Cross-chain protocol Orbit Chain attacked on New Year’s Eve

- Orbit Bridge noticed losses price $81.5 million in stablecoins and cryptos.

- Orbit Chain group introduced compensation for customers.

The New Yr’s Eve doled tears reasonably than cheers to the customers of the cross-chain protocol Orbit bridge, which grew to become one more sufferer of crypto exploits.

Orbit Chain will get robbed off

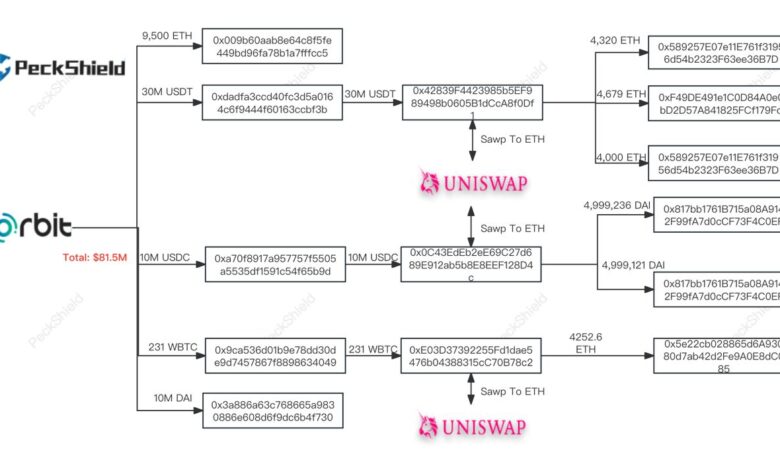

A preliminary investigation by blockchain safety agency PeckShield Inc. revealed losses price $81.5 million in stablecoins and cryptocurrencies throughout 5 separate transactions.

Stablecoin losses totaled $50 million, together with $30 million in Tether [USDT], $10 million in USD Coin [USDC], and $10 million in DAI.

About $10 million in Wrapped Bitcoin [wBTC] was misplaced whereas 9,500 Ethereum [ETH], equating to $21.5 million on the prevailing market value, was drained out of the cross-chain bridge.

Supply: PeckShield

The record of addresses the place the funds have been seen shifting to have been flagged. Customers have been requested to proceed with warning.

Inside 5 hours of the detection, Orbit Chain admitted to “an unidentified entry” to the cross-chain bridge on social platform X (previously Twitter).

The group assured the protocol customers that they have been actively looking for help from legislation enforcement companies and that an investigation was underway to find out the foundation trigger.

Orbit Chain additionally introduced a compensation distribution for customers. Customers have been requested to finish a verification course of and declare refunds primarily based on their eligibility.

For the curious, Orbit chain is a multi-asset blockchain facilitating cross-chain switch via its decentralized Inter-Blockchain Communication (IBC).

The ordeal continues

The unlucky occasion added a couple of extra tens of millions to the entire cash misplaced to blockchain hackers in 2023. As per widespread Web3 safety agency SlowMist, a complete of 462 hacks resulted in outflows of greater than $2.4 billion all year long.

Supply: SlowMist

Whereas this was a big determine when seen in isolation, a comparative research from earlier years signaled optimism. Greater than $9 billion was misplaced in 2021 whereas losses in 2022 reached $4.3 billion.

Usually, a rise in hacks appeared to have coincided with durations of curiosity within the crypto trade. Quite the opposite, bear markets go away comparatively a lot much less for criminals to focus on and earn.