Could Ethereum’s Latest Financial Product Be Its Downfall? Expert Weighs In

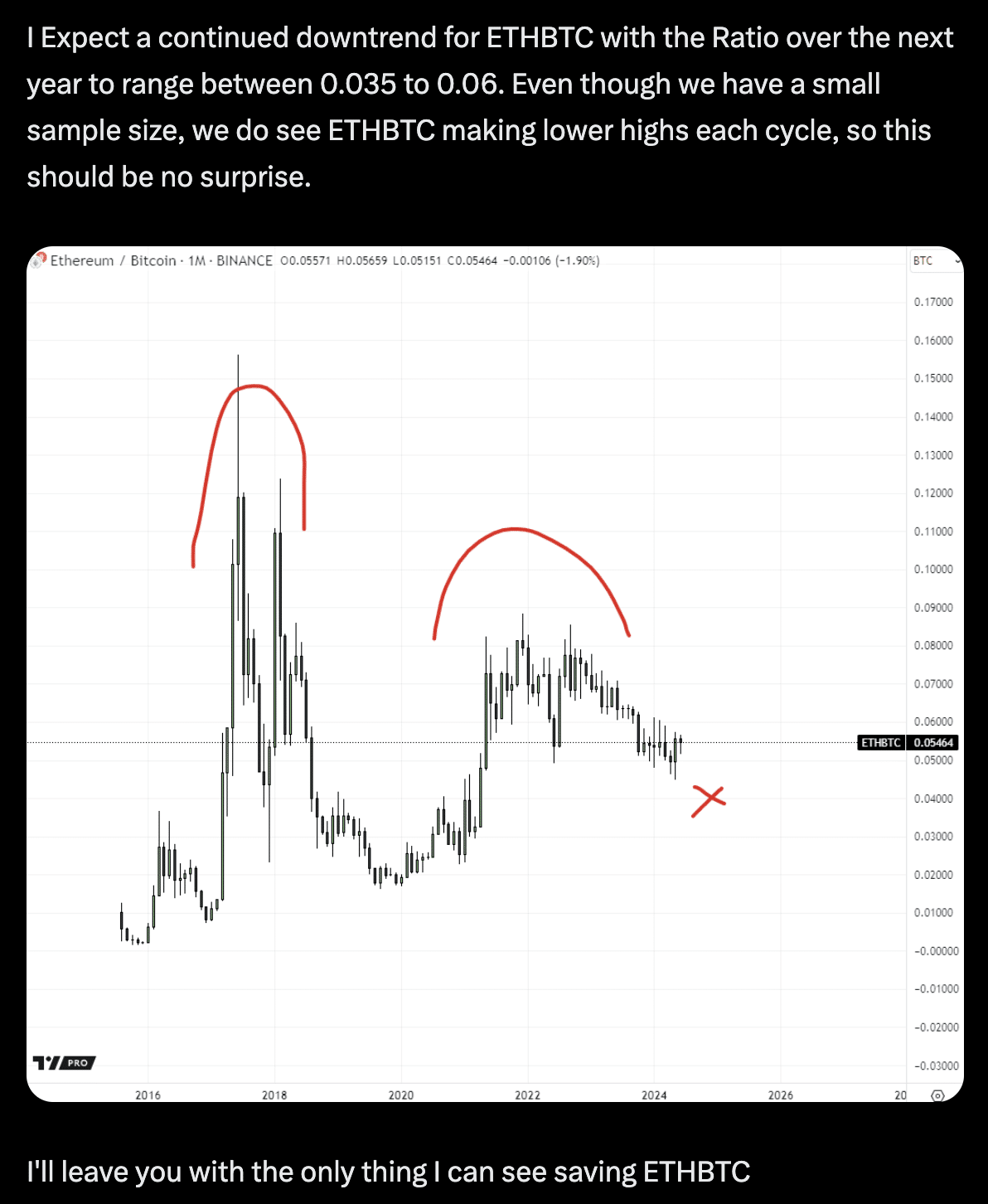

- Spot Ether ETFs might cut back Ethereum’s worth to as little as $2,400.

- Institutional curiosity in Ethereum is much less in comparison with Bitcoin, affecting ETF conversion charges.

As Ethereum [ETH] trails Bitcoin in efficiency, its worth has seen a 5.1% lower over the previous 24 hours, bringing it to a present valuation of $3,315.

This current downturn in worth displays broader market developments and investor sentiment. Regardless of this fall, analysts foresee an additional drop doubtlessly pushed by new monetary merchandise coming into the market.

Andrew Kang of Mechanism Capital speculates that the introduction of spot Ethereum exchange-traded funds (ETFs) might push Ethereum’s worth right down to as little as $2,400.

ETH ETFs to drive down Ethereum’s worth?

