Despite Ethereum’s recent decline, why ETH can still reach $4.7K

- Ethereum declined by 5.41% in 24 hours as bearish market sentiment persevered.

- An analyst began eyeing a brand new ATH of $4723.

Over the previous month, Ethereum [ETH] has skilled a robust downtrend. Though the broader cryptocurrency markets have seen excessive fluctuations, ETH has suffered essentially the most from the present market situations.

In actual fact, as of this writing, ETH was buying and selling at $2289. This marked a 5.41% decline over the previous 24 hours.

Previous to this, ETH has tried to interrupt out from the downtrend, recording beneficial properties on weekly charts. Nonetheless, the losses on every day charts have outweighed the beneficial properties over the previous week.

Regardless of these situations, a rise in buying and selling actions reveals ETH’s indicators of life. Thus, during the last 24 hours, buying and selling quantity has surged by 81.42% to $13.67 billion.

If these buying and selling actions are shopping for actions, it might imply hope, whereas a whale sell-off would imply threat for additional correction.

Whereas ETH has confronted troublesome instances, the altcoin’s situations have left analysts speaking. In style crypto analyst Javon Marks is one in all them.

Though ETH is struggling, the analysts see ETH rallying to $4723.5, citing the 2023 cycle.

What prevailing market sentiment says

In his evaluation, Marks cited 2023 the place ETH made 165% beneficial properties to rally.

Supply: X

Based on his evaluation, the present market situations mirror the earlier cycle and these situations are rising once more. If the final cycle’s situations reemerge, it would result in an upward motion to $4723.5.

Additionally, a breakout from that stage will result in historic highs of $8100, representing a 2x value surge.

When ETH reached the Go Time ranges famous by the analysts, it skilled a sustained upward momentum for 3 consecutive months to hit $2717 by January 2024 earlier than declining once more.

Broadly, the general analyst’s sentiment is extremely bullish, which might end in ETH hitting a brand new ATH.

Is ETH able to rally?

Undoubtedly, Marks supplies a optimistic outlook that may see ETH hit a report excessive. Whereas these historic patterns highlighted are promising, the present market situations have borne the burnt for ETH’s restoration.

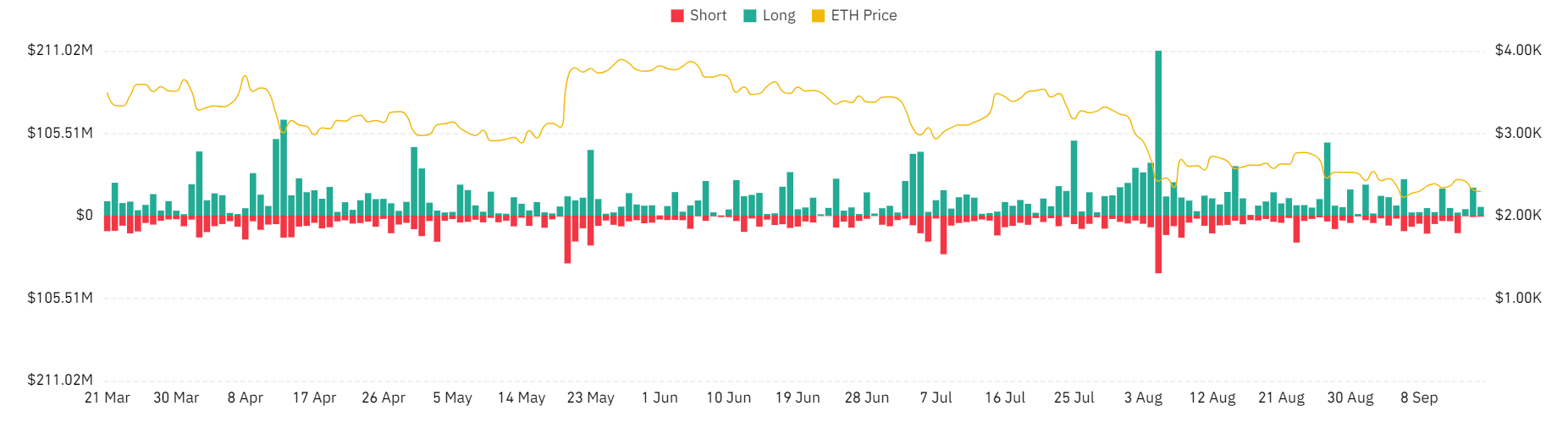

Supply: Coinglass

For starters, the final 24 hours have seen lengthy positions price $46.97 million been liquidated for ETH, alongside $2.93 million in brief positions.

