Bancor’s dramatic weekend: Of 18-month spikes and 50% crashes

Posted:

- BNT whale transfers leaped to a yearly excessive within the final 24 hours.

- Liquidations by whale traders despatched BNT costs down.

Holders of the decentralized change token Bancor [BNT] skilled a frenzy of feelings over the weekend. Following an 18-month excessive on the again of regular accumulation by whales, BNT misplaced nearly half of its market worth as some influential cohorts dumped their holdings.

The rise and fall of BNT

For the reason that eighth of November, issues began to show round for the small-cap crypto, which has remained pretty quiet in 2o23. In actual fact, the token recorded astonishing good points of greater than 60% within the final week, in line with CoinMarketCap.

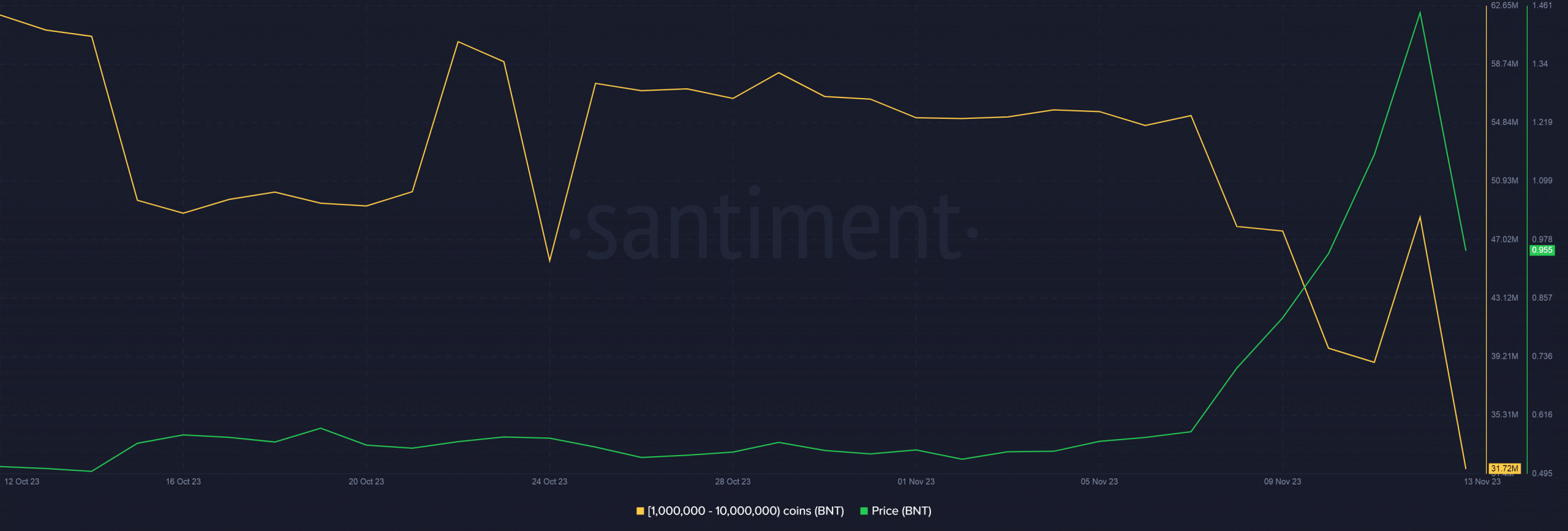

The pump was considerably aided by the buildup exercise of influential consumer cohorts. As per on-chain analytics agency Santiment, wallets holding greater than 10,000 cash have been aggressively stockpiling over the previous two weeks.

The exercise reached a peak within the final 24 hours as Bancor transfers value over 1,000,000 leaped to a yearly excessive, as proven beneath. In the identical interval, the provision held by wallets holding over 10,000 cash elevated to its highest stage since January 2022.

