Crypto VC: Ethereum is the ‘simplest, safest 3X’ opportunity now

- ETH may rally to $10K, per crypto VC accomplice at Moonrock Capital.

- There was strong traction for ETH, together with renewed staking curiosity, which may enhance costs.

A crypto VC projected that Ethereum’s [ETH] value may eye a $10K cycle excessive, regardless of lagging main cap altcoins and Bitcoin [BTC].

In accordance with Simon Dedic, founder and accomplice of crypto VC Moonrock Capital, ETH could possibly be the ‘safest 3x’ alternative now.

“At this present state of the market, $ETH is probably going the only and most secure 3x alternative nonetheless obtainable.”

Primarily based on the present worth, that’s about $10K per ETH. There have been rising bullish requires ETH, with asset supervisor Bitwise projecting the same ETH ‘contrarian wager’ outlook in October 2024.

Is ETH’s lag a possibility?

Regardless of slowing down relative to majors like Solana [SOL] and BTC, ETH has seen gentle and strong traction after the US elections.

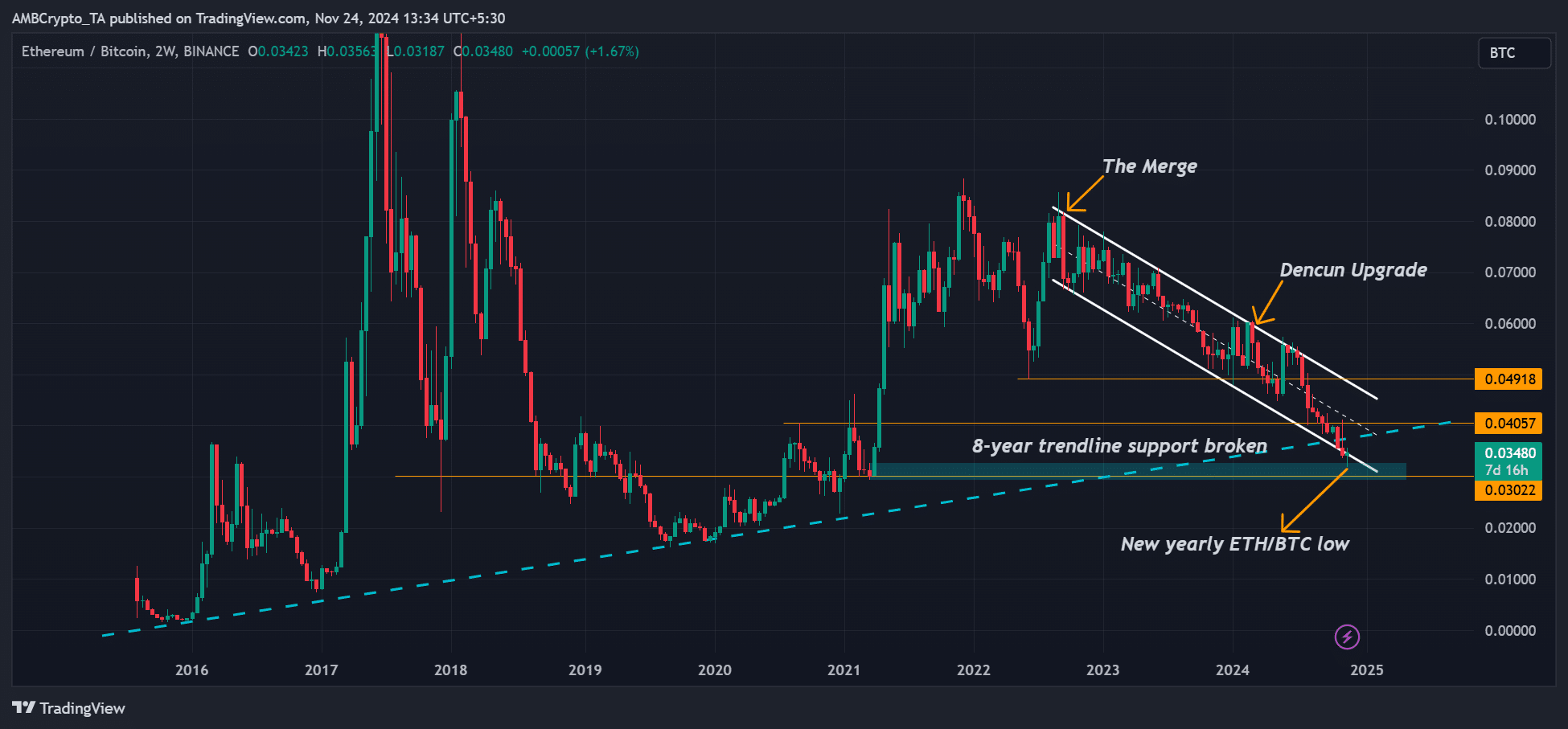

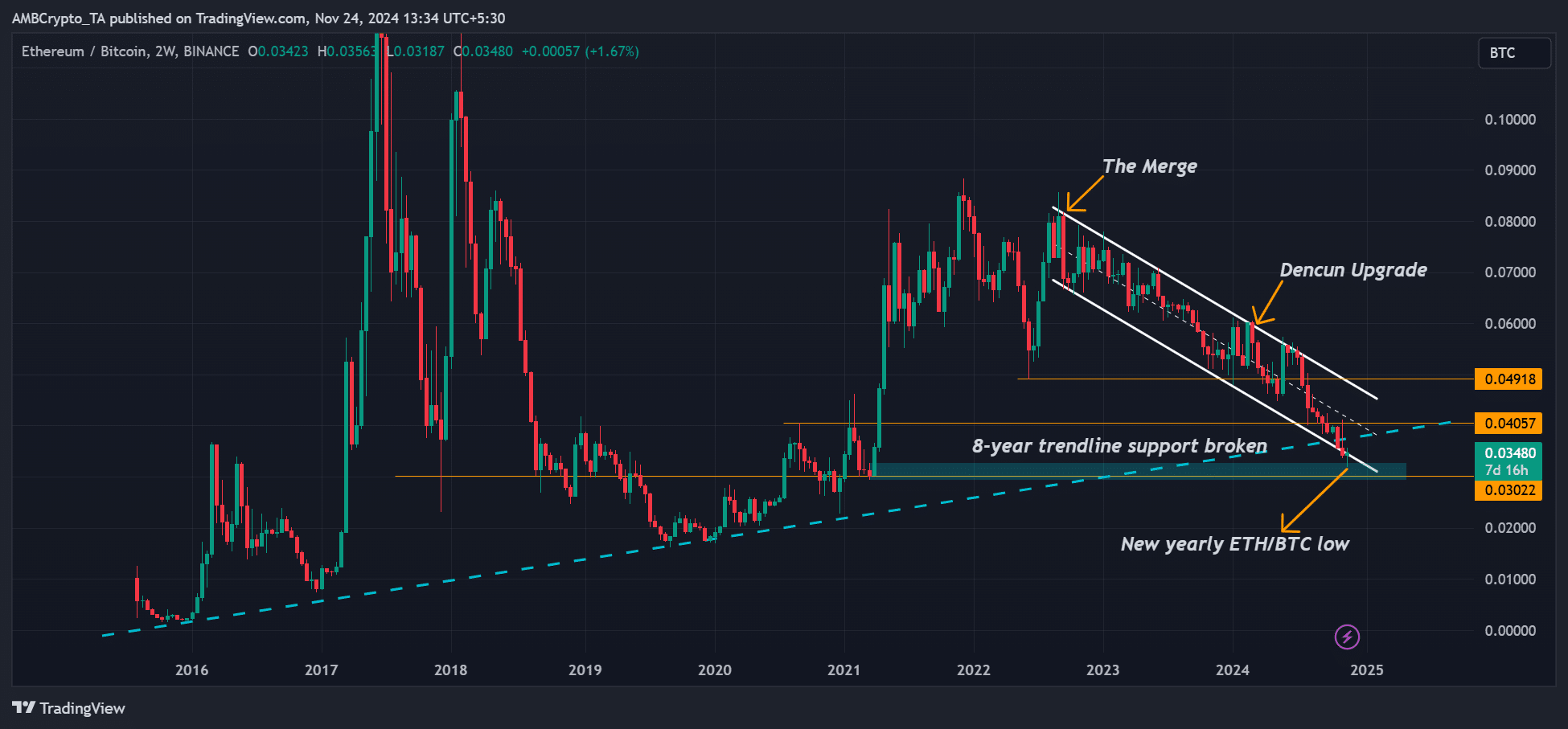

Nevertheless, unfavourable market sentiment has compounded the sluggish catch-up, with the ETH/BTC ratio printing new yearly lows of 0.031.

Which means that ETH has been underperforming BTC, a development that goes again to 2022 after The Merge.

Supply: ETH/BTC ratio, TradingView

Put in another way, traders most popular BTC and different majors relative to ETH, muting its total value efficiency.

