Crypto Trader Unveils End-of-Cycle Price Targets for Bitcoin and Ethereum Based on Historic Precedence

A crypto strategist believes that Bitcoin (BTC) and Ethereum (ETH) have extra room to run to the upside this cycle earlier than the markets take a bearish flip.

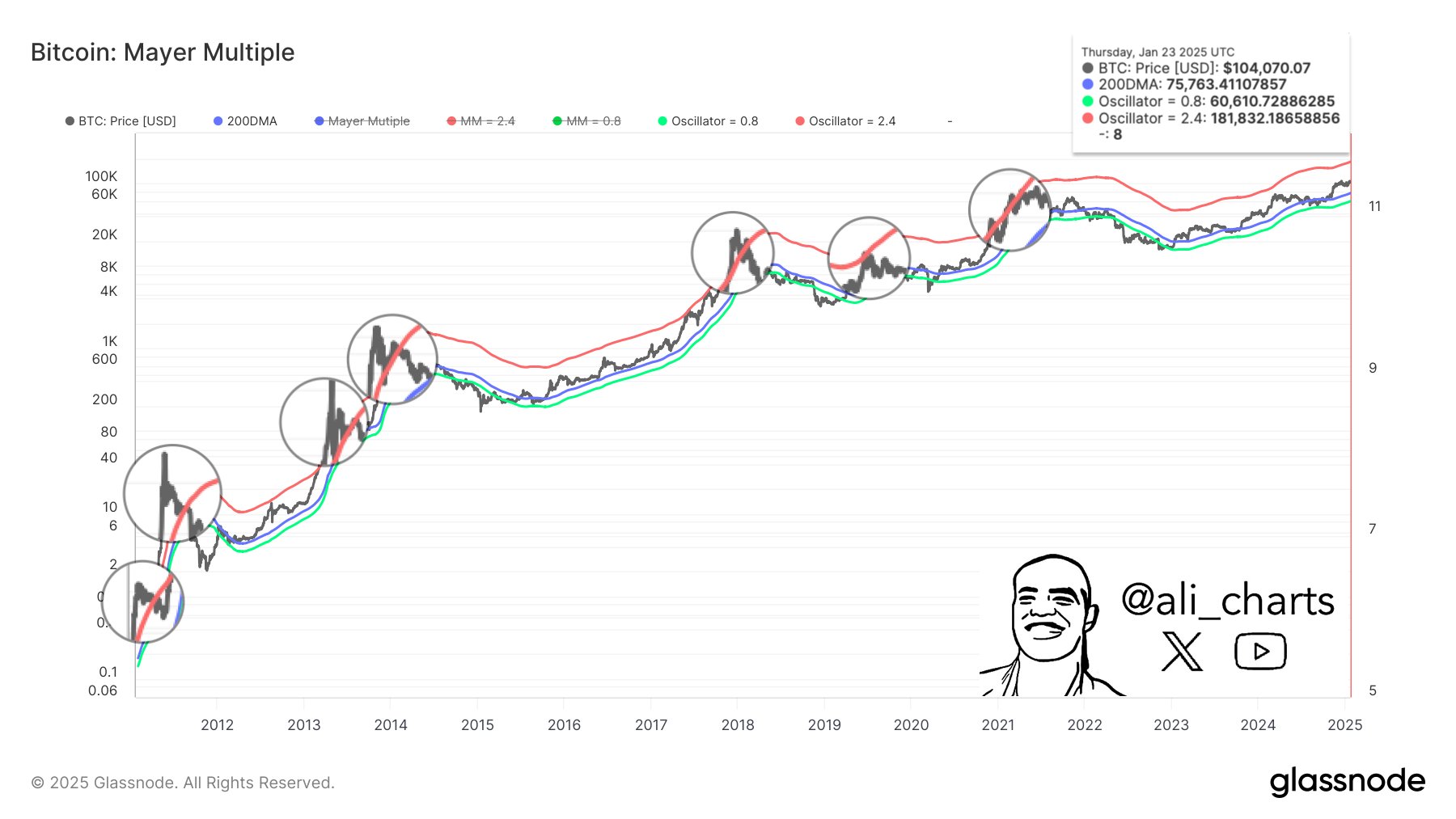

Dealer Ali Martinez tells his 120,000 followers on the social media platform X that he’s taking a look at Bitcoin’s Mayer A number of to time BTC’s market prime.

The Mayer A number of is a technical software that measures the distinction between the present value of BTC and the 200-day shifting common to find out if Bitcoin is overbought or oversold.

In response to Martinez, the technical indicator has been spot on previously in marking Bitcoin’s bull market prime.

“Traditionally, the Mayer A number of has recognized Bitcoin overbought circumstances when BTC trades above the two.4 oscillator. Each market prime has occurred above this degree.

Proper now, the two.4 degree sits close to $182,000, suggesting BTC nonetheless has room to develop.”

At time of writing, Bitcoin is buying and selling for $98,772.

As for Ethereum, Martinez says he’s conserving a detailed watch on ETH’s market worth to realized worth (MVRV) pricing band, an on-chain metric used for gauging whether or not an asset is witnessing excessive ranges of unrealized earnings or loss. When the MVRV pricing band is hovering above 2.4 for about 6% of buying and selling days, it suggests an elevated probability of investor profit-taking that would mark a cycle prime.

Says Martinez,

“In each bullish cycle, Ethereum ETH has surpassed the three.2 MVRV Pricing Band. At the moment, this degree stands at $6,770!”

At time of writing, ETH is buying and selling for $3,072.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney