crvUSD Stablecoin From Curve Finance Launched On Ethereum

Abstract:

- Sensible contracts for Curve Finance’s crvUSD stablecoin went reside on Ethereum’s mainnet, the workforce shared by way of a Twitter replace on Could 3.

- “This isn’t finalized but as a result of UI additionally must be deployed. Keep tuned!” mentioned crvUSD builders promising a person interface for the stablecoin.

- crvUSD enters a extremely aggressive Ethereum stablecoin market with names like DAI, USDT, and USDC.

Ethereum’s stablecoin market welcomes a brand new contender constructed by the builders of decentralized buying and selling venue Curve Finance.

On Could 3, the DEX builders confirmed that good contracts for crvUSD had been deployed on Ethereum’s mainnet. The workforce minted 20 million crvUSD tokens in complete. Customers can view this stablecoin provide on Etherscan.

“This isn’t finalized but as a result of UI additionally must be deployed. Keep tuned!” mentioned crvUSD builders promising to roll out a person interface for the stablecoin.

Curve Finance’s Mechanics For Its Stablecoin

Curve Finance designed its crvUSD stablecoin as a U.S. dollar-pegged token with an over-collateralized construction. Which means that crvUSD can solely be minted by posting collateral in supported cryptocurrencies. Minters should present extra collateral in opposition to the quantity of crvUSD tokens that they want to mint.

The design leverages different crypto belongings relatively than fiat currencies, a design just like Maker’s DAI stablecoin.

Choosing an over-collateralized asset construction comes with its danger. The Curve Finance workforce carried out a recent blockchain algorithm referred to as Lending-Liquidating AMM or LLAMMA to mitigate this danger. LLAMMA achieves this by liquidating and depositing crypto belongings as collateral. Builders automated the method to optimize crvUSD’s mechanics.

New Stablecoin On The Block

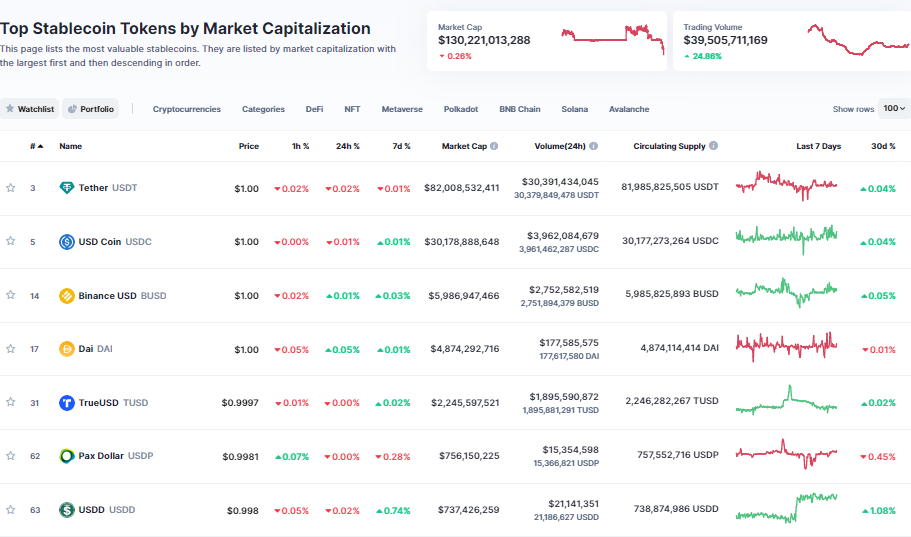

crvUSD enters a extremely aggressive Ethereum stablecoin market with names like DAI, USDT, and USDC. Nonetheless, the stablecoin was designed by one of many largest DeFi entities available on the market. Curve Finance‘s authority within the house might drive crvUSD adoption amongst stablecoin customers who faucet into crypto’s $130 billion stablecoin market cap.