Sol declines by 14% as bearish sentiments persist

- SOL has declined by 14.72% over the previous seven days.

- An analyst eyes a 40% transfer if Solana breaks above $214 or beneath $183.

Since reaching a neighborhood excessive of $223, Solana [SOL] has did not sustain with the uptrend. As such, over the previous 4 days, the altcoin has traded sideways, consolidating inside a variety of $184 and $193.

The truth is, as of this writing, Solana was buying and selling at $183. This marked a 1.42% decline on each day charts. Equally, SOL has declined on weekly and month-to-month charts, dropping by 14.72% and 18.68% respectively.

This sustained decline has left the Crypto group speaking over the altcoin’s value motion. Inasmuch, fashionable crypto analyst Ali Martinez has steered a possible 40% value transfer, citing a symmetrical triangle.

Market sentiment

In his evaluation, Martinez noticed that Solana is consolidating inside a symmetrical triangle.

Supply: X

When an asset is consolidating inside this triangle, it signifies that costs are making decrease highs and better lows. This means the market is experiencing indecision, with each patrons and sellers struggling to realize management.

Traditionally, costs often escape earlier than hitting the apex, accompanied by a spike in quantity.

In keeping with Martinez, a breakout above $214 or beneath $183 might spark a 40% transfer. A transfer above $214 might see the altcoin hit $299, whereas a transfer beneath $183 might drop it to $109.

What SOL charts recommend

The evaluation above supplies a possible value motion for SOL, both to the upside or the draw back. This means that the market is at a crossroads and each sellers and patrons are trying to retake the market.

Within the brief time period, in keeping with AMBCrypto’s evaluation, SOL is experiencing sturdy bearish sentiments and the altcoin is prone to document some losses.

