Crypto liquidations alert! What’s next after major $170 mln wipeout

- On the thirtieth of July, crypto liquidations dropped to $132 million.

- BTC’s liquidation would rise once more at $70 whereas ETH’s would rise close to $3.45k.

The crypto market witnessed a lot volatility over the previous couple of days, which will be attributed to a number of elements. Within the meantime, crypto liquidations elevated sharply.

This occurred whereas the Federal Reserve’s determination relating to new financial coverage is anticipated quickly.

Crypto liquidations elevated

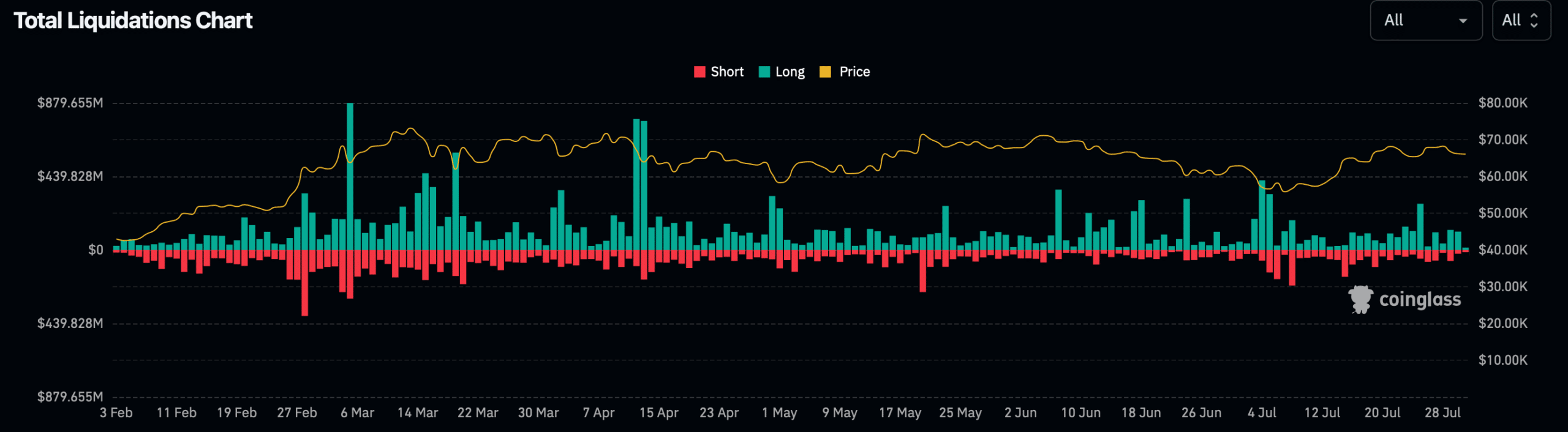

Current knowledge revealed that the crypto market’s liquidations reached $170 million. Most of those positions had been longs, that are thought of a bullish place.

A potential motive behind this could possibly be BTC’s value motion. The king of crypto’s value reached $70k at press time, after which lengthy positions merchants liquidated. This occurred at a time when seven developments came about.

For a rise, the US authorities bought $2 billion price of Bitcoins. Moreover, the Federal Reserve’s coverage assembly was held, which was anticipated to supply insignia on the upcoming financial insurance policies.

As per AMBCrypto’s evaluation of Coinglass’ data, the liquidation did decline on the thirtieth of July.

To be exact, crypto liquidations touched $132 million, out of which $109.5 million had been lengthy positions whereas $22.74 million had been brief positions.

Supply: Coinglass

Are BTC and ETH affected?

This rise in liquidation additionally had an impression on Bitcoin’s [BTC] and Ethereum’s [ETH] value actions, as they turned bearish.

In response to CoinMarketCap, each of those cash’ costs dropped marginally within the final 24 hours. On the time of writing, BTC was buying and selling at $65,980, whereas ETH had a worth of $3,311.