Whereas it was going nicely, the rally was finally stopped by profit-hungry merchants. AMBCrypto scrutinized Santiment’s information and located a pointy drop in holdings of the cohort with 1 million-10 million BNT cash.

In actual fact, outflows of greater than 16 million have been seen after the worth broke previous $1.8.

The liquidations exerted massive downward strain and BNT got here crashing down. The market cap value greater than $124 million was wiped inside hours and BNT halved in a matter of hours.

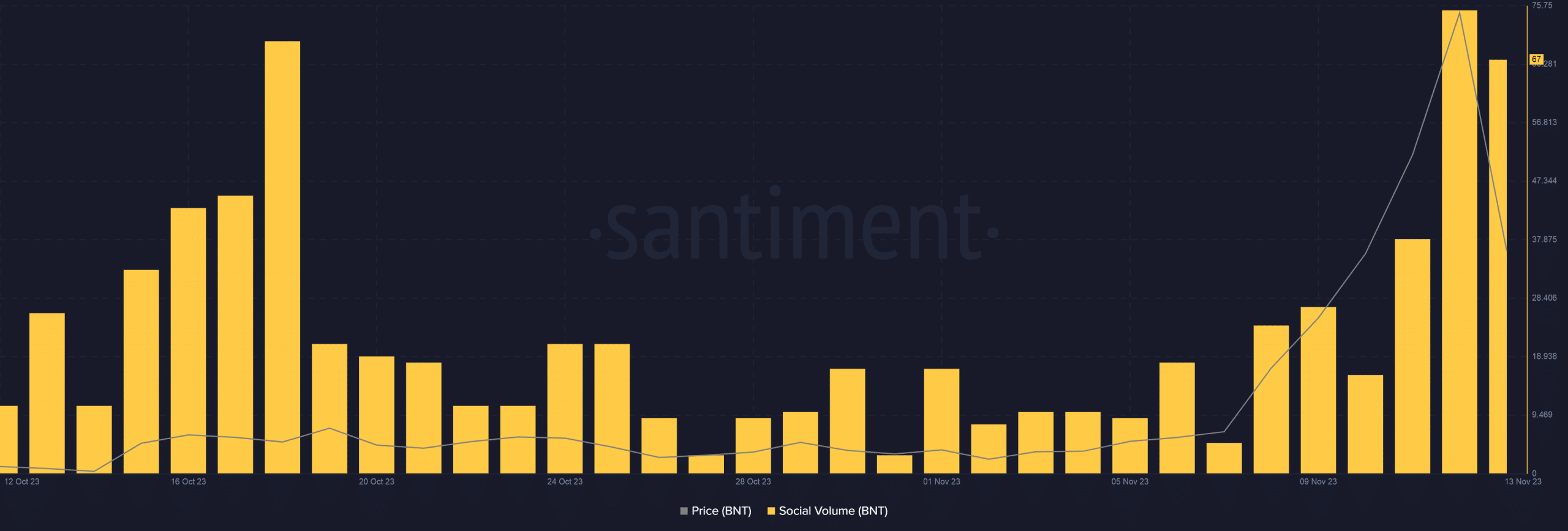

Apparently, Bancor was the topic of lots of dialogue on crypto-focused social channels. The social quantity spiked dramatically within the final 24 hours, as proven beneath.

Considerations of market manipulation

Dramatic fluctuations within the worth of small-cap belongings have usually stoked fears of market manipulation. The pump-and-dump scheme remained probably the most infamous instance of this.

As is well-known, it includes artificially inflating the worth of an asset with much less liquidity by way of coordinated shopping for and propaganda. As soon as unsuspecting retail traders are lured in and the worth is sufficiently “pumped,” the holders begin dumping their belongings at earnings.

Learn Bancor’s [BNT] Price Prediction 2023-24

Ultimately, new traders are caught with a low-value asset and find yourself being the exit liquidity of whales.

Whereas there was nothing stable to counsel any foul play within the above case, new traders must be cautious whereas getting into the market.