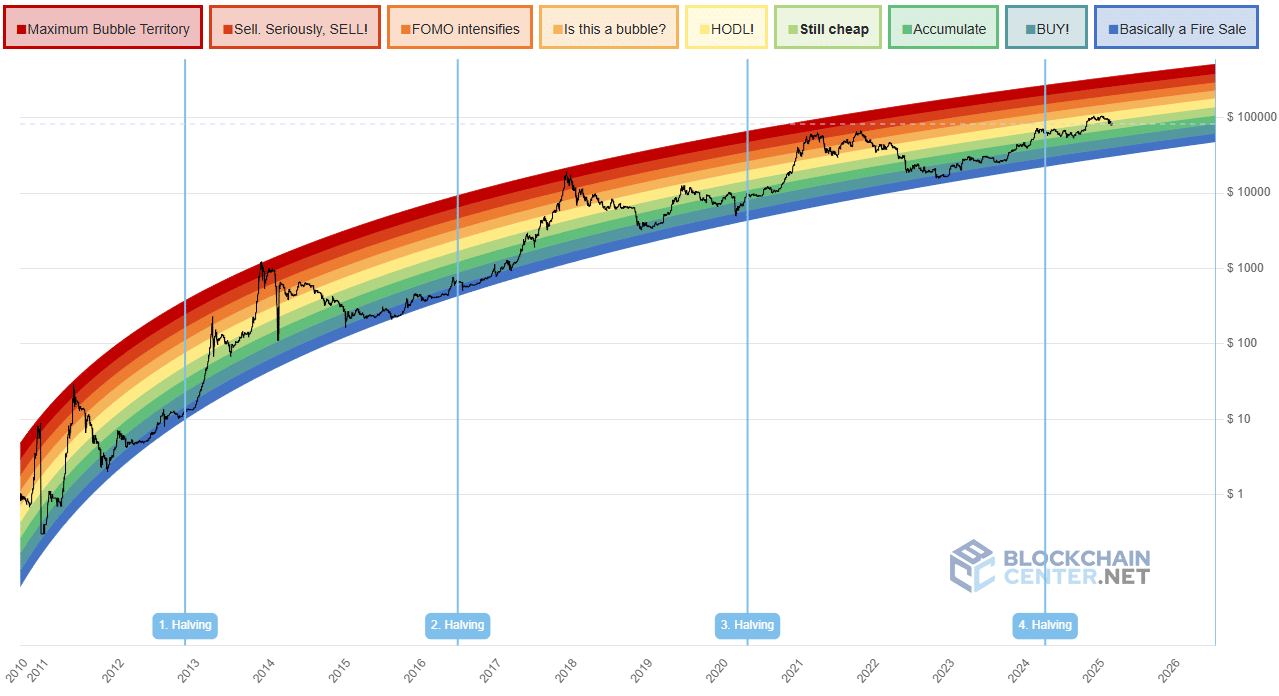

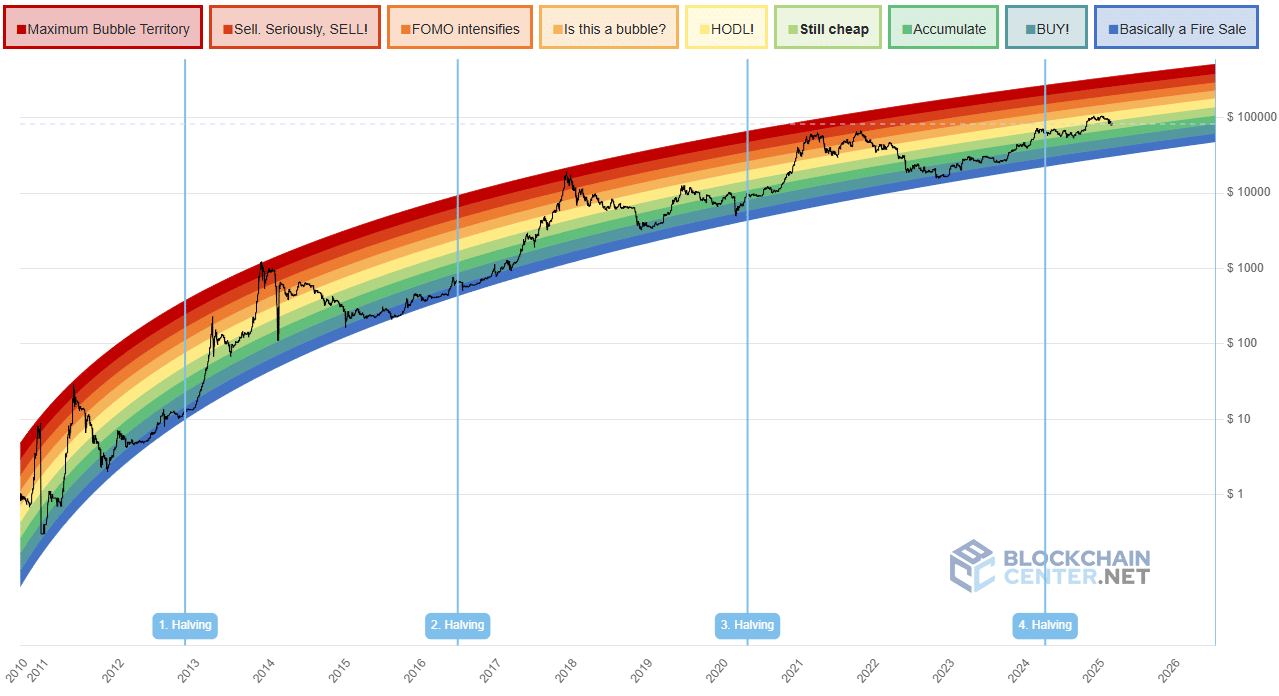

Supply: Blockchain Middle

At the very least, this was the message from the Bitcoin Rainbow Chart. The long-term valuation instrument for Bitcoin with enjoyable colours might be helpful for buyers. It’s based mostly on the concept that Bitcoin’s worth progress follows a logarithmic sample over time.

The chart has completed an excellent job figuring out cycle tops and bottoms, but it surely have to be famous that this was completed principally in hindsight. Proper now, the Bitcoin Rainbow Chart exhibits that the most important crypto was “nonetheless low cost”.

At $82k, it was fairly a grand declare, particularly within the background of declining inventory markets throughout the globe. Then once more, that is perhaps the enchantment for buyers – the chance to reward was nonetheless engaging.

