Does Ethereum’s surging supply signal better days for ETH?

- ETH noticed a big surge in provide, in step with declining costs.

- A pivot may very well be within the playing cards as demand began making a comeback.

Etherum’s [ETH] provide has reportedly soared to the best ranges that it has achieved within the final 10 months. A rising provide when demand stays fixed or decrease might result in worth dilution. However has this been the case for ETH?

Is your portfolio inexperienced? Try the ETH Revenue Calculator

A latest IntoTheBlock evaluation revealed that ETH’s internet issuance has been rising after bouncing from its 3-month low. The online issuance surged as excessive as 0.50%, which isn’t solely the best recorded throughout that interval but in addition increased than Bitcoin’s inflation.

Ether’s provide has been rising for the primary time since December ’22. The low transaction charges and growing day by day issuance contribute to this inflationary pattern. Nevertheless, with a internet issuance of 0.44% yearly, ETH’s inflation remains to be nicely under Bitcoin’s. pic.twitter.com/znWSkP4bDA

— IntoTheBlock (@intotheblock) October 14, 2023

So, does this internet issuance surge replicate the value motion? Effectively, that will not essentially be the case as a result of one has to additionally account for ETH burns and demand.

Nevertheless, if we cross-reference the issuance surge and the value motion throughout the identical interval, we see that the value has been declining.

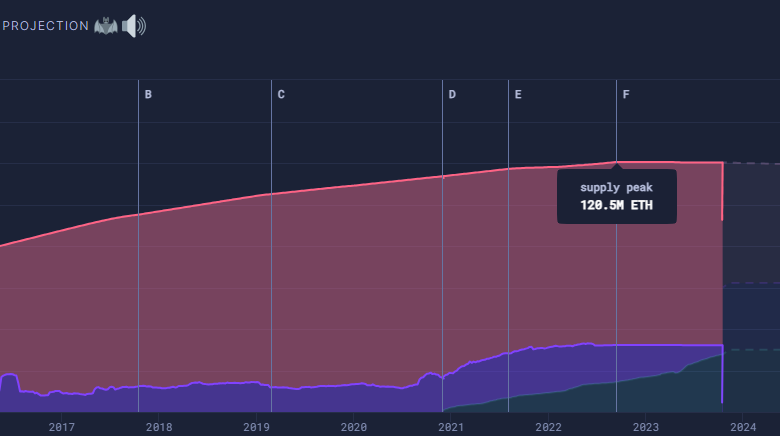

We determined to discover ETH’s provide and its 2-year projection and located one thing attention-grabbing. Roughly 8 million ETH had been in consumer accounts at press time. Furthermore, about 27.7 million ETH had been held by validators and 32.2 million had been in sensible contracts.

Supply: Ultrasound.cash

The evaluation steered that provide peaked someday within the second half of September. It additionally projected that there will probably be a provide lower in 2024. The identical metric revealed that the ETH provide held by validators has been rising because of a surge in long-term staking.

Can ETH’s tide shift in favor of the bulls?

So far as the value motion is anxious, ETH has been displaying indicators of a possible pivot within the subsequent few days. The promote strain that prevailed in the previous few weeks has slowed down and the value motion within the final three days steered it could have discovered assist close to the $1540 worth stage.

ETH exchanged palms at $1555 on the time of writing.

Supply: TradingView

Can ETH’s short-term assist set off bullish resurgence? An vital query whose reply could be discovered within the cryptocurrency’s prevailing stage of demand. Its change influx and outflow metric revealed that the variety of outflows barely outperformed the Change influx at press time.

Learn Ethereum’s [ETH] Value Prediction 2023-2024

Briefly, demand was barely increased than promote strain throughout this time interval.

Supply: CryptoQuant

The change outflow information might point out that ETH was within the technique of a worth pivot on the assist at press time. Nevertheless, its skill to bounce again sturdy and presumably ship a big upside might largely depend upon the power of the recovering demand.