Dogecoin Goes Wall Street: Grayscale Confirms ETF Launch

Grayscale Investments will record spot ETFs for Dogecoin and XRP on the NYSE Arca on November 24, 2025, providing a brand new manner for on a regular basis traders to purchase these cash by way of common brokerages.

Associated Studying

Based on change notices and regulatory filings, the funds will commerce below the tickers GDOG for Dogecoin and GXRP for XRP. The listings convert Grayscale’s present private-placement trusts into publicly traded merchandise.

Grayscale Strikes To Listing Dogecoin And XRP

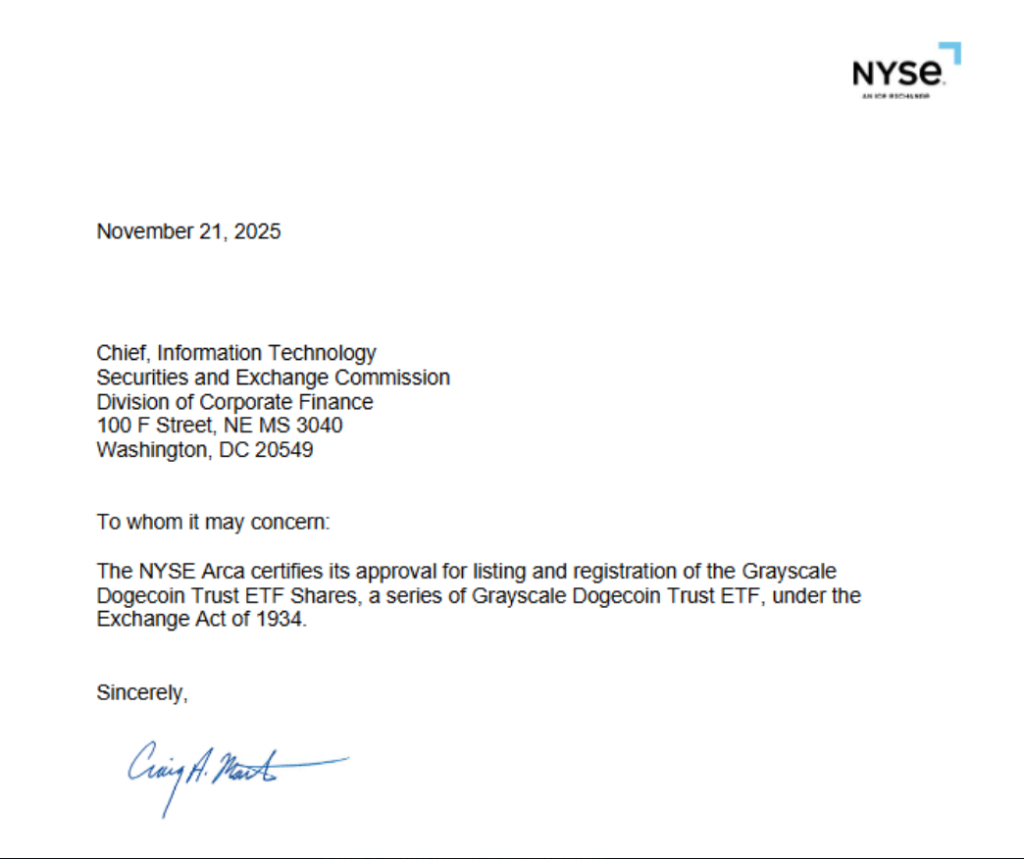

Reviews have disclosed that each ETFs obtained approval to be listed, and the paperwork was filed with the US Securities and Alternate Fee.

The transfer brings spot publicity to 2 smaller, however extensively adopted, cryptocurrencies right into a mainstream automobile. For a lot of traders, meaning entry with out immediately managing wallets or personal keys.

Grayscale Dogecoin ETF $GDOG accredited for itemizing on NYSE, scheduled to start buying and selling Monday. Their XRP spot can be launching on Monday. $GLNK coming quickly as nicely, week after I believe pic.twitter.com/c6nKUeDrtI

— Eric Balchunas (@EricBalchunas) November 21, 2025

Market Exercise Up Forward Of Launch

Buying and selling exercise in associated derivatives climbed within the lead as much as the announcement. Dogecoin derivatives quantity elevated by greater than 30% to roughly $7.22 billion, primarily based on change knowledge.

XRP derivatives surged as nicely, leaping about 51% to round $12.74 billion. Primarily based on experiences, these spikes replicate merchants positioning for potential worth swings across the ETF debut.

Spot ETFs don’t promise increased costs, however they do change who can purchase the property. Brokers, retirement plans, and funds that keep away from direct crypto custody could now step in.

That might have an effect on liquidity in each the tokens and their markets. On the similar time, the general crypto market has seen stress; experiences say the launches come throughout a roughly six-week downturn.

DOGE market cap presently at $21.4 billion. Chart: TradingView

Questions Stay Over Demand And Flows

Product charges, custody particulars, and the way the trusts convert into ETF shares will form investor urge for food. Previous launches of crypto ETFs confirmed brisk early flows for some merchandise, whereas others noticed muted curiosity. What issues for costs shouldn’t be solely listings, however inflows and outflows as soon as buying and selling begins.

Associated Studying

Buyers and analysts are more likely to watch the primary days of buying and selling for clues. Excessive quantity and tight spreads would recommend robust demand. Low turnover or vast spreads may sign tepid curiosity.

Primarily based on experiences, market members will even monitor whether or not the ETFs draw the identical kind of speculative buying and selling that has pushed derivatives quantity in current days.

The itemizing of each GDOG and GXRP on the identical date marks a notable step for mainstream crypto merchandise. Based on change filings, the funds are structured as spot ETFs that maintain the underlying tokens by way of custodians. Whereas that doesn’t take away worth danger, it does make shopping for these property easier for a broad group of traders.

Featured picture from Gemini, chart from TradingView