Could this move from 1Inch affect Uniswap prices

Posted:

- Over 400,000 UNI tokens have been lately offered off.

- UNI has continued to say no and trades under $5.

The 1Inch Funding Fund obtained Uniswap [UNI] tokens just a few months in the past and has now chosen to promote its whole holding. Will this have any impact on the UNI development?

1Inch offloads its Uniswap holdings

As reported by Spot on Chain, the 1Inch Funding Fund offered off its Uniswap holdings on seventeenth November. The tracked pockets revealed the sale of your entire stash, consisting of 416,924 UNI tokens valued at round $213 million.

The tokens have been offered at a median value of $5.11. Curiously, the pockets had beforehand bought some UNI tokens in February, buying 299,849 tokens value round $2 million at a median value of $6.67.

The latest sell-off suggests the opportunity of a loss on this funding.

The way it impacted the stream of Uniswap on exchanges

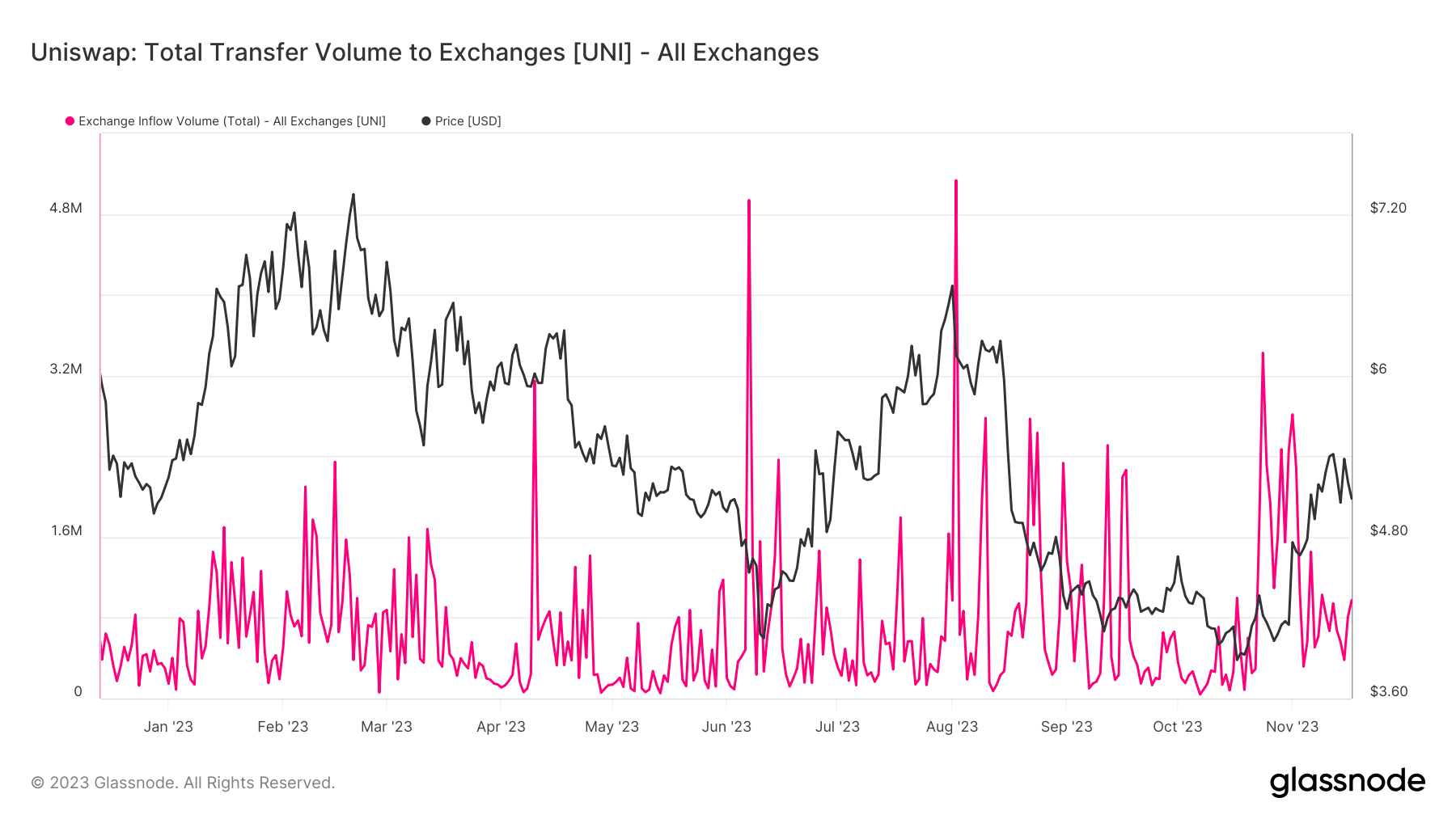

Whereas not reaching the degrees noticed earlier within the month, the inflow of Uniswap tokens into exchanges has lately skilled a noticeable improve.