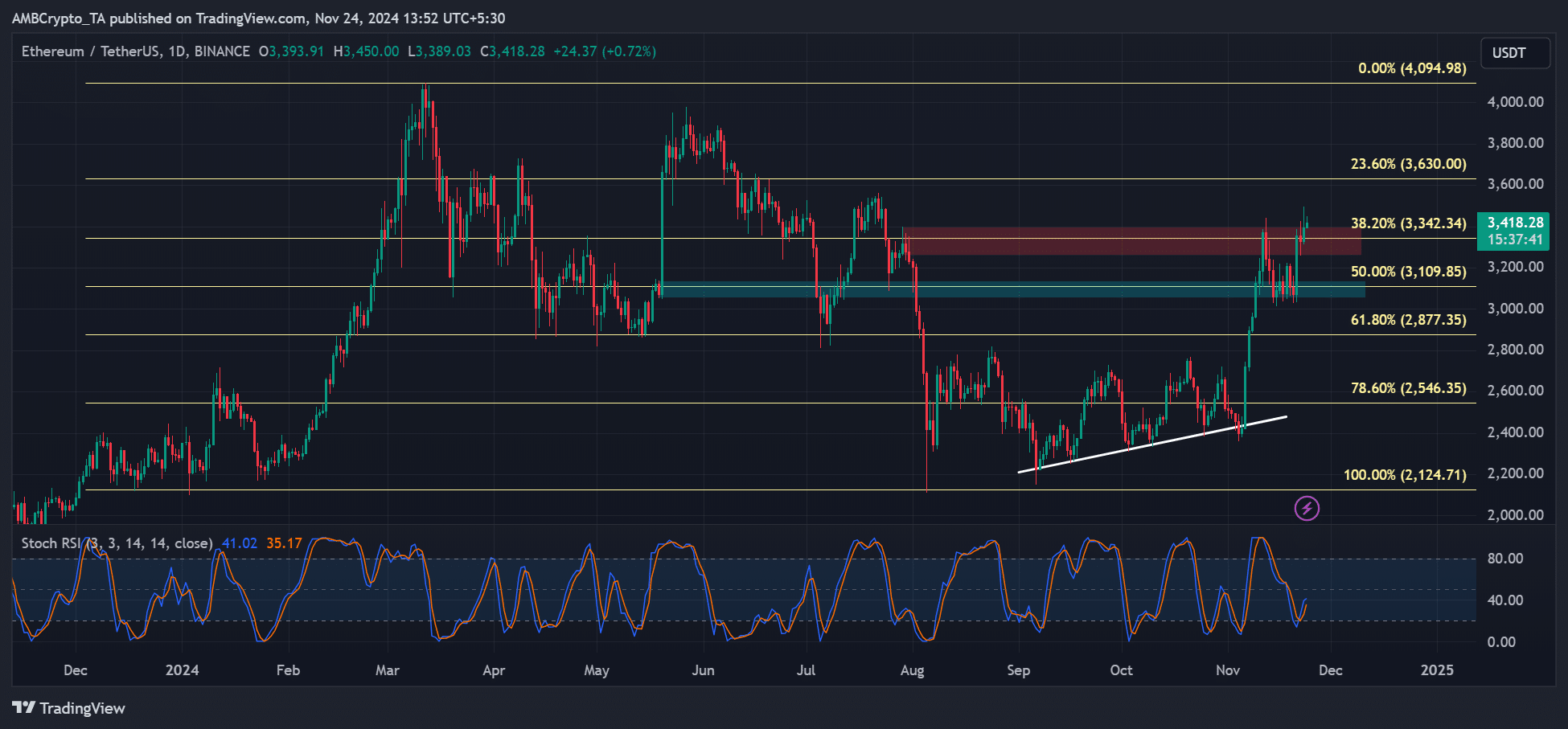

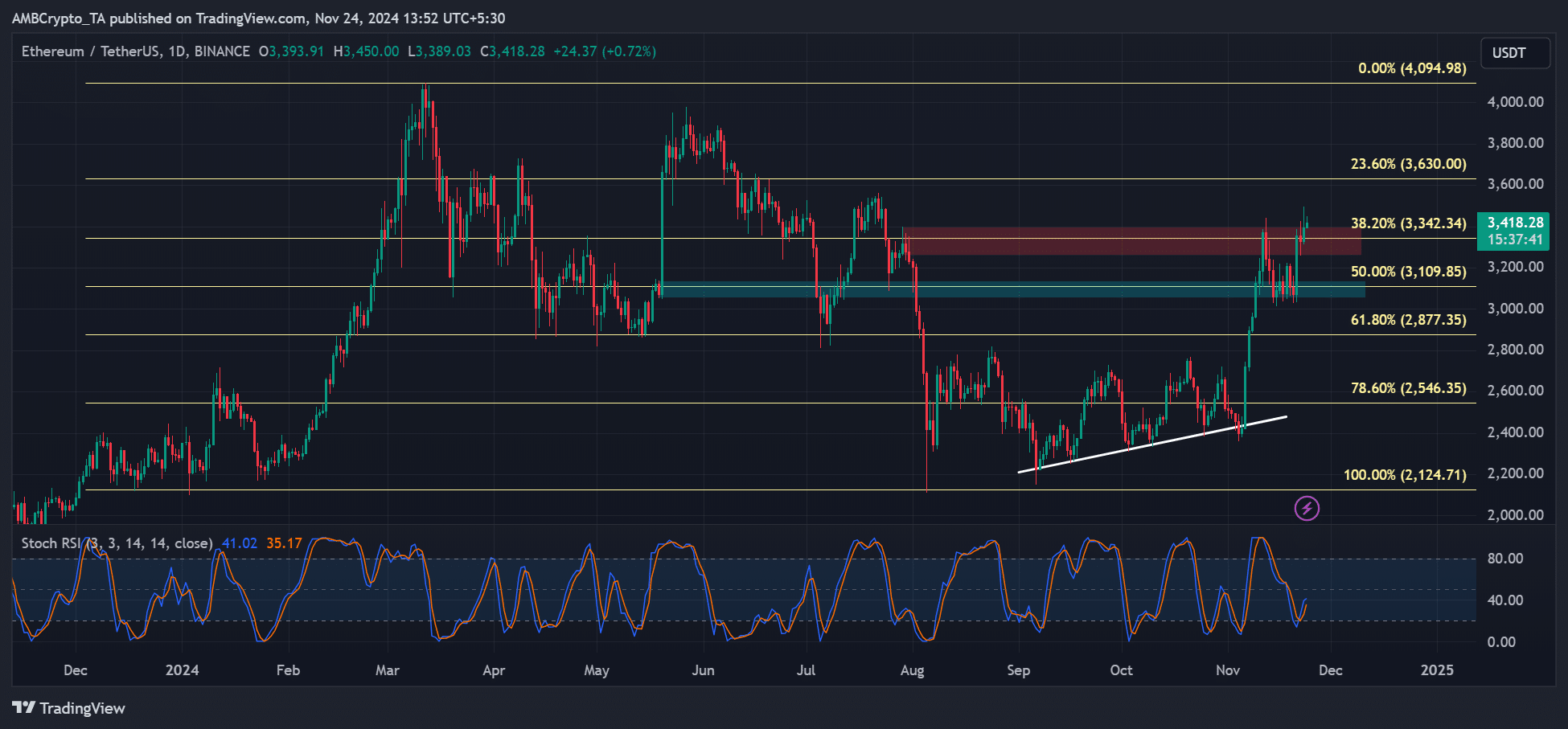

However issues may change for the altcoin king. As of press time, ETH has