Do Ethereum users prefer staking over trading?

- Given the present situation, staked ETH would proceed to surpass ETH on exchanges.

- Staked ETH accounted for 20% of complete circulating provide.

Customers have proven heightened curiosity in Ethereum [ETH] staking for the reason that Shapella Improve went reside on the mainnet in April.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Staking, which was initially regarded as a dangerous proposition owing to withdrawal ambiguity, obtained a lift after unlocking ETH was permitted. After a profitable check of the withdrawal mechanism initially, customers got here again to restake their ETH.

Since Shapella, staked ETH provide has jumped by 26%.

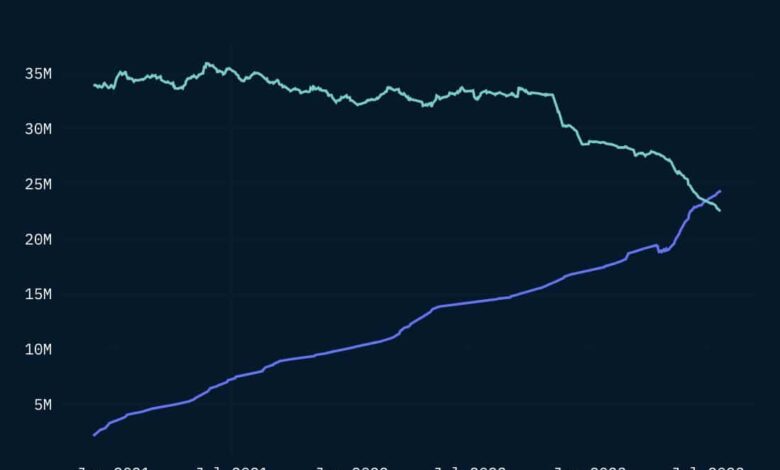

The optimistic sentiment was corroborated by knowledge from blockchain analytics firm Nansen. The agency took to Twitter to disclose that staked ETH provide exceeded ETH’s liquid provide on exchanges in June, with a forecast that this pattern would doubtless proceed within the close to future.

Supply: Nansen

Staking>> Buying and selling

There was a pointy rise within the variety of ETH staked with deposits constantly outpacing withdrawals over the past three months. On the time of publication, the entire quantity locked equated to twenty% of ETH’s complete circulating provide, as per a Nansen dashboard.

Supply: Nansen

However, there was a 31% fall in ETH balances on exchanges since November 2022. As evident within the graph under, the decline has accelerated since Shapella was launched. On the time of writing, about 22.8 million ETH was out there for buying and selling on exchanges, amounting to 19% of all tokens in circulation.

The pattern indicated that increasingly more individuals have been taking ETH out of the market and utilizing it as an funding to earn yields. And although staking rewards have progressively decreased over the previous two years, the clamor for staking has elevated.

Supply: Nansen

Supply: Nansen

Most stakers have been in losses

One other potential cause behind the persistence with staking may very well be that a number of stakers have been underwater on their investments. As per knowledge fetched from a Dune dashboard, about 60% of the stakers have been in losses since they locked their ETH on the community.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

Nearly all of this staking occurred on the value ranges of $1,600 and $3,500, through the peak of the 2021 bull run. Nevertheless, on the time of publication, ETH’s market value was $1,886.48, as per CoinMarketCap.

The underperforming market inspired stakers, particularly the skilled ones, to proceed trying to find rewards in staking, moderately than unstaking and promoting their holdings at losses available in the market.