An examination of the influx chart by AMBCrypto revealed a discernible uptrend within the quantity of UNI tokens getting into exchanges. As of this writing, the amount of UNIs flowing into exchanges was over 973,000.

Additionally, an outflow evaluation indicated that over 803,000 tokens have been leaving exchanges. This instructed that the influx quantity was solely barely increased than the outflow.

In different phrases, there have been extra gross sales than withdrawals from exchanges, albeit by a small margin. Notably, the sell-off by the 1Inch Funding Fund didn’t considerably impression the stream of UNI tokens.

UNI retains dipping

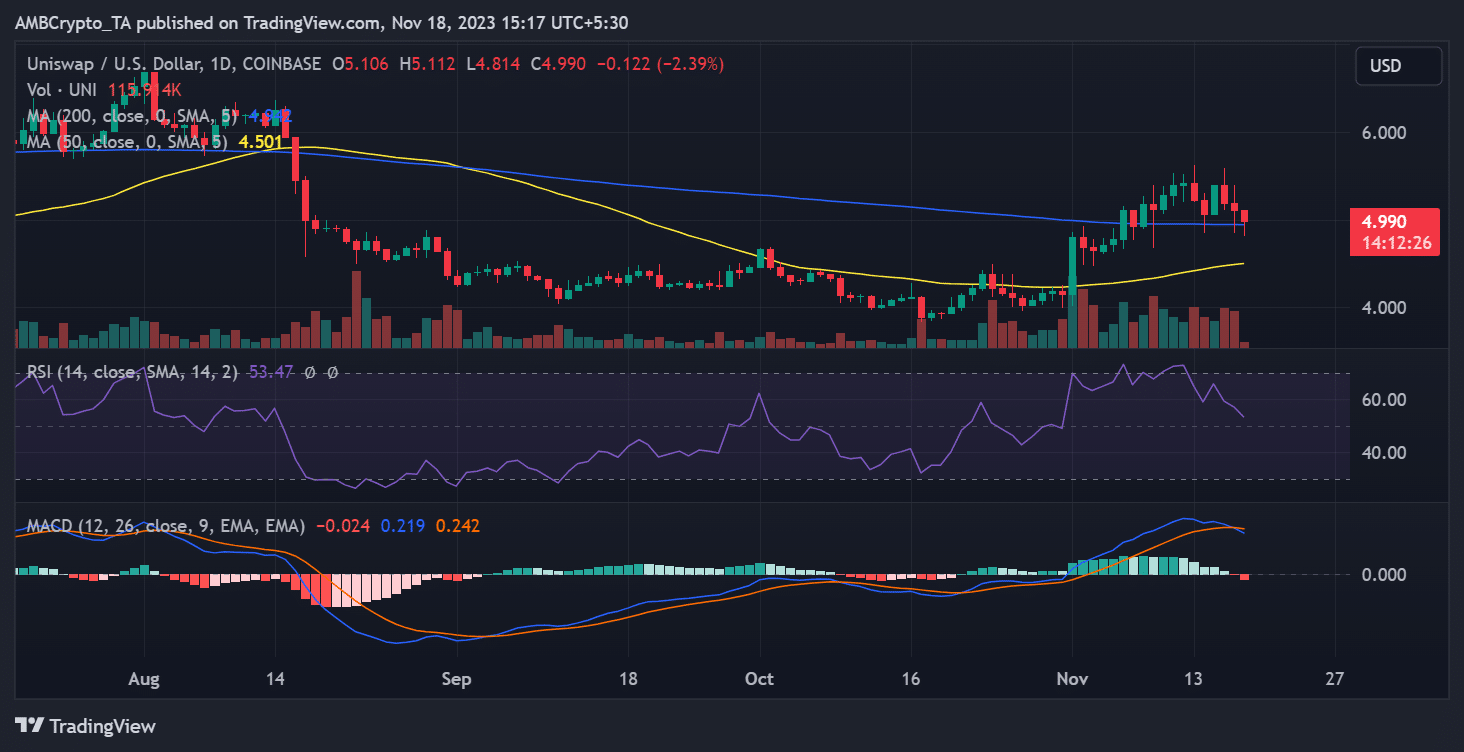

AMBCrypto’s evaluation of the every day timeframe chart for Uniswap revealed a persistent detrimental development. The chart displayed a steady downtrend over the previous three days.

On the time of this report, Uniswap was buying and selling at round $4.9, reflecting a lack of over 2%. This present decline contributed to a complete lower in worth of greater than 7% during the last three days.

How a lot are 1,10,100 UNIs worth at present

Moreover, the chart indicated that the worth development was now falling under its long-moving common (blue line). Initially functioning as help, the breach under the blue line signaled a weakening bull development.

Moreover, the Relative Power Index (RSI) corroborated this remark by indicating a decline within the bull development.