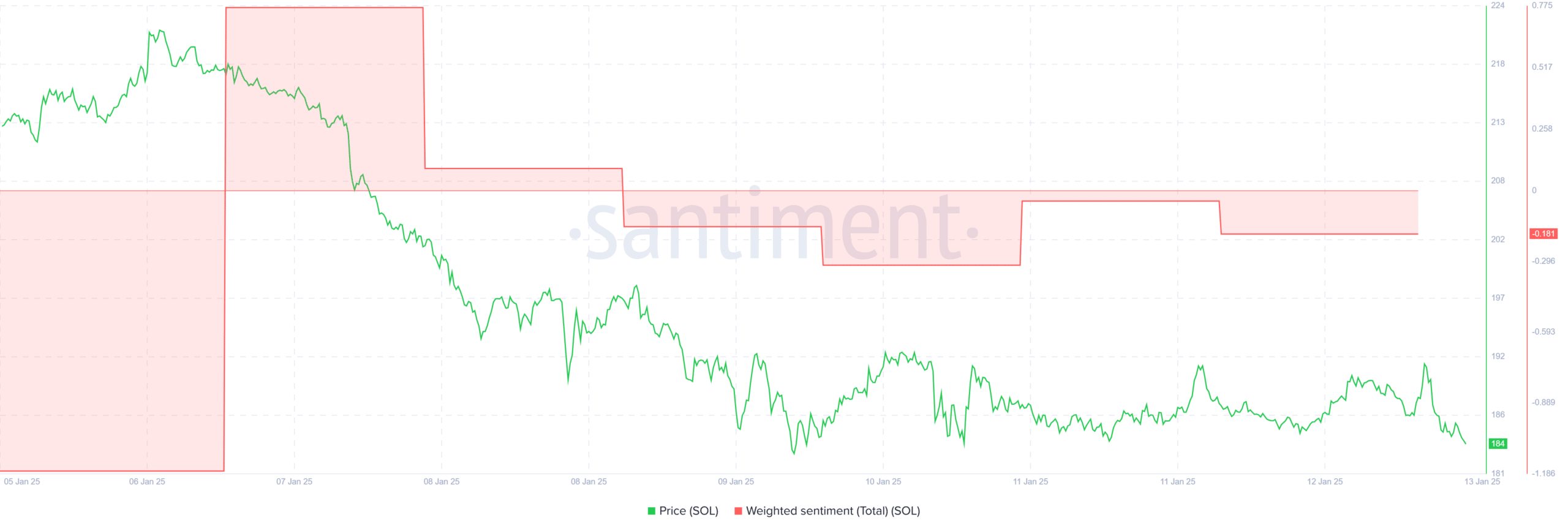

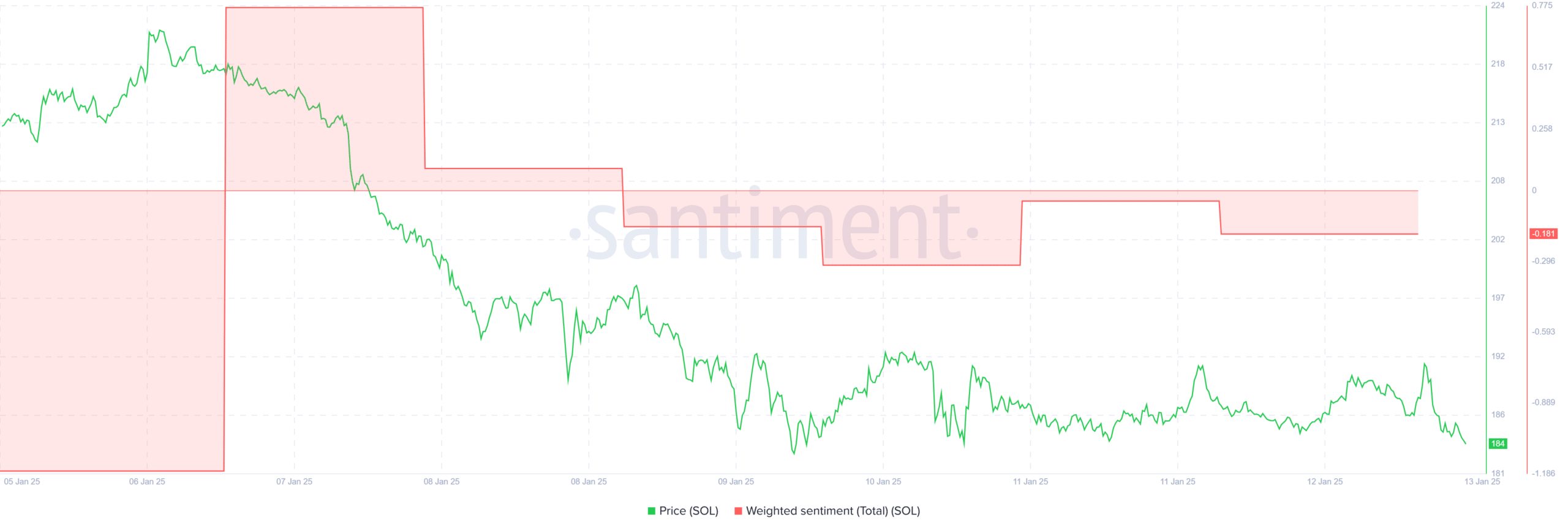

Supply: Santiment

We are able to see this bearishness as market sentiments have remained destructive over the previous 4 days. As such, weighted sentiment turned destructive days in the past, signaling that market sentiments are strongly bearish.

Supply: TradingView

Moreover, Solana’s Directional Motion Index (DMI) has pointed in the direction of a powerful downward stress. That is evidenced as +DI has dropped to 13 whereas ADX continues to rise to 23 suggesting a strengthening downward momentum.