This large liquidation of longs that reveals traders betting on market restoration have been compelled out of their positions.

The truth that traders are unwilling to pay premiums and maintain their positions urged a insecurity in future prospects.

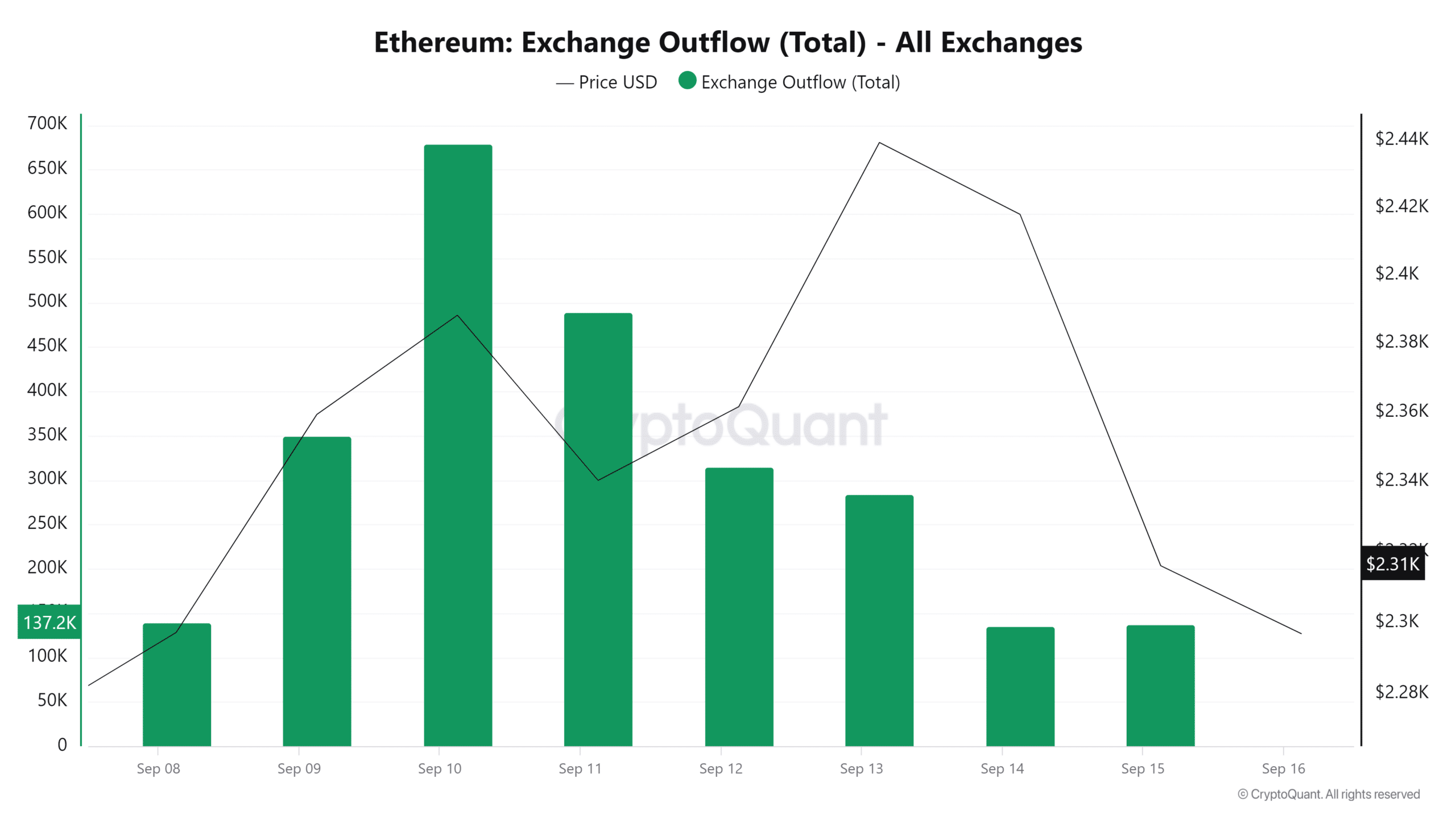

Supply: CryptoQuant

Moreover, Ethereum’s change outflow declined from 679119.6 to 71794.34 over the previous seven days. The decline reveals much less accumulation by holders, with fewer traders transferring their property off the exchanges.

