Crypto Fear and Greed Index at 31: Should Bitcoin traders be concerned?

- The Bitcoin Rainbow Chart is extraordinarily bullish long-term, projecting a possible $200k-250k goal by the tip of 2025

- Technical evaluation helped mood expectations and confirmed that the pattern remained bearish for now

Bitcoin [BTC] was buying and selling at $84.5k at press time. The buying and selling session on the 14th of April is predicted to be unstable, and the remainder of the week may see BTC submit losses.

As The Kobeissi Letter identified, the uncertainty across the bond market may influence the inventory markets and, in flip, the crypto market.

In an earlier report, it was identified {that a} spike within the Open Curiosity (OI) signaled warning, however there was an opportunity of a transfer towards $87k. Regardless of this chance, merchants and buyers shouldn’t anticipate a bullish breakout.

The Crypto Worry and Greed Index was at 31, displaying intense worry available in the market. Market volatility, social media engagement, quantity, Google traits, and BTC dominance information are used to compute the crypto worry and greed values.

The chart confirmed that the sentiment has been predominantly fearful since February.

This pattern has not modified bullishly, though BTC was again above the important thing horizontal stage at $82.5k. The market-wide turmoil must calm down earlier than Bitcoin can pattern upward.

Bitcoin is “nonetheless low cost” claims the Rainbow Chart

The Bitcoin Rainbow Chart signaled a shopping for alternative for long-term buyers. It confirmed BTC was “nonetheless low cost”. In earlier bull runs, the “Promote, significantly SELL!” territory or the utmost bubble territory has marked the cycle tops.

Assuming one thing comparable occurs in late 2025 and BTC reaches the “SELL!” territory, its value can be round $250k, in accordance with the Bitcoin Rainbow Chart.

Though the chart is enjoyable, straightforward to learn, and inherently extraordinarily bullish long-term, buyers have to be cautious and never use it completely to make their selections.