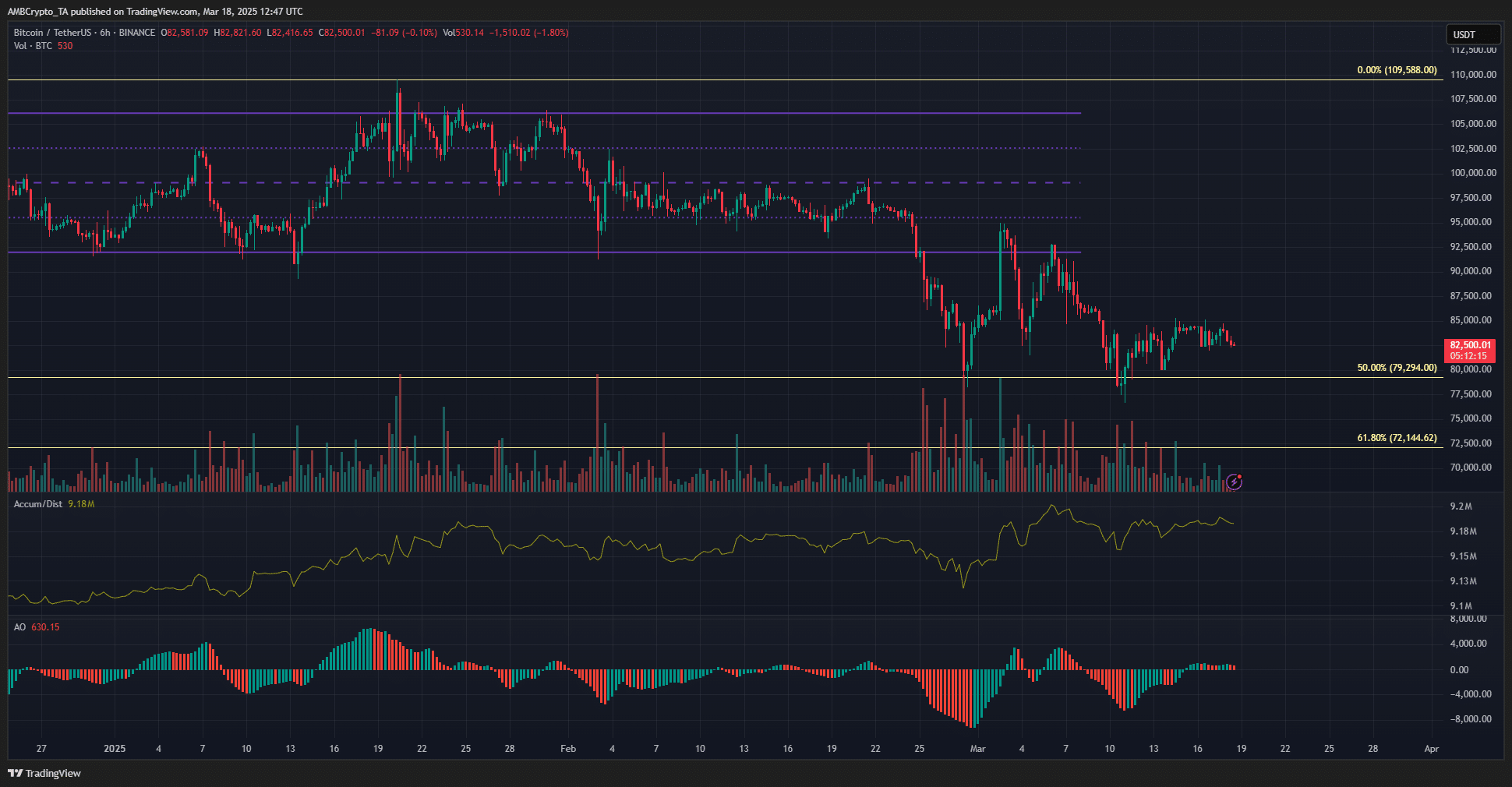

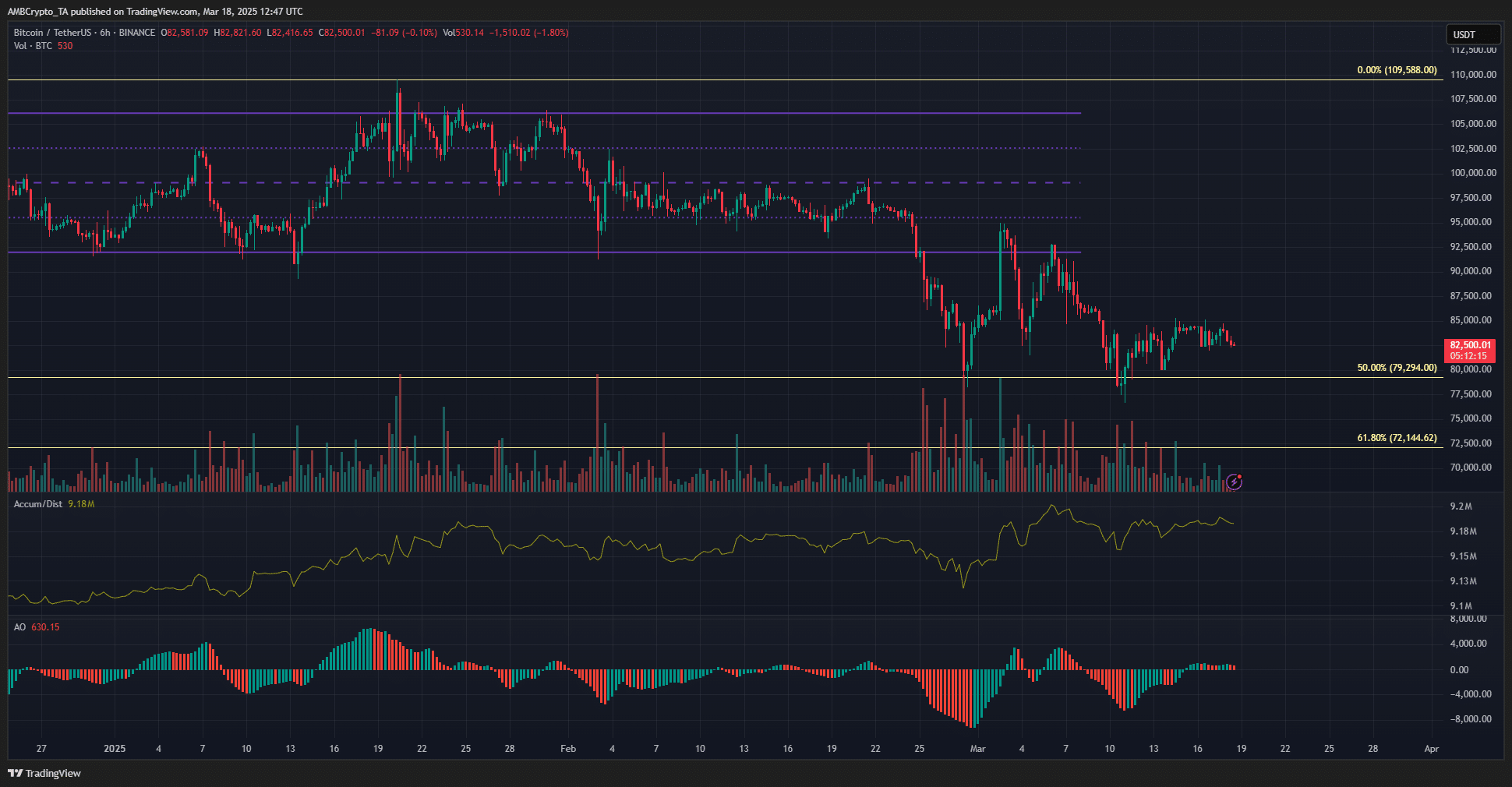

Supply: BTC/USDT on TradingView

Examination of the 6-hour chart confirmed that the short-term construction was bearish. The $85k stage has served as resistance over the previous week. The A/D indicator confirmed an uptrend in March, whereas the value has trended towards $80k.

This was an encouraging discovering. It confirmed elevated accumulation and shopping for exercise was on the rise, in line with the indicator.

The Superior Oscillator confirmed momentum was barely bullish, however not excessive sufficient to drive tendencies.