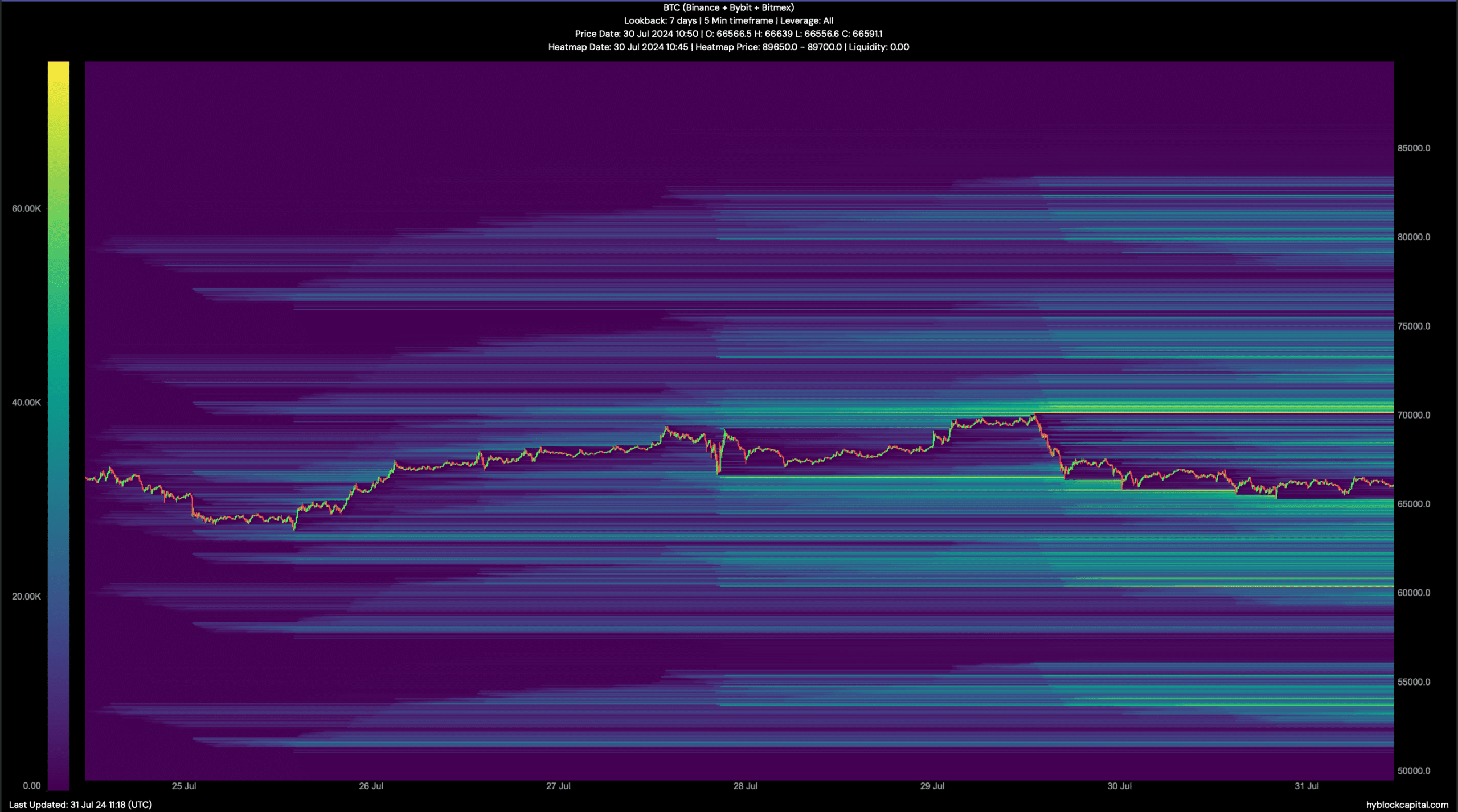

AMBCrypto then checked their liquidation heatmaps to search out out when liquidation will improve once more.

As per our evaluation, BTC would as soon as once more witness a big rise in liquidation if its value retouches $70k. Earlier than reaching that stage, BTC’s liquidation would stay comparatively low.

