Will Bearish Metrics Push BTC Price Below $80K?

The crypto market’s current restoration light on Friday as a pointy sell-off erased practically all weekly beneficial properties. Buyers turned cautious amid considerations over President Trump’s upcoming tariffs scheduled for April 2 together with stronger-than-expected core PCE information. With Bitcoin dealing with rising promoting strain beneath $85,000, it’s on observe for its worst quarter since 2018, permitting analysts to invest whether or not it’d end March beneath the important $80,000 degree.

Bitcoin to Face Worst Q1 Since 2018

Bitcoin’s value has sharply declined over the previous a number of hours. In line with Coinglass information, practically $90.56 million in BTC positions have been liquidated, together with $79.3 million from consumers and about $11.25 million from sellers.

This current value drop locations Bitcoin on observe for its worst Q1 efficiency since 2018. Information from CoinGlass signifies Bitcoin fell roughly 11.86% in Q1 2025, barely worse than the ten.83% loss in Q1 2020, although removed from the drastic 49.7% decline seen in Q1 2018.

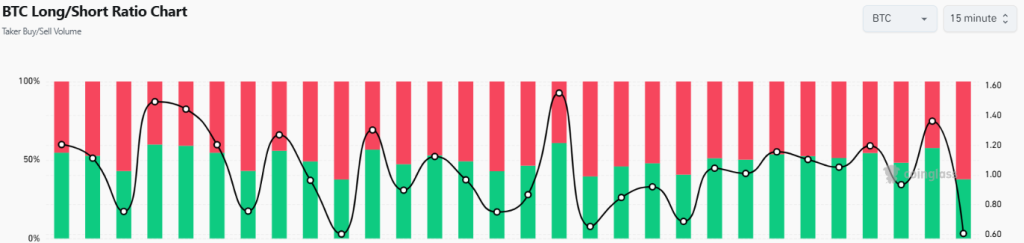

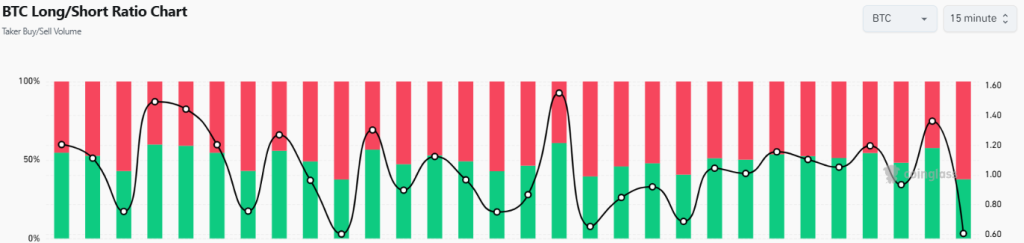

Bitcoin’s open curiosity has declined by roughly 4.5% up to now 24 hours, shifting nearer to a low of round $54 billion. The drop in open curiosity signifies declining buying and selling exercise amongst BTC merchants, which can end in decreased volatility and extra cautious market habits within the quick time period.

Moreover, the lengthy/quick ratio has skilled a noticeable decline, at the moment standing at 0.6051. This metric reveals that roughly 62.3% of merchants are actually betting on an additional value lower for Bitcoin, whereas solely round 38% are hopeful a few potential rebound. Total, these figures level to an rising bearish sentiment amongst merchants.

Additionally learn: Bitcoin ETF Influx Streak Breaks After 10-Day Surge

Including to bearish sentiment, Bitcoin ETFs skilled notable outflows, presumably pushing BTC nearer to the $80K degree. Constancy’s FBTC fund alone noticed $93.16 million in outflows on Friday, ending a 10-day streak of inflows—the longest this 12 months. Notably, FBTC had acquired $97.14 million of inflows simply the day before today, as per SoSoValue. Buying and selling quantity throughout all U.S. Bitcoin ETFs elevated barely on Friday, totaling round $2.22 billion.

What’s Subsequent for BTC Worth?

Bitcoin has just lately skilled elevated promoting strain, inflicting its value to fall beneath important Fibonacci help ranges and reaching a low of round $81,644. At current, Bitcoin trades close to $82,289, down roughly 1.7% over the previous 24 hours.

Sellers are actively holding the essential resistance at $85,000, aiming to maintain the value from bouncing again. Regardless of this, consumers stay decided and seem ready for one more push to reclaim this key degree.

If consumers handle to regain the $85,000 degree, market sentiment may shift positively, probably paving the way in which for additional upward momentum towards the subsequent main resistance close to $90,000.

Nonetheless, if consumers are unsuccessful in overcoming this important barrier, Bitcoin may face elevated promoting strain, presumably dragging the value again towards the help zone between $80,000 and $78,000.