Disastrous Bitcoin losses loom this week as the Fed’s hidden liquidity trap threatens to drain markets despite a rate hold

Bitcoin merchants will parse Federal Reserve steering on Jan. 28 for alerts on actual yields, the greenback, and dollar-liquidity plumbing. These channels can transfer spot costs even when the policy-rate hall is unchanged.

The Fed’s calendar reveals the Federal Open Market Committee assembly runs Jan. 27–28, with the press convention on Jan. 28.

Merchants usually watch the two p.m. ET assertion and a couple of:30 p.m. ET chair’s press convention as two catalysts; Kiplinger’s economic calendar lists them individually.

The sensible baseline into the choice is the goal vary set in the newest Dec. 10, 2025 implementation note.

That notice instructed the New York Fed’s buying and selling desk to keep up the federal funds fee in a 3.50% to three.75% hall and set curiosity on reserve balances at 3.65%, efficient Dec. 11, 2025.

In mid-January, the efficient federal funds fee printed at 3.64% on each Jan. 16 and Jan. 22, putting the market’s short-rate anchor close to the center of the hall going into FOMC week, based on FRED’s EFFR series.

Even with a maintain, Bitcoin’s macro sensitivity can route via repricing of the anticipated path.

Time period charges, actual yields, and greenback funding situations can transfer on tone, projections, and press convention solutions.

That “path beats the choice” framework is in line with the Fed’s December meeting.

The minutes describe significant inner disagreement across the December determination and doc market sensitivity to communications concerning the anticipated coverage path, alongside dialogue of tighter money-market situations, low ON RRP utilization and better unfold sensitivity to order ranges.

What to observe past the speed determination

For crypto desks framing the week as a threat map relatively than a binary fee guess, a working hierarchy begins with actual yields.

After that comes broad greenback energy, then liquidity plumbing that may amplify a macro shock.

The 10-year Treasury inflation-indexed yield (DFII10) stood at 1.95% on Jan. 22.

The extent issues as a result of larger actual yields are inclined to tighten monetary situations for long-duration threat.

Decrease actual yields are inclined to ease them, even when the coverage hall is unchanged.

The cross-check after the assertion and press convention is whether or not DFII10 strikes directionally within the periods that comply with.

An FOMC maintain can nonetheless reprice the real-rate time period construction if the chair’s solutions pull expectations towards “larger for longer” or towards earlier easing.

A second enter is the nominal broad U.S. greenback index (DTWEXBGS), a Board of Governors sequence carried by FRED that tracks broad greenback energy towards a basket.

In apply, a firmer broad greenback usually aligns with tighter international liquidity situations for dollar-priced threat.

A softer greenback can ease these situations, so the post-event read-through is whether or not DTWEXBGS confirms or offsets the transfer in actual yields after the occasion window.

The less-discussed layer is liquidity plumbing, the place Treasury money administration and money-market facility utilization can change the marginal availability of reserves that help threat taking.

The Treasury Common Account (WTREGEN) most not too long ago stood close to $869 billion on a week-average foundation (week ending Jan. 21).

That stage issues as a result of a TGA rebuild can drain reserves on the margin as money strikes from the banking system to the Treasury’s account on the Fed.

The remainder of the triangle is reserve balances (WRESBAL), complete Fed belongings (WALCL) and in a single day reverse repo utilization (RRPONTSYD).

Every is revealed via FRED and the Fed’s H.4.1 release hub, together with WRESBAL, WALCL and RRPONTSYD.

RRPONTSYD is outlined by FRED as an aggregated day by day quantity of in a single day reverse repurchase transactions.

That definition is related as a result of shifts in the place money is parked throughout cash markets can change sensitivity to coverage surprises.

The Dec. 2025 minutes present context for why these plumbing variables can matter round an FOMC, referencing tighter money-market situations, low ON RRP utilization and unfold sensitivity to order ranges.

| Occasion | Time (ET) | Why it issues for BTC threat | Supply |

|---|---|---|---|

| FOMC assertion | 2:00 p.m., Jan. 28 | Speedy repricing of ahead path through charges, actual yields and USD | Kiplinger calendar |

| Powell press convention | 2:30 p.m., Jan. 28 | Second volatility window if solutions shift “path” expectations | Kiplinger calendar |

| FOMC assembly dates | Jan. 27–28 | Units the schedule for the assertion and press convention | Fed calendar |

Three “maintain” situations for Jan. 28

With that hierarchy, three “maintain” situations body the Jan. 28 tape with out requiring a forecast of the speed determination itself.