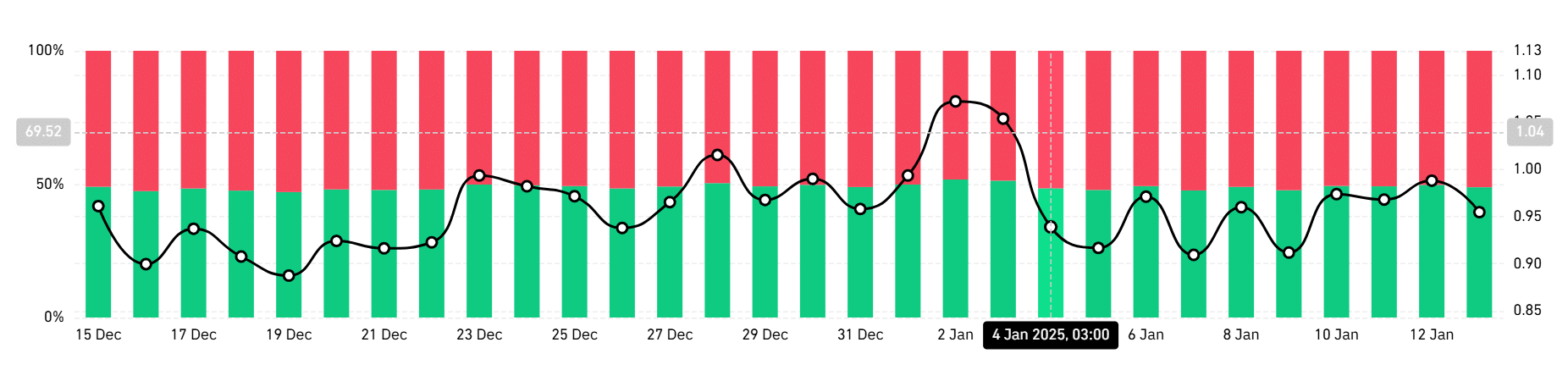

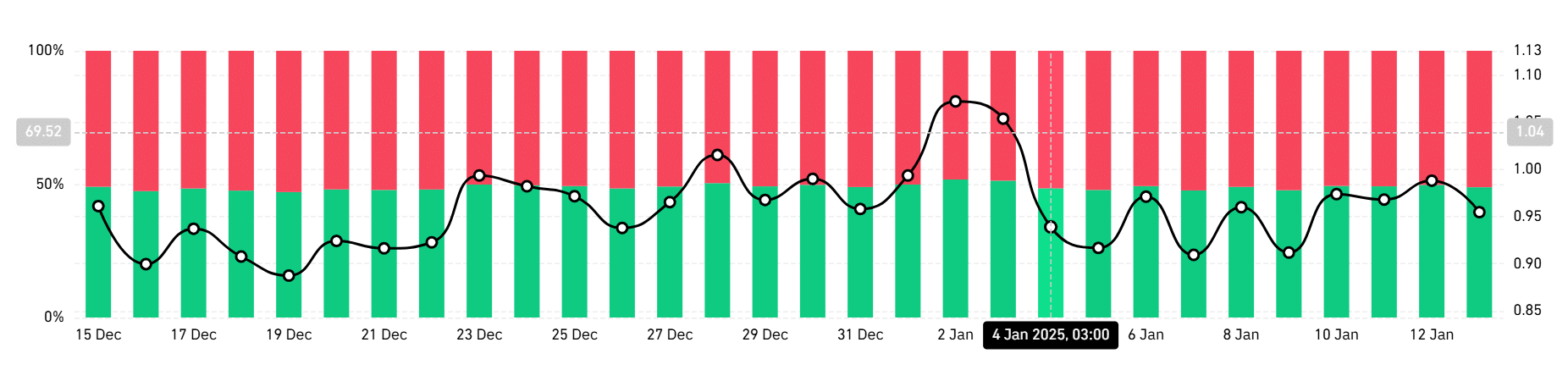

Supply: Coinglass

Trying additional, most market members are going brief. At the moment, 52% of accounts are taking brief positions, whereas 48% are taking lengthy positions. With brief positions dominating, it suggests that the majority buyers are bearish and count on costs to say no.

Learn Solana’s [SOL] Worth Prediction 2025–2026

Merely put, SOL is experiencing a powerful bearish sentiment. Subsequently, the altcoin is prone to break beneath $183.

If it drops beneath the consolidation vary, it would discover help round $175. Conversely, a transfer above this vary will see Solana reclaim the $220 resistance degree.