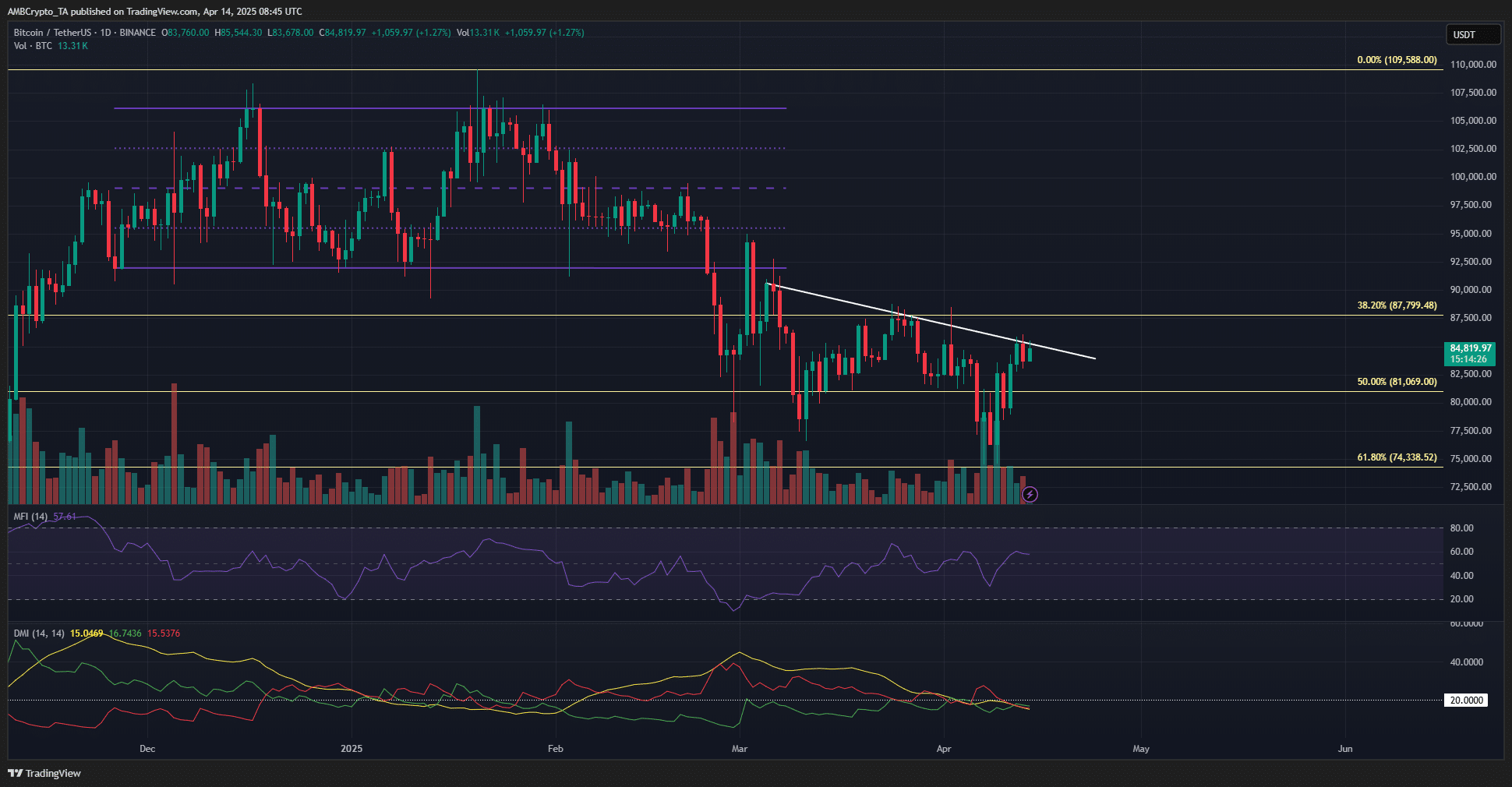

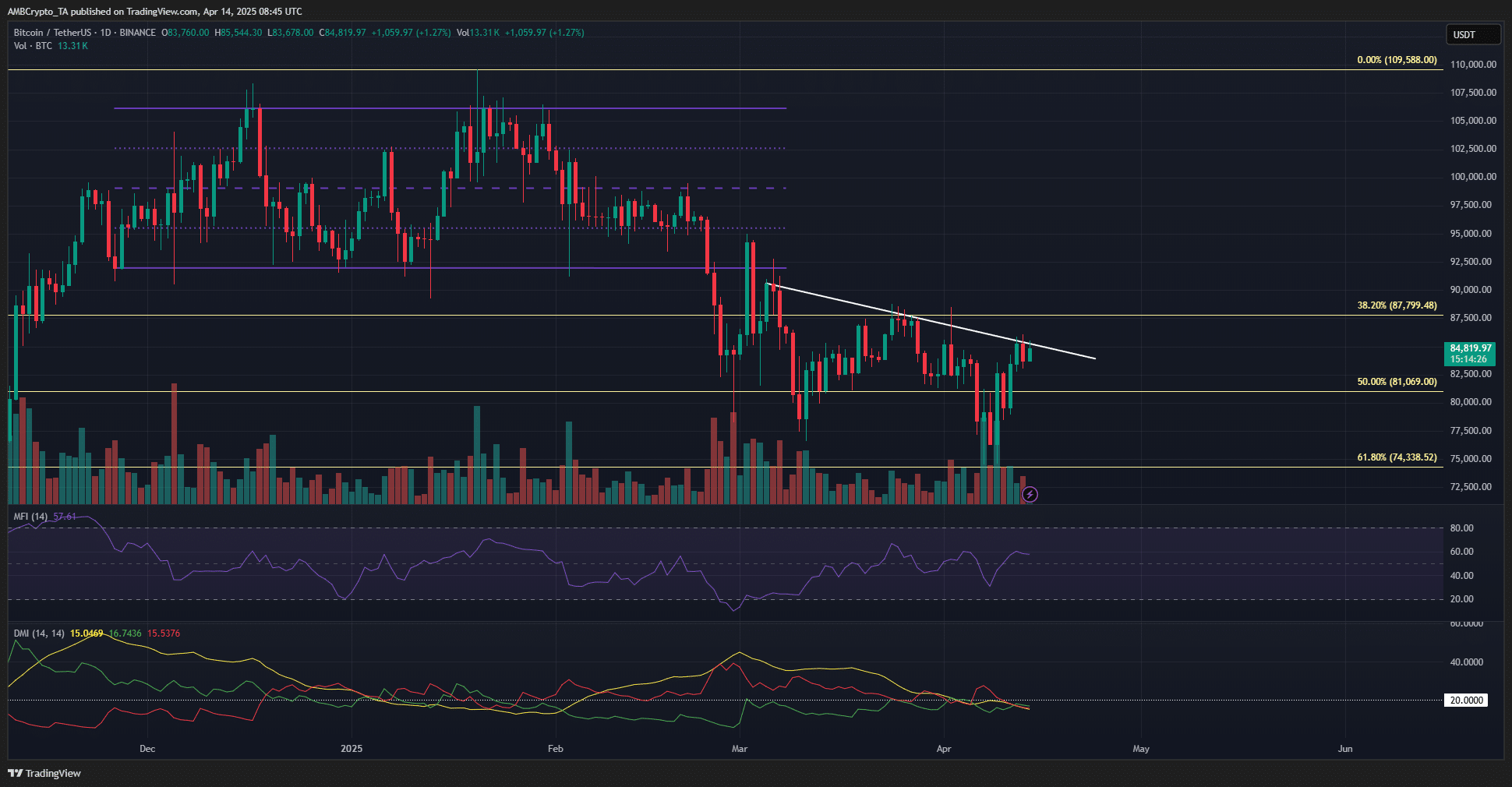

Supply: BTC/USDT on TradingView

The 1-day chart confirmed that the pattern remained bearish. The value has not made a brand new greater excessive and toiled beneath a trendline resistance over the previous month. The MFI was simply above 50 to point out a bullish market.

The DMI confirmed {that a} robust pattern was not underway, because the ADX (yellow) was beneath 20. With a bearish construction and fearful sentiment, merchants and buyers can stay sidelined or bearish on BTC.

Nevertheless, the build-up of liquidation ranges round $89.5k meant it was a possible short-term value goal.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion