Crypto Liquidity Becoming More Concentrated Within Top Exchanges, Says Analytics Firm Kaiko

The highest crypto exchanges on this planet are consuming up a much bigger and larger share of the business’s buying and selling quantity, new knowledge suggests.

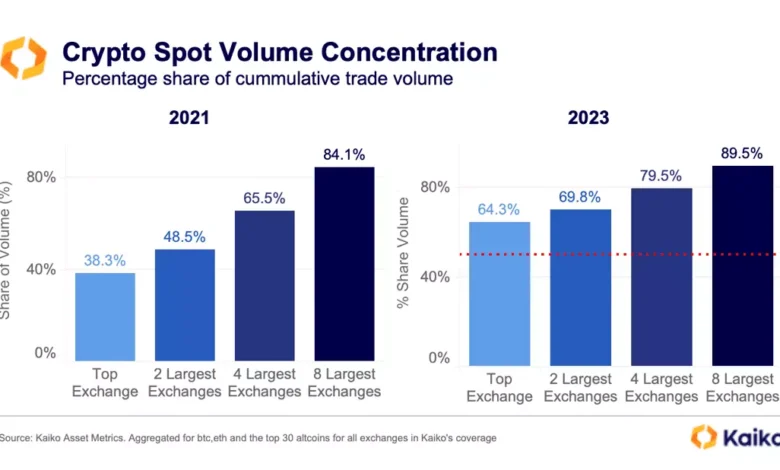

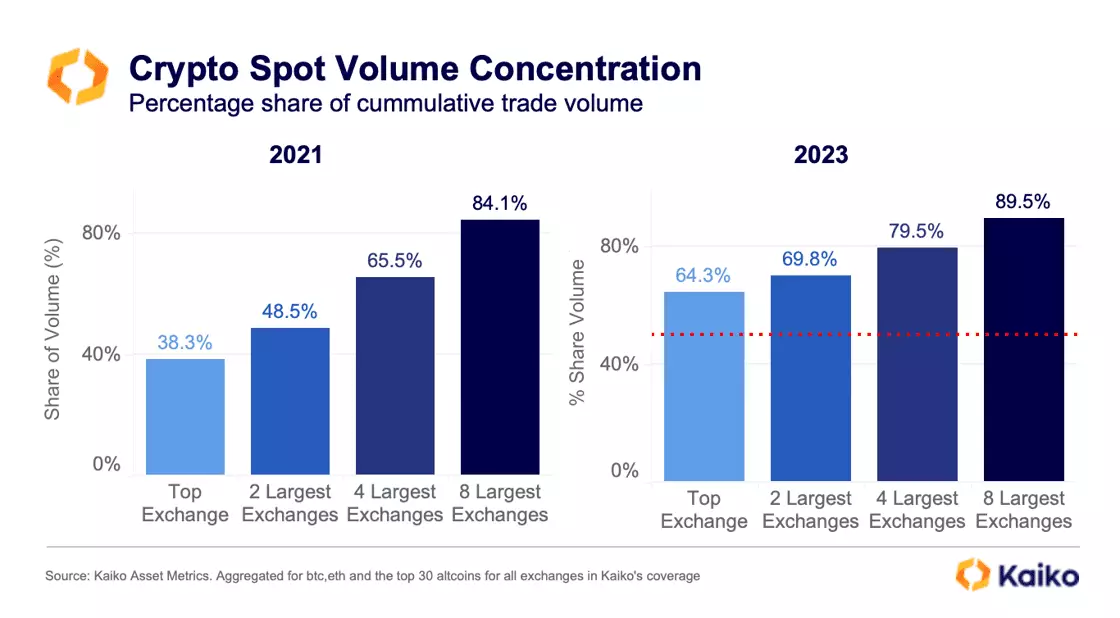

Crypto insights agency Kaiko says in a brand new report that the eight largest exchanges on this planet account for over 91% of market depth and 89% of all quantity.

Because it was a number of years in the past, Binance nonetheless leads the pack.

Says Kaiko,

“Liquidity is concentrated and has turn out to be extra concentrated over time. In 2023, the highest alternate, Binance, has accounted for 30.7% of world market depth and 64.3% international commerce quantity. The highest 8 largest platforms account for a whopping 91.7% of depth and 89.5% of quantity.

Since 2021, Binance’s market share of spot quantity has elevated from 38.3% to 64.3%. It ought to be famous {that a} large a part of this improve was linked to Binance’s zero-fee buying and selling promotion.”

Kaiko says liquidity is concentrated inside only a handful of exchanges, and whereas there are lots of of buying and selling platforms in existence, most solely cater to a distinct segment phase of market exercise.

“Whereas it could be optimum from a market perspective to have liquidity targeting only a few exchanges, the cryptocurrency business usually holds decentralization in excessive regard. On the subject of centralized alternate (CEX) liquidity, there’s little decentralization.”

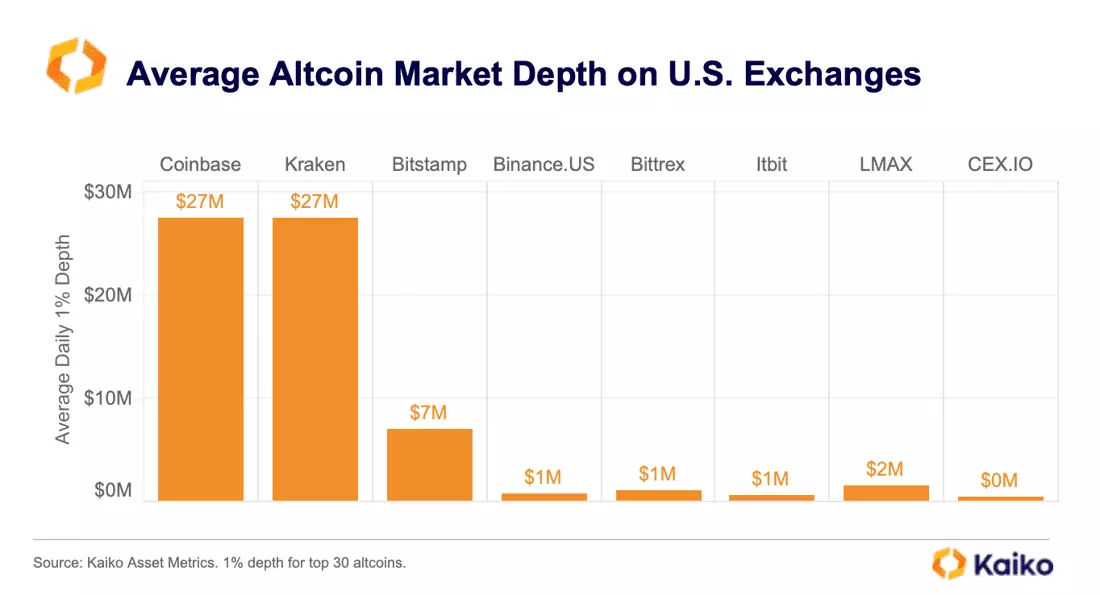

Because of the anti-crypto regulatory agenda within the US, Kaiko says that altcoin liquidity has suffered, and has turn out to be very concentrated inside three main exchanges: Coinbase, Kraken and Bitstamp.

“Kraken’s altcoin liquidity has carried out significantly effectively, making it a robust contender with Coinbase. Since August 2022, Kraken has not seen any drop in market depth for the highest 30 altcoins, whereas Coinbase has misplaced ~$5 million in liquidity.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/SvetaZi/Natalia Siiatovskaia