Supply: Hyblock Capital

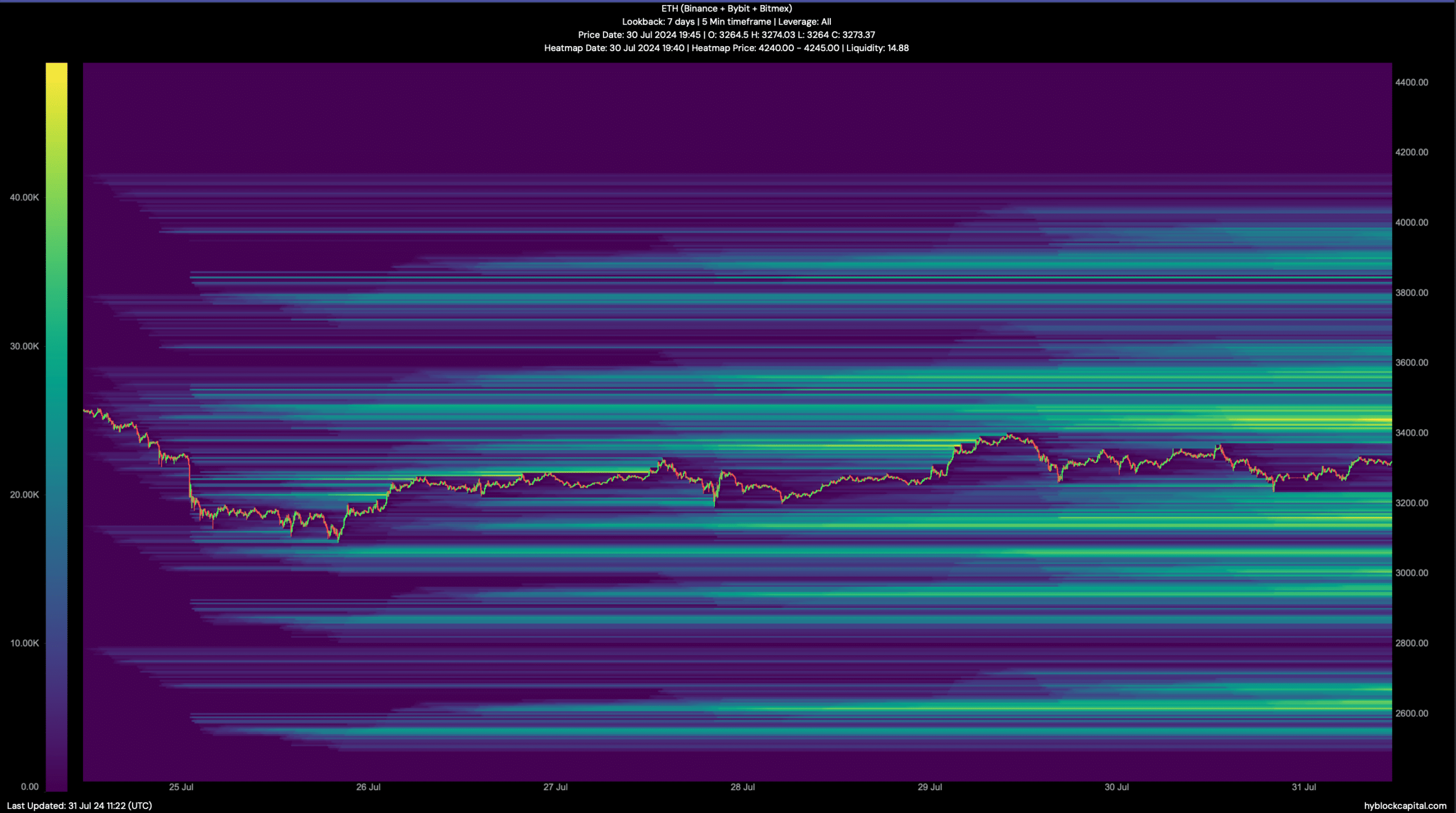

Mentioning Ethereum, its liquidation would attain $43.5k when its value touches $3.45k. Above that, ETH’s liquidity would rise once more close to the $3.8 mark.