recovered over 40% since November lows. It additionally tried to clear the $3.3K roadblock, which may speed up to higher targets of $3.6K and $4K.

Supply: ETH/USDT, TradingView

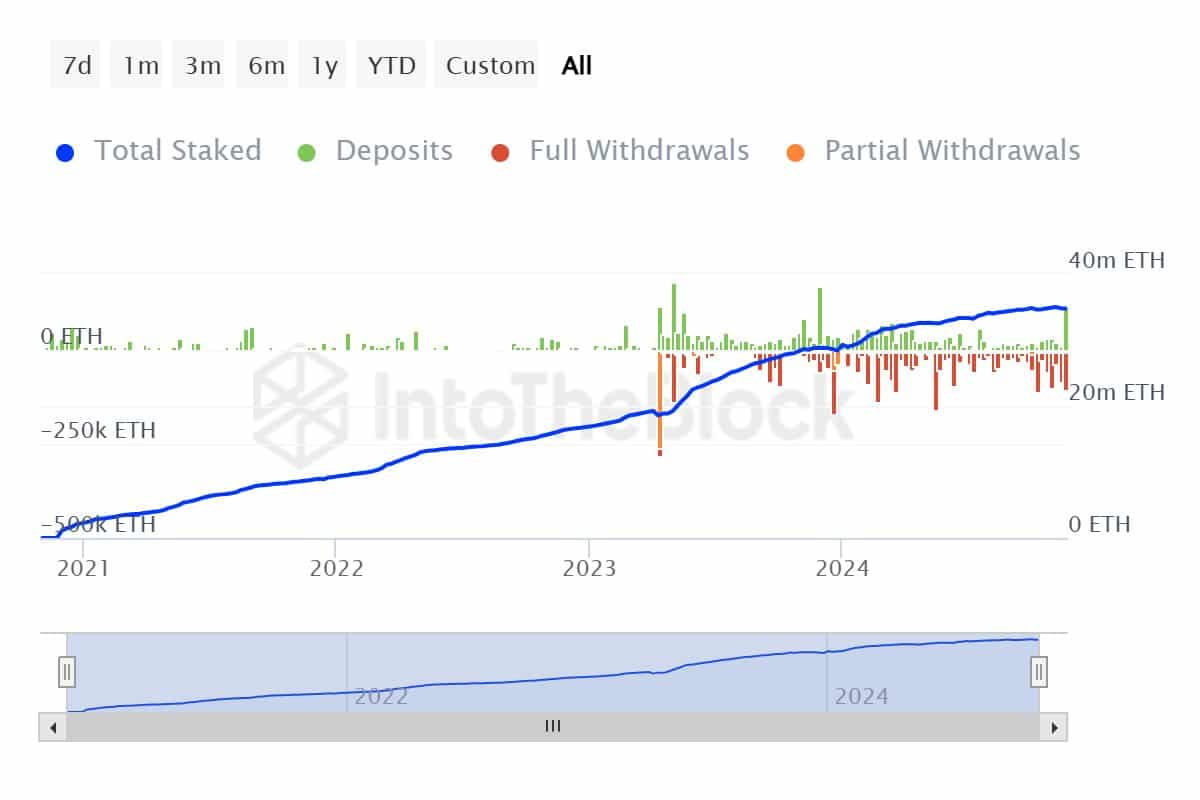

One other bullish sign, as noted by CryptoQuant’s JA Maartunn, was elevated Ethereum staking.