The rationale behind Kang’s prediction lies within the comparative lack of institutional curiosity in Ethereum versus Bitcoin.

The founding father of Mechanism Capital disclosed that the absence of robust incentives for changing spot ETH into ETFs, coupled with unimpressive community money flows, presents a difficult outlook for Ethereum’s instant future within the ETF market.

These elements might contribute to Ethereum’s wrestle to keep up its market worth within the face of evolving market buildings and investor preferences.

Moreover, the potential inflow of ETH into the ETF panorama is estimated to draw about 15% of the flows that Bitcoin ETFs have garnered, based mostly on extrapolations from Bitcoin’s ETF efficiency.

Preliminary information signifies that spot Bitcoin ETFs attracted round $5 billion in new funds inside six months of their launch.

Making use of these figures to Ethereum, it’s projected that Ethereum-based ETFs would possibly see roughly $840 million in true inflows throughout the same timeframe.

Regarding this, Kang expresses skepticism concerning the alignment between the crypto neighborhood’s expectations and conventional monetary (tradfi) allocators’ preferences, indicating that the market might have already “priced in” the results of the ETF launch.

Challenges in market notion

Moreover, the conceptual pitch of Ethereum as a decentralized monetary settlement layer and a base for Web3 purposes carries potential. Nonetheless, in accordance with Kang, present information counsel that it could be a difficult promote.

Notably, the discount in community transaction charges because of decreased exercise in decentralized finance and non-fungible tokens has shifted views, probably likening ETH to overvalued tech shares when it comes to monetary metrics.

Moreover, in accordance with Kang, the current regulatory inexperienced mild for Ethereum ETFs was considerably sudden, giving issuers restricted time to craft and disseminate efficient advertising and marketing methods.

He added that the removing of staking choices from the ETF proposals might additional dissuade buyers from changing their holdings, impacting the anticipated inflow of capital into these funds.

Concluding the perception, Kang famous:

“Does that imply ETH will go to zero? After all not, at some worth it will likely be thought of good worth and when BTC goes up sooner or later, it will likely be dragged up with it to some extent. Earlier than the ETF launch, I count on ETH to commerce from $3,000 to $3,800. After the ETF launch my expectation is $2,400 to $3,000. Nonetheless, If BTC strikes to $100k in late This fall/Q1 2025, then that would drag ETH alongside to ATHs, however with ETHBTC decrease. “

Supply: Andrew Kang on X

Are there bearish indicators from ETH?

In mild of Andrew Kang’s pessimistic view on Ethereum, it’s value inspecting Ethereum’s fundamentals to validate these issues.