Supply: Hyblock Capital

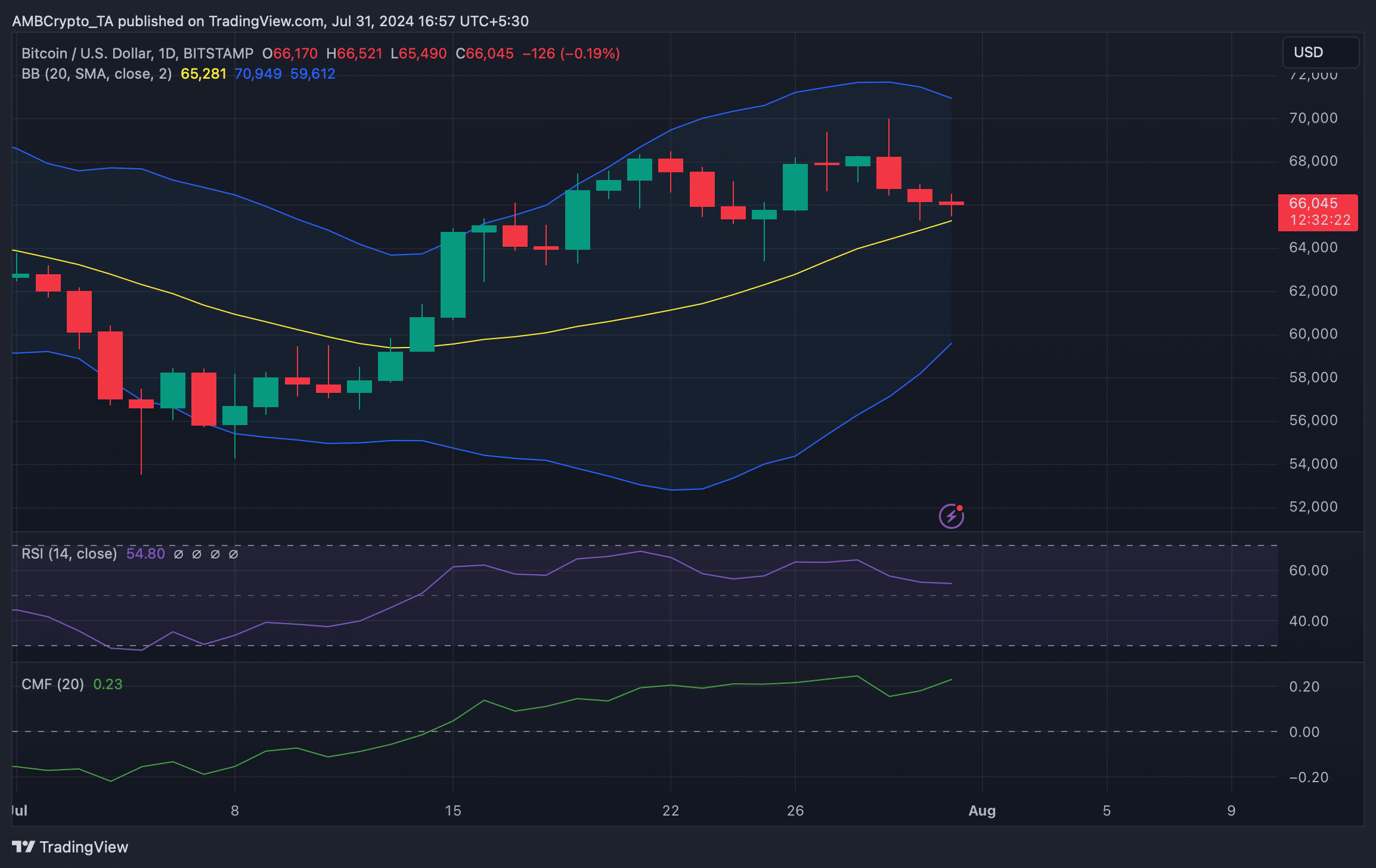

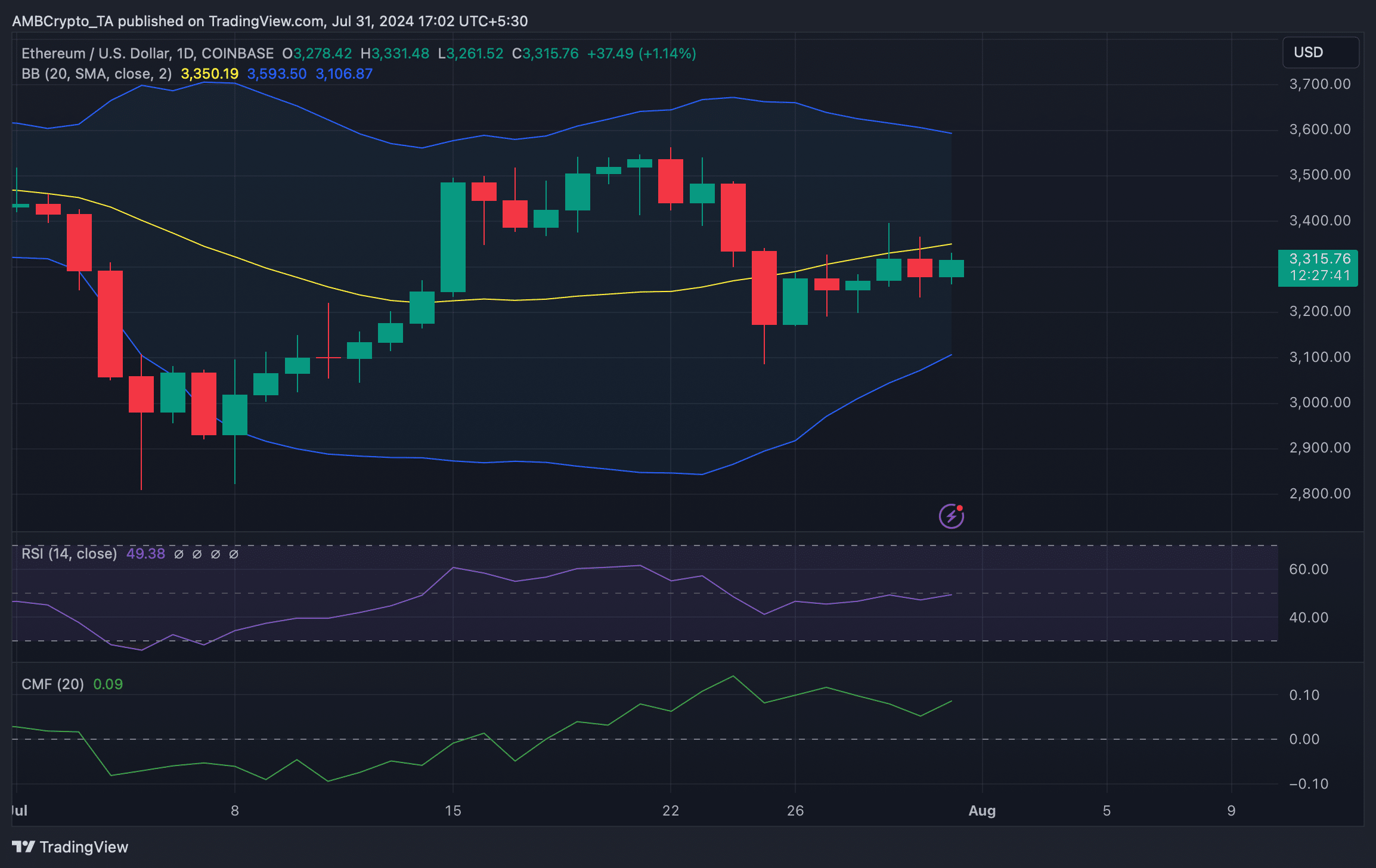

AMBCrypto then checked their every day charts to search out how doubtless it’s for them to succeed in the aforementioned stage within the brief time period. The Bollinger Bands revealed that BTC was testing its 20-day Easy Shifting Common help.

A profitable check of that would enable BTC to start yet one more bull rally. Its Chaikin Cash Movement (CMF) additionally remained bullish because it moved up. However the Relative Power Index (RSI) supported the bears.

Supply: TradingView

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Curiously, whereas BTC was testing its help, Ethereum was testing its resistance at its 20-day SMA. The excellent news was that its RSI registered an uptick.

Moreover, its Chaikin Cash Movement (CMF) additionally moved northward. Each of those indicators prompt that the probabilities of ETH turning bullish once more had been excessive.

Supply: TradingView