ETH staking recorded the best weekly web inflows for the primary time after months of outflows. Marrtunn added,

“Over the previous week, Ethereum staking recorded a web influx of +10k ETH, with 115k ETH deposited and 105k ETH withdrawn. The blue line (whole staked ETH) is climbing once more, signaling renewed confidence in staking as a long-term technique.”

Supply: IntoTheBlock

The above development, maybe pushed by renewed optimism in regards to the Trump administration’s possible approval of staking on US spot ETFs, may set off an ETH provide crunch, which might be web optimistic for ETH costs.

Learn Ethereum [ETH] Value Prediction 2024-2025

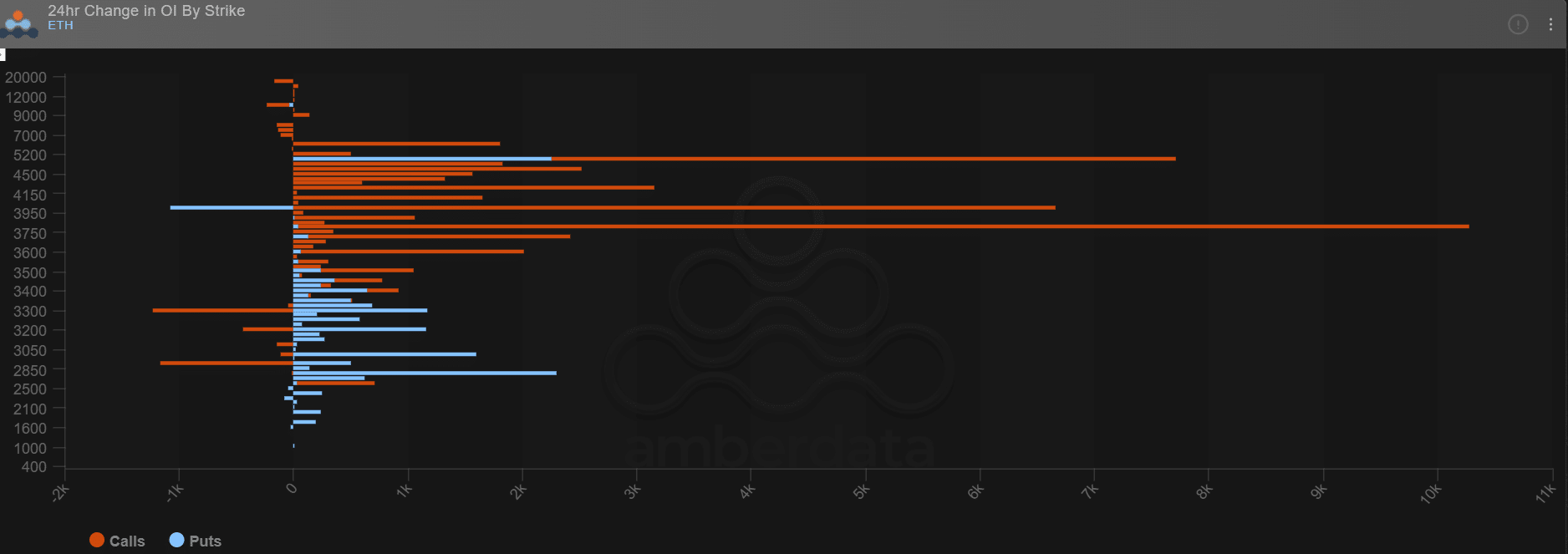

Comparable optimism was seen amongst choices merchants on Deribit. Previously 24 hours, giant payers positioned extra bullish bets (Open Curiosity spike, orange traces) on ETH, reaching $3.8K, $4K, $5K, and $6K targets.

Nevertheless, they had been additionally ready for a pullback situation with a slight rise in places choices shopping for (bearish bets, blue traces) in the direction of $3K and $2.8K targets.

Supply: Deribit