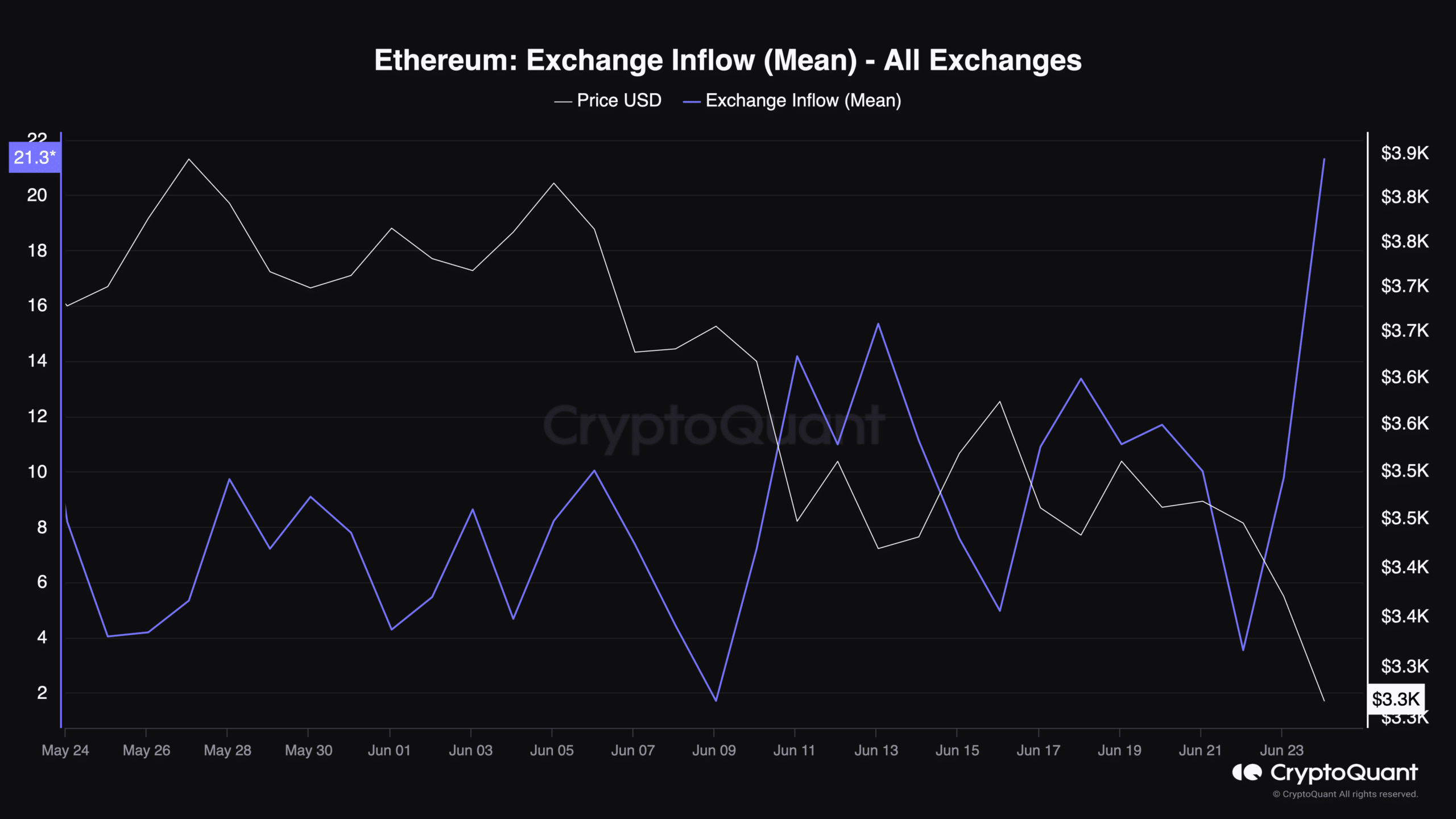

Data from CryptoQuant reveals a worrisome pattern in certainly one of Ethereum’s key metrics—there was a notable improve in Ethereum deposits on exchanges, suggesting a possible rise in promoting strain.

Supply: CryptoQuant

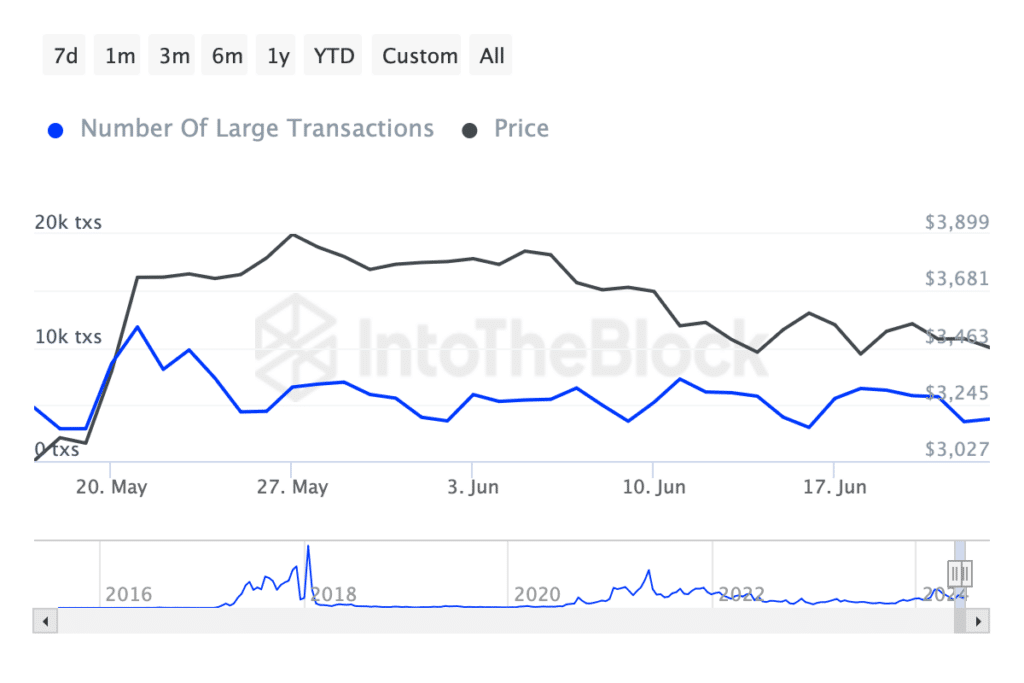

This indicator aligns with IntoTheBlock’s data, which exhibits a big discount in massive ETH transactions (these exceeding $100,000).

Learn Ethereum’s [ETH] Value Prediction 2024-2025

These transactions have decreased from over 10,000 late final month to underneath 4,000 as of as we speak.

Supply: IntoTheBlock

Regardless of these bearish indicators, a current report from AMBCrypto highlights an uptick in Ethereum’s each day energetic addresses, including a layer of complexity to the market’s dynamics.