That is one other bearish sign, because it reveals traders are ready for a chance to promote quite than decide to long-term holding.

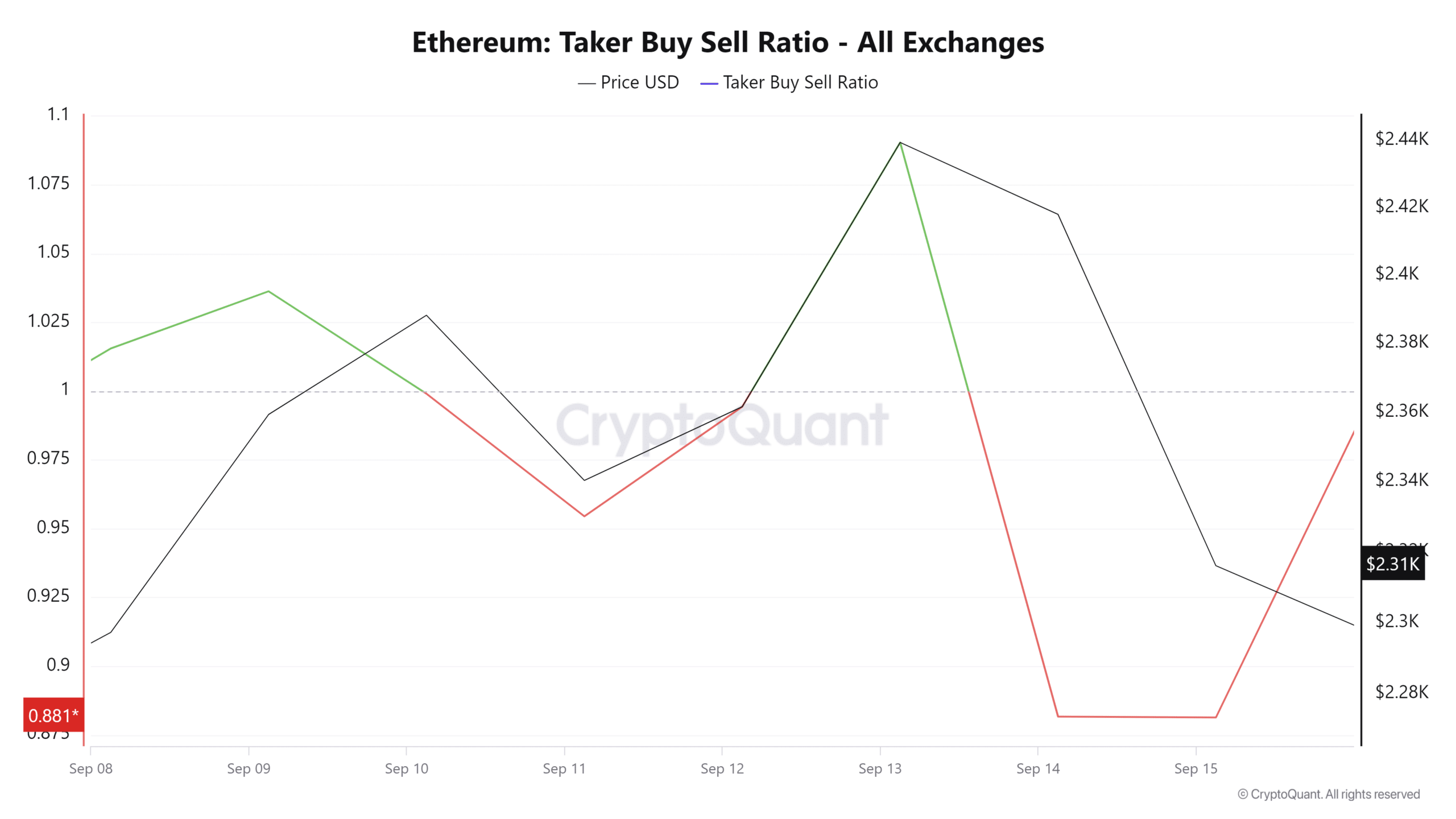

Supply: CryptoQuant

Lastly, the Taker Purchase Promote Ratio declined over the previous few days to 0.88, exhibiting that traders have been engaged in aggressive promoting than shopping for.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Merely put, the present market situations don’t assist a short-term value restoration. As indicated by the Taker Purchase Promote Ratio, the latest spike in buying and selling quantity suggests elevated promoting actions.

Thus, if the present market situations maintain, ETH will fall to the subsequent assist stage of round $2114 earlier than trying one other upward motion.