The hall is already outlined at 3.50% to three.75%.

- A dovish maintain is one the place the committee maintains the hall whereas communications pull the anticipated path towards earlier or deeper easing. That setup would most frequently be validated by actual yields transferring down from present ranges and the broad greenback softening in subsequent periods.

- A impartial maintain is one the place messaging stresses information dependence and adaptability. That may depart Bitcoin’s path extra depending on positioning and volatility dynamics across the 2:00 and a couple of:30 home windows relatively than sustained strikes in DFII10 or DTWEXBGS.

- A hawkish maintain is one the place the hall stays in place whereas the ahead path reprices towards tighter situations. That setup would usually be accompanied by larger actual yields and a firmer broad greenback.

It turns into extra market-sensitive if reserve situations are already tight or if Treasury money balances are rebuilding.

Some desks additionally plan for a “hawkish lower” sample, the place a lower is delivered however communication retains monetary situations restrictive.

The actionable level for Bitcoin stays the identical: whether or not DFII10 and the broad greenback transfer within the path in line with simpler or tighter situations after the choice window.

For an instance of how “hawkish lower” dynamics have performed out in crypto market protection, see CryptoSlate’s prior reporting on a hawkish lower setup.

A sensible solution to separate noise from a repricing is to match realized post-event motion with an options-implied yardstick for a 24-hour Bitcoin window.

One generally used conference is to transform Volmex-style occasion expectations (Bitcoin and Ethereum volatility metrics) to 24-hour ranges. We are able to convert implied volatility to a day by day transfer by dividing by the sq. root of 365 calendar days.

Utilized to FOMC week, that template will be run twice, from 2:00 p.m. ET to 2:00 p.m. ET the following day and from 2:30 p.m. ET to 2:30 p.m. ET the following day.

The aim is to check whether or not the assertion or the press convention drove any outsized transfer.

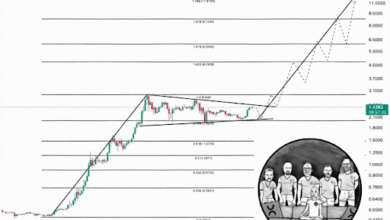

For merchants searching for context past the occasion day, a previous research of 2025 post-FOMC seven-day returns positioned outcomes in a spread from about +6.9% to -8.0%.

Assembly-to-meeting outcomes fluctuate and depend upon the macro backdrop. Nevertheless, that historical past is best handled as a distribution of outcomes than a playbook.

The Fed’s minutes emphasize how shifts in communication and forward-path expectations can dominate the choice itself.

Publish-meeting checks over the following 24–72 hours

After the Jan. 28 occasion window, the following 24 to 72 hours of monitoring tends to be mechanical.

- The primary test is whether or not DFII10 holds its post-meeting path, because it printed 1.95% on Jan. 22 and might shift rapidly if actual yields reprice with the ahead path.

- The second is whether or not DTWEXBGS traits in the identical path as actual yields, as a result of cross-asset trades usually want affirmation from each charges and FX to persist.

- The third is whether or not liquidity measures reinforce or offset the macro impulse, utilizing TGA ranges, reserve balances, Fed stability sheet information, and day by day ON RRP aggregates.

These all feed the identical reserve-sensitivity channel mentioned within the Dec. 2025 minutes.

| Variable | Newest datapoint in pack | Publish-FOMC read-through for BTC | Supply |

|---|---|---|---|

| Coverage hall | 3.50% to three.75% | Units the “maintain” baseline; path and tone nonetheless reprice time period charges | Fed implementation note |

| EFFR | 3.64% (Jan. 16 and Jan. 22) | Anchors front-end funding situations into the assembly | FRED |

| 10-year actual yield (DFII10) | 1.95% (Jan. 22) | Path can dominate BTC response even on a maintain | FRED |

| TGA (WTREGEN) | $869B (week ended Jan. 21) | TGA rebuild can drain reserves on the margin | FRED |

| Broad USD (DTWEXBGS) | Sequence definition for broad greenback energy | Affirmation layer for international liquidity situations | FRED |

The week’s setup leaves Bitcoin uncovered much less to the hall print itself than as to if the Fed’s communication shifts the ahead path sufficient to maneuver actual yields and the greenback.

Then, merchants will watch whether or not liquidity plumbing reinforces the transfer via reserve sensitivity.

For associated CryptoSlate context on policy-driven liquidity narratives, see protection of quantitative tightening and Fed-linked volatility.