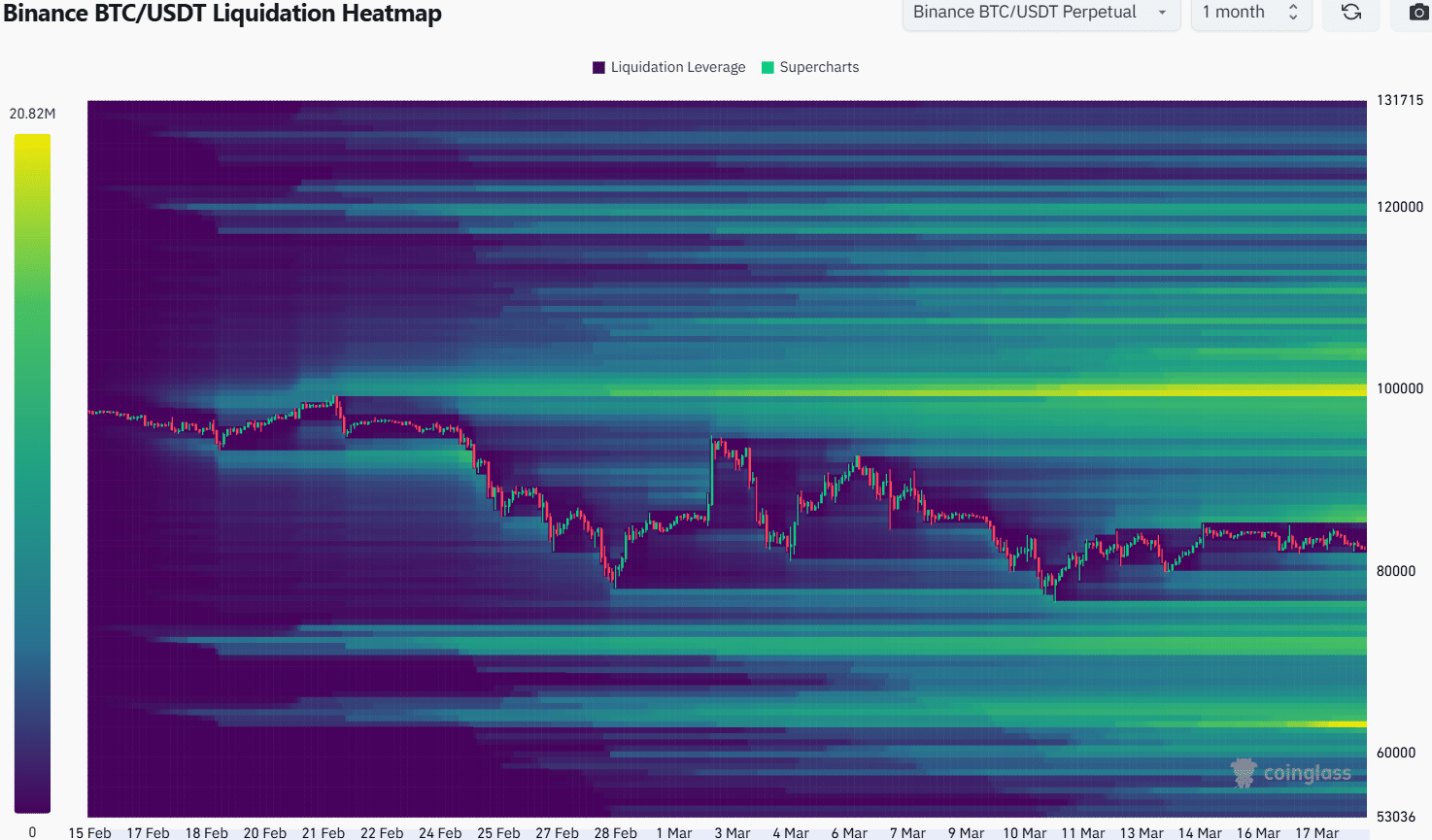

Supply: Coinglass

The 1-month liquidation heatmap outlined the $100k and $71.7k-$72.3k as vital liquidity clusters. Nearer to the value, the $86.3k and $76.3k had been additionally ranges that would appeal to costs to them.

Given the bearish construction of BTC, a transfer southward appeared possible. Nevertheless, the A/D indicator confirmed a bounce was potential.

Furthermore, such a bounce past the native resistance at $85k may flip market contributors bullish, earlier than the bearish reversal is initiated on the $86.3k magnetic zone.

Therefore, merchants ought to keep a bearish outlook till the native resistance areas are breached.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion